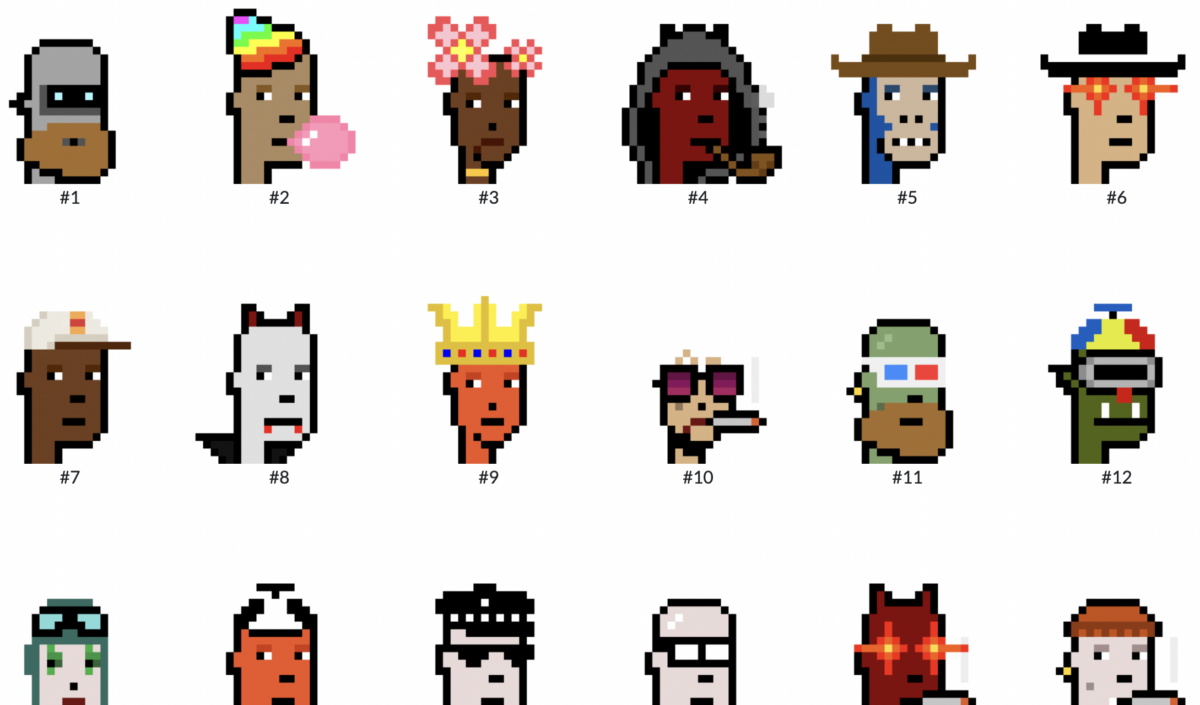

Because the launch of the Ordinals protocol by software program engineer Casey Rodarmar on January 21, 2023, nearly 2,000,000 “digital artifacts” have been created — starting from memes to large NFT initiatives like Taproot Wizards. However regardless of the explosive rise and frenzied media protection of those seemingly new “Bitcoin NFTs,” builders have been targeted on enhancing the protocol’s performance since no less than as early as 2012.

In brief, there have all the time been methods to mint and launch property on Bitcoin’s underlying blockchain. These instruments started with issues like Bitcoin Colored Coins and, later, platforms like Counterparty in 2014, which helped lay the muse for tokenized property like Spells of Genesis and Rare Pepes to emerge in 2016.

On this respect, Ordinals signify merely the newest development throughout the ever-evolving Bitcoin ecosystem. To acknowledge the efforts of builders who’ve been diligently engaged on the chain, let’s discover the quite a few instruments and options that actually represent the ecosystem.

Counterparty

Counterparty was based in 2014 by Robert Dermody, Adam Krellenstein, and Evan Wagner. The protocol, together with an inbuilt decentralized trade, was created to increase Bitcoin’s performance by figuratively “writing within the margins” of normal transactions.

In essence, as a Layer-2 answer — a platform that works “on prime of the foundational Bitcoin mainnet (one thing that inherits the safety of the unique blockchain, however supplies further performance) — Counterparty supplies the infrastructure for innovation and superior options. For instance, minting new Bitcoin-based property isn’t doable with atypical Bitcoin software program.

Whereas surpassed by Ethereum and different well-liked NFT chains lately, Counterparty nonetheless has an energetic neighborhood of supporters with near 30,000 Twitter followers and over 100,000 assets —a few of that are bridged to Ethereum by the Emblem Vault.

Extra importantly, Counterparty is finest often known as the unique residence for what finally got here to be often known as the “CryptoArt movement” — a style of natural, decentralized, and verifiably uncommon art work and memes on Bitcoin largely catalyzed by property like Rare Pepes — tokenized variations of the Pepe the Frog meme by Matt Furie, which nonetheless command vital sums on secondary markets.

How does it work?

Much like how Ethereum token requirements outline how sure property work on its protocol, Counterparty provides the infrastructure that outlines how folks can create distinctive tokens on the Bitcoin blockchain. These property aren’t restricted to digital collectibles or tokens however something with a confirmed rarity — even bodily objects.

Counterparty is Bitcoin-native and may embed and use information from the Bitcoin protocol when executing contracts, so transacting on the platform seems to be simply as it will when utilizing BTC. Counterparty nodes merely interpret the info in these transactions primarily based on particular guidelines. From there, the protocol creates its native ledger of associated transactions that it has seen on the underlying Bitcoin community.

One other approach to consider how transactions on Counterparty work is through the idea of Russian nesting dolls, whereby the Bitcoin transaction would comprise a smaller Counterparty transaction inside it. Added complexities apart, the transactions on Counterparty are the identical as Bitcoin and, due to this fact, simply as safe.

That mentioned, a notable distinction between Bitcoin and Counterparty is the connection between nodes. In contrast to Bitcoin nodes, Counterparty nodes don’t talk with one another and don’t provide a “peer-to-peer community.” Whereas all of them share the identical code and obtain the identical transaction information, the first function of Counterparty nodes is to hook up with the Bitcoin software program.

As soon as linked, the nodes obtain and decode information from every transaction whereas benefiting from Bitcoin’s safety and computing energy. As well as, as with gasoline on Ethereum, customers nonetheless must pay mining charges when transacting on Counterparty.

How do dispensers work?

Shopping for and promoting property on Counterparty is usually finished through computerized dispensers, which work like digital merchandising machines. Anybody can create a dispenser and resolve how a lot of a token or asset to promote, together with the value in BTC.

Shopping for property from these dispensers is akin to transferring tokens between digital wallets. Consumers simply must scan the dispenser’s QR code or enter its pockets tackle after which ship the minimal required quantity of BTC for the objects they need to purchase. The dispenser will then ship the asset to the customer’s pockets.

Dispensers are primary good contracts with set guidelines that deal with and distribute property independently. To assist mitigate scams, a warning signal will present subsequent to an empty dispenser, informing potential patrons to not ship any BTC as a result of the dispenser is closed.

What’s XCP?

Shopping for property on Counterparty will also be finished utilizing the platform’s native XCP token. In contrast to extra standard strategies for launching tokens like crowd gross sales or preliminary coin choices (ICOs), Counterparty used the proof-of-burn (PoB) consensus protocol to subject XCP in January 2014.

To raised safe the community, miners burn a few of their cash to amass a digital mining rig, granting them the flexibility and authority to mine blocks on the Counterparty community. The extra cash a miner burns, the bigger their digital mining “platform” turns into.

The Counterparty group mentioned it settled on PoB to maintain the distribution of tokens as honest and decentralized as doable whereas avoiding potential authorized points. To generate XCP within the community, round 2,140 BTC—valued at over $2 million again then—had been destroyed or “burned” by sending them to a provably unspendable Bitcoin address with no identified personal key, making them completely misplaced. The XCP token can also be utilized in varied methods within the Counterparty protocol, like serving to customers create new property, commerce, and make bets. XCP trades on exchanges like Dex-Trade and Zaif, paired with both BTC or the Japanese yen.

What are some disadvantages?

In comparison with extra mainstream marketplaces like OpenSea, the place one merely has to attach their MetaMask or Ethereum pockets, the person interface on Counterparty isn’t as streamlined and requires just a few extra steps to mint property. Additionally, as with gasoline wars on Ethereum, dispensers might be front-run, with transactions being prioritized over others if folks pay greater charges to miners.

Ordinals

Extending on the idea that originated in 2012 is Ordinals. This platform permits folks to inscribe messages or pictures onto the smallest divisible models of Bitcoin, often known as Satoshis (named after the pseudonymous creator, Satoshi Nakamoto). These distinctive inscriptions might be shared, traded, and preserved immediately on the Bitcoin blockchain. As of April 2023, over 1,900,000 Ordinals have been created.

For these unfamiliar with the mechanics, every Bitcoin is damaged into 100,000,000 models known as satoshis (or sats) or 1/100,000,000 of a BTC. Launched on the Bitcoin mainnet, the Ordinals protocol permits individuals who function Bitcoin nodes to inscribe every satoshi with information (saved in a Bitcoin transaction’s signature), thus creating what’s often known as an Ordinal.

That information inscribed on Bitcoin can embrace good contracts, which, in flip, allows NFTs. In different phrases, Ordinals are NFTs or digital artifacts like pictures, textual content, packages, and video video games you possibly can mint or inscribe immediately onto the Bitcoin blockchain, in contrast to Counterparty, which features extra like a Layer-2 answer (circuitously on the mainnet). Though the thought of inscriptions on Bitcoin isn’t something new, it’s largely doable because of the Taproot improve launched on the Bitcoin community on November 14, 2021.

How are Ordinals completely different from different NFTs?

Drawing parallels between Ordinals and NFTs will help demystify an inherently advanced system, but it surely’s important to acknowledge the refined distinctions between them. NFTs on blockchains like Ethereum or Solana sometimes level to off-chain information on the Interplanetary File System (IPFS) — a decentralized storage answer akin to an exterior exhausting drive. This strategy permits for dynamic metadata updates, making it appropriate for initiatives that want to reinforce picture high quality or alter the looks of their NFTs over time.

Nevertheless, this capacity to alter NFT metadata is the setback that Ordinals Rodarmor was attempting to enhance with the brand new protocol. In accordance with Rodarmor, NFTs are “incomplete” as they compromise integrity or safety with off-chain or exterior information.

As compared, Ordinals are “full” as all the info is inscribed or saved immediately on the Bitcoin blockchain. Therefore the rationale behind naming them “digital artifacts” reasonably than Bitcoin NFTs. One other distinction is that whereas most NFTs have creator royalties imbued within the contract or hooked up to the asset, Ordinals don’t. As acknowledged by Rodarmor, an Ordinal “is meant to mirror what NFTs needs to be, typically are, and what inscriptions all the time are, by their very nature.”

The best way to create and commerce Ordinals

Whereas nonetheless burdened by a slight technical barrier, inscribing on Bitcoin is changing into simpler. After establishing a pockets, some key strategies embrace:

- Run a Bitcoin node and inscribe an Ordinal your self.

Sometimes, these companies require customers to provide a BTC tackle to obtain the Ordinal, usually utilizing an Ordinal-compatible pockets like Sparrow. Customers are then knowledgeable of the variety of satoshis (smaller models of Bitcoin) wanted to cowl transaction and information charges, in addition to a service price. Cost might be made in BTC, and an tackle for fee shall be supplied. The price of inscribing an Ordinal can fluctuate from beneath $50 in BTC to a number of hundred {dollars}, relying on the file dimension.

What are some disadvantages?

Customers needs to be conscious that, in contrast to common BTC transactions, which normally full inside minutes, the doubtless risk-laden technique of sending BTC for an Ordinal would possibly take hours and even days to finalize.

Nevertheless, the thought of filling Bitcoin blocks with JPEGs and movies — and even video video games — isn’t sitting effectively with some within the Bitcoin neighborhood who’ve voiced concerns that placing NFTs immediately on the Bitcoin community will drive up transaction prices.

Regardless of this divisiveness, Ordinals are one other methodology for anybody to protect their messages for posterity. Some technologists and builders have even began to seek out and inscribe satoshis with a selected historic date and inscribe distinctive messages on them with essential historic information or details that may be subverted by standard mainstream media.

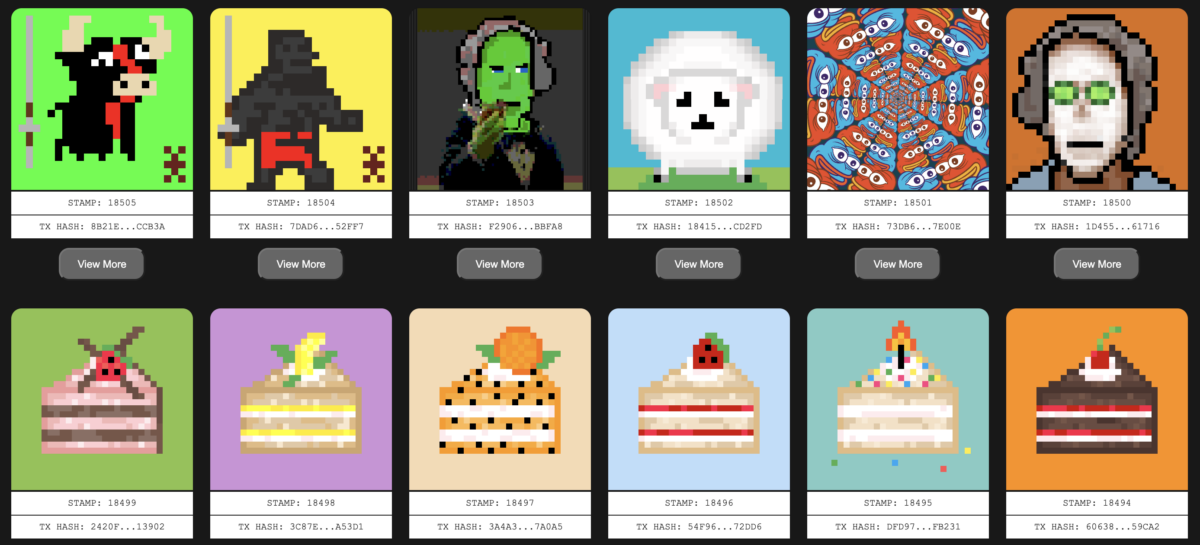

Bitcoin Stamps

Subsequent up is Bitcoin Stamps. One drawback and misnomer within the broader NFT world (together with Ordinals) is that storing “artwork on the Blockchain” is sufficient to obtain permanence. The fact is that the majority NFTs are merely picture tips to centralized internet hosting or saved on-chain in prunable witness information.

Bitcoin Stamps proposes a technique of embedding base64-formatted picture information utilizing transaction outputs in a novel vogue. To place it extra merely, Bitcoin Stamps are digital collectibles much like ERC-1155 semi-fungible tokens saved on Bitcoin’s unspent transaction outputs (UTXOs) as a substitute of witness information like Ordinals.

Bitcoin Stamps abide by the next guidelines:

- A Bitcoin Stamp must be a numeric asset, like this: [A1997663462583877600].

- You’ll be able to create a Bitcoin Stamp from an present numeric asset that wasn’t a stamp earlier than. To do that, replace the asset to incorporate the stamp:base64 string in a brand new transaction.

- You’ll be able to’t duplicate Bitcoin Stamps on the identical asset. If an asset is already a stamp, altering the outline subject to a brand new base64 string gained’t make it a brand new stamp. A brand new STAMP transaction will nonetheless be created on the blockchain, however the official STAMPS challenge gained’t index it. That is to take care of a one-to-one relationship with the primary created stamp.

- The picture information needs to be in jpg, png, gif, or webP format and encoded in base64.

How do Stamps differ from Ordinals?

There are a number of methods wherein Stamps differ from Ordinals:

- Storage: Bitcoin Stamps are saved on Bitcoin’s unspent transaction outputs (UTXOs), whereas Ordinals are saved within the witness information.

- Protocol: Bitcoin Stamps use the Counterparty protocol, an open-source messaging protocol constructed on the Bitcoin blockchain, whereas Ordinals are usually not talked about to make use of this protocol. Moreover, Stamps is utilizing Counterparty naked multi-sig transactions for minting Bitcoin Stamps, permitting customers to securely ship BTC to a script-linked tackle.

- Minting price: The price of minting Bitcoin Stamps is roughly 4 occasions greater than inscribing Ordinals. Nevertheless, Counterparty permits for extra flexibility in minting bigger portions, which may result in economies of scale.

- Immutability: The encoded picture information for Bitcoin Stamps reside within the transaction outputs on the Bitcoin blockchain, requiring Bitcoin nodes to obtain all the info to take care of the blockchain. In distinction, Ordinals’ picture information lives in witness information, creating an surroundings the place the picture information might be pruned.

- Flexibility: Counterparty supplies much less person friction in minting a 1:1 or 1:100 at any given time, giving it extra feature-rich capabilities for on-chain Bitcoin protocols than Ordinals.

- Progress price: Bitcoin Stamps have been rising sooner than Ordinals, doubtless as a result of flexibility of minting bigger portions.

To mint Bitcoin Stamps, a picture is transformed to textual content, encoded as a Base64 file, and broadcasted to the Bitcoin community utilizing the Counterparty protocol. The information is then recompiled to recreate the unique picture.

What are some disadvantages?

Some controversy round Bitcoin Stamps revolves round information permanence, UTXO set bloating, and disagreement about utilizing block house for digital art work. However, as with Ordinals, regardless of these debates, the emergence of Bitcoin Stamps as soon as once more highlights the capabilities of the Bitcoin blockchain as builders proceed to develop new functions and enhance person expertise.

Nostr

One other platform that leverages the performance of Ordinals is Nostr, a decentralized social community launched in 2021 by Bitcoin developer Joost Jager. Nostr allows customers to submit messages and content material immediately on the blockchain (utilizing the Ordinals system) in a censorship-resistant method, free from the constraints of any central authority or algorithmic censorship in any other case rampant on platforms like Twitter and Meta.

While still growing in adoption, the significance of Nostr invariably lies in its capacity to foster an surroundings the place free speech and expression can thrive unimpeded by the whims of centralized powers. In a world the place data is more and more managed and manipulated, Nostr gives a platform that upholds democracy, transparency, and autonomy, permitting customers to have interaction in open discourse, share concepts, and collaborate with out worry of censorship.

In different phrases, this decentralized strategy — tapping into the censorship-resistant nature of the Bitcoin blockchain — can reshape the best way we work together on-line, giving voice to the unvoiced and paving the best way for a extra equitable digital panorama.

A promising future

Whereas missing in comparative quantity compared with Ethereum, the regular rise of creativity and flexibility on the Bitcoin blockchain implies that builders and creators are provided a wider array of selections without cost expression on-line. Furthermore, being classified as a commodity by the U.S. Commodity Futures Buying and selling Fee in September 2015 additional bolsters Bitcoin’s function in championing freedom. This classification affords it larger autonomy and fewer stringent rules than different cryptocurrencies deemed securities, enabling customers to specific themselves extra overtly by the community.

Because the community expands with new nodes and as extra customers be part of to discover and have interaction with varied ideas throughout all layers, the ecosystem turns into more and more safe and decentralized. And it’s by such modern instruments that we inch nearer to a balanced and equitable digital panorama the place each person has the chance to thrive and thus foster an surroundings the place extra people can advance the reason for liberty within the digital age.