- DOT held the #1 rank on the record of cryptos with the best Nakamoto Coefficient metric

- Nonetheless, different DOT metrics and market indicators confirmed a bearish image

Polkadot [DOT] was within the information once more because it managed to realize the #1 rank on this record of cryptocurrencies with the best Nakamoto Coefficient metric. The Nakamoto Coefficient reveals the variety of validators (nodes) required to efficiently decelerate or stop any explicit blockchain from working as supposed.

The upper the Nakamoto Coefficient in relation to the whole variety of validators, the much less probably a decentralized blockchain is to be disrupted by collusion. Other than DOT, Avalanche [AVAX] and Solana [SOL] made it to the highest three on the record.

NC metric minimal variety of validators required to make up 33.3% of community staking share to stop a nasty validator from manipulating transactions. The upper worth means larger decentralization 🔥

And @Polkadot is ranked #1

Particulars 👉 https://t.co/RFm2gfZGzp #Polkadot $DOT pic.twitter.com/BAYfKWE9FU— Polkadot Insider (@PolkadotInsider) January 15, 2023

How a lot are 1,10,100 DOTs value at present?

Extra to be merry about…

Along with the aforementioned data, Polkadot nomination swimming pools hit one other milestone solely two months after its launch. Based on the official tweet, pool members have bonded over 1,000,000 DOT.

To offer extra context, Polkadot nomination swimming pools make it simpler to stake natively by decreasing the barrier for incomes rewards to as little as 1 DOT, and effectively balancing the pursuits of smaller and bigger DOT holders.

1/ Polkadot nomination swimming pools have hit one other milestone – simply 2 months after launch, greater than 1,000,000 DOT has been bonded by pool members!

Test the 🧵 to be taught extra about Polkadot nomination swimming pools and methods to stake natively on Polkadot.

To begin staking now 👇

— Polkadot (@Polkadot) January 13, 2023

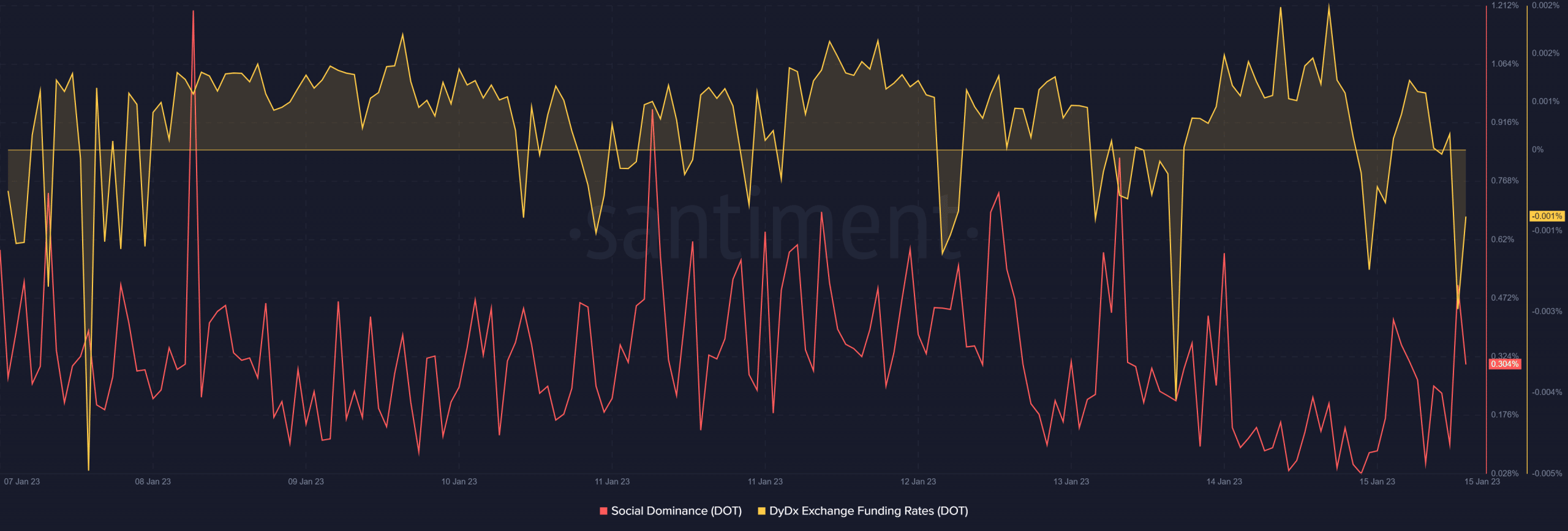

Nonetheless, regardless of these updates, DOT most well-liked to steer clear of the limelight particularly on the worth entrance. DOT failed generate any vital demand within the futures market as its DyDx funding charge registered a decline on 15 January.

Curiously, Polkadot topped the list of cryptocurrencies when it comes to social exercise on 14 January. Nonetheless, Santiment’s chart advised the other story as DOT’s social dominance went down during the last week.

One other main bearish sign was revealed by CryptoQuant, because it confirmed that DOT’s Relative Power Index (RSI) was in an oversold place. This might pull DOT’s worth down within the coming days.

Supply: Santiment

Is your portfolio inexperienced? Take a look at the Polkadot Revenue Calculator

What subsequent for DOT?

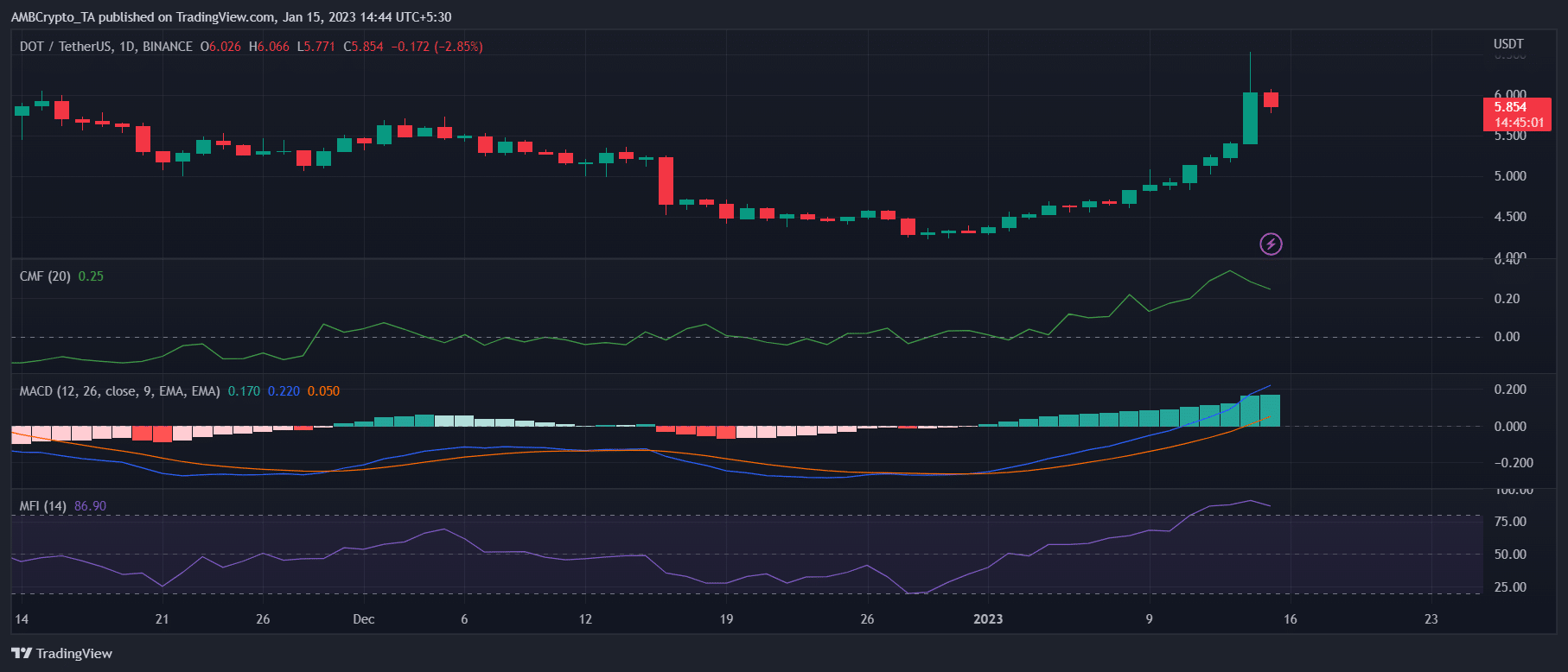

DOT’s each day chart additionally painted a bearish image, thus strengthening the opportunity of a worth decline. The Cash Movement Index (MFI) was within the overbought zone, which was a bearish sign.

Furthermore, the Chaikin Cash Movement (CMF) additionally registered a downtick, additional growing the possibilities of a worth fall. Nonetheless, the Shifting Common Convergence Divergence (MACD) stood in favor of the bulls.

Supply: TradingView