Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- EOS reached a vital overhead resistance.

- The Funding Fee remained unchanged, however improvement exercise and sentiment elevated.

Regardless of outperforming the crypto market, the uptrend of EOS [EOS] may gradual. EOS was an outlier, on the time of writing, after posting a 7.5% hike prior to now 24 hours because the crypto sector declined by 3.5%, according to Coinmarketcap. Nevertheless, the uptrend momentum may gradual as a result of EOS reached a vital overhead resistance degree.

Learn EOS Worth Prediction 2023-24

EOS’s sturdy restoration in March was partly boosted by the deliberate launch of an EVM scheduled for April 14, 2023. Yves La Rose, CEO of EOS Community Basis, introduced on Twitter that the EVM can be 3X sooner than BNB and Solana mixed.

On April 14th, #EOS EVM will launch!

Combining the efficiency of EOS with the familiarity of Ethereum, Solidity builders are in for a deal with.

At 800+ swaps per second, $EOS EVM can be BY FAR the quickest EVM, benchmarked 3x sooner than Solana + BNB and 25x sooner than Avax. pic.twitter.com/JxYtcbLiTE

— Yves La Rose (@BigBeardSamurai) March 1, 2023

Can bears acquire entry on the $1.276 hurdle?

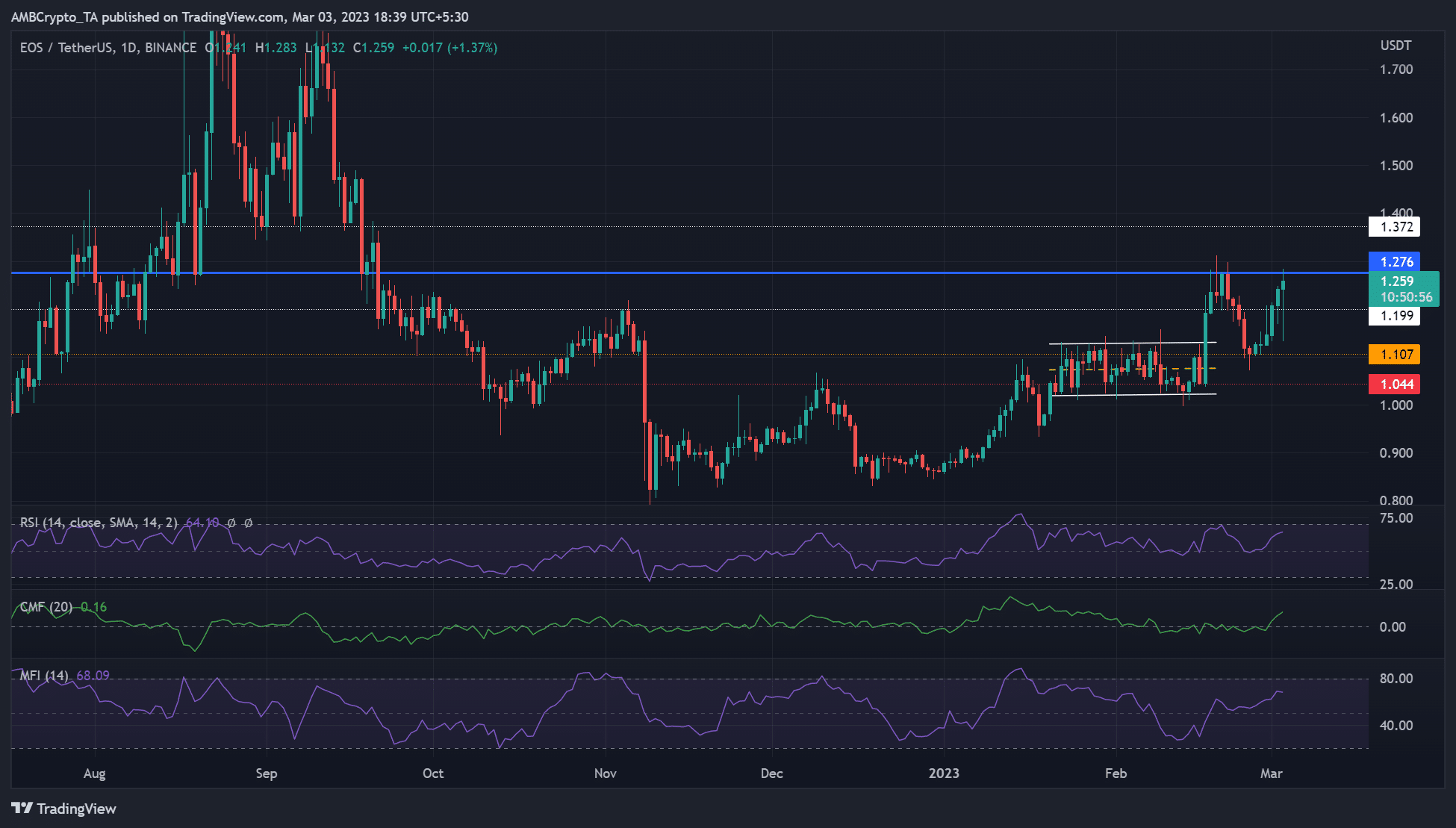

Supply: EOS/USDT on TradingView

EOS consolidated inside the $1.022 – $1.130 vary between mid-January and February earlier than an upside breakout in mid-February. However the bulls confronted worth rejection after hitting the $1.276 resistance degree. If the development repeats, EOS may face an identical rejection and supply bears shorting alternatives.

Bears may look to e book income at $1.119 or the quick assist at $1.107. An prolonged drop past these ranges may very well be stored in verify by $1.044 or $1.000. As such, the cease loss may very well be positioned above the $1.276 hurdle.

Alternatively, bulls may bypass the hurdle and search extra positive aspects forward. The subsequent key resistance lies at $1.372, $1.500, and $1.748. A bullish BTC and surge above $23K may speed up the upswing wanted to bypass the $1.276 roadblock.

The RSI (Relative Energy Index) and MFI (Cash Circulate Index) confirmed upticks, indicating shopping for strain and accumulation elevated. As well as, the Chaikin Cash Circulate (CMF) moved northwards, indicating the market favored bulls.

Growth exercise elevated, however the Funding Fee stagnated

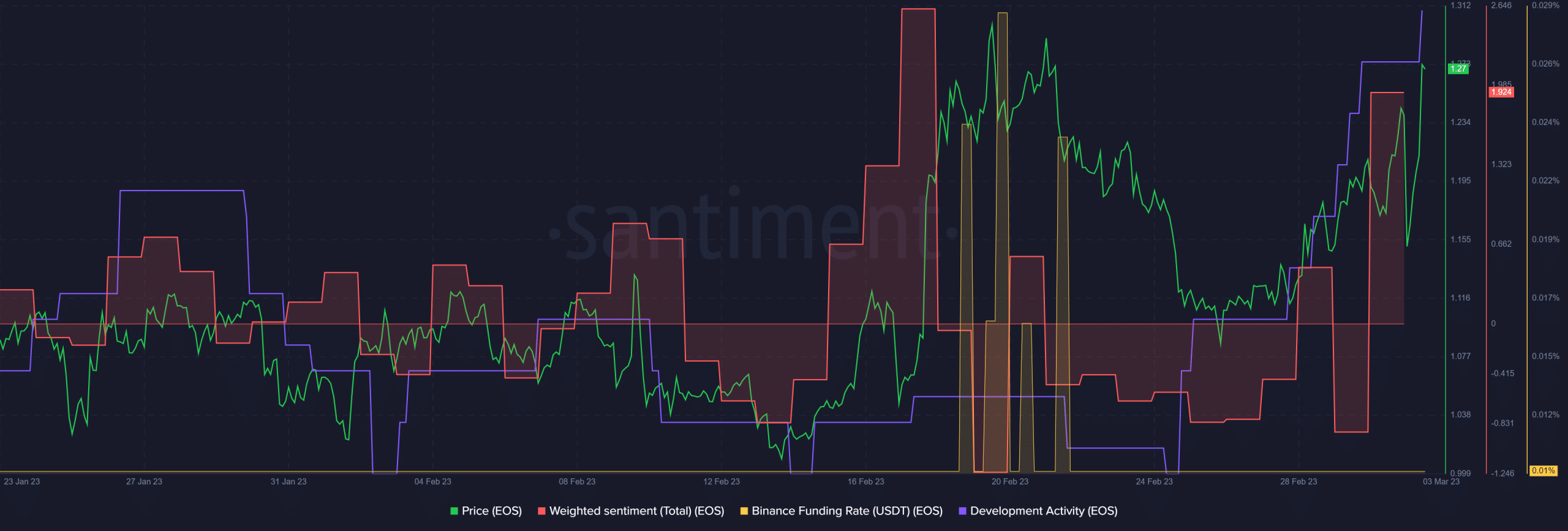

Supply: Santiment

In accordance with Santiment, EOS noticed a pointy improve in improvement exercise, exhibiting the community was present process large constructing, maybe in preparation for the April EVM launch.

The uptick within the improvement exercise may increase buyers’ outlook on the native token. Curiously, the weighted sentiment improved and exhibited a excessive optimistic elevation, exhibiting improved buyers’ confidence within the token.

Is your portfolio inexperienced? Take a look at the EOS Revenue Calculator

Nevertheless, the Funding Fee remained eerily stagnant, exhibiting EOS rally hasn’t attracted a lot demand within the derivatives market. Such a restricted demand may undermine the uptrend and doubtlessly tip the dimensions in favor of the bears.