Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- The amount profile instrument confirmed EOS has misplaced a vital help degree.

- The crammed imbalance confirmed demand may reverse the current retracement.

EOS has carried out nicely within the markets and maintained its upward trajectory regardless of uncertainty throughout the market. Despite the fact that Bitcoin has retraced a superb portion of its beneficial properties over the previous two weeks, EOS was fast to rebound.

Learn EOS Worth Prediction 2023-24

This was a present of energy. Cash resilient throughout a BTC dump, or those which can be fast to recuperate, are typically sturdy cash for consumers and will outperform a superb chunk of the opposite mid-cap cash. Aside from relative energy, technical causes had been additionally noticed for EOS’s current efficiency.

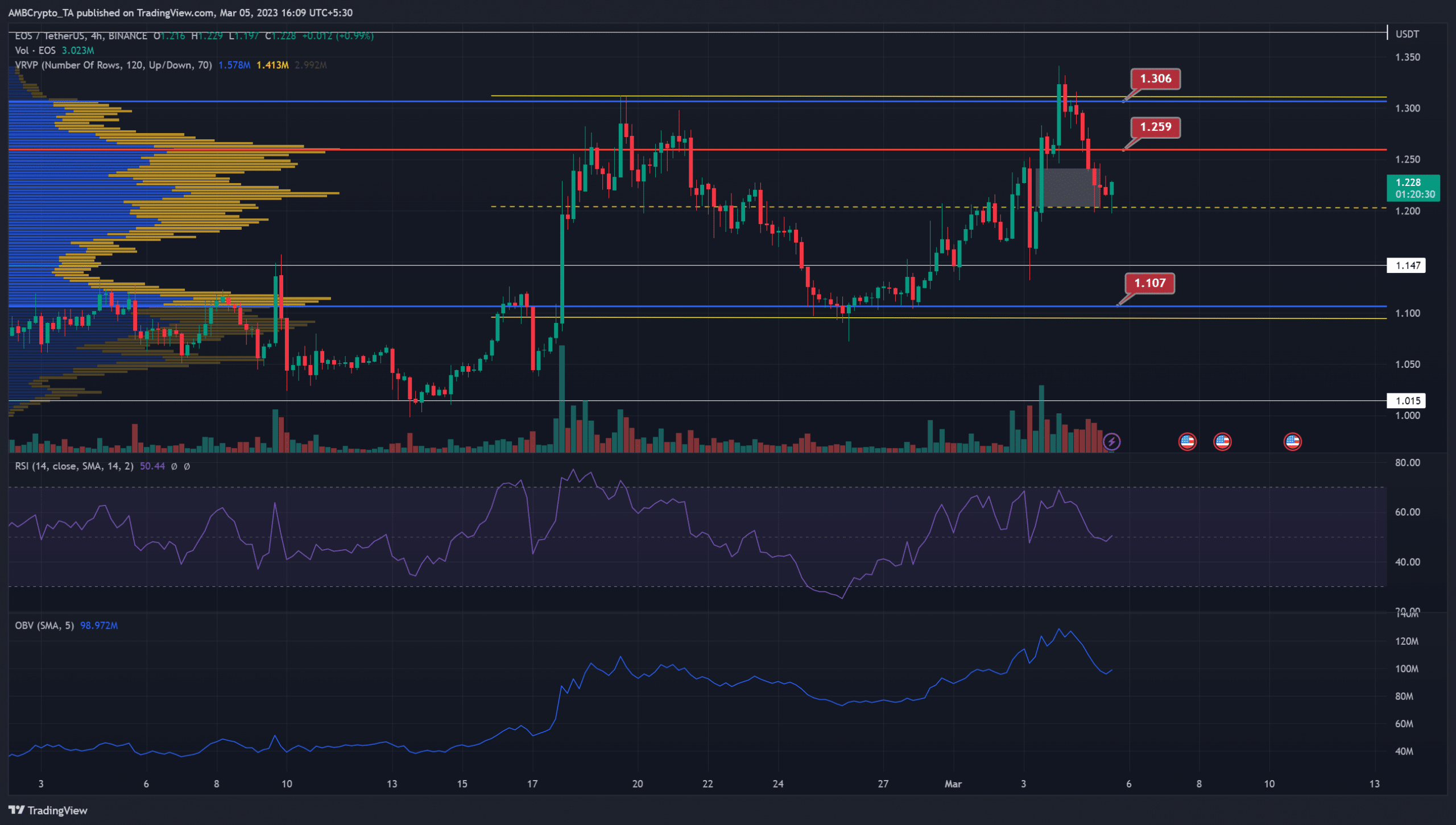

EOS confirmed indicators of a rebound after filling the FVG

Supply: EOS/USDT on TradingView

The Seen Vary Quantity Profile confirmed the Level of Management at $1.26. The Worth Space Excessive and Low sit at $1.3 and $1.1, and these three ranges are key horizontal ranges for EOS within the coming weeks.

In yellow, a spread was plotted for the asset that prolonged from $1.1 to $1.31, with the mid-range mark at $1.2. The vary values are fairly near the values highlighted by the VPVR instrument, which bolstered their significance.

On the 4-hour chart, the RSI stood at 50 and has been above the impartial 50 mark since 28 February. This highlighted some bullish momentum on this interval, and the buying and selling quantity was excessive relative to the previous weeks.

The OBV has additionally trended upward all through March, regardless of the drop in costs.

Is your portfolio inexperienced? Examine the EOS Revenue Calculator

Furthermore, the market construction remained bullish on the day by day timeframe, regardless of the volatility on H4. Moreover, the worth crammed an imbalance (white) on the charts from the current pump. This imbalance sat proper atop a help degree. Altogether, the inference was that extra beneficial properties can comply with for EOS.

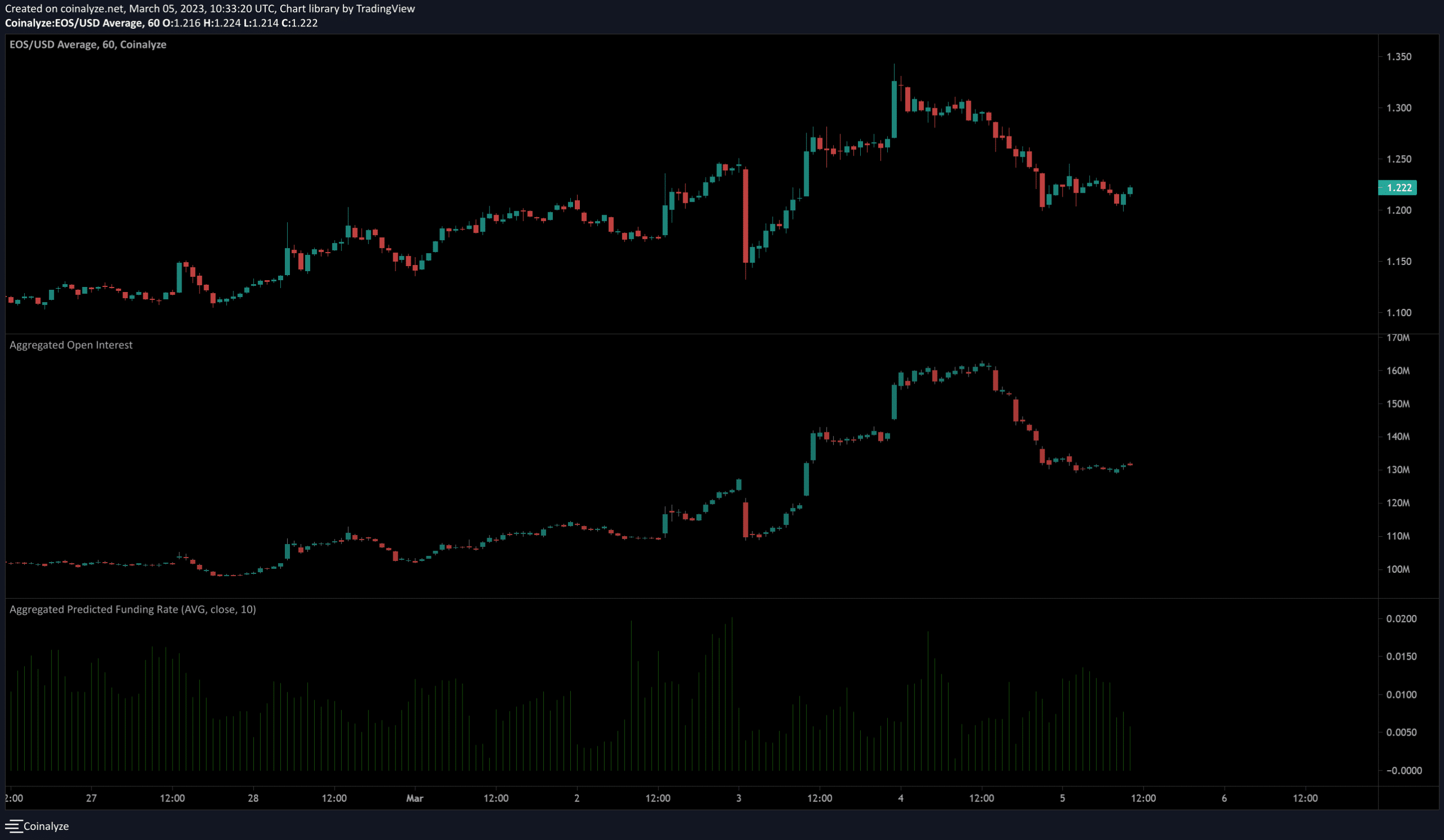

Lengthy positions are discouraged primarily based on Open Curiosity knowledge

The futures knowledge was optimistic for the bulls. The funding price was optimistic which confirmed bullish sentiment out there. The Open Curiosity noticed a pullback when EOS confronted rejection on the vary highs.

This meant lengthy positions had been probably closed in the course of the dump however the brief sellers didn’t enter the market en masse, as that may have seen an increase in OI. Due to this fact, the consumers have some room to shift issues of their favor.