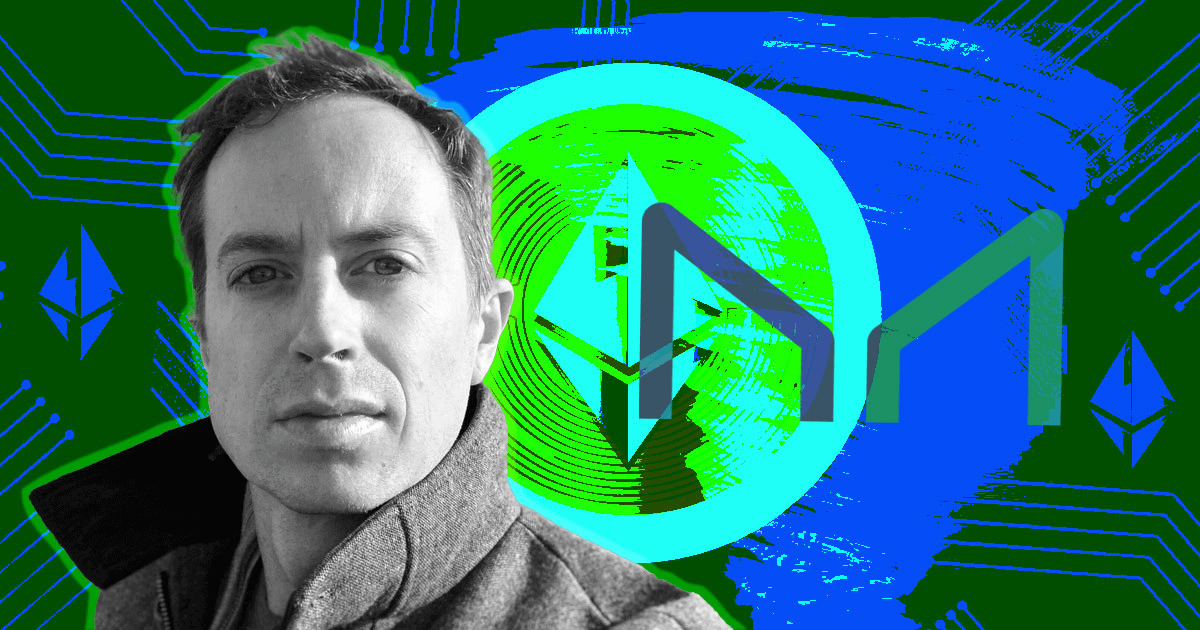

Shapeshift CEO and founder Erik Voorhees advisable the MakerDAO group take precautionary measures after the U.S. Treasury sanctioned Twister Money.

Particularly, Voorhees suggested MakerDAO customers to take away their USDC collateral and convert the funds into one other stablecoin. However he stopped wanting advocating a extra censorship-resistant selection.

Expensive @MakerDAO $DAI group… it’s best to begin unwinding your USDC collateral instantly, changing it into stables which are extra censorship resistant.

You may have a while to do it, however it’s essential to get began.

— Erik Voorhees (@ErikVoorhees) August 8, 2022

On August 8, the U.S. Treasury issued a press launch stating crypto mixer Twister Money was sanctioned because of its function in laundering illicit crypto funds price over $7 billion since 2019. Underneath Secretary of the Treasury for Terrorism and Monetary Intelligence, Brian E. Nelson stated:

“Regardless of public assurances in any other case, Twister Money has repeatedly didn’t impose efficient controls designed to cease it from laundering funds for malicious cyber actors regularly and with out primary measures to handle its dangers.”

The incident has given rise to dialogue on governmental overreach and alternate options to centralized stablecoins.

The tip of Twister Money

The Twister Money web site is offline, its builders have been booted from GitHub, and Circle has blacklisted USDC addresses owned by the group following the sanctions.

A number of months prior, Circle CEO Jeremy Allaire dismissed claims that the corporate might freeze USDC accounts for no matter motive as FUD. He additional countered by implying that entities working throughout the regulation don’t have anything to worry.

Coin Middle issued a press release on the matter, saying sanctions in opposition to a software, reasonably than an individual or entity with company, is a blow for individuals who want to preserve their privateness, “together with for in any other case completely authorized and private causes.”

“It seems, as an alternative, to be the sanctioning of a software that’s impartial in character and that may be put to good or dangerous makes use of like another expertise.”

The purpose has been extensively supported by members of the crypto group, who view the sanctions as an assault in opposition to private sovereignty.

Massive Brother is watching

The founding father of Bankless, Ryan Adams, chimed in by calling the actions of the U.S. Treasury “the opening shot of huge brother’s assault on crypto.”

In a later tweet, Adams additionally posed the query, the place will this finish? Suggesting Uniswap could possibly be subsequent, then Ethereum — additional insinuating a tiptoe to totalitarianism.

“If software program isn’t protected, then speech isn’t.”

In response to USDC censorship, a researcher at NEAR Protocol DeFi platform Proximity, @resdegen, proposed the event of a brand new decentralized stablecoin free from governmental directives.

Resdegen considers Reflexer’s Rai and Liquidity’s LUSD 100% decentralized, however each are collateralized, which is disadvantageous scalability-wise. Resdegen steered creating a brand new venture which might be algorithmically pegged utilizing BTC or ETH derivatives contracts.

6/ There are some really decentralized options reminiscent of $RAI or $LUSD as their collateral is simply $ETH

I extremely suggest studying about them (Vitalik is an enormous supporter of RAI)

Nevertheless, being collateralized stablecoins implies that their scalability depends upon ETH market cap

— Res ®️ (@resdegen) August 8, 2022