Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.

- The $20.4-$20.8 is an space of liquidity.

- The transfer downward to hunt stop-losses might see a reversal towards $22.3 and $23.9.

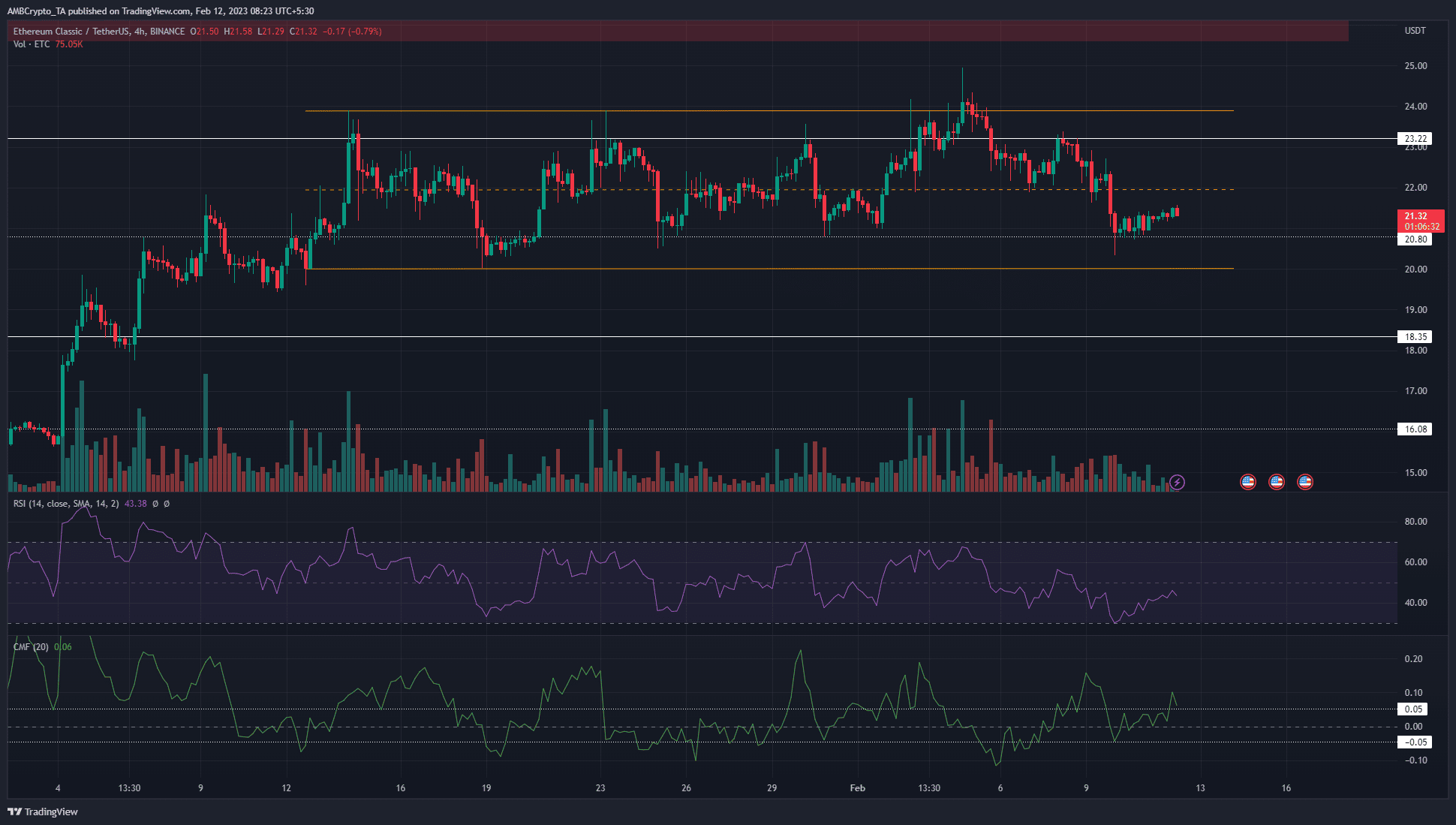

Ethereum Traditional noticed the decrease timeframe momentum flip to bearish on 5 February, when the worth fell beneath $23.22. ETC additionally retested the identical as resistance on 8 February. Because of this drop, the market construction additionally shifted to a bearish bias.

Reasonable or not, right here’s ETC’s market cap in BTC’s phrases

Bitcoin sat on a powerful degree of help at $21.6k. The latest drop crammed the imbalance on BTC’s worth chart. It appeared probably that upward momentum can proceed as soon as extra after flushing out late however overeager bulls.

The vary lows stay untested however bearish momentum has weakened

Supply: ETC/USDT on TradingView

The $20.8 degree has been essential since early January. Ethereum Traditional has traded inside the vary (orange) since 14 January. The vary prolonged from $20 to $23.9, with the mid-point at $21.95. The mid-point has been a short-term important degree of help and resistance over the previous month.

How a lot are 1, 10, 100 ETC value?

The market construction of ETC on the 12-hour chart was decisively flipped to bearish when the bulls had been exhausted by the promoting strain on 9 February. Costs slumped sharply beneath the mid-range mark. Since then, a bounce in costs was seen.

The RSI climbed again towards impartial 50, which confirmed the bearish momentum was dropping power. The CMF additionally pulled itself above +0.05, which denoted important capital movement into the market over the previous couple of days.

A transfer again above the mid-range mark and a subsequent retest could be a shopping for alternative. Alternatively, a transfer to the vary lows at $20, which can also be a psychological help degree, might see a bounce towards the vary highs.

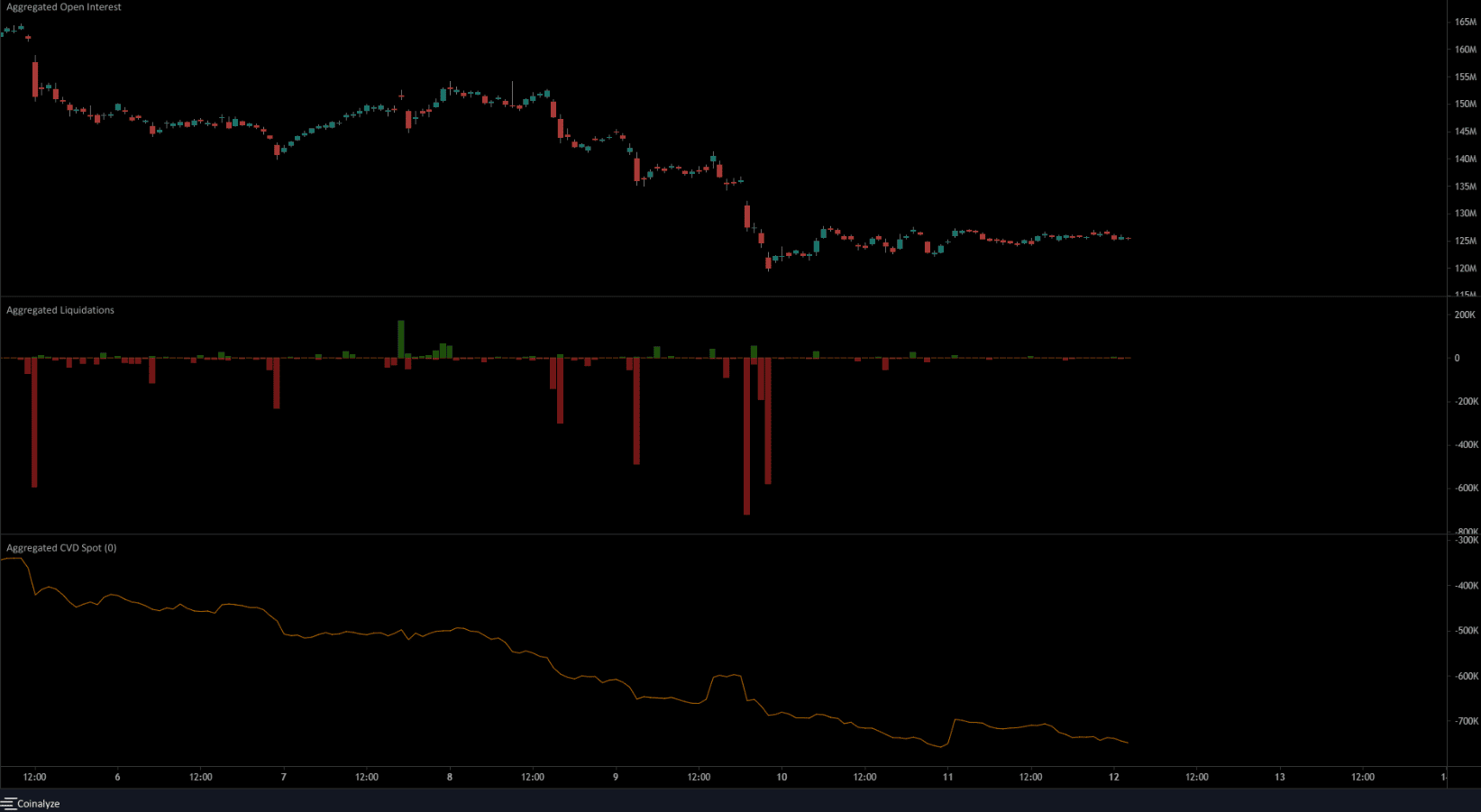

Lengthy liquidations fueled a transfer decrease and sentiment retains a bearish bias

9 February noticed $1.5 million value of lengthy positions liquidated within the span of 4 hours. This was when the worth slipped from $22 to achieve the $20.4 mark. The sudden drop alongside the liquidations meant that promoting strain additionally spiked quickly, however halted simply above $20.

Up to now couple of days, the falling spot CVD has flattened. This prompt the promoting strain might be at an finish, at the least quickly.

Nonetheless, the Open Curiosity posed worrying inquiries to the bulls. It has been flat over the previous couple of hours, at the same time as the worth bounced 4.8% from $20.34 to $21.32. This occurred over the weekend.

Therefore, the conclusion was not a short-term consolidation section to reverse the promoting strain. Moderately it might be some calm earlier than one other leg down on the worth charts.