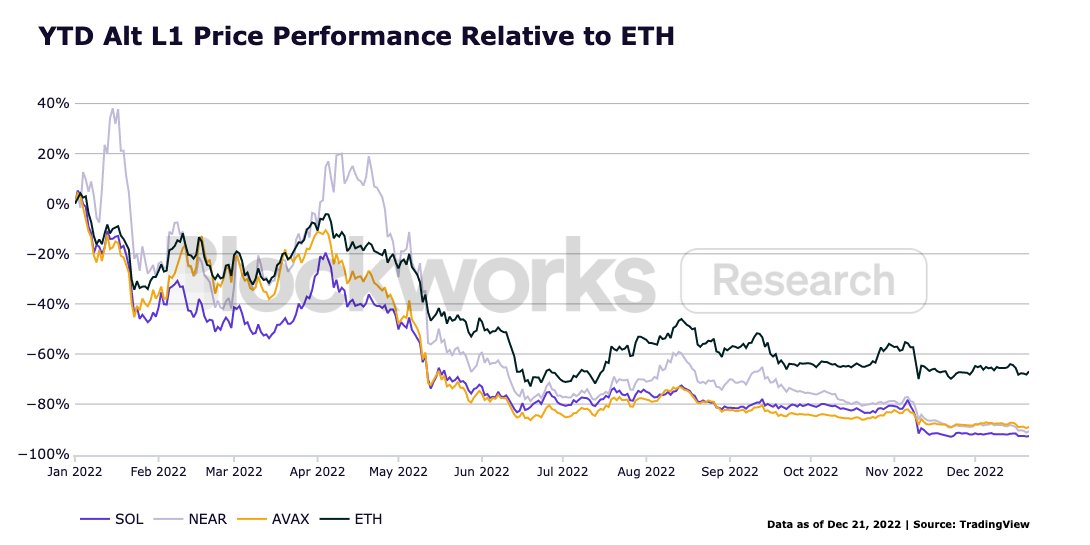

- ETH’s value fared significantly higher than different layer-1 altcoins this yr.

- SOL suffered probably the most decline in worth.

On a year-to-date foundation, the worth of main altcoin Ethereum [ETH] fared higher than different layer-1 altcoins (Alt L1s), together with Solana [SOL], Close to [NEAR], and Avalanche [AVAX], a brand new report revealed.

The cryptocurrency market has skilled a big downturn in latest months, with a complete lack of over $1.4 trillion in worth. This decline has been attributed to a spread of points inside the trade, together with failed initiatives and an absence of liquidity.

As well as, the autumn of FTX, a significant participant out there, has additionally contributed to the general decline.

Learn Ethereum’s [ETH] Value Prediction 2023-2024

Based on the report, previous to the transition of Ethereum to a proof-of-stake (POS) consensus mechanism, the unfold between ETH and Alt L1s had already begun to widen. This divergence turned extra important following the Merge.

Supply: Blockworks Analysis

ETH and its friends

Exchanging palms at $1,194.62, ETH’s value has fallen by 67% since January, knowledge from CoinMarketCap confirmed. Of the Alt L1s listed above, SOL has suffered probably the most decline, with a 94% drop in its worth.

The latest controversy surrounding Solana and its ties to disgraced-founder Sam Bankman-Fried has additionally contributed to a lower in SOL’s worth. As well as, up to now week, the community noticed main NFT initiatives announce their intentions emigrate to Ethereum and Polygon, all of which have introduced Solana’s longevity into query.

As for NEAR, it has misplaced 90% of its worth for the reason that yr began. There are, nevertheless, a sequence of upgrades to the Close to Protocol within the coming yr that many anticipate will result in a rally in NEAR’s worth.

In the meantime, AVAX traded at $11.24 at press time, having declined by 89% for the reason that yr began.

How a lot Ethereum are you able to get for $1?

Due to PoS

Based on the report, ETH fared significantly higher than different Alt L1s, primarily because of Ethereum’s profitable migration to a PoS consensus mechanism on 15 September.

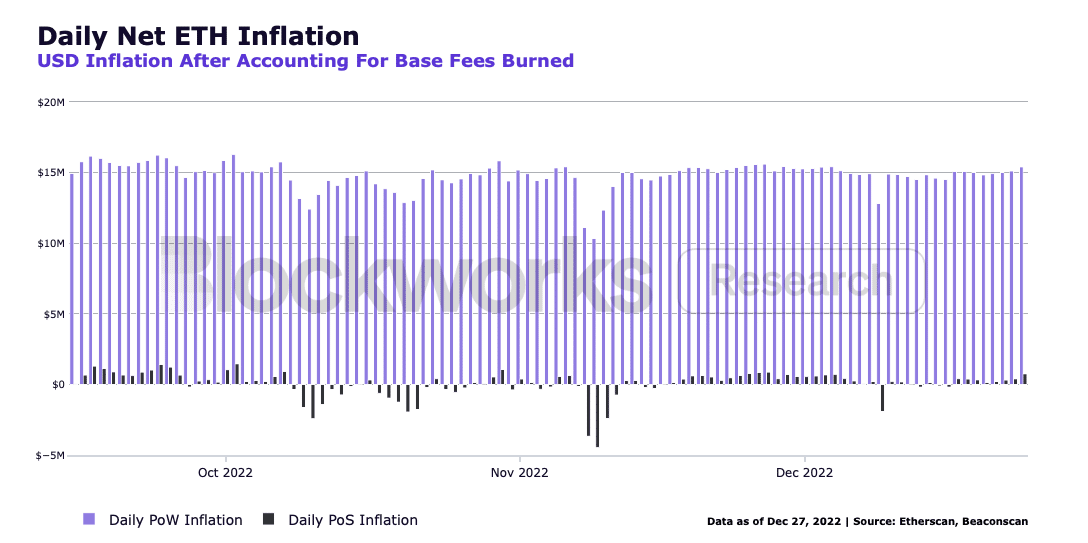

It was famous that probably the most notable affect of the change to PoS for Ethereum was the change in ETH’s provide dynamics. After the Merge, ETH’s provide inflated by solely 3,800, in comparison with the 1.2 million inflation that might have occurred if the community had continued to function underneath Proof-of-work (PoW) consensus. On this regard, Blockworks Analysis discovered,

“In different phrases, over $1.5B of promote stress has been faraway from the market on account of the Merge in underneath simply 4 months,”

Supply: Blockworks Analysis

![Ethereum [ETH] fared better than SOL, NEAR, AVAX on YTD basis, thanks to…](https://ambcrypto.com/wp-content/uploads/2022/12/kanchanara-ffoMzQNvx2s-unsplash-1-1000x600.jpg)