- The check on Goerli would be the final gown rehearsal for the upcoming Shanghai Improve.

- ETH recorded a steep fall on the information of the postponement at press time.

The much-anticipated Shanghai Improve that would allow the withdrawal of staked Ethereum [ETH] has been pushed to the second week of April, as determined through the network’s core developers’ call.

A lot to the frustration of stakers who had been eagerly in search of an finish to the two-year wait, the builders arrived on the consensus that the mainnet launch for the improve would occur a month after the Goerli testnet launch which was mounted for 14 March through the name.

One of many builders steered an earlier date for the Goerli launch as it can permit extra time between Goerli and the mainnet launch.

There was a proposal to have Goerli launch on 16 March but it surely was dropped in favor of 14 March in order to have sufficient time to investigate and focus on the outcomes on the following core builders name which might fall on 16 March.

The check on Goerli would be the final gown rehearsal for the upcoming Shanghai Improve. In response to the builders, the Sepolia testnet launch went easily barring a couple of infrastructure-level points.

Learn Ethereum’s [ETH] Value Prediction 2023-24

State of Staking

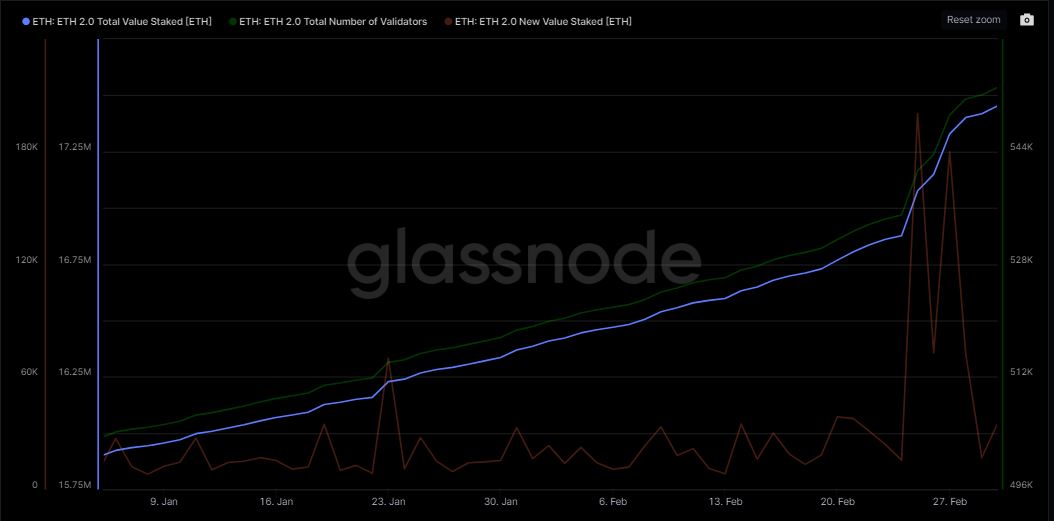

As per information from Glassnode, the general staking exercise on Ethereum noticed first rate progress over the earlier week. On the time of writing, practically 17.5 million ETH was locked within the community’s sensible contracts, representing a week-over-week progress of three%.

The expansion within the whole variety of validators adopted the identical trajectory.

Nonetheless, the speed at which new ETH was being staked plunged 82% over the earlier week. This might have been because of a scarcity of readability across the Shanghai Improve mainnet launch date.

Supply: Glassnode

As per Staking Rewards, the full quantity of ETH staked at press time represented greater than 14% of ETH’s whole circulating provide.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

Unfavourable sentiment steps in

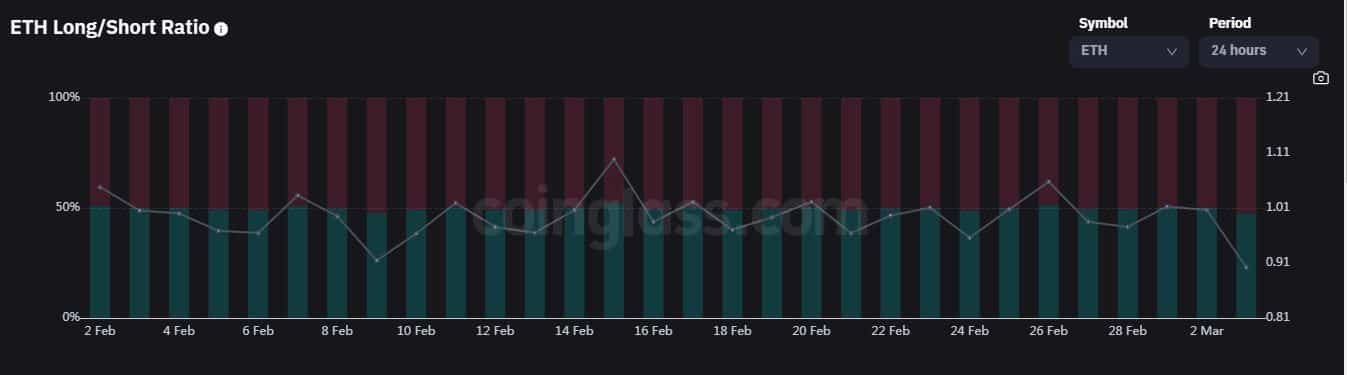

The information of the delay pulled ETH to its lowest worth in over two weeks, as per CoinMarketCap. The king of the altcoins plunged 4.64% within the final 24 hours to commerce under $1600.

ETH’s Lengthy/Brief Ratio dipped under one. Thus, indicating that the variety of lengthy positions dropped. This may very well be because of traders’ bearish outlook towards the coin.

Supply: Coinglass

![Ethereum [ETH] nosedives as Shanghai Upgrade gets pushed to April](https://ambcrypto.com/wp-content/uploads/2023/03/Ethereum-1-1000x600.jpg)