The second-largest crypto asset by market cap, Ethereum (ETH), has extra upside potential, based on analytics platform Santiment.

The crypto analytics agency says that Ethereum is prone to soar above the $2,000 value after hitting a excessive final reached seven months in the past over the weekend.

“Ethereum’s value hadn’t eclipsed $1,840 since August 18th. Regardless of this seven-month excessive, the community hasn’t appeared to warmth up and create notable transaction limitations resulting from excessive demand. This can be a good signal that ETH has a door open to $2,000 and past.”

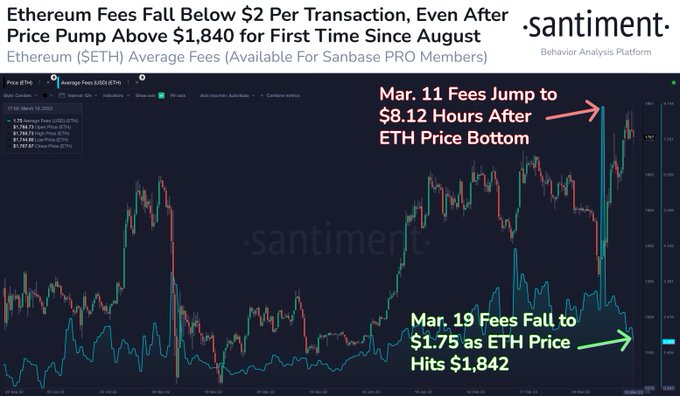

Regardless of the worth bounce, Santiment says that Ethereum’s transaction charges fell under $2 when ETH hit a seven-month excessive in comparison with rising above $8 earlier this month when the second-largest crypto fell to a two-month low.

A Twitter survey carried out by Santiment over the weekend additionally indicated that there are extra individuals who consider Ethereum will rise above $2,000 first than those that suppose it can drop under $1,600 first. Practically 10% of the respondents mentioned they see Ethereum hovering above $2,000 subsequent whereas 5.2% mentioned they see ETH falling beneath $1,600 subsequent.

On Bitcoin (BTC), Santiment additional says that March’s rally is respectable. In line with Santiment director of selling Brian Quinlivan, Bitcoin’s rally has coincided with the banking sector’s meltdown.

“With the calendar previous the midway mark in March, Bitcoin has gone on one other tear, breaking above $27,800 for the primary time since June, 2022.

So why did costs handle to soar? Nicely, there have been a number of completely different key occasions within the first half of March.

The obvious seemed to be the collapse of one of many bigger US banks, Silicon Valley Financial institution (SVB). And it seems this has prompted large ripple results among the many banking sector, usually.”

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses you might incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney