Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.

- ETH has been rejected at $1,743 and faces OB at a 78.6% Fib degree.

- Fluctuating open curiosity (OI) might preserve the above problem going.

After the discharge of US CPI, buyers’ risk-on method has seen Ethereum [ETH] publish a 17% hike prior to now 4 days. It reached a brand new excessive of $1,743 after Bitcoin [BTC] hit the $25k mark.

Nonetheless, a pointy correction occurred after BTC misplaced the psychological $25,000 mark. Though the bulls of ETH discovered regular help on the 61.8% Fib degree, the impediment remained on the 78.6% Fib degree.

Learn Ethereum [ETH] Value Prediction 2023-24

The hurdle of the 78.6% Fib degree: Are additional positive factors unlikely?

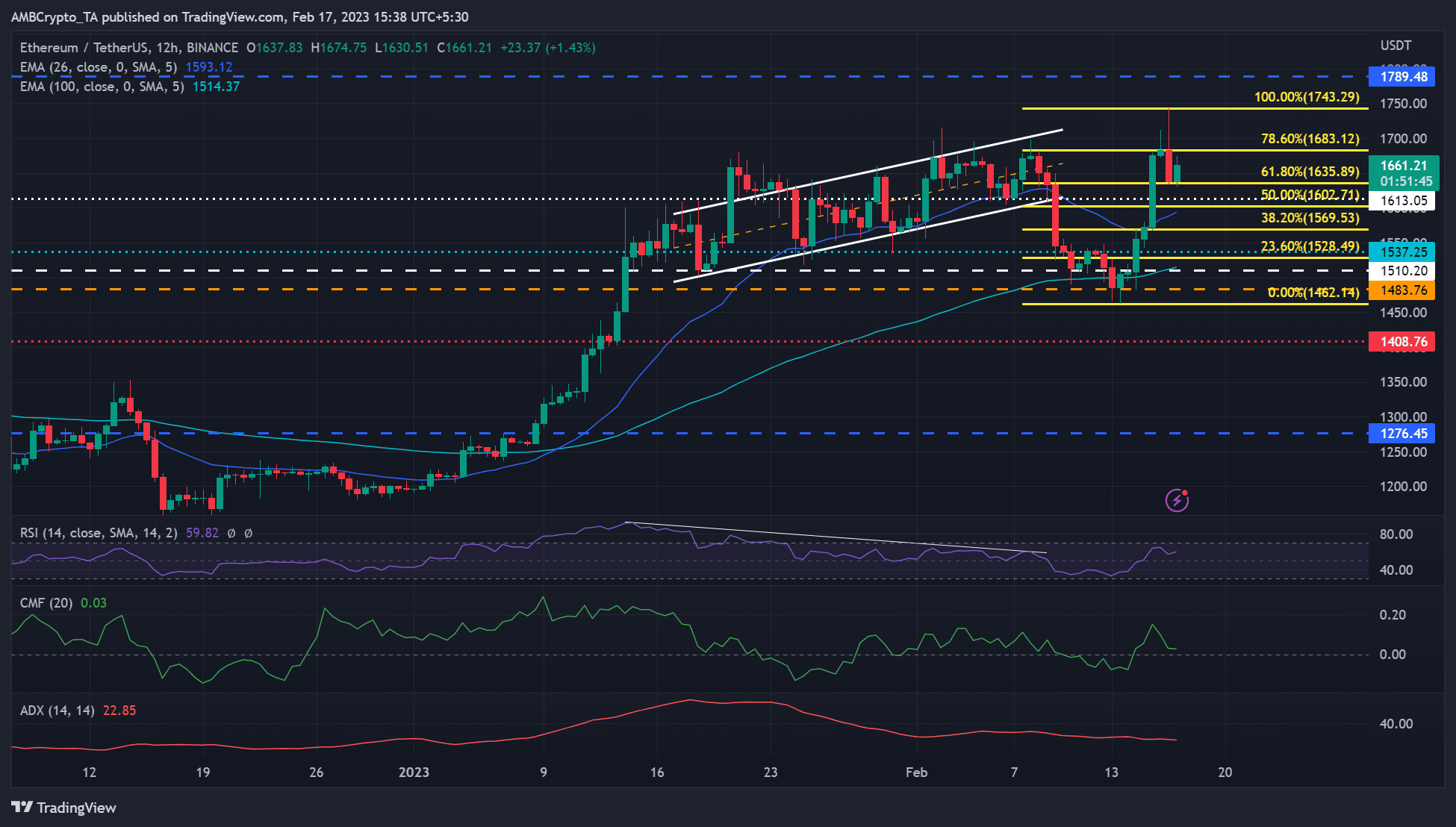

Supply: ETH/USDT on TradingView

Regardless of an prolonged rally after 10 January, the upward momentum of ETH has weakened on the 12-hour chart. That is highlighted by the bearish RSI divergence and the falling Common Directional Motion Index (ADX).

The sharp decline from the ascending channel (white) turned the market into bearish, however the zone between $1,483 and $1,510 saved the drop in examine, permitting the bulls to publish a 17% acquire. ETH might goal the overhead resistance of $1,743 if BTC holds the $23.5k help and continues to rise.

Nonetheless, the bulls want to beat the bearish order block (OB) on the 78.6% Fib degree of $1,683 – close to $1,700. This degree has blocked the additional uptrend of ETH since mid-January. One other important resistance degree to be careful for if ETH clears this hurdle is the September excessive of $1,790.

A break under the swing low of $1,483 would invalidate the bullish thesis above. This might lead the bears to devalue ETH in the direction of $1,400 or $1,276.

ETH noticed a short-term accumulation, however OI fluctuations might complicate issues

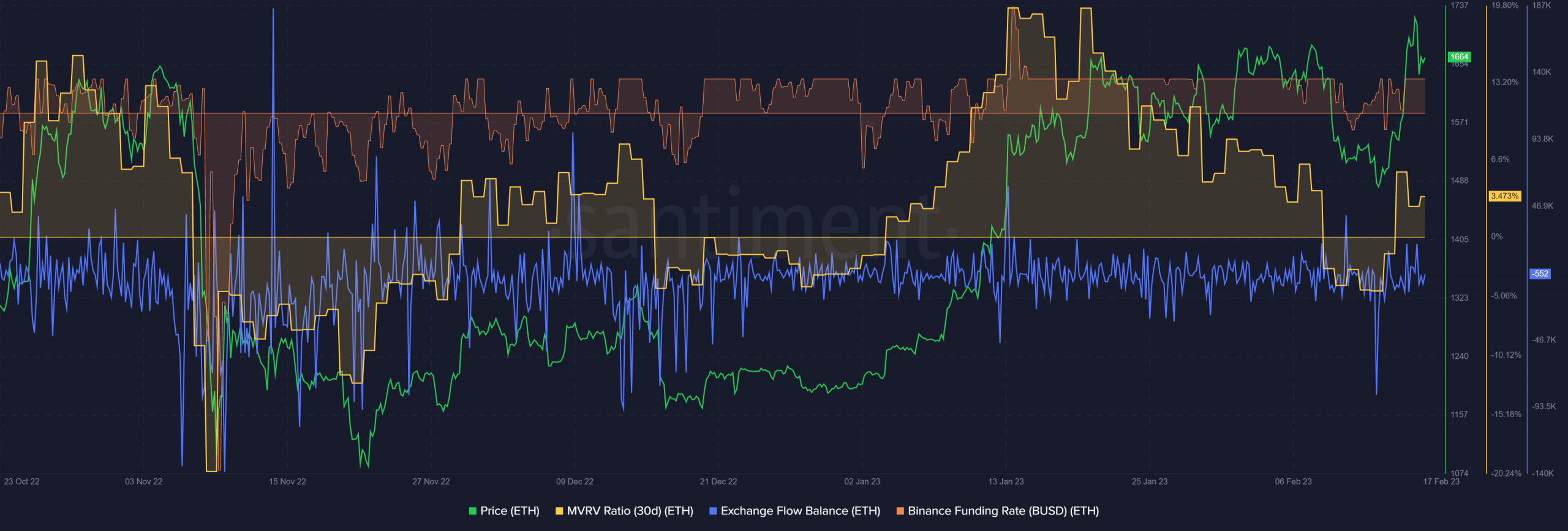

Supply: Santiment

At press time, extra ETH was out of the exchanges than in, as proven by the detrimental alternate move stability. This means that there was much less ETH on the market on the exchanges, so there was short-term accumulation.

As well as, the current Ethereum upswing has lowered holder losses because the 30-day MVRV turned from optimistic to detrimental. The demand described above can also be bolstered by a optimistic Funding Fee, indicating bullish sentiment within the derivatives market.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

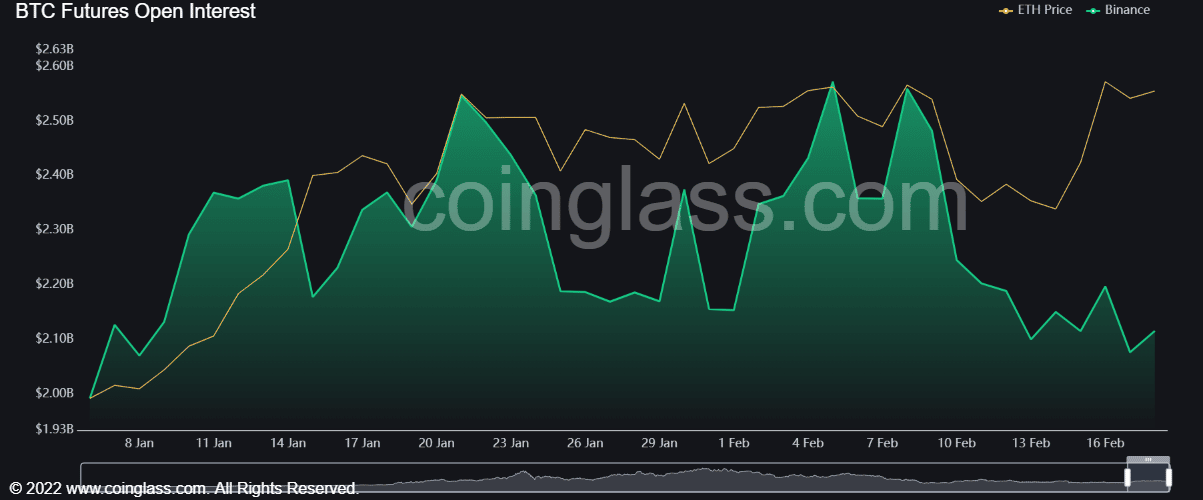

Nonetheless, the open curiosity (OI) fluctuations highlighted by Coinglass might complicate the bulls’ efforts. In distinction to the January rally, which was accompanied by a gradual rise in OI, the current upswing has been characterised by fluctuations.

A gradual rise in OI and a break above the 78.6% Fib degree might sign robust upside momentum able to retesting the $1,743 and different resistance ranges.

Supply: Coinglass

![Ethereum [ETH] stuck at $1,700 as bulls need to overcome this Fib level](https://ambcrypto.com/wp-content/uploads/2023/02/shubham-dhage-geJHvrH-CgA-unsplash-1000x600.jpg)