- ETH whales lead the cost in latest rally.

- Quick squeeze turbocharges ETH’s momentum after exiting bear entice.

Ethereum [ETH] concluded a bearish second week of February, however the tide was altering at press time. The crypto market delivered a bullish efficiency during the last two days and ETH was not left behind.

Learn Ethereum’s [ETH] Worth Prediction 2023-24

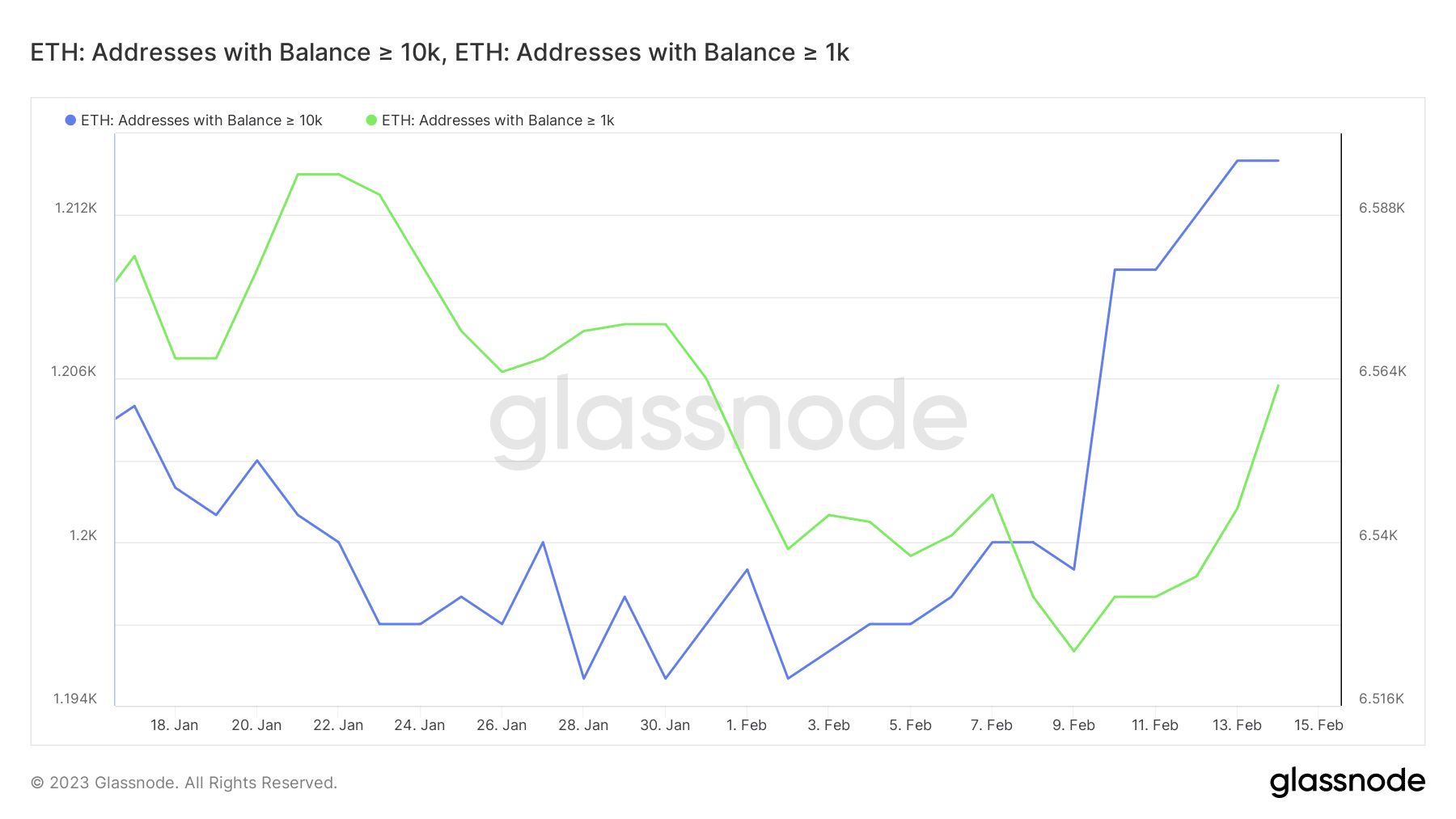

Whereas ETH bulls have reclaimed dominance, newest alerts have revealed the grip that they’d over the market on the time of writing. As per Glassnode, the variety of addresses holding a minimal of 10,000 ETH reached a four-week peak on 15 February. In different phrases, ETH whales have kicked their accumulation into excessive gear.

📈 #Ethereum $ETH Variety of Addresses Holding 10k+ Cash simply reached a 1-month excessive of 1,216

View metric:https://t.co/paW9ojeWBw pic.twitter.com/UNk8h5T8Z2

— glassnode alerts (@glassnodealerts) February 15, 2023

Addresses holding at the very least 1,000 ETH additionally demonstrated one thing related, because the metric grew to its highest level because the begin of February 2023. This confirmed that whales had been accumulating, thus sustaining the pattern noticed in January 2023.

Supply: Glassnode

The state of ETH demand

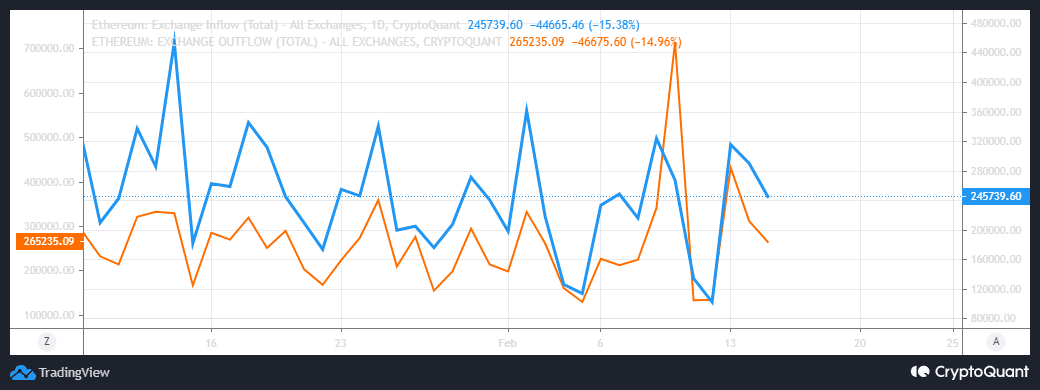

A have a look at ETH’s trade flows revealed that there was nonetheless vital promote stress at press time, implying that a number of buyers had been bearish. However, the general scenario, so far as exchanges had been involved, was that there was the next internet outflow.

Supply: CryptoQuant

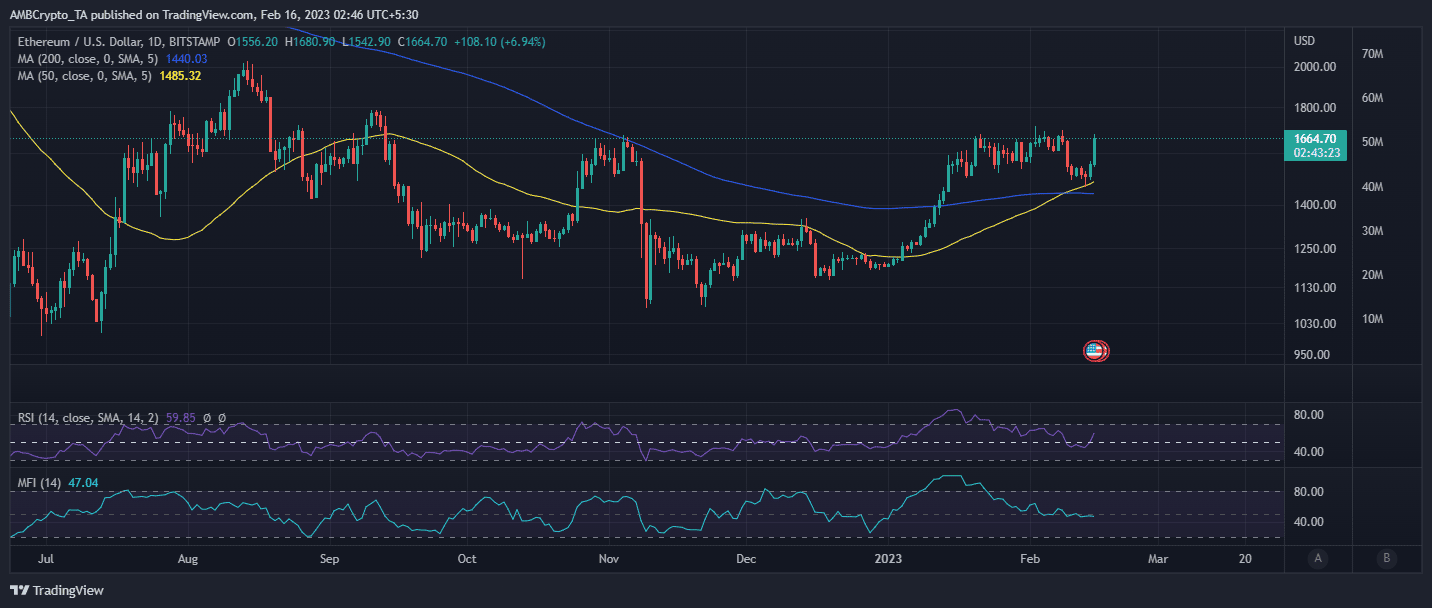

The upper trade outflows coupled with robust demand from whales have yielded a noteworthy impression on ETH’s worth. It pulled off an 11.48% rally to its press time worth of $1665.30. Nonetheless, this upside places it inside the similar vary because the resistance stage, the place it has failed to interrupt by way of within the final three weeks.

Supply: TradingView

ETH’s means to maintain the bullish momentum will rely on whether or not it could possibly preserve the demand. A rise in promote stress close to the resistance will signify the next chance of a promote wall forming once more. Then again, the bulls might goal to push greater by sustaining robust demand.

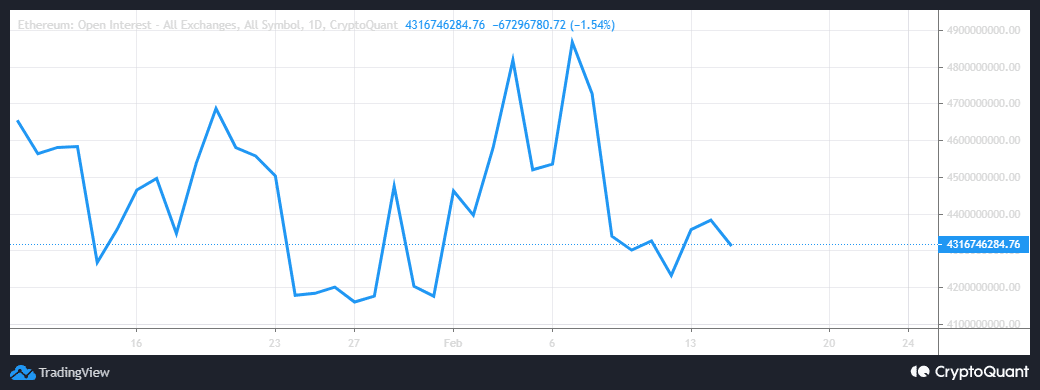

One of many methods to trace demand is to look into the demand from the derivatives market. ETH’s open curiosity metric registered an uptick between 12 – 14 February. It has since reverted to the draw back, suggesting that derivatives demand was slowing down on the time of writing.

Supply: CryptoQuant

One other bearish retracement is perhaps on the playing cards for ETH if the spot market mimics the above commentary within the derivatives market. Then again, ETH’s efficiency to date this month underscores a bear entice which can clarify the present rally.

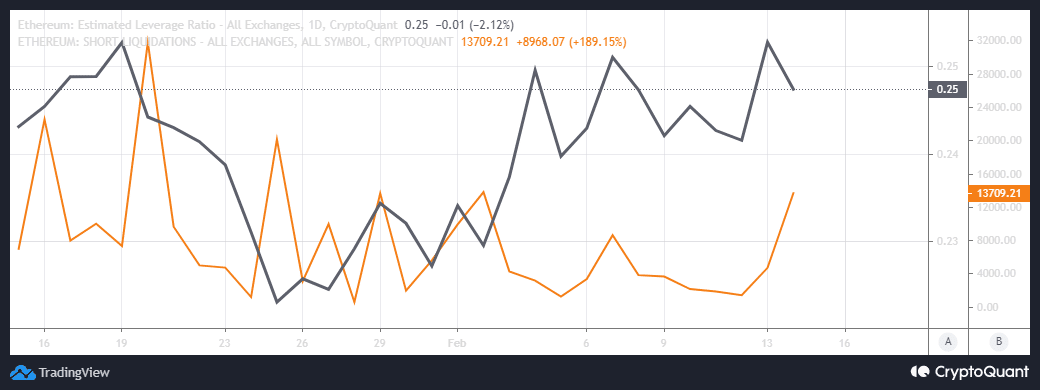

ETH’s bearish worth motion within the second week of February was bearish. This will have created a false expectation of extra draw back, therefore a rise in leveraged quick positions.

Supply: CryptoQuant

Is your portfolio inexperienced? Try the ETH Revenue Calculator

The chart above signified a surge within the estimated leverage ratio, which peaked on 13 February earlier than pivoting. This pivot marked the top of the latest bearish pullback, after which merchants exited their leveraged positions. This confirmed that leveraged quick merchants had been exiting their positions, and that’s the reason quick liquidations had been on the rise.

The above commentary additionally confirmed that the momentum out there was partly fueled by a brief squeeze at press time. Thus, the jury continues to be out on whether or not ETH would maintain its momentum.

![Ethereum [ETH] whales stack up, but is this enough for a level retest?](https://ambcrypto.com/wp-content/uploads/2023/02/eth-michael-1000x600.jpg)