Blockchain

Ethereum community’s fuel payment skyrocketed to a brand new multi-month excessive amid a rising memecoin frenzy. The excessive transaction payment has swelled Ethereum’s every day income multifold in comparison with Bitcoin (BTC). Whereas Ethereum proponents celebrated the expansion in income, many others have been fast to level out the rising congestion on the community and the issue in processing transactions.

There was an uncommon shift within the prime 10 gas-burning altcoins the place as a substitute of ETH (ETH), WETH, and USDT (USDT), memecoins reminiscent of TROLL, APEDand BOBO have been among the many prime 10 spenders.

⛽️ A extremely uncommon shift in prime 10 fuel burning #altcoins has emerged immediately. As a substitute of $ETH, $WETH, and $USDT being on the prime of the payment distribution checklist, we’re seeing new belongings like $TROLL, $APED, and $BOBO amongst them. Learn our newest deep dive. https://t.co/7SlmJ59k2m pic.twitter.com/Y2kaLKZTrL

— Santiment (@santimentfeed) April 19, 2023

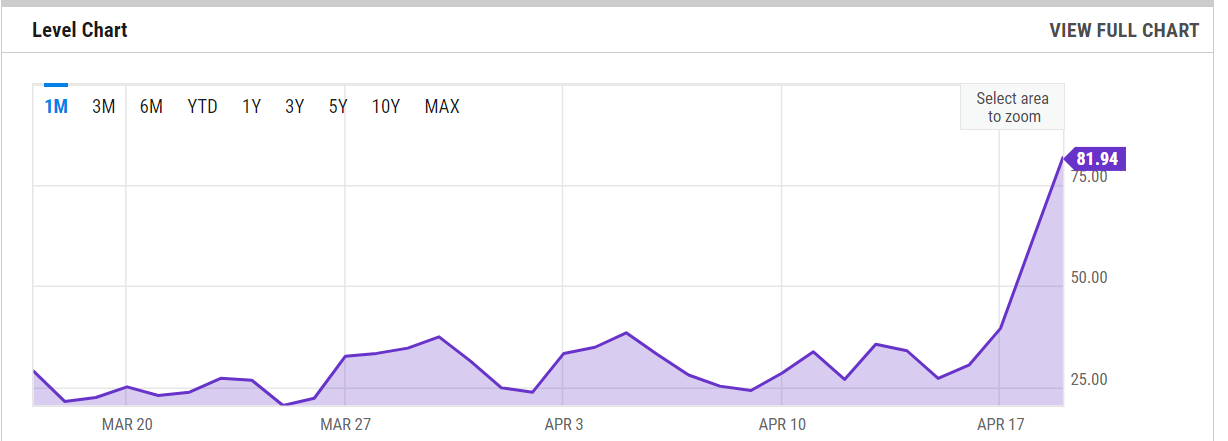

The common fuel value for Ethereum transactions as of April 20 was 81.94 gwei, up from 60.82 gwei on April 19 and 44.42 gwei final yr — a rise of 34.74% from April 19 and 84.46% from April 20, 2022. Gwei is a denomination of the Ether and represents one billionth of 1 ETH.

ETH fuel payment enhance in final month. Supply: Ychart

Impartial Ethereum educator Anthony Sassano shared the surge in every day payment income of the Ethereum community and stated that the second-largest blockchain had introduced in 28 occasions the income of Bitcoin. He additionally cited Ethereum layer-2 platforms like Arbitrum One which have outperformed the BTC community by way of every day income because of the ongoing meme frenzy.

Day by day and weekly income of assorted blockchain. Supply: Twitter

Ethereum proponent’s fundamental argument is that the excessive fuel payment and subsequent larger income spotlight the community’s rising usability. Nonetheless, many on Crypto Twitter have been fast to level out that the intensive utilization they’re referring to is just some thousand customers playing on memecoins.

The intensive utilization you’re speaking about are a couple of thousand customers playing meme cash. I believed (and hoped) eth was presupposed to be the way forward for finance

— nap.BasicallyRiskFree (@CryptoPannella) April 20, 2023

A number of customers reportedly paid fuel charges as excessive as a couple of hundred {dollars}, whereas others complained about having to pay a better fuel payment than the precise transaction.

attempt to purchase a ~$20 NFT on eth, and the fuel is ~$40.

some ppl say the infra operators should be paid. positive, however imaging paying visa $40 payment for purchasing a $20 digital good.. infra ought to be inexpensive. pic.twitter.com/5L4SYjT5af— 0xMQQ (@0xMQQ) April 18, 2023

One other distinguished cause for the hovering fuel charges was blamed on a Maximal Extractable Worth (MEV) buying and selling bot that’s front-running memecoin trades on an enormous scale. The bot in query jaredfromsubway.eth has been the highest fuel spender within the final 24 hours, spending 455 ETH ($950,000) and utilizing 7% of the overall fuel of the community.

Associated: Tether blacklists validator deal with that drained MEV bots for $25M

Within the final two months, it spent greater than 3,720 ETH ($7 million) in fuel charges and carried out greater than 180,000 transactions.

bro has used 7% of the overall fuel on ethereum over the previous 24hrs (455 ETH) simply feasting away on $pepe

information from the legendary @hildobby_ https://t.co/j3SqtQnkKJ pic.twitter.com/hWavtdO1D5

— beetle (@1kbeetlejuice) April 18, 2023

The Subway-themed bot is utilizing the sandwich buying and selling method to pocket thousands and thousands of {dollars} whereas congesting the community on the identical time.

Journal:‘Account abstraction’ supercharges Ethereum wallets: Dummies information