- The aftereffect of Ethereum’s merge did not yield a considerable impact on the ETH worth.

- The funding fee flatlined as merchants provided no push for elevated quantity.

Because the 15 September Ethereum [ETH] Merge approaches its three-month anniversary, merchants nonetheless stay in hysteria over the influence the occasion has had.

Recall that there was blazing pleasure within the lead-up to the Proof-of-Stake (PoS) transition. This was as a result of prospect of a optimistic worth response.

This, sadly, didn’t seem as the end result; in reality, over time, ETH dropped beneath $1,500. Per present circumstances, ETH refused to provide any spectacular efficiency as highlighted by Santiment’s latest report.

Right here’s Ethereum’s Worth Prediction 2023-2024

Incoherence- the order of the day

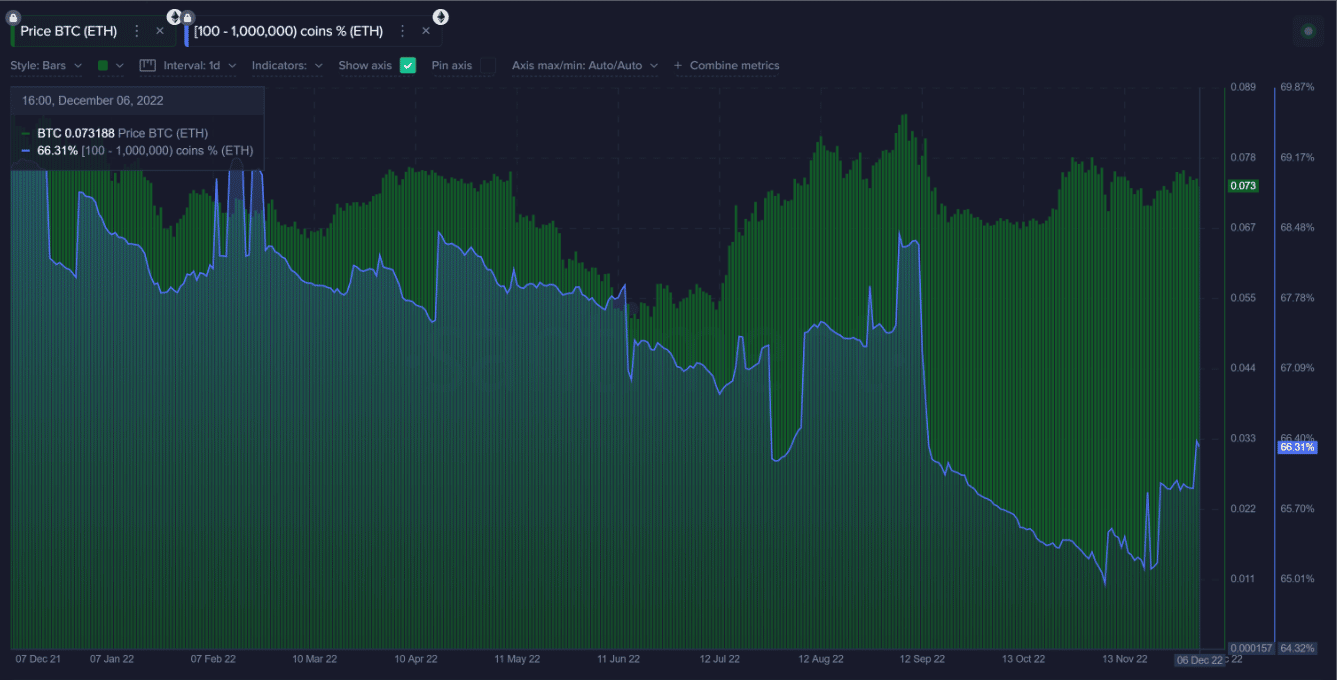

In accordance with Santiment’s on-chain analyst, Brianq, not each a part of side of Ethereum was obsessive about negativity. The analyst famous that whales had been phlegmatic with amassing the second-ranked cryptocurrency in market worth weeks after the Merge as much as the tip of October.

Nevertheless, since 7 November, these bulging purse traders started stockpiling the asset.

Supply: Santiment

The info above signaled that ETH traders who held between 100 to 1,000,000 cash look to have put again their resolution to halt. As such, the renewed curiosity ensured that these whales floated 2.09% of the general provide.

The measures taken right here paint a trigger for a bullish justification. For these contemplating this metric alone as a rationale for bulls, different metrics counsel that the coast won’t be clear but. So, it couldn’t be time to wager on the current upward continuation.

In relation to the deeds of market members, Santiment confirmed that the funding rate had improved. This was as a result of the Binance funding fee utilizing USDT and BUSD have been truthful sufficient as each have been at 0.01%.

Nonetheless, the standing mirrored largely neutrality as Brianq additionally agreed that the shortage of utmost worry and greed contributed to the present situation.

Supply: Santiment

Nonetheless, brief liquidations weren’t exempted as ETH most well-liked the upside within the final 24 hours. In accordance with Coinglass, total liquidations over the past day was $13.76 million, with shorts taking up $11 million of the wipeout. This implied that the ETH development as of 8 December didn’t favor trades that projected a downside.

Bearing the brunt amid the wait

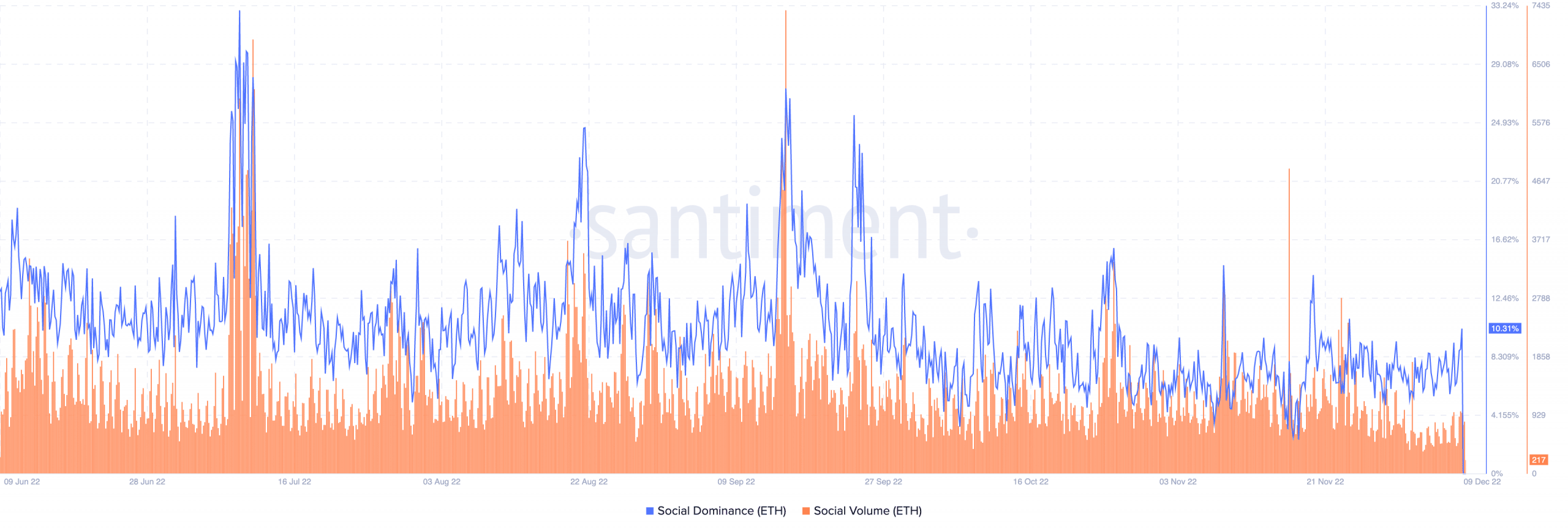

Socially, it was not the perfect of instances for Ethereum shortly after the Merge. This was as a result of decline in discussions across the asset. Curiously, there was development currently as ETH’s social dominance rose to 10.31%. Notably, the social quantity was suppressed to 193.

Supply: Santiment

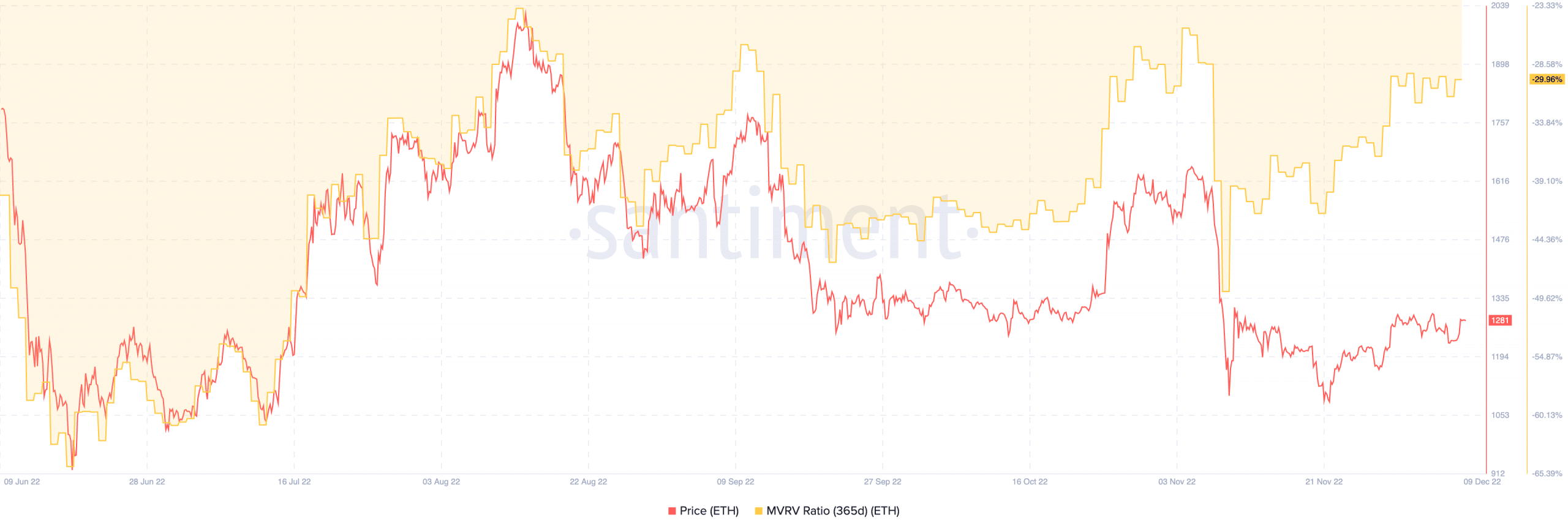

For long-term holders, proudly owning ETH nonetheless meant long-standing affliction. This was due to the situation displayed by the 365-day Market Worth to Realized Worth (MVRV) ratio.

On the time of writing, Ethereum’s MVRV ratio was -29.96. This meant that traders who owned and nonetheless held the altcoin possessed returns within the unfavorable.

However with the MVRV ratio selecting an uptrend, ETH’s long-term projection signaled bullish traits. Nevertheless, within the brief time period, it was possible that bearishness would possibly prevail. Therefore, there might nonetheless be an opportunity to commerce beneath $1,000.

Supply: Santiment