Whereas most networks noticed their DeFi TVLs recognize in October, newly-forked chain EthereumPoW [ETHW] led with the very best TVL hike. This, based on knowledge from CryptoRank.

As per DefiLlama, at press time, 15 DeFi protocols have been housed throughout the proof-of-work community with a TVL of $5.54 million. In the direction of the start of October, TVL on EthereumPoW stood at $1.42 million. Nevertheless, as extra DeFi protocols have been launched on the chain throughout the 31-day interval, its TVL grew by 365% to shut the buying and selling month with a TVL of $6.6 million.

Supply: DeFiLlama

Launched on 15 September following the Ethereum community’s profitable Merge, the EthereumPoW ecosystem has since seen progress regardless of the overall controversy surrounding how the POW community got here to be.

For instance, as of twenty-two October, 4 NFT marketplaces have been operational on the chain with six native NFTs initiatives.

— Wagmi33 Basis (@wagmi33fund) October 22, 2022

ETHPOW since launch

Based on knowledge from OKLink, since ETHPOW community turned operational on 15 September, transactions accomplished on it totalled 1.72 billion. Customers have paid as transaction charges – 126.12 million – throughout the similar interval.

Moreover, the depend of complete addresses on the community, on the time of writing, was 263 million addresses, with 262 million of these inactive. Additionally, the chain helps numerous Ethereum-based tokens issued based on the ERC-2 normal (528,689 tokens), the ERC-721 normal (137,591tokens), and the ERC-1155 normal (18,135 tokens).

As for its native token ETHW, since launch, its value has declined by 95%. Ranked 68th with a market capitalization of $670 million at press time, it was exchanging fingers at $6.27.

What do you have to count on?

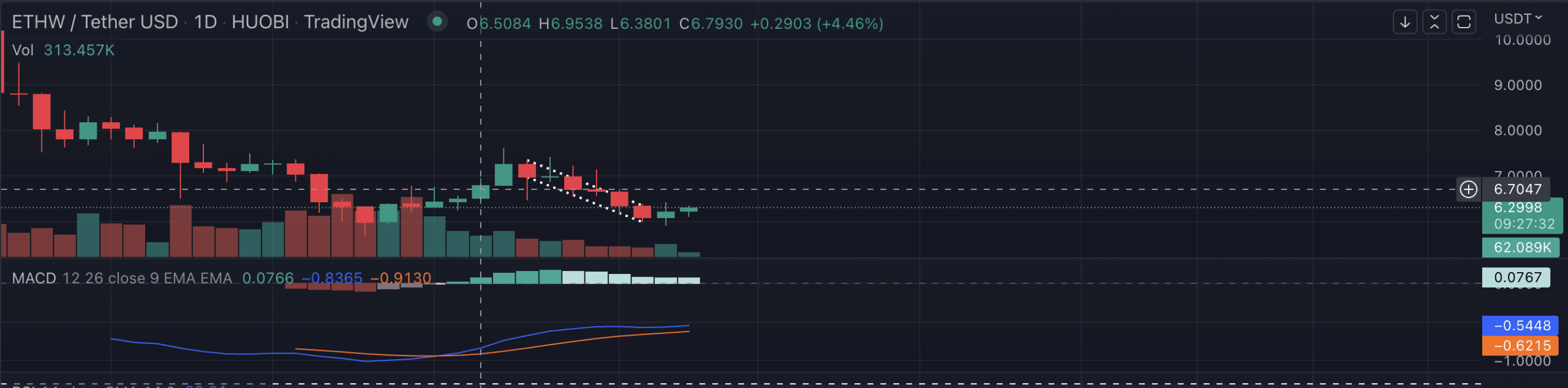

ETHW’s value has been on a downtrend since 28 October, forming a falling wedge. Nevertheless, the buying and selling session on 3 November was marked by a bullish breakout, one indicating {that a} value reversal may be imminent.

A have a look at the asset’s MACD revealed {that a} bullish divergence had shaped since 27 October. This meant that promoting momentum had slowed and the downtrend was due for a reversal.

Supply: TradingView

Whereas it is a good indication that ETHW would possibly see some reduction quickly, it’s not sufficient to conclude that that is sure to occur. A consideration of ETHW’s Relative Power Index (RSI) confirmed that it rested beneath the 50-neutral spot at 33 at press time, heading to the oversold place.

The asset’s Directional Motion Index (DMI) additionally urged that the sellers’ power (crimson) at 21.77 was above the patrons’ (inexperienced) at 21.66, which means that sellers had management of the market.

Supply: TradingView

![EthereumPoW [ETHW]: How a forked chain is leading others on this front](https://ambcrypto.com/wp-content/uploads/2022/11/julian-wallner-KHgSurk57V4-unsplash-1-1-1000x600.jpg)