- Bitcoin could also be subjected to regulatory headwinds within the subsequent few weeks.

- Whale and institutional demand for Bitcoin see a slight restoration.

Bitcoin had a powerful begin this 12 months however that sentiment may quickly change. Particularly now that fears of a recession are threatening to tear the proverbial bandage off the recovering market. The chance of regulatory-induced FUD may also contribute to a much less thrilling end result than anticipated.

Bitcoin did expertise a little bit of a slowdown in demand in the previous few days forward of the FOMC bulletins. Nevertheless, the identical statement stays regardless of a positive price hike. A possible cause for that is that the specter of a regulatory apocalypse is now nearer as Congress resumes.

Ron Hammond from the Blockchain Basis famous in an interview that extra stringent regulatory motion is to be anticipated. Regulators at the moment are extra alert after the FTX crash. FTX hearings are anticipated to begin quickly and this may occasionally encourage Congress to push for a regulatory framework.

Regulators are already cracking the whip on banks

Many mainstream banks adopted a softer stance on cryptocurrencies within the final two years. This contains permitting prospects to purchase or promote cryptocurrencies immediately via their financial institution accounts. This may occasionally now not be the case now that banks have been suggested by regulators to keep away from all cryptocurrency dealings.

The FTX debacle has already affected liquidity and shutting off entry via the normal banking system could yield a crypto demand shock. These issues may be the rationale why Bitcoin bulls didn’t get well strongly after the FOMC announcement.

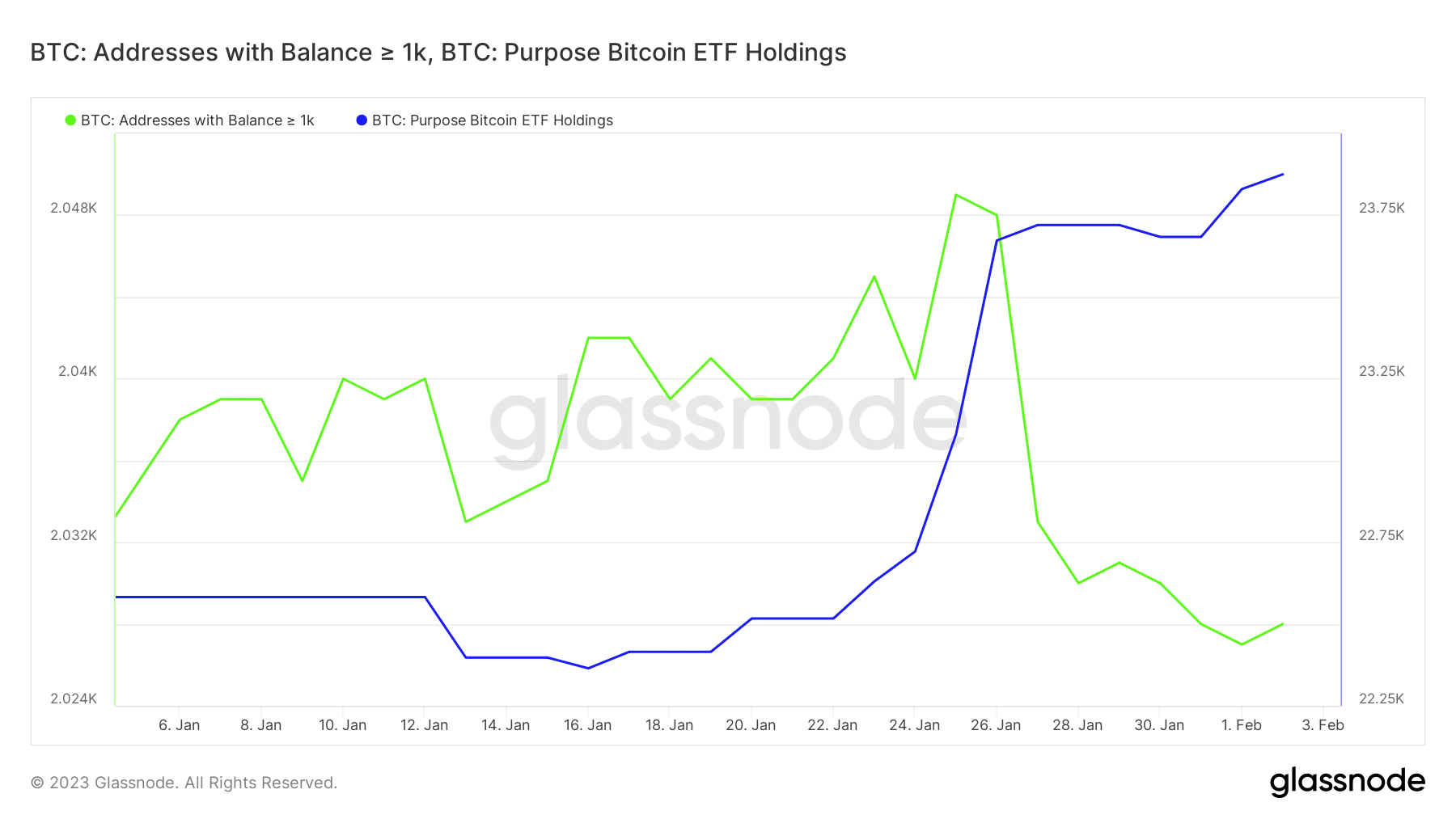

The demand aspect has actually demonstrated fascinating observations in the previous few days. For instance, addresses with balances larger than 1,000 BTC dropped by a considerable margin between 25 January and 1 February.

Supply: Glassnode

The identical metric seemed to be pivoting at press time, and if this continues, then it might symbolize a stronger bullish transfer. Some whale and institutional demand appear to be on the restoration. For instance, the Bitcoin Objective ETF holdings lastly began accumulating within the second half of January.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Bitcoin’s change flows did fluctuate in direction of the top of January according to the elevated uncertainty. Nevertheless, the primary three days of February introduced forth some restoration. Moreover, change outflows outweighed change inflows on the time of writing. This confirms that purchase strain is growing.

Supply: Glassnode

The present surroundings available in the market underscores uncertainty and concern in regards to the subsequent transfer. Some anticipate BTC to proceed rallying whereas others see the January rally as a false signal that the bull market has commenced.

On the plus aspect, the present issues may dissipate if the regulators implement crypto-friendly laws.