As soon as once more, the calendar 12 months is coming to an finish. And in the USA, which means the monetary 12 months for most people is ending as properly. With April 18 marked because the official due date for federal particular person revenue tax returns, sadly, it’s a day that brings confusion for, properly, everybody. However over the past 12 months, it’s grow to be particularly laborious for people who find themselves reporting positive factors from NFTs.

Don’t let the nerves get the very best of you, although, since attorneys are readying themselves to help within the broad number of 2023 crypto tax wants. Hopefully, this 12 months, these making last-ditch Google searches for “NFT tax loopholes” will as an alternative discover a wealth of data on the way to report NFT belongings, positive factors, and losses.

In fact, that doesn’t imply it will likely be the best factor you’ve ever achieved or that you just shouldn’t take it severely. In any case, missteps might be pricey (I ought to know… thanks IRS audit division). However there are solutions. So, earlier than you go claiming huge losses since you offered your PFPs far under market worth, listed here are the important thing issues that each creators and collectors have to find out about taxes and NFTs.

How are NFTs taxed?

It’s essential to grasp how the IRS sees NFTs in 2023. Sadly, the U.S. tax code doesn’t formally deal with how NFTs must be taxed. However there are some guiding ideas which have allowed specialists to kind of suss out how issues work.

To start with, there’s a robust argument to be made that NFTs shouldn’t be claimed as “collectibles” in response to the U.S. tax code. However NFTs are collectibles, proper? So, why aren’t they taxed as such?

As a result of collectibles under IRC Section 408(m)(2) embrace:

- Any murals,

- Any rug or vintage,

- Any steel or gem (with restricted exceptions, under),

- Any stamp or coin (with restricted exceptions, under)

- Any alcoholic beverage, or

- Another tangible private property that the IRS determines is a “collectible” underneath IRC Part 408(m).

The usage of “different” within the final merchandise on the listing makes it clear that collectibles should be tangible private property. So whereas NFTs could also be artwork, they positively aren’t tangible. The jury continues to be out on this, nevertheless it appears fairly clear that NFTs aren’t taxed as collectibles.

But others, like U.S. Senators Cynthia Lummis and Kirsten Gillibrand, wish to see NFTs taxed as one thing fully exterior the scope of collectibles. In keeping with a proposed 2022 crypto bill penned by the 2 by which “digital belongings” and “digital forex” is strictly outlined, NFTs might do properly to be handled as commodities (like petroleum, cotton, soybeans, and so on.) slightly than as securities.

Which means NFTs would fall underneath the purview of the Commodity Futures Buying and selling Fee (CFTC) slightly than the Securities and Alternate Fee (SEC). However whereas the aforementioned invoice makes an attempt to control digital asset exchanges, taxpayers probably gained’t really feel any of its ripples whereas reporting their NFT taxes from the 2022 season.

So, for probably the most half, specialists assume that NFTs must be handled extra merely and regarded adjoining to the infrastructure that already exists for fungible cryptocurrencies like Ether and Bitcoin. But when we take one other step down the ladder, we will’t low cost that crypto is commonly considered the identical as shares — extra like property.

Briefly, according to the IRS, NFTs are additionally taxed alongside crypto as property. Whereas we might proceed to invest for one more 12 months whether or not tokens ought to or shouldn’t be thought of collectibles or commodities, merchants merely have to know that NFTs are topic to capital positive factors tax.

Capital positive factors taxes and NFTs

In essence, a capital positive factors tax is a tax positioned on income earned from the sale of any asset that has elevated in worth over a holding interval. That…is a little bit of a mouthful. A neater technique to put this is perhaps to say: Should you mint an NFT at 0.08 ETH after which promote it for two.5 ETH a couple of months later, that creates a taxable capital acquire since you made cash (or capital).

Yep, shopping for an NFT low, holding for a couple of months, then promoting excessive is taxable, and fairly considerably. However this is applicable to losses as properly. So, if you happen to bought an NFT for two.5 ETH and offered it at 0.08 ETH for a ultimate lack of 1.7 ETH, guess what — that’s a capital loss.

So whether or not you’re a creator or a collector who dabbles in buying and selling NFTs, you could know that capital positive factors and losses don’t simply occur while you change crypto for fiat forex. They occur while you purchase and promote NFTs. Certain, that may appear a bit contradictory, contemplating the decentralized ethos of the NFT house. However because the IRS outlined in Notice 2014-21, the worth change of any given cryptocurrency can create a capital acquire or loss.

Whether or not you might be promoting an NFT, swapping one coin for one more (like ETH → APE), or cashing out crypto for USD, most of your transactions are prone to be thought of taxable occasions. And these positive factors can accrue a severe markup when it comes time to settle up with the IRS. However right here’s the factor: In the eyes of the IRS, the size of time you’ve held onto an NFT makes a huge distinction in how it’s taxed. That is the place the size of HODL turns into essential.

Say you maintain an NFT for lower than a 12 months, and you then promote it for greater than you paid. That is referred to as short-term capital acquire. These are typically taxed on the identical price as your common revenue. In keeping with the 2023 tax brackets established by the IRS, that will likely be someplace between 10 to 37 %.

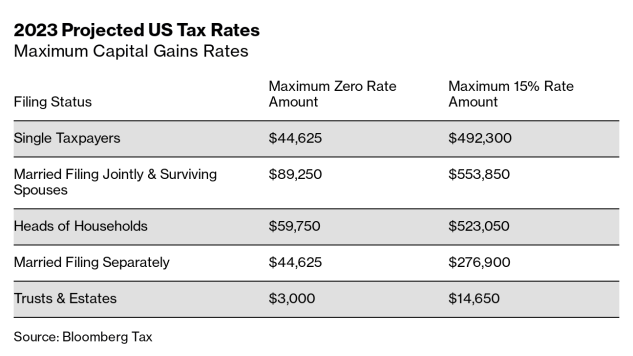

Lengthy-term capital positive factors, alternatively, are taxed much less. Since NFTs have solely been common for the higher a part of two years, this one’s a bit tough. Should you did find yourself holding an NFT for greater than a 12 months, that’s a long-term capital acquire and is taxed at 0, 15, or 20 %, relying on the worth.

Though the 2023 capital positive factors tax threshold has but to be formally launched, Bloomberg outlines the projected 0 and 15 % charges within the picture under. For probably the most half, that is the place common NFT merchants will likely be (until you made a severe six- or seven-figure killing this 12 months). Seek the advice of Form 8949 (particularly “Gross sales and Different Inclinations of Capital Property”) for extra on this.

Tips on how to calculate your NFT taxes

To the IRS, the circumstances of your NFT purchases all matter. As legal professional Jacob Martin explains in his NFT Tax Guide, you’ll want to contemplate issues just like the size of time you held your crypto earlier than shopping for an NFT, what the worth of your most well-liked coin was while you purchased in vs. while you bought the NFT with it, how lengthy you held the NFT, the worth distinction while you purchased the NFT vs. while you offered it, how lengthy you held the crypto post-sale, and so forth (hopefully, you get the thought).

Additionally, make sure to examine whether or not you bought an NFT with USD as an alternative of crypto. This can be a non-taxable occasion, and one which has been rising in reputation with the arrival of bank card checkout through platforms like Nifty Gateway.

However, whereas the mode of buying an NFT can dictate whether it is taxable, promoting an NFT is at all times a taxable occasion. NFTs are thought of offered anytime they’re traded for USD, different tokens (ETH), or used to buy one thing else. And sure, this is applicable to pawning NFTs, fractionalizing NFTs, and even swapping an NFT for one more NFT.

NFT taxes for creators

What we’ve talked about within the first half of this information principally applies to NFT collectors. Whether or not you determine as a collector or dealer (or not), if you happen to’re shopping for and promoting NFTs, the above information might aid you perceive what kind of data you could have readily available for submitting taxes. For NFT creators, although, issues are a bit completely different.

Should you’re buying and selling NFTs, which most artists do along with creating and promoting, you’ll want the data above. However there’s extra to know with regards to positive factors accrued by the sale of your individual authentic artwork. Thankfully for artists, although, it’s all quite simple from right here.

Creating an NFT is just not a taxable occasion, however promoting that NFT is. The final rule of thumb to observe as an NFT artist/creator is: while you promote an NFT, you’ll have to pay taxes on the income. Income for NFT creators usually are not thought of positive factors, slightly, they’re revenue. And this revenue will likely be taxed at your common revenue tax price. For self-employed people, this rate is 15.3 percent. Even if you happen to had been paid in crypto peer-to-peer and never through a market transaction, that is thought of revenue (similar to promoting a print of considered one of your works) and is taxed as such.

It’s essential to notice that self-employment tax is completely different than your common revenue tax price of 10 to 37 %. You’ll want to find out how a lot of your web earnings from the 12 months are topic to self-employment tax. For a bit extra on this subject, NerdWallet has a great explainer to assist any self-employed particular person get the leap on taxes.

Should you’ve engaged in any NFT-related charitable giving all year long, for instance, by donating considered one of your NFTs to a museum or an public sale home for a superb trigger, issues get a bit stickier than easy self-employment taxes. On this case, make sure to seek the advice of our full, lawyer-written article on the subject right here.

In any other case, make sure to keep in mind: Self-employment taxes are the way in which to go, and NFTs that you just purchased or offered, however didn’t create, will likely be topic to the capital positive factors tax defined earlier on this information.

Are you prepared for Tax Day?

So, taxes aren’t so scary…proper? They’re positively difficult and can take quite a lot of time to finish (particularly if you happen to’re an lively dealer with a lot of transactions), however all in all, they’re doable. In case your 9,999 fellow PFP house owners can do it, so are you able to!

Should you’re nonetheless a bit confused although, think about doing a bit extra analysis into NFT taxes by yourself. Martin’s aforementioned NFT Tax Guide is a superb place to begin — though you’ll need to spend a little bit of ETH minting an NFT to realize entry to the complete information. Or higher but, ask across the NFT neighborhood to see if somebody will mortgage you their information for some time.

In all actually, one of the simplest ways to do your taxes in 2023 could also be to seek the advice of a tax skilled. Bear in mind, nft now is just not providing you tax recommendation, however corporations like ZenLedger and Taxbit provide nice companies to assist these throughout the crypto, NFT, and DeFi areas with their taxes. As soon as 2022 involves an in depth, it’ll be as much as you to get your taxes sorted.