Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

- The market construction was bullish on larger timeframes.

- The institution of a spread may supply a interval of consolidation.

In January, Fantom rallied from $0.16 and reached $0.65 in early February. It represented a 230% transfer upward, and on the time of writing FTM traded close to the zone of help at $0.43.

It appeared unlikely that such a robust transfer may happen over the following month or two.

Learn Fantom’s [FTM] Value Prediction 2023-24

The markets usually want time to consolidate earlier than such a transfer, upward or downward. Fantom was inside one such section of consolidation. The asset confirmed indicators of forming a spread, which merchants can use within the coming weeks.

The formation of a spread meant merchants can look to bid FTM on the lows

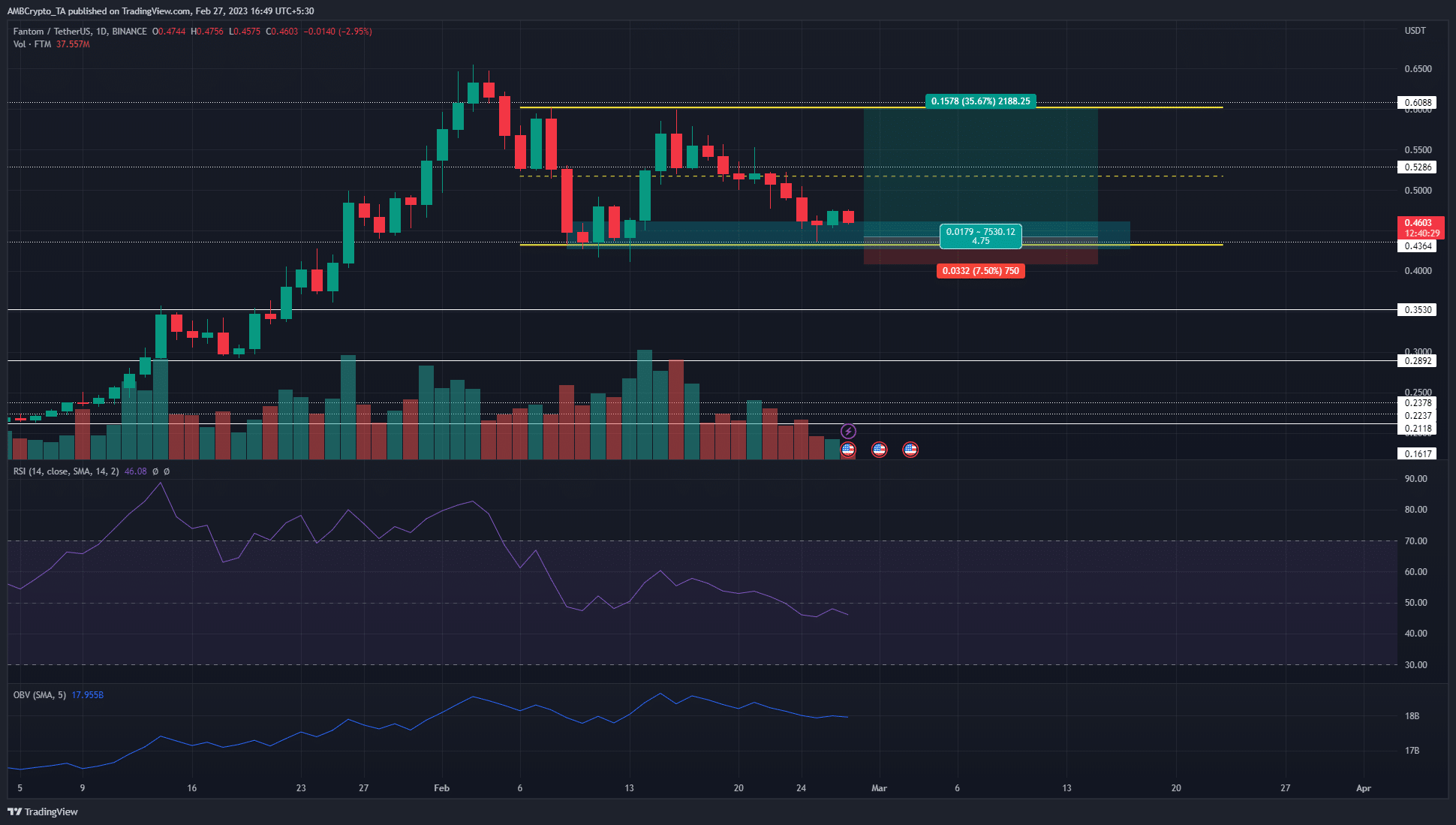

Supply: FTM/USDT on TradingView

The vary prolonged from $0.43 to $0.6, with the mid-point at $0.515. This vary was lower than a month outdated. Furthermore, the extremes of the vary have solely been examined twice every. The truth that the mid-range mark was revered as each help and resistance instructed that the vary plotted within the chart above was viable.

A bullish order block was noticed on the backside of a spread. From this stage, FTM noticed a violent transfer northward to succeed in $0.6 in mid-February. On the time of writing, the value was testing the identical area as soon as once more.

The RSI slipped beneath the impartial 50 mark, to spotlight some bearish momentum. It underlined the likelihood {that a} downtrend would possibly start. Nevertheless, the OBV has been rising over the previous few weeks. It confirmed regular shopping for strain regardless of the formation of the vary.

How a lot are 1, 10, 100 FTM price immediately?

If the OBV continued to rise within the coming weeks, a breakout previous $0.6 may push towards $0.85 and $1.1. Till then, shopping for and promoting close to the vary extremes may very well be a worthwhile possibility for Fantom merchants.

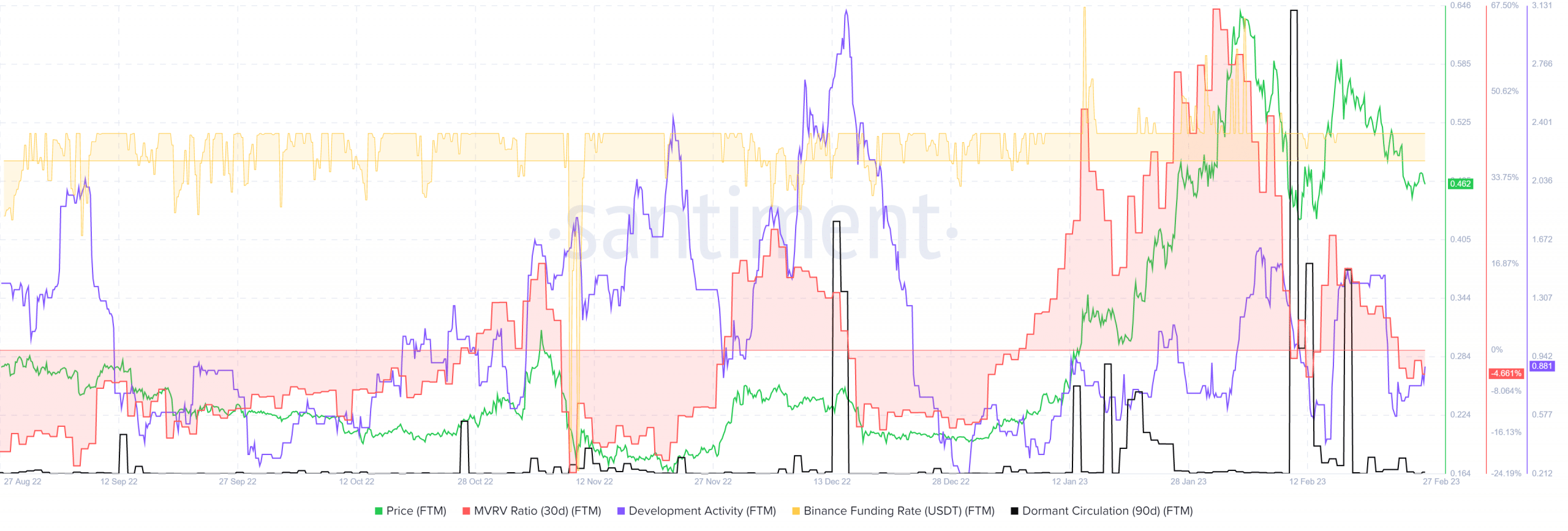

An increase in dormant circulation marked the earlier native prime after holders booked income

The 30-day MVRV ratio fell into unfavourable territory. It rose to 3-month highs in late January however has plunged decrease since then. This indicated holders booked a revenue and strengthened the promoting strain seen in current weeks. Though not sturdy sufficient to provoke a long-term downtrend, it was sufficient to halt the explosive rally.

The 90-day dormant circulation noticed a sudden spike on 12 February, and one other one on 18 February. The current spike additionally marked an area prime for FTM.

Due to this fact, this was one other metric merchants can control to present a warning of huge sell-offs. In the meantime, the event exercise was regular and continued with none correlation with the value motion, which ought to encourage long-term patrons.