Because the U.S. heads into the following election 12 months, crypto considerations have begun to seep into mainstream American politics—particularly, the terrifying prospect of a United States central financial institution digital forex (CBDC).

U.S. politicians akin to Ted Cruz, Tom Emmer, Robert F. Kennedy Jr., and Ron DeSantis have all steered, both explicitly or by means of proposed laws, that the Federal Reserve System have to be prevented from creating, issuing, and even researching CBDCs as a matter of coverage. The implication, amplified by voices on social media, is that the Federal Reserve is actively working towards creating a CBDC as an instrument of state management.

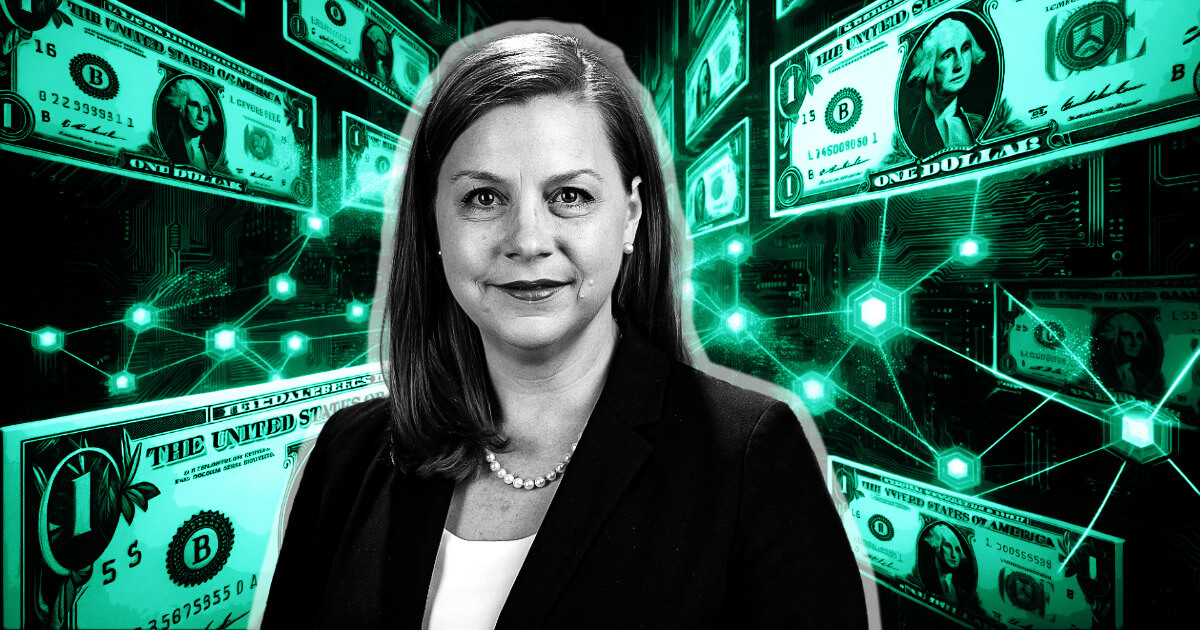

The documented actuality, nonetheless, exhibits that the Fed is something however desirous to introduce CBDCs to the U.S. financial system. Talking at a roundtable dialogue in Washington, D.C. this morning, Fed governor Michell Bowman reiterated the Fed’s reluctance to embrace CBDC tech and criticized its capability for fixing actual issues in international finance.

No compelling argument

Bowman’s speech centered round ongoing curiosity in digital property, together with crypto-assets, stablecoins, CBDCs, and programmable cost platforms. She particularly critiqued the concept of a U.S. CBDC, questioning whether or not it may resolve monetary issues extra successfully or effectively than current options.

Highlighting the significance of accountable innovation in cash and funds, Governor Bowman underlined the necessity to tackle frictions throughout the cost system, promote monetary inclusion, and supply the general public with entry to protected central financial institution cash. Nevertheless, she is unpersuaded {that a} central financial institution digital forex is suited to the duty, saying:

These are all vital points. I’ve but to see a compelling argument {that a} U.S. CBDC may resolve any of those issues extra successfully or effectively than alternate options, or with fewer draw back dangers for customers and for the economic system.

She additional famous that the U.S. cost system continues to evolve with improvements like FedNow, the Federal Reserve’s new interbank system for immediate funds. This technique permits collaborating banks, companies, and customers to make and obtain immediate funds, with speedy fund availability always.

Governor Bowman additionally confused that the introduction of a CBDC may pose vital dangers and tradeoffs for the monetary system, together with appreciable client privateness considerations. She argued that the U.S. intermediated banking mannequin, through which industrial banks difficulty credit score to customers and establishments whereas managing reserves by means of the Federal Reserve System, could be the extra appropriate mannequin for future monetary innovation. A CBDC may disrupt this technique, doubtlessly hurting customers and companies whereas presenting broader monetary stability dangers.

The Fed and web3

The Federal Reserve’s lively engagement with the nuances of the crypto-asset panorama, together with improvements like stablecoins, CBDCs, DeFi, and tokenization, not solely demonstrates that it takes the sector critically however that it shares a few of the identical considerations.

It doesn’t, nonetheless, imply that the Fed is bounding towards digital greenback dominance. Whereas theoretically unnerving, the concept of an imminent U.S. CBDC has turn out to be the topic of largely unfounded anxieties, in no small half as a result of it merely might not be within the Fed’s curiosity—or certainly, that of america—to take action.

As market individuals, commentators, legal professionals, lobbyists, and politicians proceed to fumble their means towards a workable, complete crypto coverage framework, it’s vital to keep in mind that our collective focus must be on constructive dialogue and collaboration fairly than sowing seeds of unwarranted concern, uncertainty, and doubt.

The submit Fed Governor Michelle Bowman expresses central financial institution’s skepticism of CBDCs appeared first on CryptoSlate.