- FTM’s worth pullback may retest the previous help zone at $0.2395

- The decrease timeframes recorded a bearish MACD crossover

- FTM noticed a decline in positively weighted sentiment and funding charges

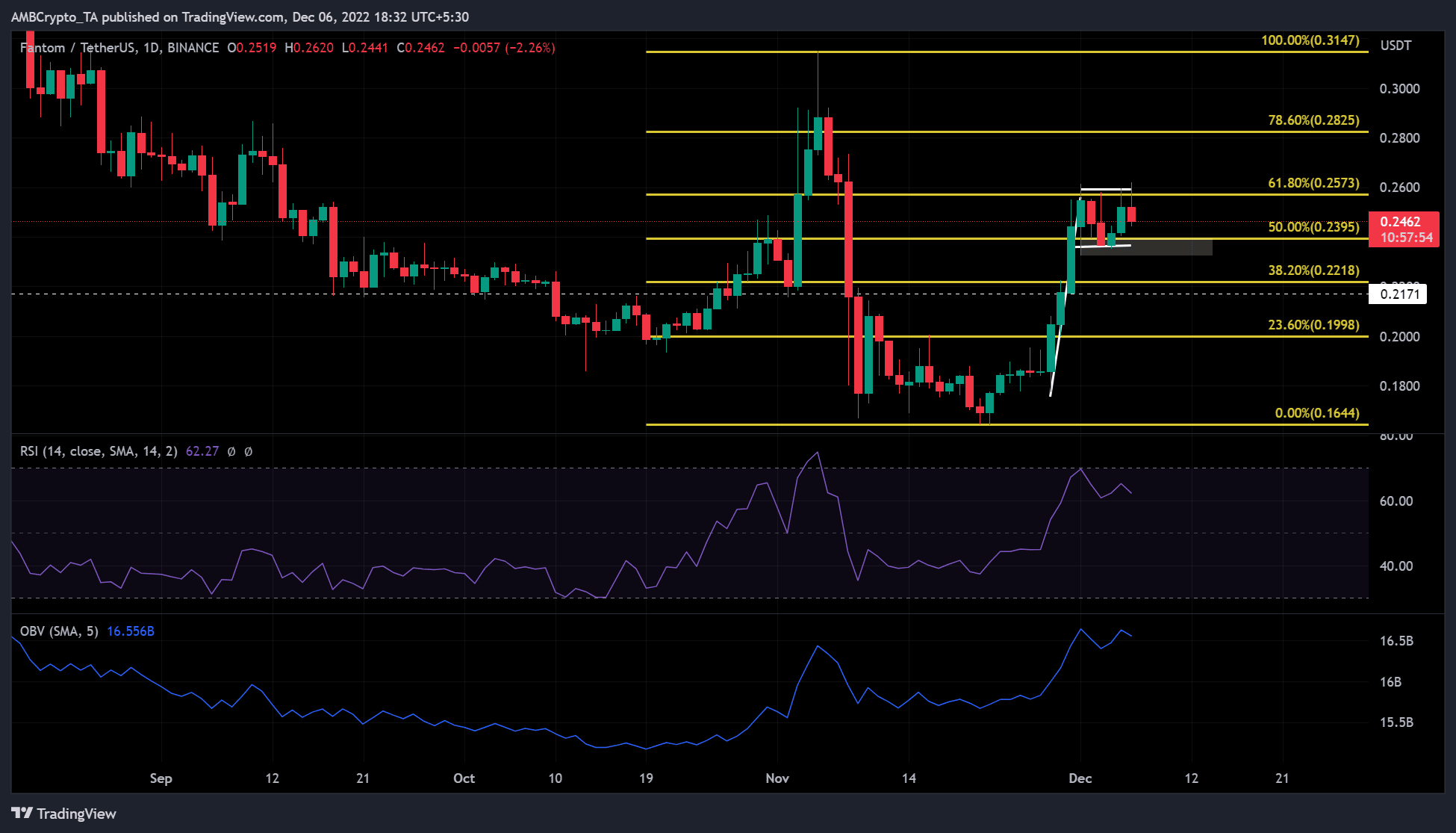

The present worth correction in Fantom (FTM) may present a brand new shopping for alternative for an extended commerce. FTM’s worth motion since 28 November has fashioned a bullish flag sample.

So, FTM may see a bullish breakout if the present worth motion follows the flag sample and settles on the $0.2395 help. This could be an extended place you can maximize provided that you purchase cheaper after the present worth correction.

At press time, FTM was buying and selling at $0.2462, and the bears may pull the worth all the way down to retest $0.2395.

Will FTM’s worth pullback be the ultimate contact on this flag chart sample?

Supply: FTM/USDT on TradingView

FTM has rallied since 28 November, regaining over 39% of its misplaced worth after the FTX implosion. On the time of publication, FTM’s bears have been having a area day, with the decrease timeframe charts recording a bearish MACD crossover. It means bears have management of markets in decrease time frames and will quickly come into extra prolonged time frames.

The bears may prevail till the FTM worth reaches the 50% Fibonacci retracement stage ($0.2462). The help talked about above has been reached not too long ago, so the worth decline might be a retest of this stage.

Moreover, FTM’s current worth motion traces a bullish flag sample. A worth decline to the above stage would assist full the sample in anticipation of a doable bullish breakout.

The Relative Power Index (RSI) indicator has pulled again from the oversold entry line. It is a signal of easing shopping for strain as sellers enter the scene. Consequently, sellers may push FTM all the way down to the $0.2462 stage.

As well as, On Steadiness Quantity (OBV) has reached the identical highs after a current surge. This reveals that the buying and selling quantity is just not going past the current stage to extend the shopping for strain. Thus, the rising promoting strain may trigger FTM to be pushed to $0.2462 or decrease.

Nonetheless, an intraday shut above the present resistance on the 61.8% Fib stage ($0.2573) would invalidate the above forecast. Such an early bullish breakout would offer an extended entry place with the 78.6% Fib stage ($0.2825) as a brand new goal.

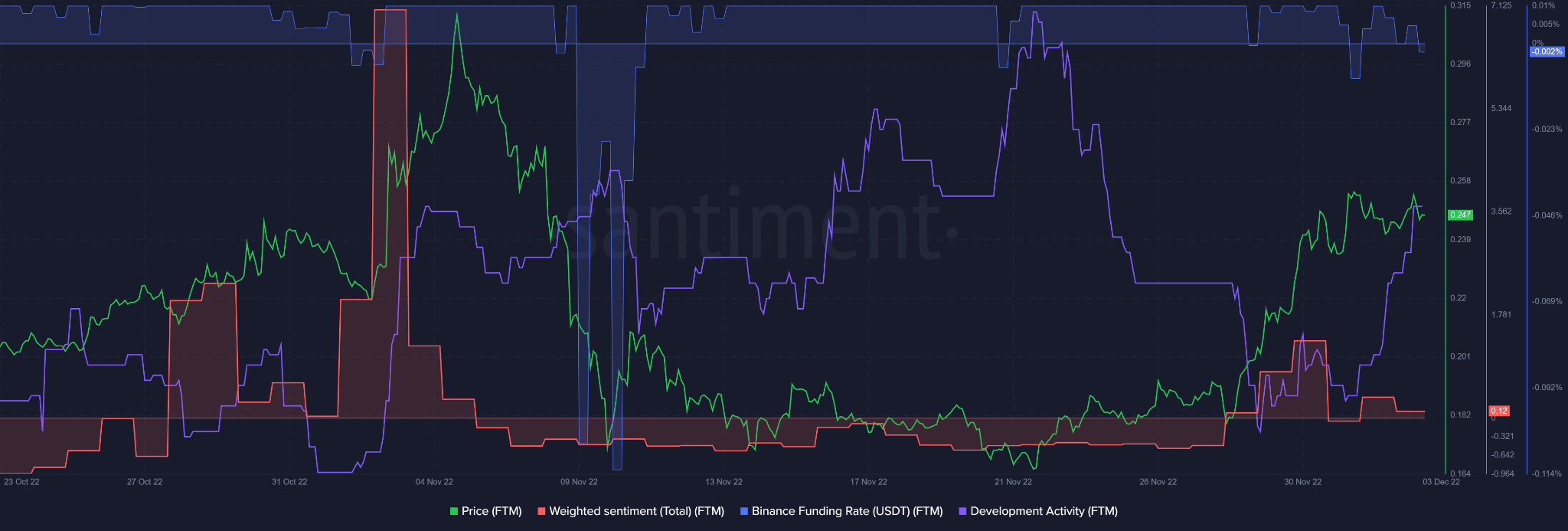

FTM noticed a drop in funding fee and weighted sentiment

Supply: Santiment

That stated, the altcoin noticed a slight decline in weighted sentiment and slid slowly towards the impartial place. Accordingly, we noticed that FTM’s Binance Change Funding Charges slipped into detrimental territory.

This means that FTM’s futures market has a bearish outlook, the same sentiment that the spot market was slowly adopting, on the time of publication.

As well as, FTM has seen a steep improve in improvement exercise, which leveled off at press time. FTM’s worth has risen with the current surge in improvement exercise. Subsequently, a flattening of improvement exercise may undermine additional upward tendencies.

Thus, the above indicators and metrics help the bearish bias that the FTM worth will fall to $0.2462.

Nonetheless, if BTC turns bullish, FTM will entrance a direct breakout from the flag sample, which might invalidate the worth’s pullback bias.