- Balancer’s TVL fell after the introduction of Boosted Swimming pools, earlier than recording a quick uptick

- Balancer (BAL) has, nevertheless, remained flat of late

Greater than a yr in the past, Balancer created its Boosted Pool to draw liquidity to the protocol by offering traders with extra incentives. How balanced has this made the protocol and its native token – BAL?

– Learn Balancer (BAL) Value Prediction 2022-2023

The Balancer boosted Pool

Balancer Boosted Pool is a function of the Decentralized Finance (DeFi) protocol – Balancer. The Balancer Boosted Pool permits liquidity suppliers (LPs) to deposit two sorts of belongings in a pool – The bottom asset and the enhance asset. The bottom asset usually has decrease volatility whereas the enhance asset has greater volatility. The enhance asset is used to generate extra returns for liquidity suppliers.

Based on a latest report by Messari, Balancer developed boosted swimming pools to enhance LPs’ capital effectivity. Depositors would possibly revenue from buying and selling commissions and curiosity due to the swimming pools. LPs obtain $0.50, the Decentralised Autonomous Group (DAO) treasury receives $0.175, and veBAL lockers obtain $0.325 for each greenback in charges paid.

What impact has this motion had on Balancer’s Complete Worth Locked? (TVL)

Balancer TVL boosted?

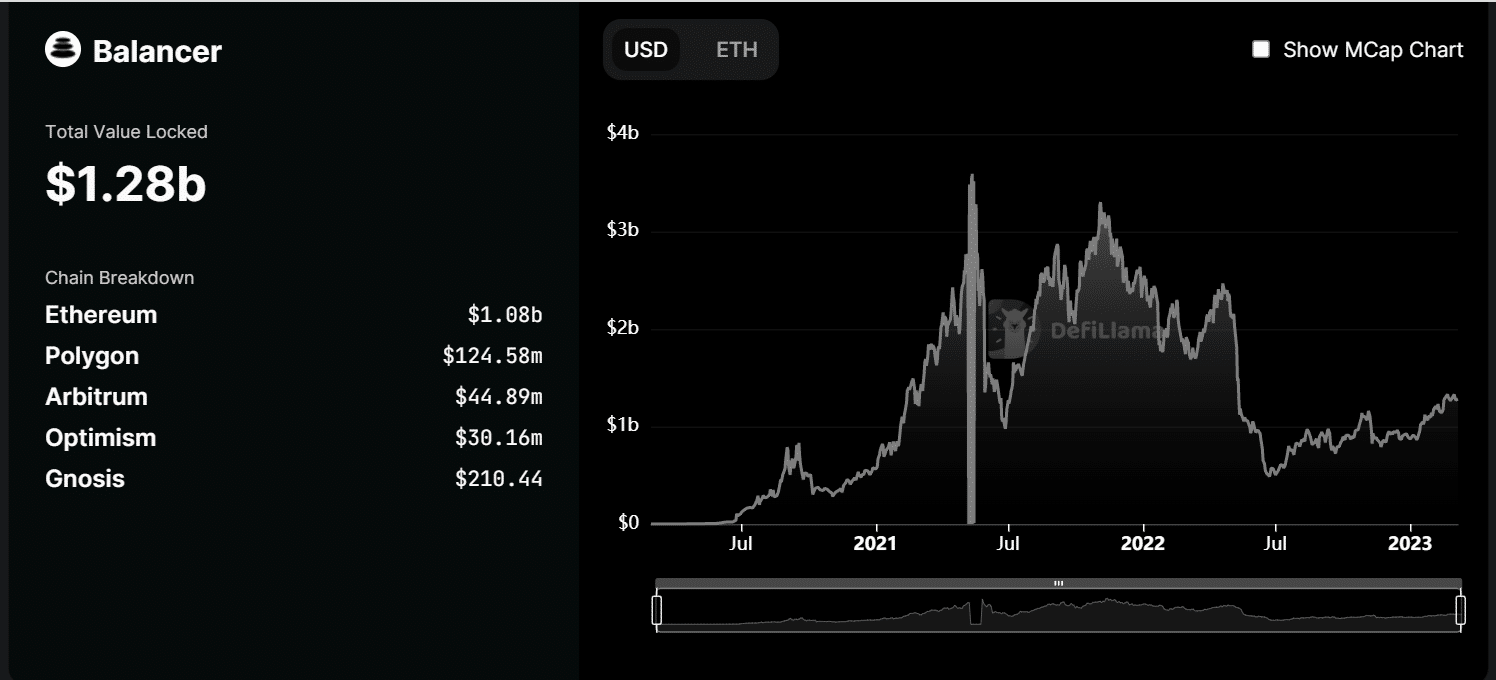

Because the introduction of the boosted swimming pools, the development in TVL has been extra of a downward development than an upward one, in accordance with statistics from DefiLlama. The chart revealed that the TVL has fallen from nearly $2 billion to $1 billion for the reason that swimming pools had been established. The TVL was roughly $1.28 billion, on the time of writing, with a slight hike seen since January.

Supply: DefiLlama

BAL’s motion stays stagnant

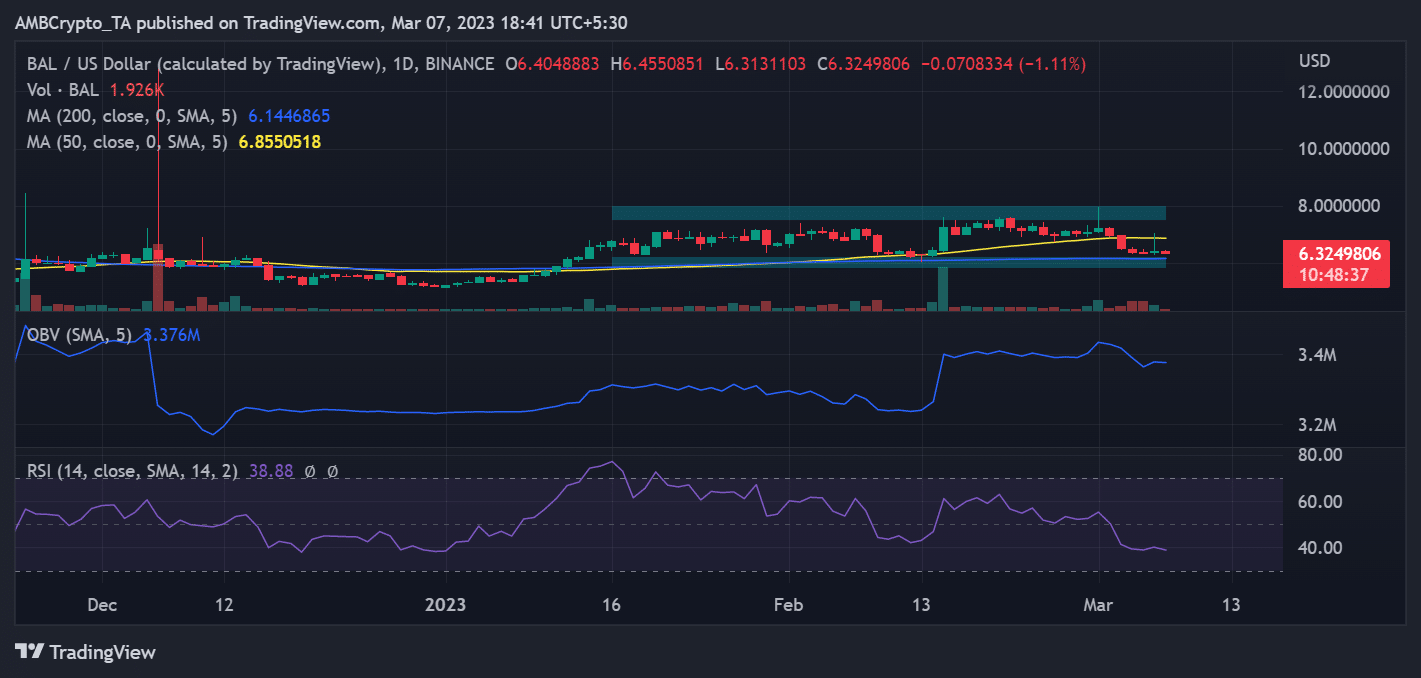

Balancer’s (BAL) worth has been comparatively flat in latest weeks. The truth is, a take a look at its worth motion on the day by day timeframe confirmed no discernible upward or downward development. On the time of writing, the asset had dropped practically 1% in worth and was buying and selling at round $6.35.

Supply: TradingView

After exceptional beneficial properties in January, it has been unable to beat the resistance between $7.5 and $7.9. Moreover, all through the identical interval, its help has remained secure at about $6.19. As a result of its poor worth motion, it has fallen beneath the Relative Power Index’s impartial line (RSI). The RSI indicated a big bear development for BAL, which has been trending beneath 40.

– How a lot are 1,10,100 BALs price immediately

Fewer lively addresses and…

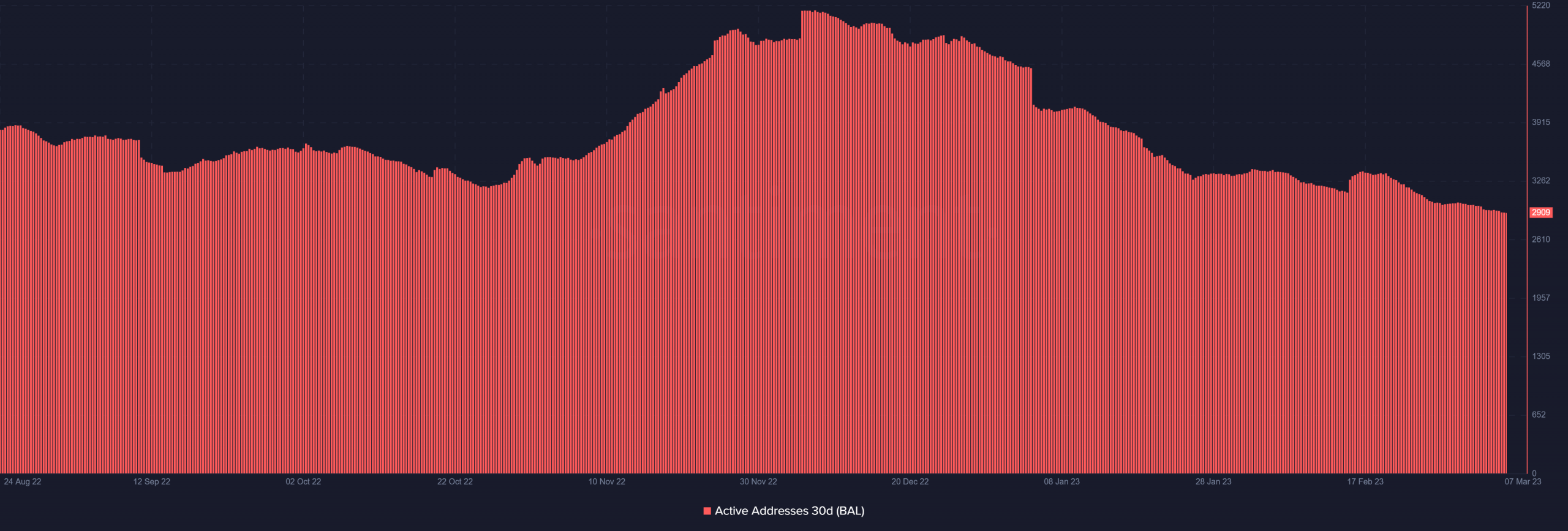

Based on Santiment, there has additionally been a decline within the variety of lively addresses on the community. The 30-day lively addresses on Balancer have been falling over the past a number of weeks.

There have been 2,912 lively addresses at press time, down from over 4,000 seen in January.

Supply: Santiment

![Gauging the impact of Boosted Pools on Balancer’s [BAL] market trend](https://ambcrypto.com/wp-content/uploads/2023/03/rocks-15712_1920-1000x600.jpg)