NFT

Research present that most individuals who try to clean commerce nonfungible tokens (NFTs) are unprofitable. However that doesn’t cease them from attempting, which makes it a evident regulatory and enforcement situation for the trade.

In wash buying and selling, manipulators purchase and promote an asset between themselves to create the looks that the asset is in greater demand and, subsequently, price greater than it will be in any other case. With NFTs, wash buying and selling is pretty easy: Think about an investor holds $1 million in Ether (ETH). The investor mints an NFT and proceeds to promote it to themself for all of the ETH they personal. The transaction is then on the blockchain for $1 million in ETH. The value of the NFT has been set via a wash commerce to the advantage of the person who minted the NFT.

It is perhaps tempting to suppose that it is a “victimless” crime because it’s unlikely any cash truly modified palms if it was a wash commerce, however that’s false. By rewarding allegedly pretend high-volume merchants with actual cash, NFT traders stand to lose thousands and thousands to scammers, and legit merchants could also be fooled into overpaying for his or her investments.

Associated: GameFi builders may very well be dealing with huge fines and laborious time

These fraudulent transactions additionally drive Gresham’s Legislation (unhealthy cash drives out good cash) in crypto, driving out professional traders and merchants because the change’s status is destroyed.

On the subject of NFTs, nonetheless, the foundations aren’t so clear. Such tokens might not be securities, so the identical legal guidelines and rules governing securities buying and selling might not apply to them.

The background on wash buying and selling legal guidelines

Wash buying and selling has been barred in america for the reason that passing of the Commodity Alternate Act in 1936 in response to its reputation as a manipulation software. Since then, nonetheless, the Securities and Alternate Fee and Commodities Futures Buying and selling Fee have rigorously scrutinized markets and introduced quite a few enforcement actions for “wash merchants,” thereby including a level of security to the securities and futures markets.

In accordance with the SEC, “Wash buying and selling is an abusive follow that misleads the market concerning the real provide and demand for a inventory.” In the meantime, the U.S. Inside Income Service prohibits taxpayers from deducting losses that end result from wash gross sales, so it’s solely potential that wash buying and selling NFTs might lead to an enforcement motion. It hinges on how NFTs are categorized by regulators.

Merchants ought to look at gross sales historical past intently earlier than shopping for NFTs

Accepting the concept cryptocurrencies are typically risky, together with the gradual tempo of enforcement actions towards new belongings like NFTs, it appears pure that many sellers will attempt to inflate their asset’s worth to draw new patrons and earn a revenue. NFT patrons ought to suppose twice and do their due diligence earlier than making a big funding into an NFT.

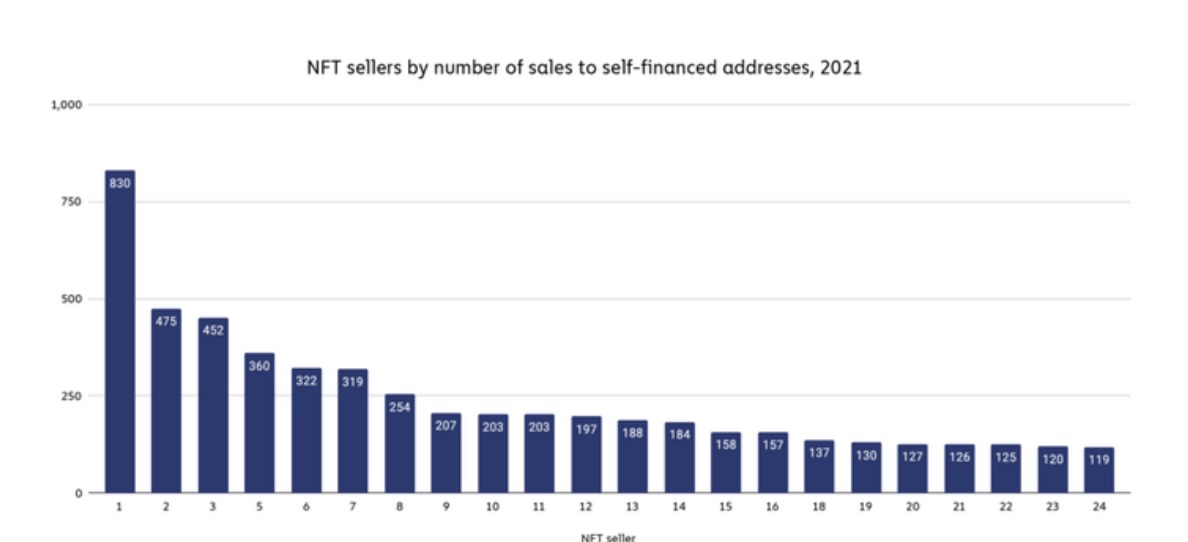

NFT gross sales to self-financed addresses in 2021. Supply: Chainalysis

It might appear to be they’re getting a priceless asset due to the quantity or measurement of transactions during which the funding has been concerned, however the reality could also be that the asset was solely purchased and offered between two wallets owned by the identical individual making the asset seem extra in demand that it truly is.

The SEC might be already getting ready to bag its first NFT merchants

Even with legal guidelines and enforcement actions, we nonetheless see wash buying and selling within the common securities and commodities market, so that you might be sure it exists in newer and evolving markets. Hopefully, the SEC is already engaged on enforcement within the NFT market. Investigations are typically nonpublic, so some merchants might already be in regulators’ sights. It’s a secure guess that in the long term, federal regulators will meet up with this new asset class, and wash buying and selling amongst NFTs might be reined in as nicely.

Associated: Intelligent NFT merchants exploit crypto’s unregulated panorama by wash buying and selling on LooksRare

The SEC ought to transfer to guard traders, first by ruling that NFTs might be handled like securities, after which monitoring exchanges for indicators of manipulation as they do for different asset courses.

Brendan Cochrane, Esq., CAMS is the blockchain and cryptocurrency companion at YK Legislation LLP. He’s additionally the principal and founding father of CryptoCompli, a startup centered on the compliance wants of cryptocurrency companies.

This text is for common info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the writer’s alone and don’t essentially replicate or symbolize the views and opinions of Cointelegraph.