- GMX has the best TVL on Arbitrum.

- Its native token may see a worth drawdown with consumers’ beginning to expertise exhaustion.

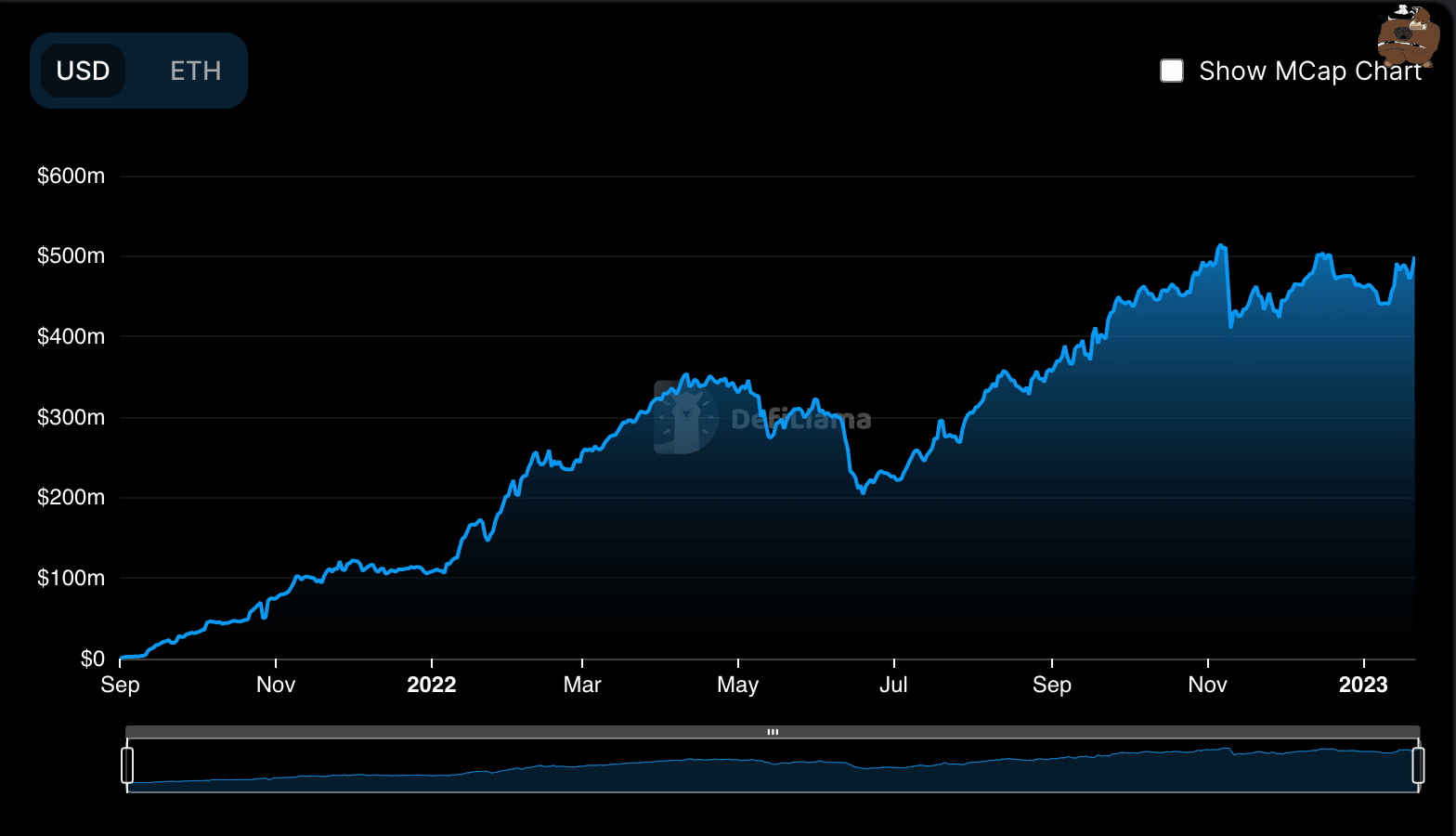

Regardless of the volatility within the decentralized finance (DeFi) market in 2022, GMX, a decentralized trade for spot and perpetual buying and selling on Arbitrum and Avalanche, has maintained its place because the challenge with the best complete worth locked (TVL) on Arbitrum, in accordance with knowledge from DefiLlama.

Is your portfolio inexperienced? Verify the GMX Revenue Calculator

Since its launch in September 2021, GMX’s utilization has steadily grown, resulting in a rise in its complete worth locked (TVL). In truth, amid the market insanity within the 2022 bear market, GMX’s TVL grew by over 300%.

GMX’s complete worth locked (TVL) grew considerably regardless of the bearish atmosphere that plagued the market in 2022. It is at present the most important protocol on Arbitrum, with roughly $400M in TVL on the time of writing. pic.twitter.com/WQS4JuPRgZ

— The Block Analysis (@TheBlockRes) January 20, 2023

As of this writing, GMX’s TVL was $427.72 million giving it a 37.49% share of the general TVL of $1.14 billion of the Arbitrum community.

Supply: DefiLlama

Likewise, its deployment on Avalanche was ranked because the challenge with the fourth-largest TVL on the chain after Aave, Benqi, and Dealer Joe. To this point this 12 months, GMX’s TVL on Arbitrum has grown by 8%, knowledge from DefiLlama confirmed.

Extra customers equal more money

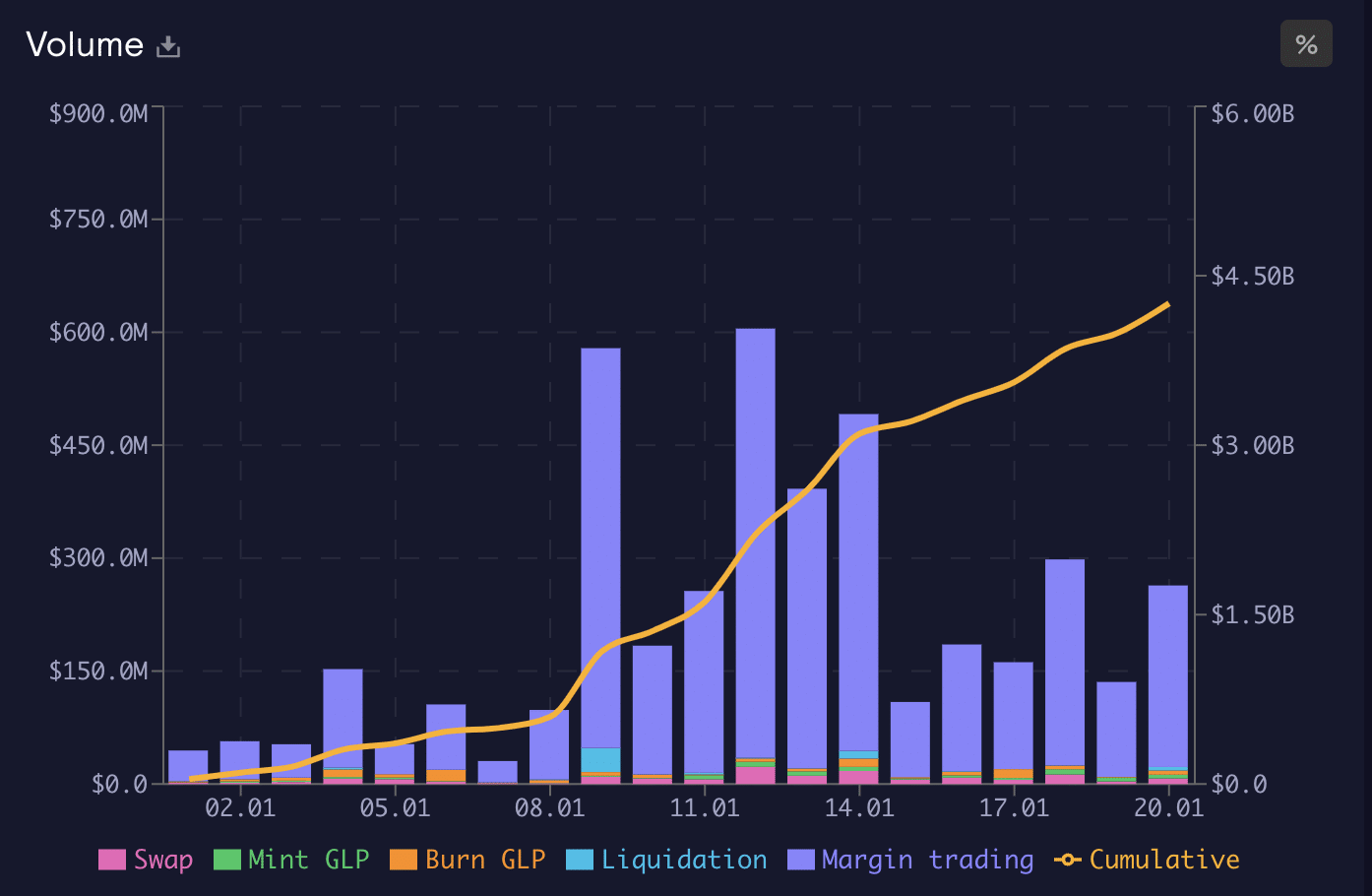

Because the 12 months began, GMX has seen an incredible rally within the depend of complete customers on the DEX. Per knowledge from GMX Stats, the depend of complete customers of the trade has grown by 164% since 1 January. The every day counts of recent and current customers on the DEX have constantly elevated.

Supply: GMX Stats

Elevated consumer exercise has led to a development in buying and selling quantity on the trade. As of this writing, complete buying and selling quantity on the DEX stood at $4.25 billion, having risen by over 9000% because the 12 months started.

Supply: GMX Stats

Moreover, the charges paid to course of transactions on the DEX have additionally elevated. Because the begin of the 12 months, GMX has recorded cumulative transaction charges of $7.98 million.

Supply: GMX Stats

How a lot are 1,10,100 GMXs price as we speak?

GMX worth efficiency

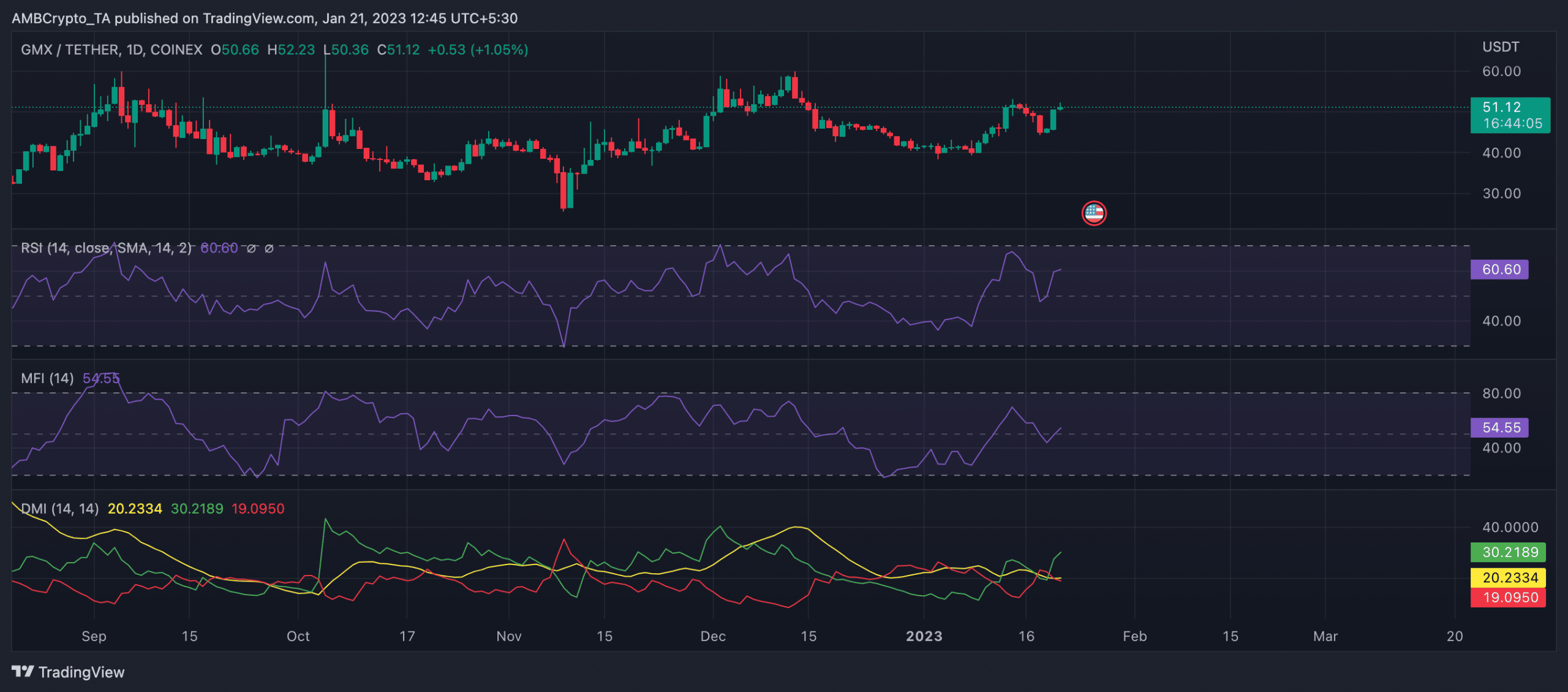

At press time, GMX, the DEX’s utility, and governance token exchanged palms at $51.20. On a year-to-date foundation, its worth has elevated by 23%, knowledge from CoinMarketCap revealed.

An evaluation of GMX’s efficiency on a every day chart revealed a gradual uptick within the alt’s accumulation. At press time, key momentum indicators have been positioned above their respective impartial zones in uptrends. For instance, the Relative Power Index (RSI) was pegged at 60.60. Likewise, GMX’s Cash Stream Index (MFI) was noticed at 54.55.

Additional, a take a look at the alt’s Directional Motion Index (DMI) confirmed that consumers had management of the market. The +DMI line (inexperienced) was positioned above the -DMI line (purple). Sometimes, when the +DMI line is above the -DMI line, it means that the consumers’ energy exceeded that of the sellers.

On the time of writing, the Common Directional Index (ADX) for GMX, which is used to measure the energy of a pattern out there, was at 20. When an asset’s ADX is above 25, it signifies that the pattern is powerful, however whether it is beneath 25, it means that the pattern is weak or nonexistent. Subsequently, with the ADX at 20, consumers’ energy may be declining. Consequently, a worth lower could also be imminent within the GMX market.

Supply: GMX/USDT on TradingView