- HBAR bulls show readiness to take over because the bears develop weak.

- The coin’s newest report coupled with short-term help retest is probably going the explanation behind the sentiment shift.

The Hedera community continues to be one of many layer-1 blockchains which have been quickly gaining reputation. Whereas this was a giant think about HBAR’s bullish bounce for the reason that begin of the 12 months, it has not been sufficient to stop the lack of a 3rd of its YTD beneficial properties.

HBAR has to this point declined by roughly 36% from its YTD peak in February. Nonetheless, it’s now clear that the bears are dropping their momentum after dominating for over three weeks now.

Bullish indicators are already beginning to pile up, suggesting {that a} potential pivot could be within the works.

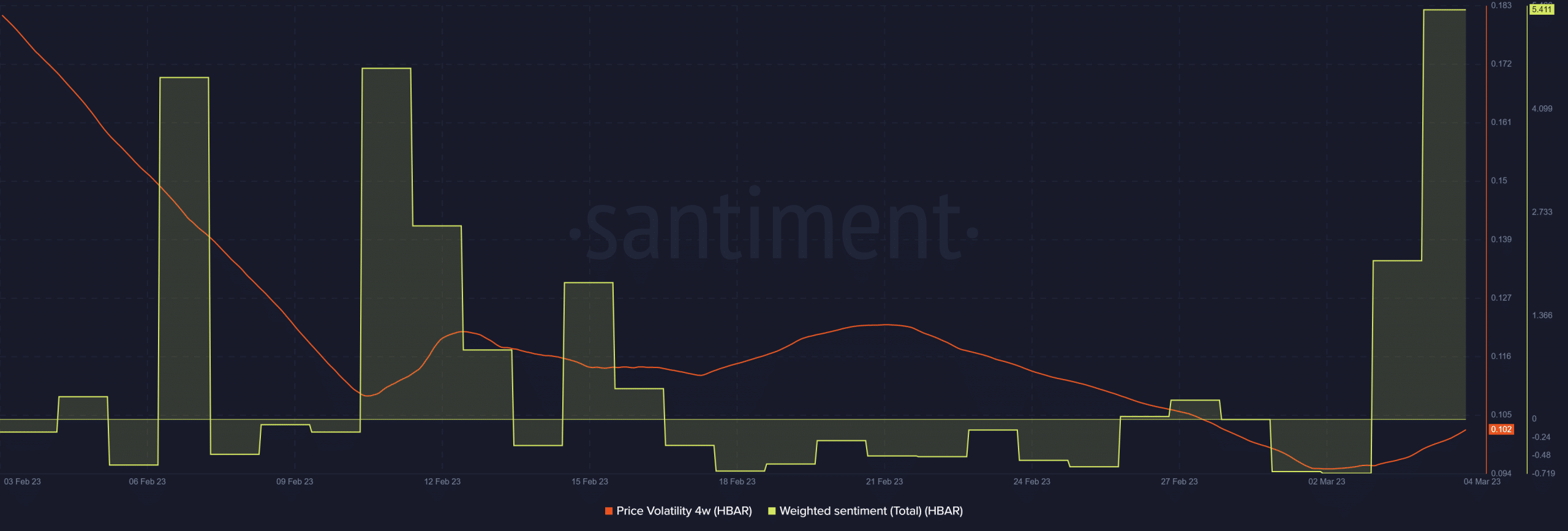

Buyers have been eager on the slowdown in HBAR’s momentum. The latest spike within the weighted sentiment metric is a transparent indication that buyers have shifted to bullish expectations.

In truth, the weighted sentiment simply concluded final week with a surge to its highest degree previously 4 weeks.

Supply: Santiment

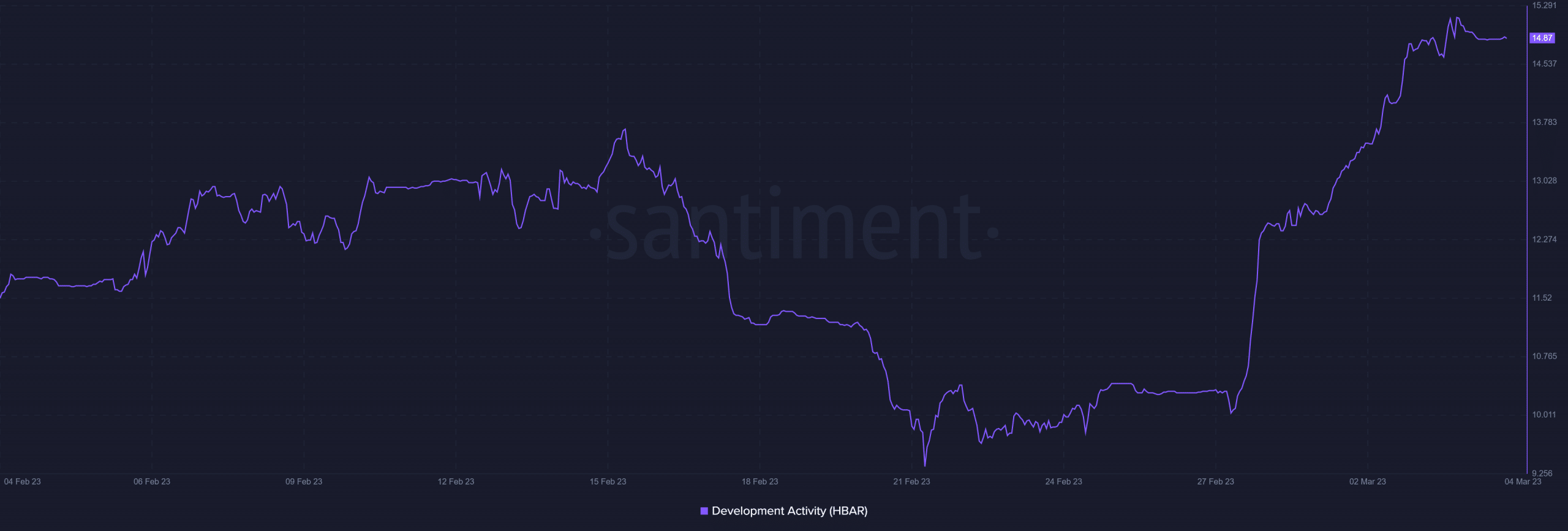

Additionally, the worth volatility metric ended February at its lowest month-to-month degree however it’s now exhibiting a return to increased volatility. As well as, these adjustments are happening at a time when the community’s builders are in full swing.

Supply: Santiment

HBAR retests short-term help

HBAR’s value motion just lately bottomed out on the $0.062 value degree which beforehand acted as a short-term help degree. Up to now the worth was up for the second consecutive day. The final time such an statement was made was earlier than 20 February.

The coin’s slight upside within the final two days signifies that some bullish exercise has been happening after the help retest.

Nonetheless, this doesn’t essentially imply it’s immune from extra downsides. The worth is but to enter into oversold territory regardless of hovering above this zone.

In the meantime, the MFI was bearish, suggesting that the shopping for strain continues to be low.

What number of are 1,10,100 HBAR’s value right this moment?

The timing of this help retest can be noteworthy. The top of the bearish momentum occurred the identical day that Hedera reported that it has to this point processed greater than 4 billion transactions.

It additionally reported radical development to this point this 12 months, courtesy of wholesome enterprise adoption of its Hedera Consensus Service (HCS).

(1/3) This 12 months, the #Hedera community has seen a sustained and big uptick in its transaction quantity, the majority of it being the results of elevated #enterprise utilization of the Hedera Consensus Service (HCS) as a decentralized public notary and system of immutable document. 🧵

— Hedera (@hedera) March 3, 2023

The transaction depend milestone reportedly represents Hedera’s mainnet transactions with a 400 TPS common.

The report is probably going the explanation for the return of buyers’ confidence noticed within the weighted sentiment. The following demand stays comparatively subdued regardless of pivot expectations.

A possible cause for that is the surge within the total crypto market’s bearish expectations for March.