- Within the final 24 hours, HBAR has seen an uptick within the variety of short-trading positions opened

- Nonetheless, with low buying and selling quantity up to now, quick merchants would possibly lose out

The intraday buying and selling session on 3 January noticed many merchants wager towards a rally within the costs of a number of altcoins, together with Hedera [HBAR], knowledge from Santiment revealed.

Learn Hedera’s [HBAR] Worth Prediction for 2023-24

These trades, referred to as “shorting,” contain buyers promoting property they don’t personal within the hopes of shopping for them again at a cheaper price. Some market watchers believed that these property could possibly be susceptible to “quick liquidations”. That is the place quick sellers are compelled to purchase again the property at the next value as a consequence of market circumstances.

📊 Merchants are aggressively shorting #altcoins at the moment, and a few property could possibly be primed for #short liquidations. Based mostly on excessive bets being positioned on costs taking place, $DGB, $HBAR, $HT, $KAVA, $KSM, $SOL, & $ZEC could be candidates for small breakouts if #alts get any momentum. pic.twitter.com/SuFz4obrmL

— Santiment (@santimentfeed) January 3, 2023

Let’s take a look at how the exercise of those quick merchants has impacted HBAR’s value within the final 24 hours.

Will the Hedera shorters win?

At press time, HBAR traded at $0.0388, having declined by 1% within the final 24 hours. With HBAR tokens value $16 million traded inside the similar interval, buying and selling quantity was down by 6%.

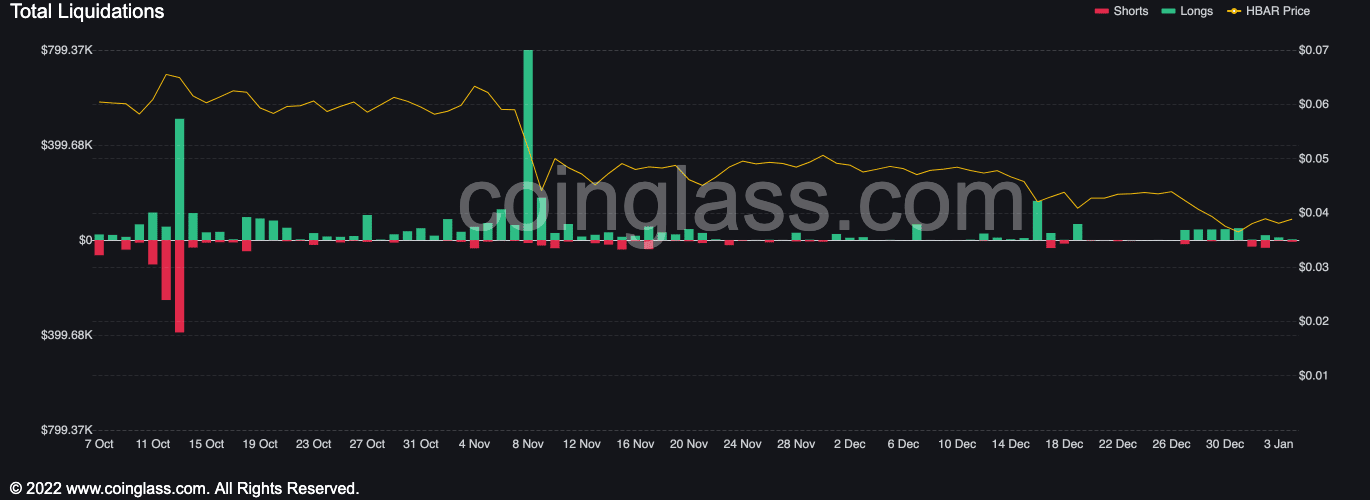

In response to knowledge from Coinglass, liquidations within the cryptocurrency market within the final 24 hours totaled $92.17 million. Moreover, no less than 24,250 merchants liquidated their holdings. HBAR liquidations of simply $21,529 accounted for 0.023% of the overall sums faraway from the market.

Supply: Coinglass

When the crypto market is marked by a excessive variety of quick merchants and low liquidation, as with HBAR, it may imply just a few various things.

First, the quick merchants could also be assured of their prediction that the worth will go down. Moreover, they don’t seem to be nervous about being “squeezed” out of their positions. This could possibly be as a result of they’ve a powerful conviction that the worth will go down. The identical is also the case as a result of they’ve taken measures to guard themselves from potential losses.

Additionally, the market could also be comparatively secure, and there’s not a lot volatility or value motion. This might make it simpler for brief merchants to carry on to their positions with out worrying about being compelled to shut them out due to a sudden value swing.

Lastly, the buying and selling quantity could also be low, contributing to low liquidation. When buying and selling quantity is low, there could also be fewer consumers and sellers available in the market, making it tougher for brief merchants to shut out their positions.

Are your HBAR holdings flashing inexperienced? Examine the revenue calculator

HBAR’s bearish instances to proceed?

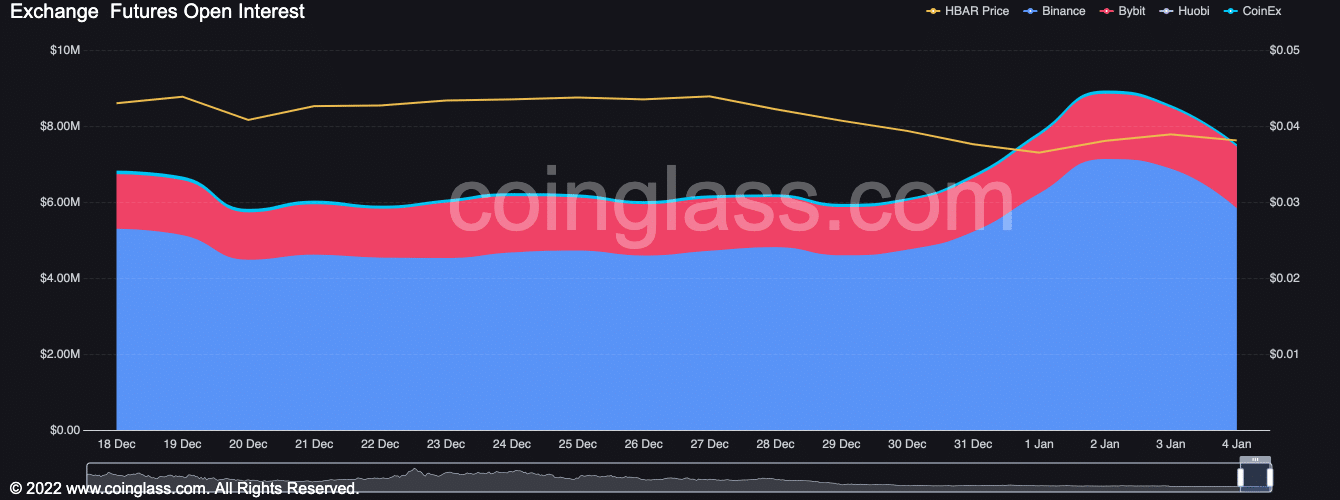

Nonetheless, whereas HBAR would possibly see low buying and selling exercise within the final 24 hours, a take a look at its Open Curiosity revealed a decline. At $7.5 million at press time, the asset declined by 12% within the final 24 hours.

It’s thought of bearish for open curiosity to say no, because it means that merchants are closing out their positions and taking earnings or reducing losses. This could possibly be seen as an indication of lowering bullish sentiment, as merchants are selecting to exit their positions quite than maintain on to them in anticipation of additional value appreciation.

Supply: Coinglass

Therefore, the anticipated value decline by HBAR quick merchants could be on the horizon.