A well-liked crypto strategist says that one chart may foreshadow bullish continuations for Bitcoin (BTC) and the remainder of the crypto markets.

Analyst Justin Bennett tells his 110,600 Twitter followers that the Tether dominance chart (USDT.D) is on the verge of violating the diagonal assist that has saved the metric in an uptrend since November 2021.

Merchants usually control the USDT.D chart because it reveals how a lot of the crypto market cap is comprised of stablecoin Tether (USDT). A bearish USDT.D chart is historically interpreted as bullish for Bitcoin and crypto because it signifies that merchants are parting with their stablecoins to take threat.

Says Bennett,

“Essentially the most bullish sign proper now for crypto is the Tether dominance chart, for my part.

This strikes inversely to crypto and is at present breaking down.

Unconfirmed as of now. Weekly shut will probably be key.”

At time of writing, the USDT.D chart stands at 6.88%, beneath Bennett’s trendline of round 7%.

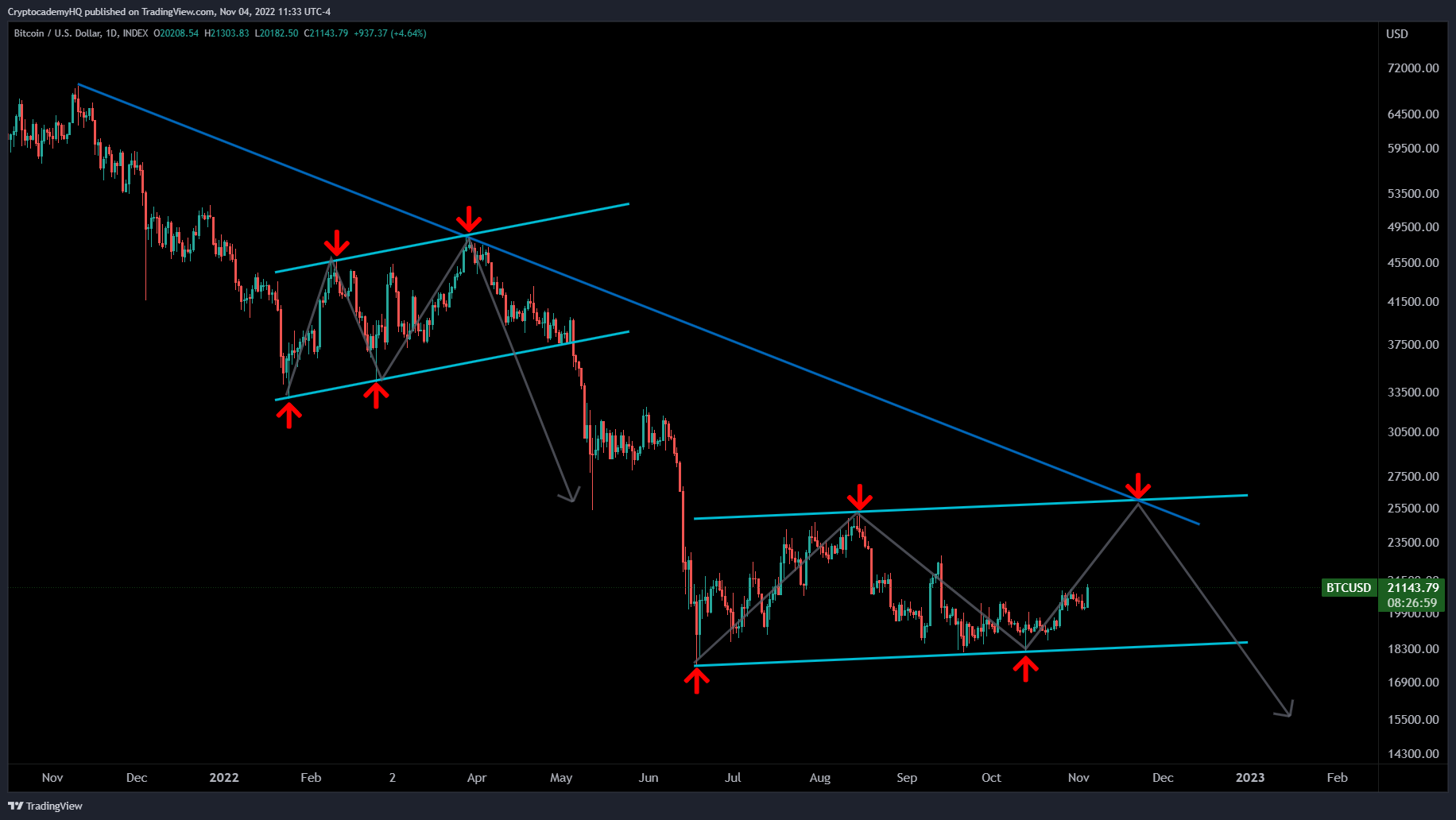

Because the USDT.D chart flash indicators of doubtless ending its one-year uptrend, Bennett says Bitcoin is able to rally towards his goal of $26,000 by December.

“A $26,000 BTC peak remains to be on the desk…

Nevertheless, just a few issues have to happen, together with Bitcoin getting above $22,800 and the DXY (US greenback index) closing beneath 109.30 [points] subsequent week, amongst different issues.

There are not any straightforward duties right here.”

At time of writing, Bitcoin is altering arms for $21,211, flat on the day.

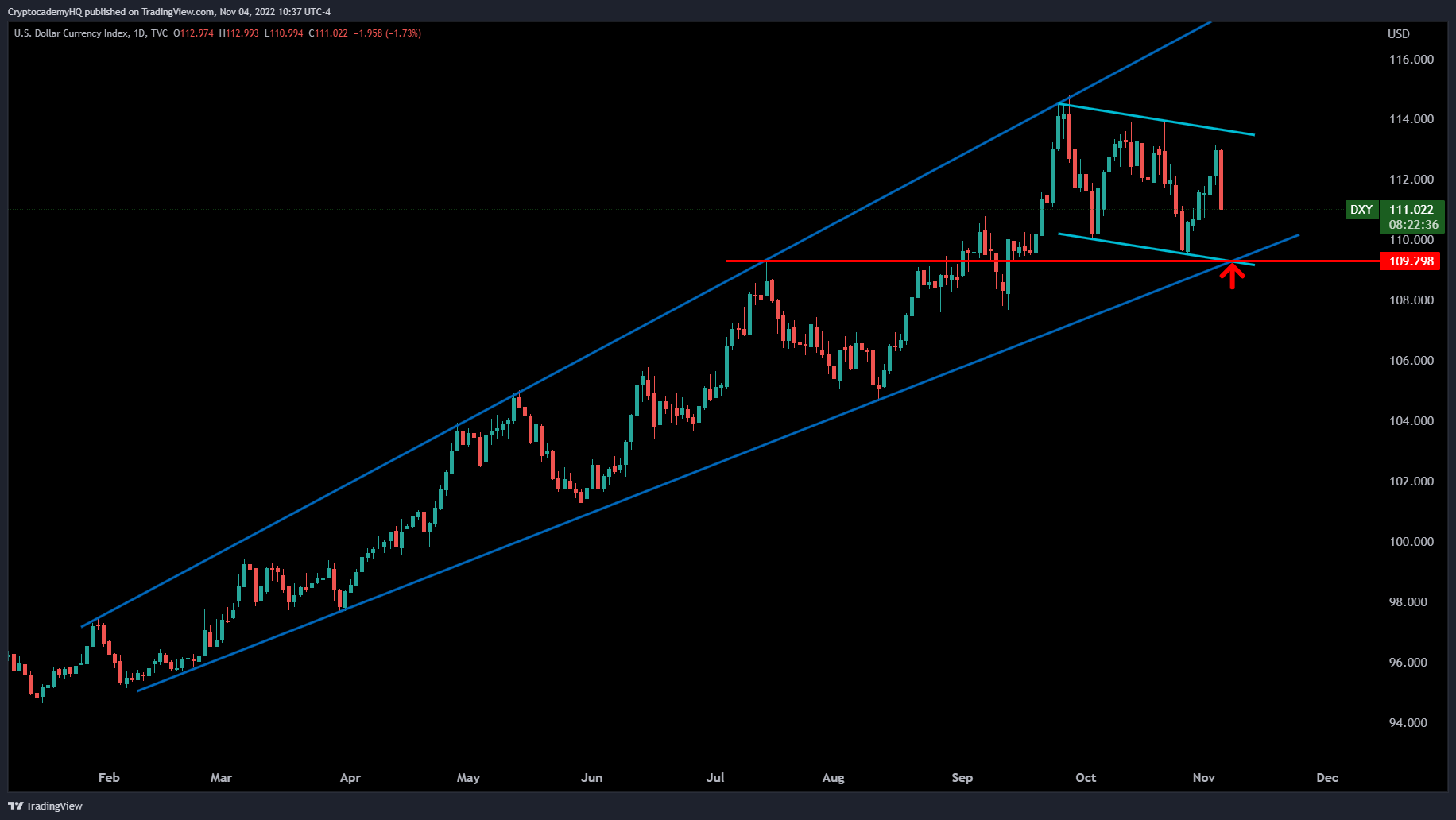

Bennett additionally explains why he believes the 109.30 stage for the DXY could possibly be key for a sustained crypto rally.

“I can’t stress sufficient how important 109.30 will probably be for the DXY subsequent week.

The confluence there may be huge.

2022 pattern line, descending channel assist, and key month-to-month stage.

Shut beneath = prolonged crypto rally.

Bounce aggressively = crypto pullback.”

Just like the USDT.D metric, merchants additionally observe the efficiency of the DXY as a plummeting index means that buyers are leaving the protection of the US greenback to build up threat belongings like Bitcoin and crypto.

At time of writing, the DXY is at 110.78 factors.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you might incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in online marketing.

Featured Picture: Shutterstock/Tithi Luadthong