The Bitcoin market is as soon as once more in turmoil, and the reason being an outdated acquaintance: no, not the US Federal Reserve, however the worries and rumors about Tether’s stablecoin, USDT. Anybody who has been lively within the Bitcoin and crypto marketplace for some time is aware of that rumors about USDT’s lack of backing are a part of each bear market. And this bear market appears to imply it notably “properly” because the Tether FUD is now making a reappearance on this cycle.

As NewsBTC reported earlier immediately, USDT has barely misplaced its peg to the US greenback because the Curve 3Pool has misplaced its steadiness. The explanation for that is that whales are promoting USDT and buying and selling it for USDC in addition to DAI. Nonetheless, in keeping with Tether CTO Paolo Arduino, the corporate is “able to redeem any quantity 1:1 in opposition to US {dollars}”.

Traditionally, the de-pegging of USDT shouldn’t be an unusual prevalence. Samson Mow, CEO of Bitcoin centered firm JAN3, writes:

Tether FUD is all the time the FUD backside. It’s what they pull out when there’s nothing left. Up quickly.

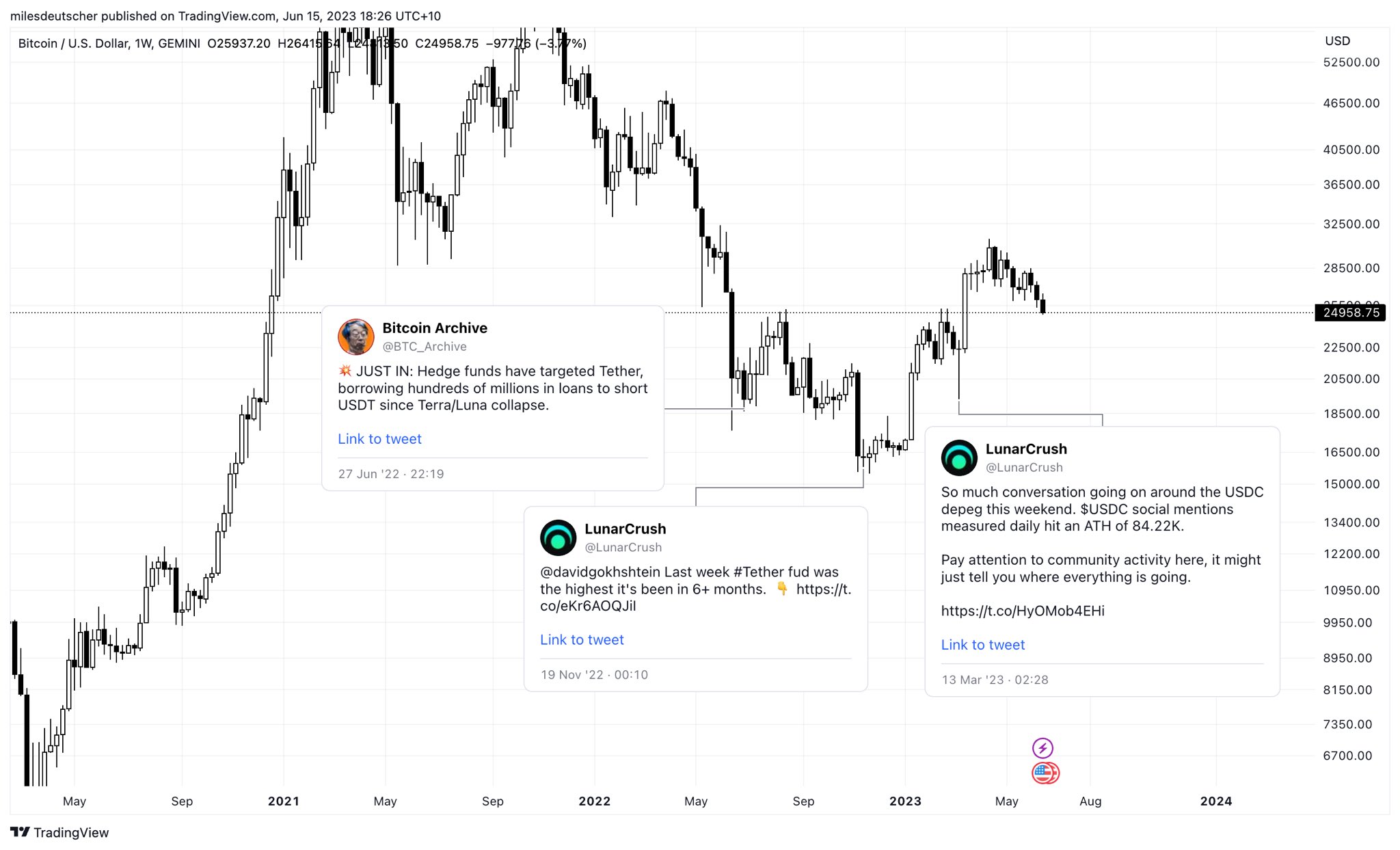

Analyst Miles Deutscher has the same view. He defined: “Enjoyable Reality: Stablecoin FUD usually marks native bottoms,” and shared the next chart.

Backside Sign For The Bitcoin Value?

As might be seen within the chart, the Tether FUD first surfaced on the finish of June 2022. On the time, information emerged that hedge fund Fir Tree Capital Administration was shorting Tether after the Terra ecosystem stablecoin Terra USD collapsed. Opposite to hypothesis, nevertheless, Tether was in a position to course of all USDT redemptions, despite the fact that the worth of USDT had fallen to $0.9520 briefly.

In mid-November 2022, the cryptocurrency trade FTX went bankrupt after its competitor Binance backed out of a purchase order settlement. The Tether FUD hit a 6-month excessive and the value of USDT fell to $0.9970. Once more, Tether was in a position to deal with all redemptions, whereas the market discovered an area backside.

Most lately, USDC depegging offered the native backside sign in March this yr. The occasion was brought on by the collapse of the counterparty from stablecoin issuer Circle, Silicon Valley Financial institution (SVB). Crypto whales had additionally tried to take income from the scenario on the time, whereas different USDC holders offered out of panic.

Tether emerged because the clear winner from the latter scenario and was in a position to seize massive market shares from USDC since then. Most lately, Tether reported big income, a few of which they’re investing in Bitcoin, as NewsBTC reported.

That is another excuse why crypto skilled Thor Hartvigsen believes that the probability of Tether not having sufficient funds to settle all USDT redemptions is “fairly low”, adding: “In line with Tether, the corporate made $1.48b in income in Q1 alone which introduced the reserve surplus to $2.44b. They’ve additional been winding down financial institution deposits (maintain lower than $0.5b right here) and bought over $53b in US treasuries all through 2022.”

Remarkably, the value of USDT has already returned to its default stage at press time. After the USDC/ USDT worth on Binance climbed briefly to $1.0042, it was now already again at $1.0019.

As of press time, the Bitcoin worth was bucking the Tether FUD and holding barely above $25,000. Nonetheless, the drop under the 200-day EMA (blue line) is considerably crucial. Most lately, BTC fell under this indicator which is called the “bull line” in the course of the USDC de-pegging. Due to this fact, Bitcoin bulls are suggested to stage the same response as in March to forestall an additional plunge.

Featured picture from iStock, chart from TradingView.com