- Bitcoin lacked demand regardless of the spectacular run of the primary ten days in 2023

- A brief time period retreat could possibly be seemingly relying on the CPI end result as provide in revenue spikes

Anticipating a return of the Bitcoin [BTC] bull market may sound too hasty regardless of the king coin resurgence above $17,000. CryptoQuant analyst, Cauceconomy opined this after assessing the situation of the Bitcoin demand.

BTC, which had extra inexperienced days than reds since 2023 started, had helped renew the keenness of its traders. However for Cauceconomy, a major breakout is perhaps unlikely.

Are your holdings flashing inexperienced? Verify the BTC Revenue Calculator

Buying and selling quantity restraining demand

In accordance with his publication on the crypto knowledge perception platform, Bitcoin’s lack of demand could possibly be traced to its community utilization. It is because every block affirmation interprets to elevated each day transactions.

Nevertheless, that has not been the state of affairs recently as miners have not essentially been profitable to extend productiveness by confirming extra blocks. Therefore, the buying and selling quantity has been repressed.

In accordance with CoinMarketCap, the BTC 24-hour buying and selling quantity was a 1.75% lower at press time. This aligned with the analyst’s reference to a dip in transactions on the Bitcoin community.

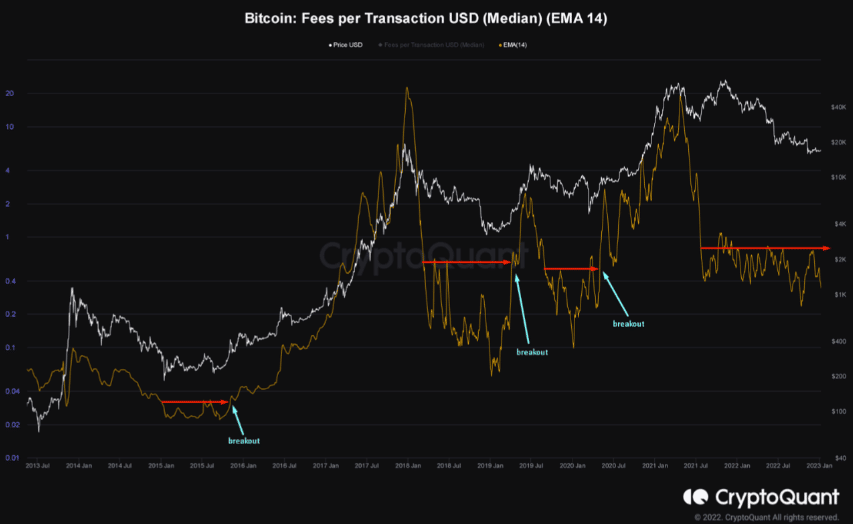

Supply: CryptoQuant

In addition to, Cauceconomy backed up his opinion by citing the historic development. He identified that there was often a notable breakout through the bear market earlier than the bull season in earlier cycles as proven by the above picture. In the meantime the present momentum displayed by BTC has proven nothing of such. The analyst stated,

“For us to have development within the fundamentals of the community, we might want to see larger demand for buying and selling and, consequently, larger charges for each day transactions. Right now, we haven’t had that breakout but and buying and selling quantity stays low, indicating low demand.”

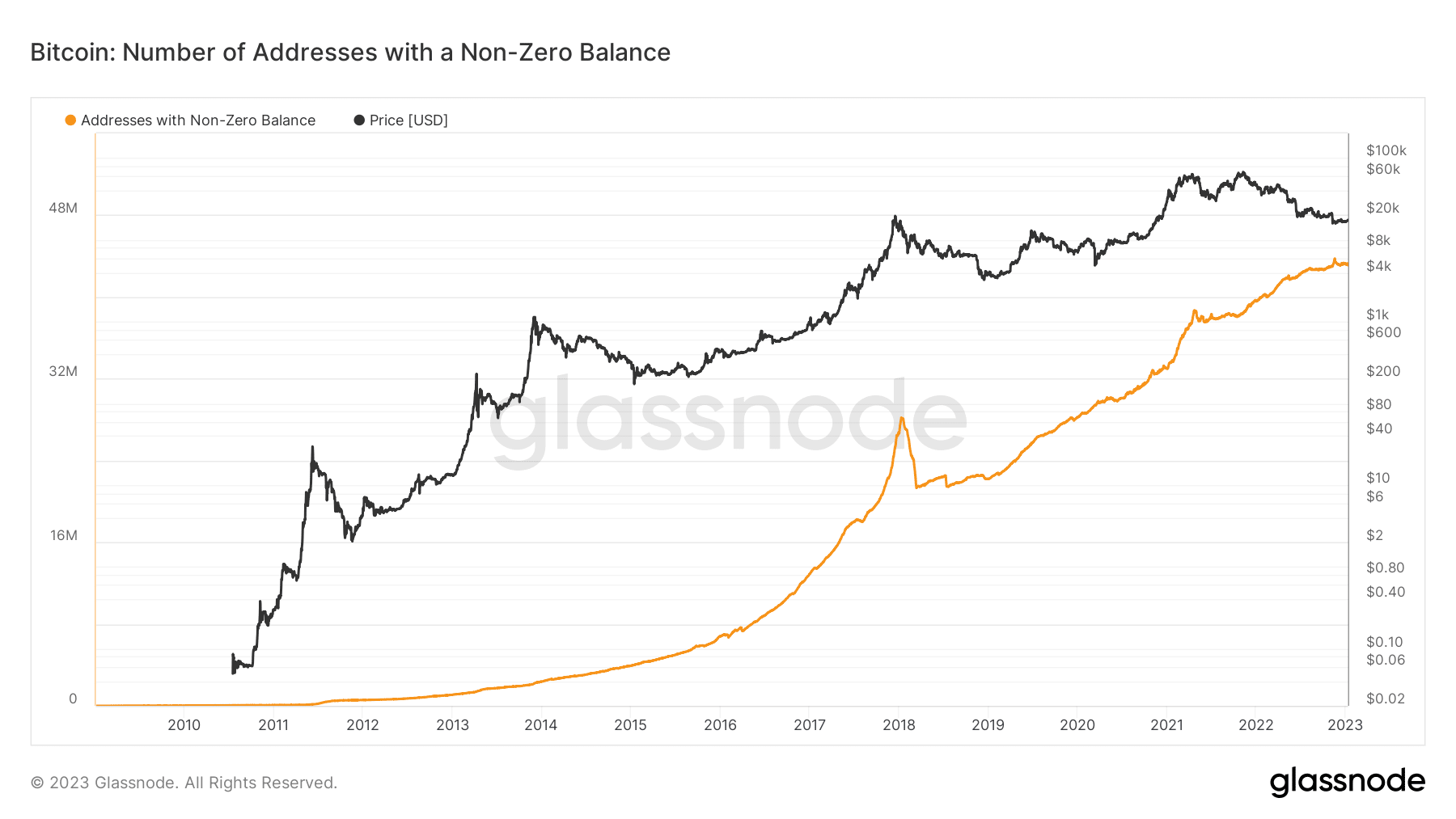

On evaluating the Bitcoin addresses with non-zero balance, Glassnode confirmed that there was a slight lower from the height registered in November 2022.

The information on the time of writing, reported the quantity to be 43,170,375. Though this was a marginal distinction, it prompt a lackluster perspective in the direction of community utilization consumer base enlargement.

Supply: Glassnode

What number of BTCs are you able to get for $1?

The trigger to take heed

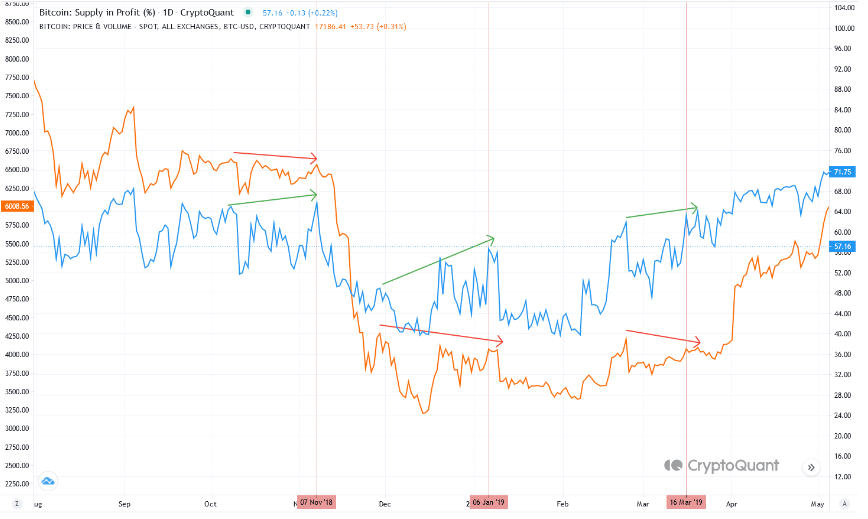

As well as, one other submit on CryptoQuant warned optimistic traders of an impending value drop. On-chain analyst Gigisulivan was the one who raised the alarm after his evaluation of the provision in revenue proportion. At press time, the Bitcoin provide in revenue proportion headed in the direction of peaks, and was forming a divergence.

Like Cauceconomy, he additionally referred to historical past as conditions like that finally led to a brief time period BTC pull again. For context, in 2018 and 2019, it solely took a number of days earlier than the projected end result occurred. So, it is perhaps the case as effectively contemplating the current circumstances.

Supply: CryptoQuant

Nevertheless, the analyst talked about that macroeconomic elements would even have a say within the potential BTC development. Due to this fact, the results of the Client Worth Index (CPI) report on 12 January may decide if the provision in revenue proportion goes forward with the forecast.