- The Uniswap income elevated by 63% as customers thought-about buying and selling USDC pairs on the DEX.

- Whereas the TVL additionally climbed, UNI holders resisted accumulating.

Panic unfold throughout the crypto ecosystem as Circle [USDC] opened up about its publicity to the Silicon Valley Financial institution (SVB) contagion. And as anticipated, the market skilled a quick draw back.

However the despair was not with out ecstasy as Decentralized Alternate (DEX), Uniswap [UNI] made a 63% Week-on-Week (Wow) hike in supply-side charges and general income.

Lifelike or not, right here’s UNI’s market cap in USDC’s phrases

Turbulence in TradFi however a reviving DeFi?

In response to Token Terminal, the buying and selling quantity was the catalyst answerable for the rise. The buying and selling quantity right here represents traders’ participation in utilizing the Uniswap platform for transactions.

It’s, nevertheless, noteworthy to say that the whole community charges milestone was solely attainable due to the USDC weekend depeg.

yesterday’s spike in buying and selling exercise pushing @Uniswap‘s week over week development 🆙 pic.twitter.com/mxSdM1DV1f

— Token Terminal (@tokenterminal) March 12, 2023

Recall that centralized exchanges (CEXes) together with Binance and Coinbase nearly instantly halted USDC buying and selling on their platforms because the unlucky occasion went public. However on a number of DEXes, USDC dominated the buying and selling pair ranks.

On 11 March, the protocol’s founder Hayden Adams confirmed that buying and selling quantity hit $12 billion. And this occurred after the USDC challenge with the Tradtional Finance (TradFi) establishment.

🦄 @Uniswap at nearly $12b in day by day quantity, hitting 11 digits for the primary time ever!!!

👀 I do not typically tweet quantity milestones anymore however that is over 5% of Nasdaq https://t.co/ZUszhiUNPu

— hayden.eth 🦄 (@haydenzadams) March 12, 2023

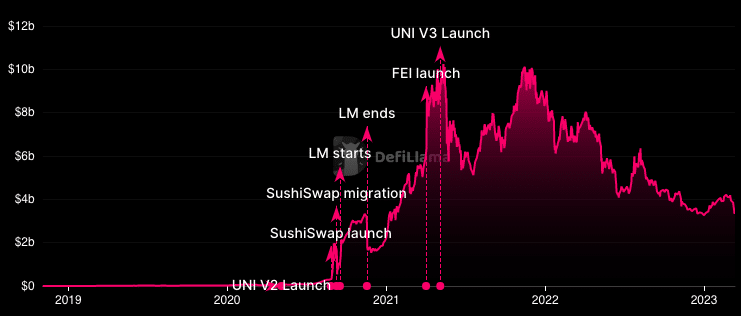

Due to this fact, the landmark was in a position to affect the Uniswap Whole Worth Locked (TVL). The TVL measures how prepared traders are to lock up funds in DeFi contracts. At press time, the Uniswap TVL elevated by 5.24%, in line with DeFi Llama.

Supply: DeFi Llama

The above information implies that traders’ belief in triggering distinctive deposits on the automated Ethereum [ETH]-based trade had improved.

Nonetheless, for the reason that stablecoin started its sojourn to regain the greenback peg, general on-chain quantity on Uniswap had lowered. However was there any affect on the UNI token?

UNI: It’s “no allegiance” season

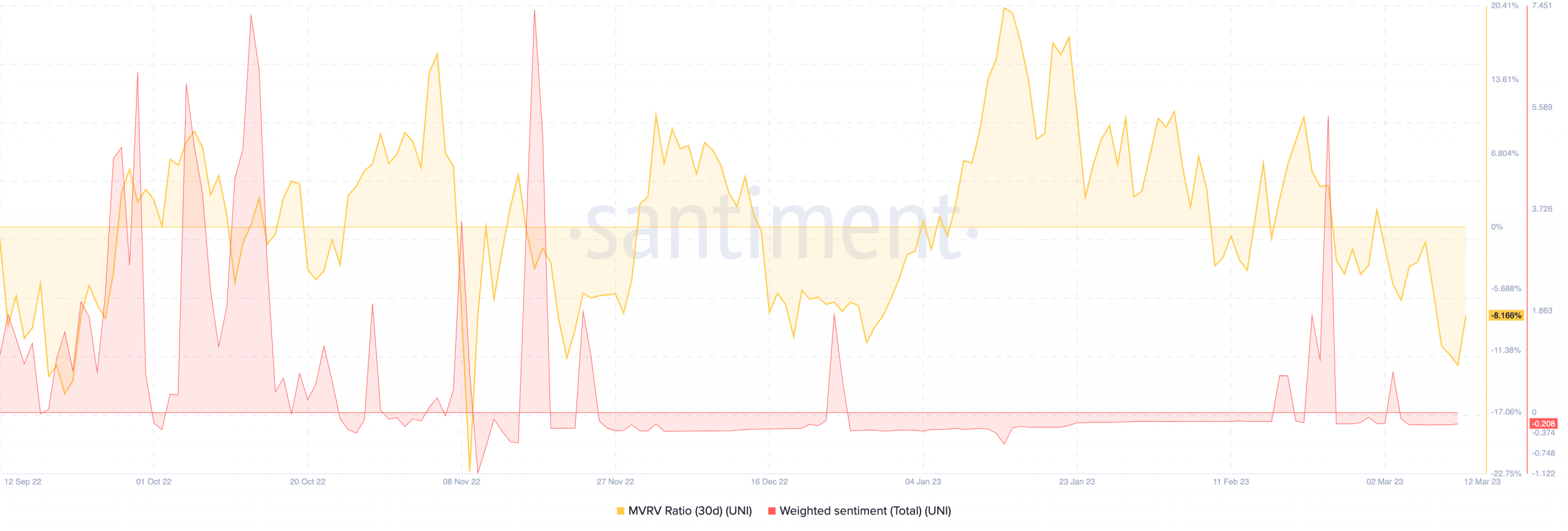

Effectively, particulars from Santiment confirmed that UNI’s 30-day Market Worth to Realized Worth (MVRV) ratio recovered to -8.214%. The MVRV ratio acts as an indicator to identify traders’ motive to purchase or promote because of an asset’s rise in worth or in any other case.

Since UNI emerged on an growing development, it meant that there was extra intent to promote the token over the previous few days.

However this choice could possibly be linked to short-term holders of the token who’ve made about 5.24% features within the final 24 hours. Regardless of the rise in worth, the discernment towards UNI didn’t heighten.

Supply: Santiment

Is your portfolio inexperienced? Examine the Uniswap Revenue Calculator

At press time, the on-chain analytic platform revealed that weighted sentiment was -0.208. This implied that almost all of messages publicly written about UNI weren’t essentially on the constructive aspect.

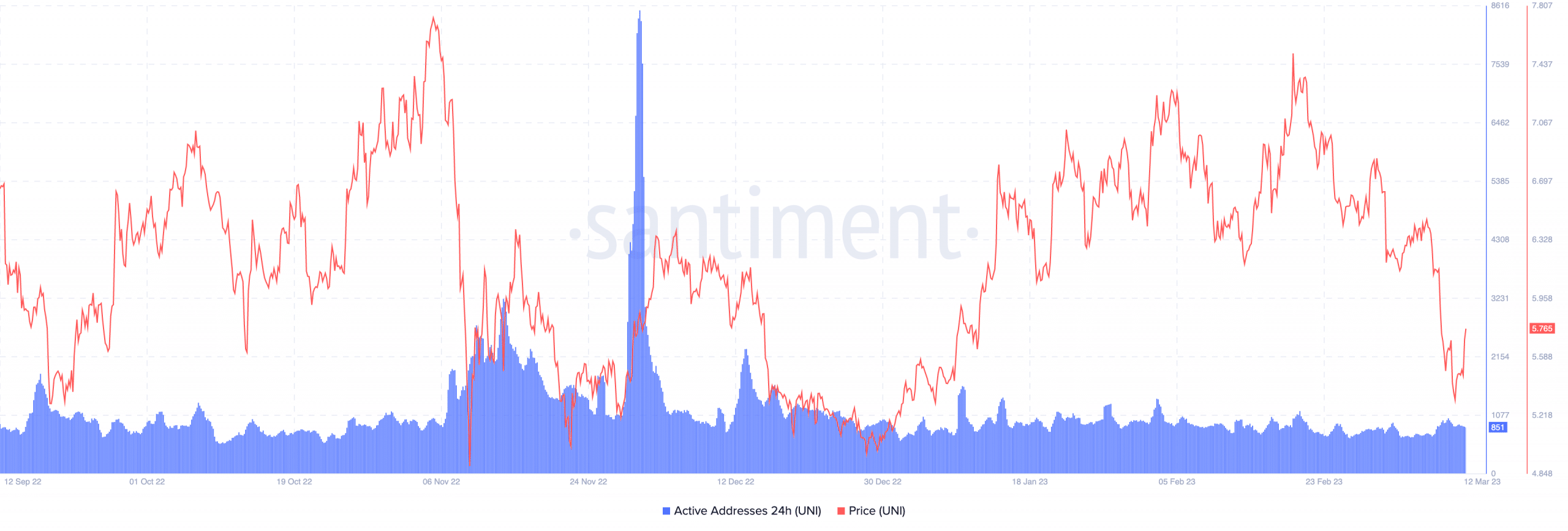

The reluctance to show renewed religion within the token was additionally proven by the energetic addresses. On the time of writing, the UNI active addresses which surged briefly to 960, had been right down to 858. This signifies that hypothesis across the cryptocurrency was not excessive whereas UNI trade fingers at $5.76.

Supply: Santiment