- A take a look at how the upcoming FOMC assembly will affect the Shiba Inu demand.

- Bullish bias forming however buyers nonetheless transferring with warning in anticipation of ultimate outcomes.

The Shiba Inu group is undoubtedly happy with SHIB’s efficiency in January. However now that the month is coming to its conclusion, a way of uncertainty has returned to the market, particularly in regard to its efficiency in February.

The upcoming FOMC assembly will seemingly have the most important impression on Shiba Inu holders’ portfolios.

An excellent understanding of what the FOMC assembly is will enable Shiba Inu holders to raised perceive the way it influences their portfolio.

Nicely, for starters, the conferences are held as soon as each three weeks and one of many key highlights is the revision of the Federal Fund price. The latter is the speed at which banks borrow from the Federal Reserve.

The hyperlink between the FOMC and Shiba Inu worth motion

The Federal Reserve makes use of the Federal fund price as a software for balancing the financial system. A decrease price means it’s cheaper to borrow, making it simpler for individuals to entry liquidity and thus a neater funding setting.

Then again, a better price makes borrowing much less interesting and discourages funding.

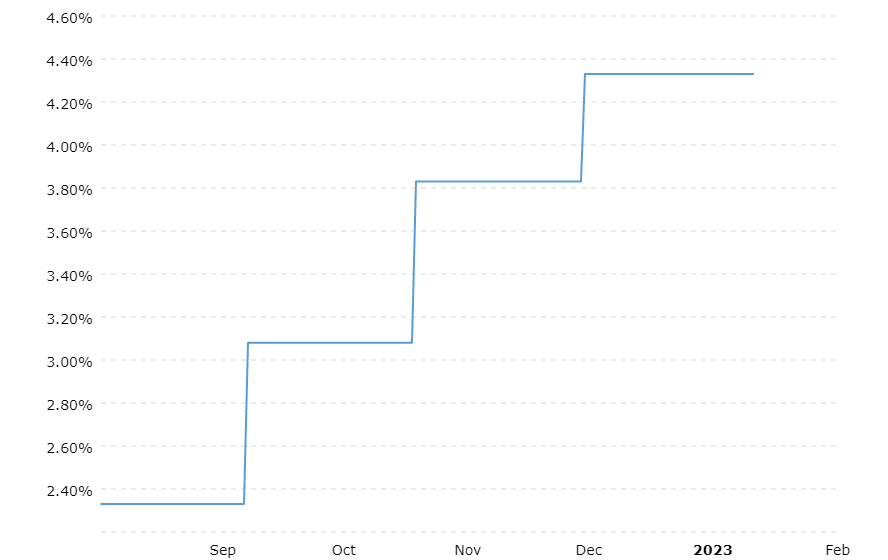

The Federal fund price has been rising for probably the most half in 2022 as a part of the FED’s quantitative tightening measures to curb inflation.

Shiba Inu and the remainder of the market skilled a bullish surge after the final FOMC assembly. It’s because the FED solely elevated rates of interest by 0.5% or 50 foundation factors in comparison with 0.75% or 75 foundation factors within the earlier month’s announcement.

Supply: Macrotrends

The market interpreted the decrease FFR as an indication that the FED was easing off its aggressive price hike. This was additionally accompanied by studies that the FED was seeing constructive ends in its battle in opposition to inflation. The next FOMC meeting is scheduled to happen on 31 January and 1 February.

How will the FOMC’s subsequent FFR have an effect on Shiba Inu?

There may be hypothesis that the FED will hike the FFR by 25 foundation level. If this seems to be true, then it could help a bullish sentiment, and thus SHIB might expertise renewed shopping for strain.

Such an consequence would enable it to beat the resistance we noticed in the previous couple of days on the $0.0000123 worth degree.

Supply: TradingView

If a rally is an consequence, then Shiba Inu buyers can anticipate the worth to surge by as a lot as 14% to the following Fibonacci resistance line.

If the speed hike is greater than that, it could spoof buyers, triggering one other selloff for Shiba Inu.

A ten% or extra pullback could also be on the playing cards and that consequence will push it again nearer to or under its 200-day MA.

The week forward 🫡

Wednesday: US FOMC [25bps hike priced with 98% probability, another 25bps in March is likely]

Thursday: UK + European central financial institution conferences

Friday: US NFP job market information [Unemployment rate to tick higher from 3.5% to 3.6%, 193k jobs exp. to have been added]

— tedtalksmacro (@tedtalksmacro) January 29, 2023

How are the markets reacting to date?

Typically the market begins to react even earlier than the precise FOMC minutes are launched. Some speculate that it’s because individuals in privileged positions know concerning the FED’s price determination earlier than it’s formally launched.

As such, some market members might have privileged entry, permitting them to react accordingly.

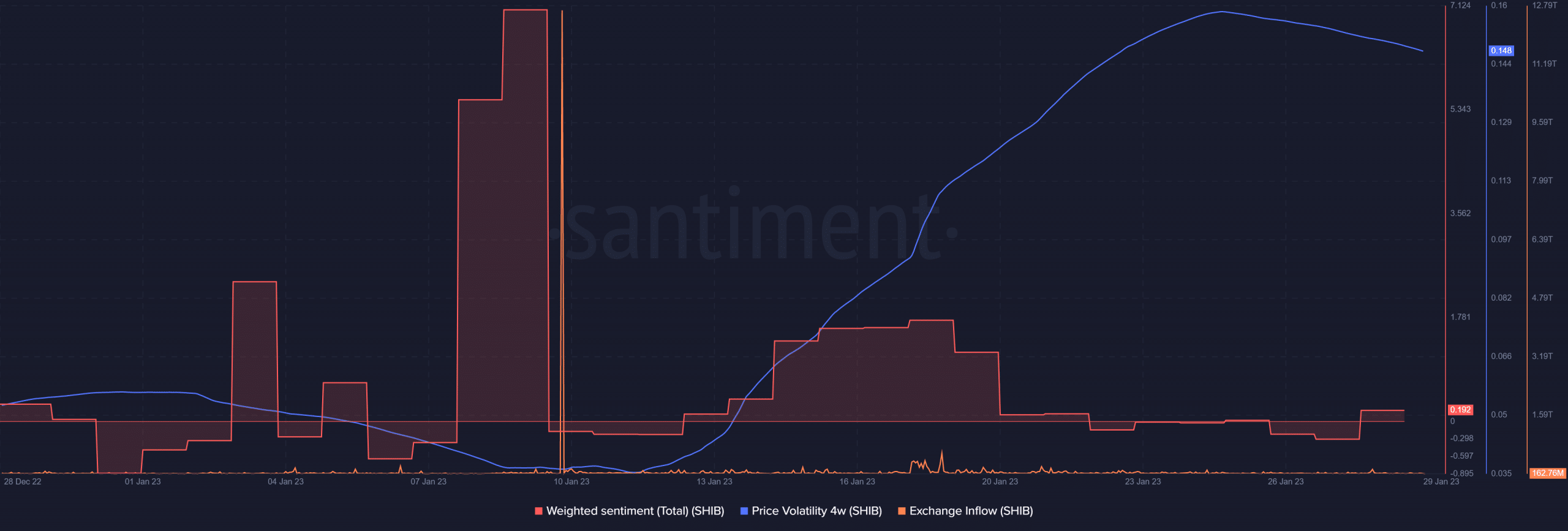

Curiously, Shiba Inu’s weighted sentiment metric did register a slight uptick within the final two days. This may increasingly recommend that optimism is returning to the market.

Nicely, this isn’t essentially a affirmation that buyers anticipate one other surge particularly now that the expectations are leaning in the direction of a 25 foundation level hike.

Supply: Santiment

In the meantime, the worth volatility has tanked barely in the previous couple of days however one other surge may be on the best way. It’s because the FOMC information might set off extra buying and selling exercise this week.

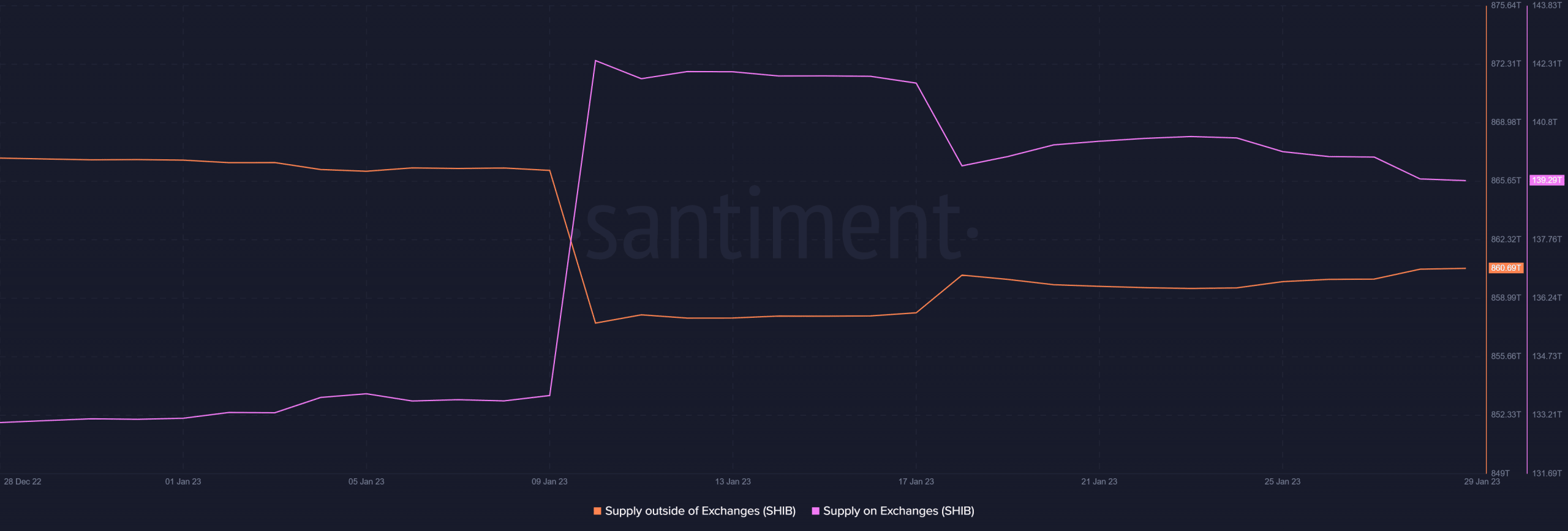

Trade flows additionally spotlight an identical consequence. The provision on exchanges has dropped considerably in the previous couple of days, whereas the other is true for provide exterior exchanges.

Supply: Santiment

The above metrics affirm that there’s a greater demand for SHIB than promoting strain. Nonetheless, this isn’t affirmation that the bulls will prevail.

There may be nonetheless ample time for a bearish pivot particularly if the FOMC decides to go together with a better price hike than anticipated.

As soon as the official information is out, we are going to seemingly see a rise in directional momentum. SHIB merchants and buyers can benefit from the following pattern which is able to supply alternatives for short-term good points.

However, for now, the very best technique could be to ‘wait and watch’ the market’s play.