The Worldwide Financial Fund’s (IMF) Director of Financial and Capital Markets, Tobias Adrian, warned that extra crypto tasks would possibly fail, significantly stablecoins.

The feedback made for unwelcome information as buyers, nonetheless uncooked from the Terra implosion and subsequent liquidity drain, proceed to carry hope that the worst is over.

Chatting with Yahoo Finance, Adrian stated that if a recession arises, he expects cryptocurrencies and different risk-on property to come back underneath additional promote stress, giving method to extra ache forward.

Crypto stablecoins underneath the highlight

Increasing additional, the IMF Director stated the knock-on impact of an financial downturn may see the failure of “coin choices,” as he singled out algorithmic stablecoins as significantly susceptible.

“There could possibly be additional failures of a few of the coin choices — specifically, a few of the algorithmic stablecoins which were hit most laborious, and there are others that would fail.”

Algorithmic stablecoins obtain worth stability by an automatic course of that mints extra tokens when the value will increase above the peg, and burns tokens when the value falls under the peg.

Present vital algorithmic stablecoins in operation are USDD on Tron, USDN on the Close to Protocol, and Ethereum’s Frax, which is an element algorithmic half collateralized.

Nevertheless, collateralized stablecoin choices are additionally in danger, in response to Adrian. Particularly, Tether, which Adrian stated is susceptible “as a result of they’re not backed one to at least one.”

“[Some fiat-backed stablecoins] are backed by considerably dangerous property…it’s definitely a vulnerability that a few of the stablecoins will not be totally backed by cash-like property.”

Tether was ordered by the New York Lawyer Basic to submit obligatory quarterly stories on its reserve holdings in February 2021. Subsequent stories confirmed reserves had been composed of great illiquid property, resembling “business papers,” elevating doubts over the corporate’s capability to fulfill its obligations.

Since then, Tether has diminished its business paper holdings by $5 billion to $3.5 billion.

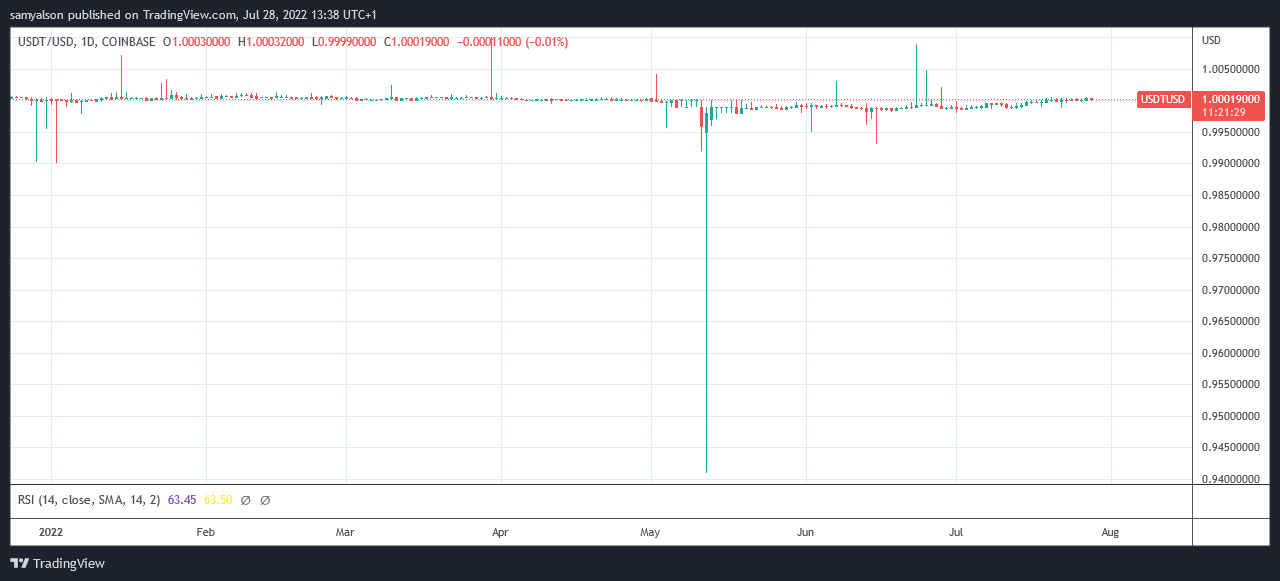

Tether dropped considerably under its $1 worth peg in the course of the Terra collapse, going as little as $0.94. On the time, Bitfinex CTO Paolo Ardoino performed down the importance of the drop, saying the peg was not damaged as holders may all the time redeem straight from the corporate for face worth.

What recession?

Beforehand, a recession was outlined as two consecutive quarters of unfavourable GDP development. Nevertheless, policymakers have redefined the time period as a ” holistic have a look at the info – together with the labor market, client and enterprise spending, industrial manufacturing, and incomes.”

The transfer was extensively mocked as an incredulous play by the present U.S. administration. Political Commentator Glenn Beck referred to as this a weak ploy to win a shedding argument whereas additionally bringing in a number of different political sizzling potatoes.

Beneath Biden alone, the Left has tried to redefine girl, fetus, home terrorist, rebel, voter suppression, unlawful alien, anti-police, and now recession. What a method! If you lose an argument, simply change the DICTIONARY!

— Glenn Beck (@glennbeck) July 27, 2022

On July 28, the Bureau of Financial Evaluation stated U.S. GDP for the second quarter had shrunk by 0.9%, marking the second successive quarter of financial contraction.

Regardless of denials of a recession from the present administration, crypto buyers could be prudent to heed Adrian’s phrases.