- BTC whales intensified accumulation within the final eight weeks.

- Open Curiosity and Funding Charges revealed that buyers harbored bullish sentiments.

Elevated whale exercise for the reason that graduation of the brand new buying and selling yr has led to a 26% development within the value of Bitcoin [BTC], as per a 14 January tweet from Santiment.

🐳 Amongst most of the foreshadowing metrics for this 2023 breakout was the quickly rising quantity of addresses holding 100 to 1,000 $BTC. Worth pumps usually happen marketwide when whales accumulate #Bitcoin. The #1 asset in #crypto is +26% in two weeks. https://t.co/JMh83m3mIu pic.twitter.com/FiRTLIc3LB

— Santiment (@santimentfeed) January 14, 2023

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Bitcoin whales present their energy

In line with the on-chain knowledge supplier, the rely of BTC whales holding 100 – 1,000 BTCs rallied by over 3% within the final two months. At press time, the rely of this cohort stood at 14,110 whale addresses.

When whales intensified the buildup of a crypto asset, it typically created a constructive sentiment amongst different buyers. This results in a rise in demand for the asset, which may, in flip, drive up its costs.

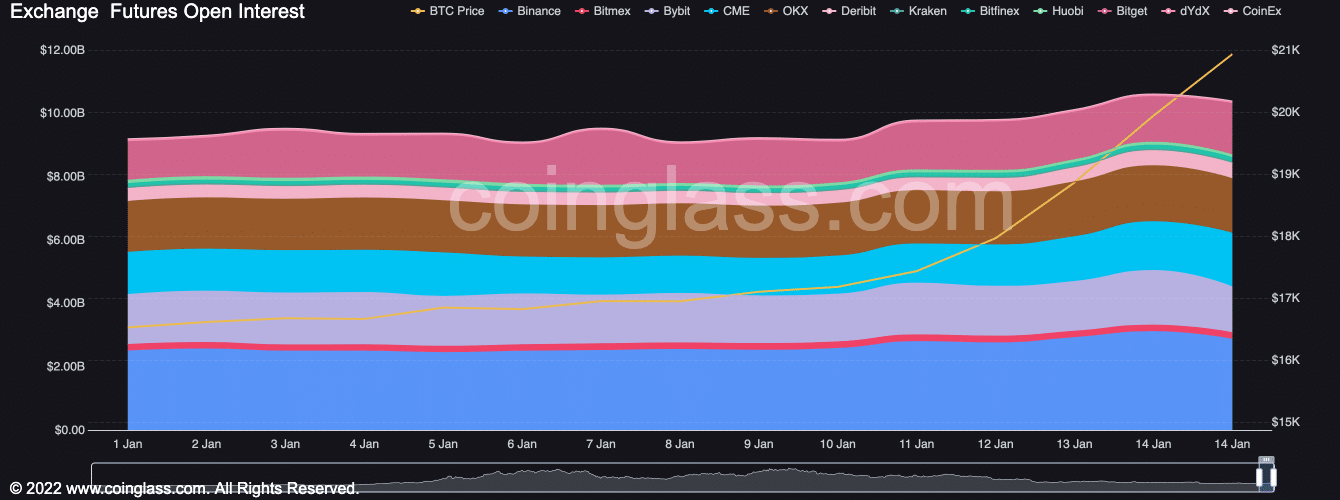

Additional, BTC’s Open Curiosity has been rallying for the reason that yr began. Per knowledge from Coinglass, the king coin’s Open Curiosity has grown by 13% since 1 January 2023.

Open curiosity refers back to the variety of excellent contracts, or positions, that haven’t but been settled. A rise in open curiosity prompt that extra merchants and buyers had been getting into buying and selling positions on the asset. That is typically thought to be an indication of elevated demand for the asset, which precedes a value rally.

Supply: Coinglass

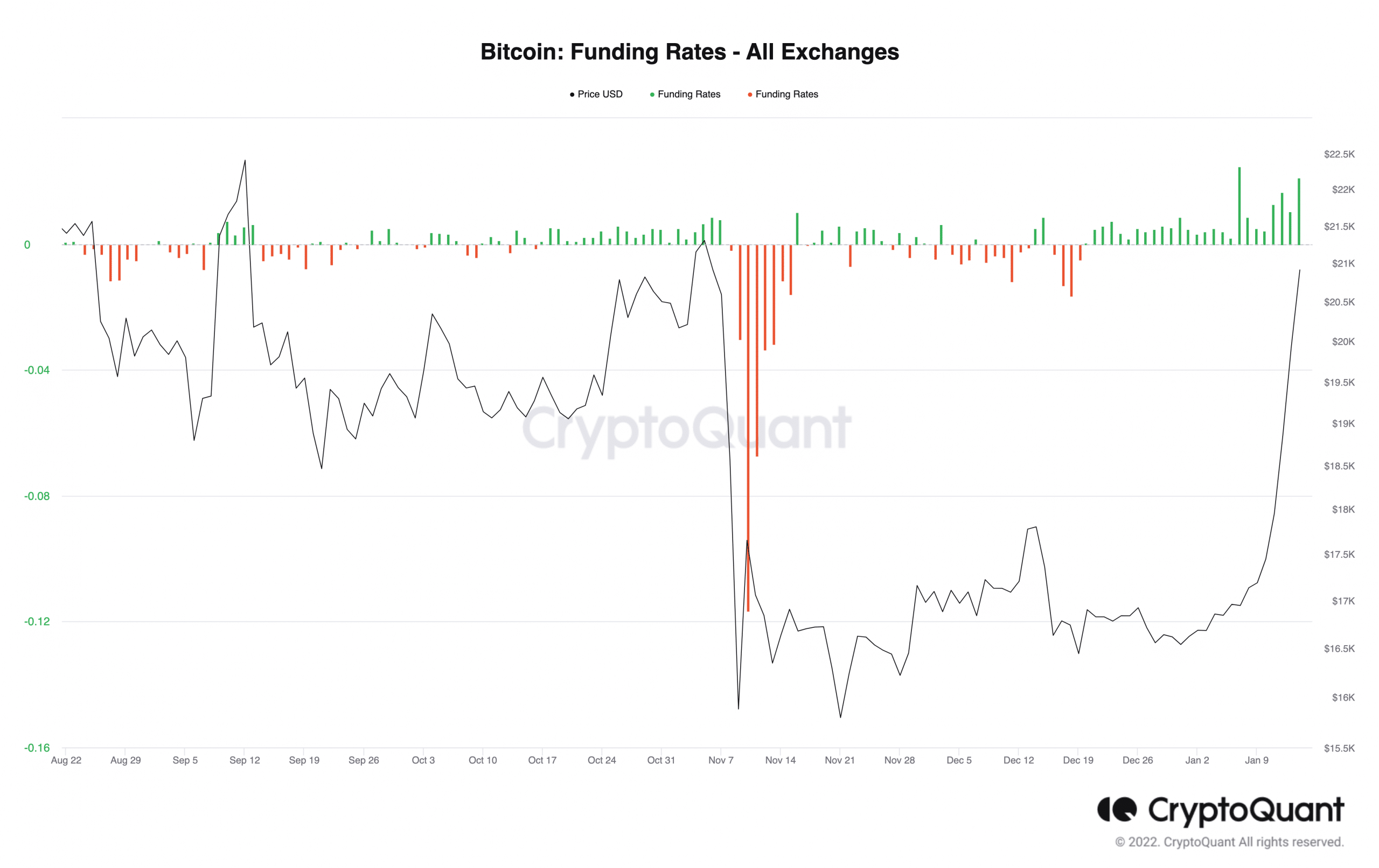

Likewise, funding charges on the BTC community since 2023 have been constructive, knowledge from CryptoQuant confirmed.

Supply: CryptoQuant

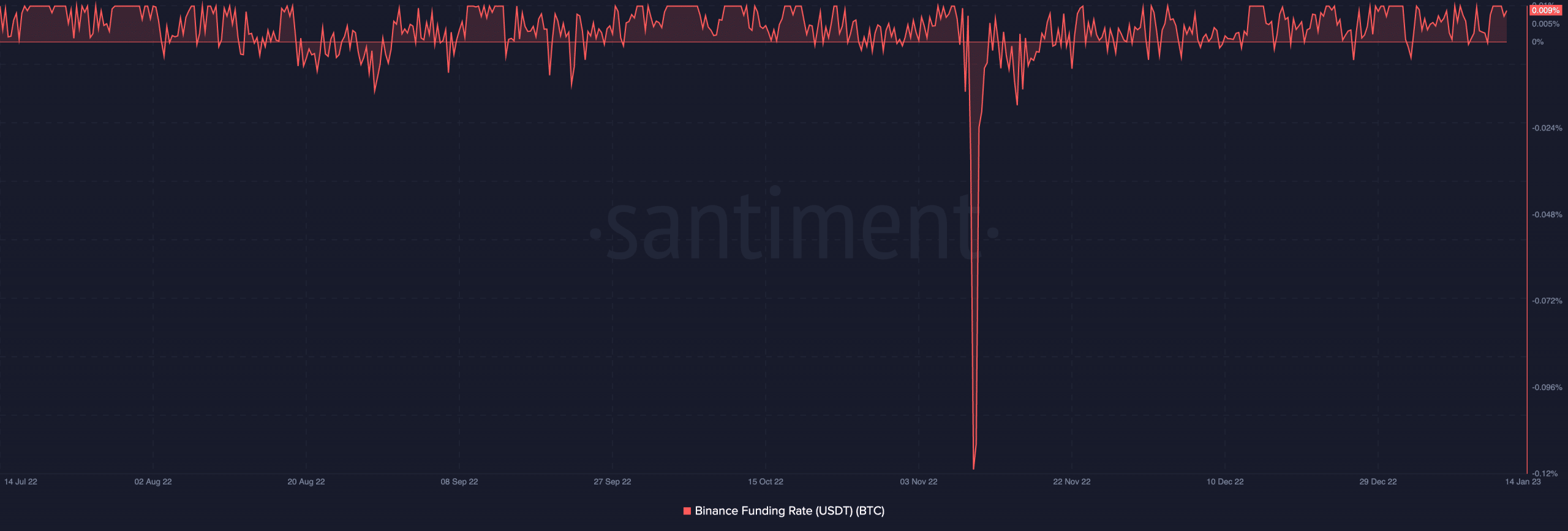

For instance, regardless of the FTX debacle in November 2022 and the consequential decline in BTC’s worth, merchants had been undeterred and continued to take lengthy positions.

Supply: Santiment

Hold this behind your thoughts

CryptoQuant analyst Inspocrypto discovered that BTC logged the very best spot influx on 13 January, which confirmed that holders of 1000 to 10,000 BTC had resumed sending their holdings to exchanges.

Sensible or not, right here’s BTC market cap in ETH’s phrases

Whereas the rise in an asset’s trade influx is commonly thought to be a bearish signal, it may additionally imply that the asset is turning into extra liquid and simpler to commerce, which might be constructive for the market.

On the place BTC’s value may go subsequent, Inspocrypto opined,

“For bulls, the vary between 19k – 19.2k is essential. In the event that they break that vary and preserve above, we are able to go additional, heading 23k – 24k. In any other case, we are going to retest 15.6k and commerce decrease ranges beneath 15k.”

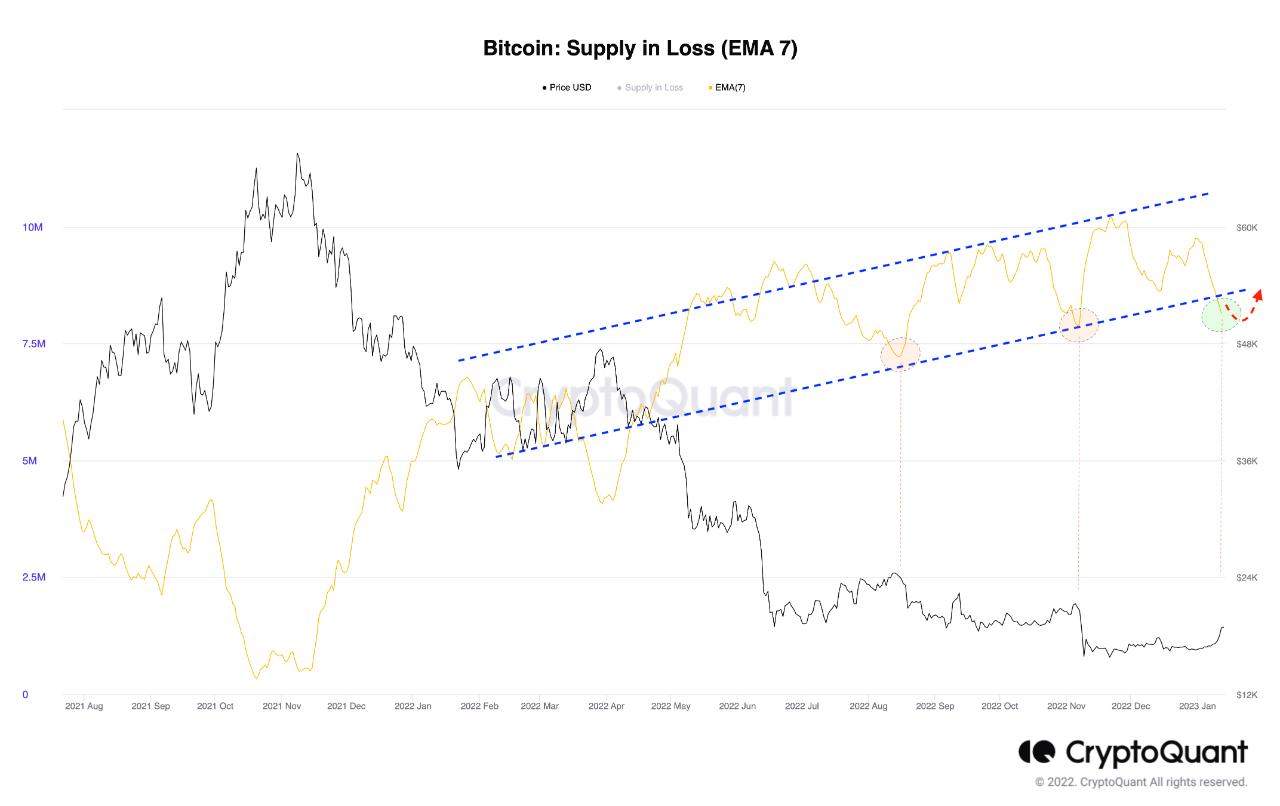

Supply: CryptoQuant

Additional, on what BTC holders ought to anticipate, one other CryptoQuant analyst, TariqDabil, whereas assessing BTC’s Adjusted Spent Output Revenue Ratio (aSOPR) mentioned,

“To make sure in regards to the value motion forward of us, we should always see a retest to the aSOPR rising development, then a (fall down) and transition to a downtrend….”

Supply: CryptoQuant