- Litecoin’s hash charge and issue skyrocketed

- Metrics and Galaxy Rating appeared optimistic too

- Nevertheless, the RSI and MFI had been close to the overbought zone on the charts

Litecoin’s [LTC] hash charge has been on hearth these days, with the altcoin recording sustained upticks for a number of weeks now. Some credit score for this may be given to the Ethereum Merge, due to which miners began switching to different networks resembling Ethereum Basic, Ravencoin, and Litecoin.

Litecoin’s Hashrate is⚡️⚡️⚡️

Exceeding 600TH/s in the previous few hours. pic.twitter.com/nNs1WxxWbr

— Litecoin Basis ⚡️ (@LTCFoundation) November 23, 2022

Due to the hike in hash charge, LTC’s mining difficulty has additionally been appreciating of late. Whereas the hash charge and issue had been growing, LTC’s worth registered an unprecedented uptick too. Actually, in line with CoinMarketCap, LTC registered greater than 30% 7-day positive aspects. At press time, it was trading at $78.61 with a market capitalization of over $5.6 billion.

Learn Litecoin’s [LTC] Worth Prediction 2023-24

Higher days forward?

The hike in hashrate will also be attributed to this worth enhance as it’s attainable that new miners had been becoming a member of the ecosystem in hope of upper earnings. Apparently, a number of developments and updates that occurred within the Litecoin ecosystem instructed that good days for miners may be forward.

In response to LunarCrush, as an illustration, LTC is on the listing of cryptos which have the very best Galaxy Rating. It is a main bullish sign for LTC, one projecting a sustained uptrend within the days to comply with.

LunarCrush Galaxy Rating™ is a proprietary rating that’s continuously measuring a cryptocurrency in opposition to itself with respect to the group metrics pulled in from throughout the online.

Prime 10 cash by 1-week Galaxy Rating™ 🪐🚀$DYDX $BTC $ETH $XRP $LTC $BCH $BNB $USDT $XLM $ADA pic.twitter.com/OFaUmMSbeK

— LunarCrush (@LunarCrush) November 23, 2022

Not solely that, however the Litecoin ecosystem can also be fairly heated on the social entrance as its social mentions measured hourly hit 1.84K lately – The best level within the final 90 days, reflecting the recognition of the coin within the crypto-community.

Metrics favoured the patrons

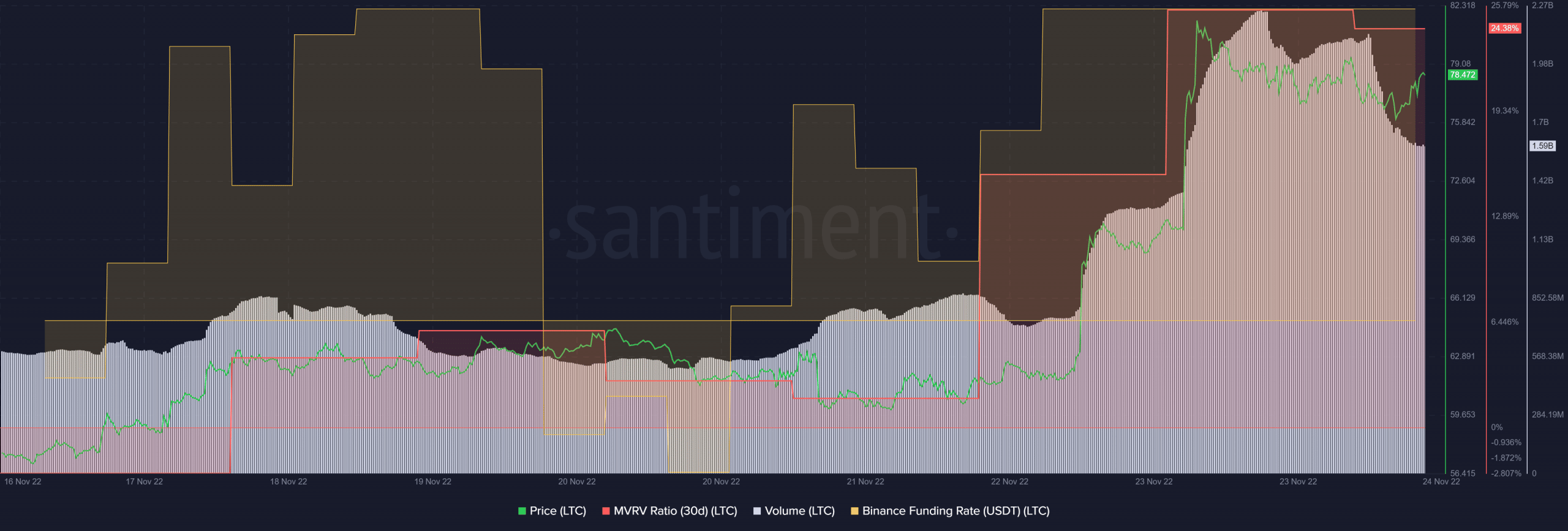

A take a look at LTC’s on-chain metrics indicated that the traders might need extra days to cherish. LTC’s MVRV Ratio was significantly larger over the past week, which is a bullish sign. Furthermore, LTC additionally acquired numerous curiosity from the derivatives market, as its Binance funding charge additionally marked a rise.

LTC’s quantity additionally skyrocketed a number of days in the past, however on the time of writing, it had registered a decline. This may be troublesome going ahead.

Supply: Santiment

Bears could also be gearing up

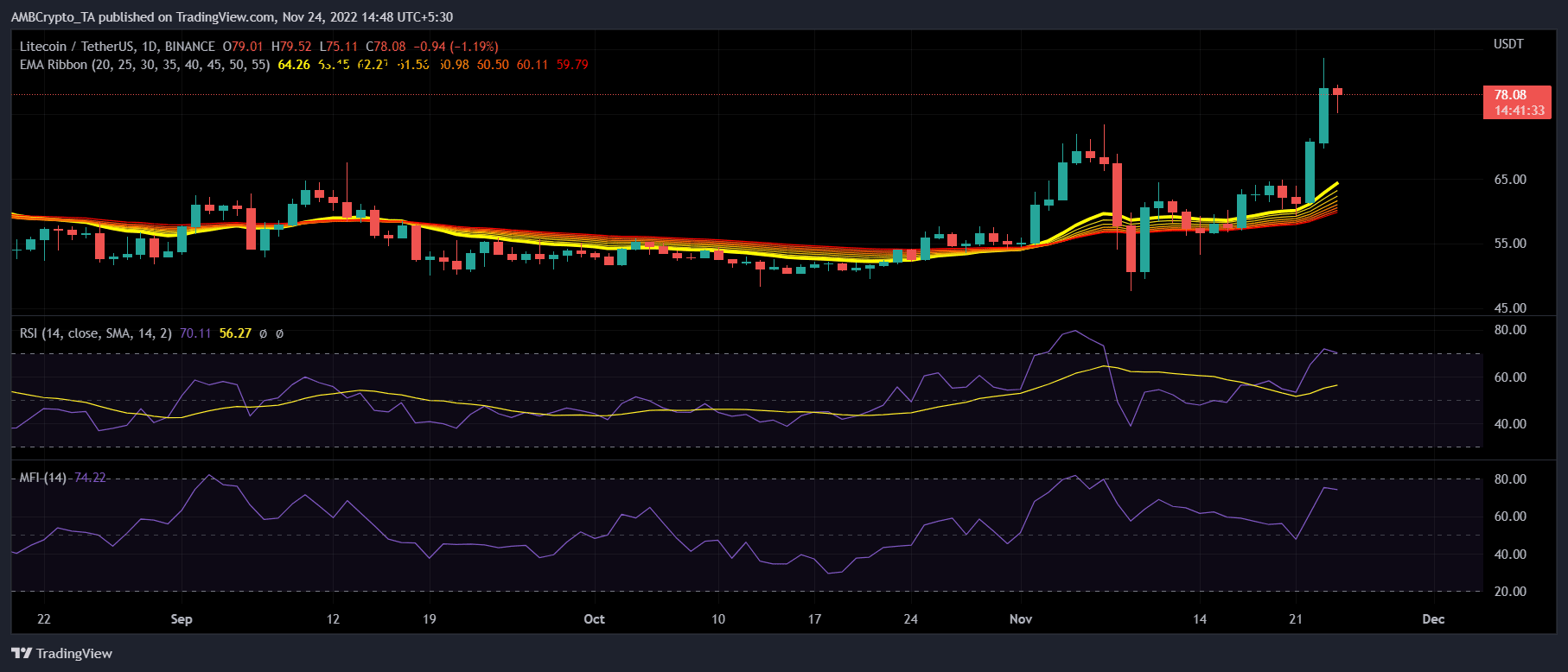

Whereas a lot of the metrics gave a optimistic impression of LTC, its market indicators informed a unique story.

TradingView’s chart revealed that the crypto’s Relative Energy Index (RSI) hit the overbought zone after which registered a slight decline – An indication of a attainable market prime. The Cash Movement Index (MFI) additionally took the identical path and was simply close to the overbought zone, additional growing the probabilities of a development reversal within the coming days.

Nonetheless, the Exponential Transferring Common (EMA) Ribbon supported the bulls because the 20-day EMA was resting above the 55-day EMA.

Supply: TradingView

![Is caution an option for Litecoin [LTC] investors going forward](https://ambcrypto.com/wp-content/uploads/2022/11/LTC-2-1000x600.png)