- Solana positive factors builders by the droves, however growth exercise nonetheless comparatively low.

- SOL bears take over because the bulls run out of momentum.

Solana [SOL] acquired a foul rep in 2022 as some of the disrupted blockchain networks. Quick ahead to the current, and the narrative is step by step altering within the community’s favor.

Learn Solana’s [SOL] Value Prediction 2023-24

Solana has kicked off 2022 as one of many quickest rising developer ecosystems in 2022. That is in line with a report ready by Electrical Capital on 17 January. In line with the replace, the variety of builders engaged on Solana crossed the two,000 mark in 2022. As well as, developer rely grew by 83% between December 2021 and December 2022.

1/ A brand new report by @ElectricCapital reveals that Solana is the quickest rising developer ecosystem, surpassing 2,000 whole builders in 2022. It is second in uncooked numbers solely to Ethereum.

Let’s dig into the numbers.https://t.co/HQvPbQzQD2 pic.twitter.com/xV6pnoT7db

— Solana (@solana) January 17, 2023

Not all properly with Solana

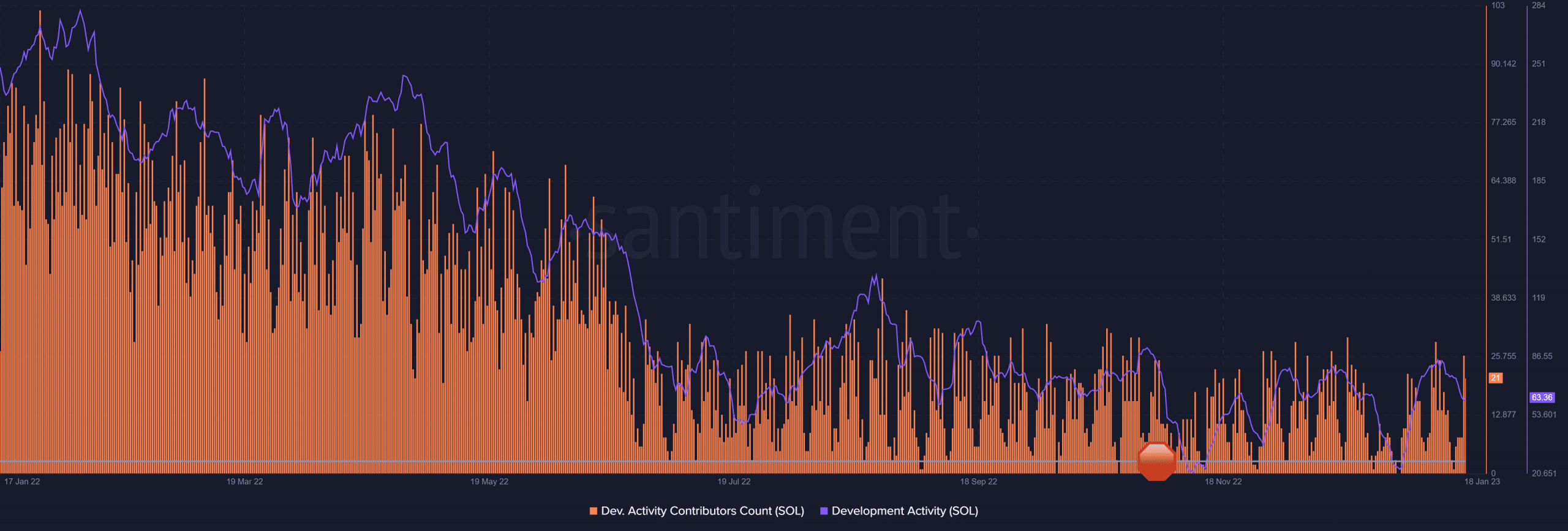

Nonetheless, Solana traders shouldn’t mistake this announcement for an indication that growth exercise had elevated exponentially. Quite the opposite, the metric dropped considerably over the past 12 months because of the bear market’s influence. The identical utilized to the event exercise’s contributor’s rely.

Supply: Santiment

Other than the variety of builders, Solana just lately skilled a surge within the adoption of precedence charges and native payment markets. This was noticed on the dApp and pockets ranges throughout the community.

Why is that this vital for SOL holders? It underscores a rise in urgency or precedence for these requiring such providers, which suggests there may be vital visitors.

Precedence Charges and Native Price Markets are seeing speedy adoption throughout the community on the pockets and dapp stage. However what are precedence charges? How do native payment markets work?

Learn extra

👇 https://t.co/fpgY1IM1Rx— Solana (@solana) January 18, 2023

In different phrases, Solana was experiencing natural progress at press time. Maybe the challenges confronted final 12 months have demonstrated resilience and thereby supported adoption. However how does this have an effect on SOL’s efficiency?

Can SOL maintain its rally?

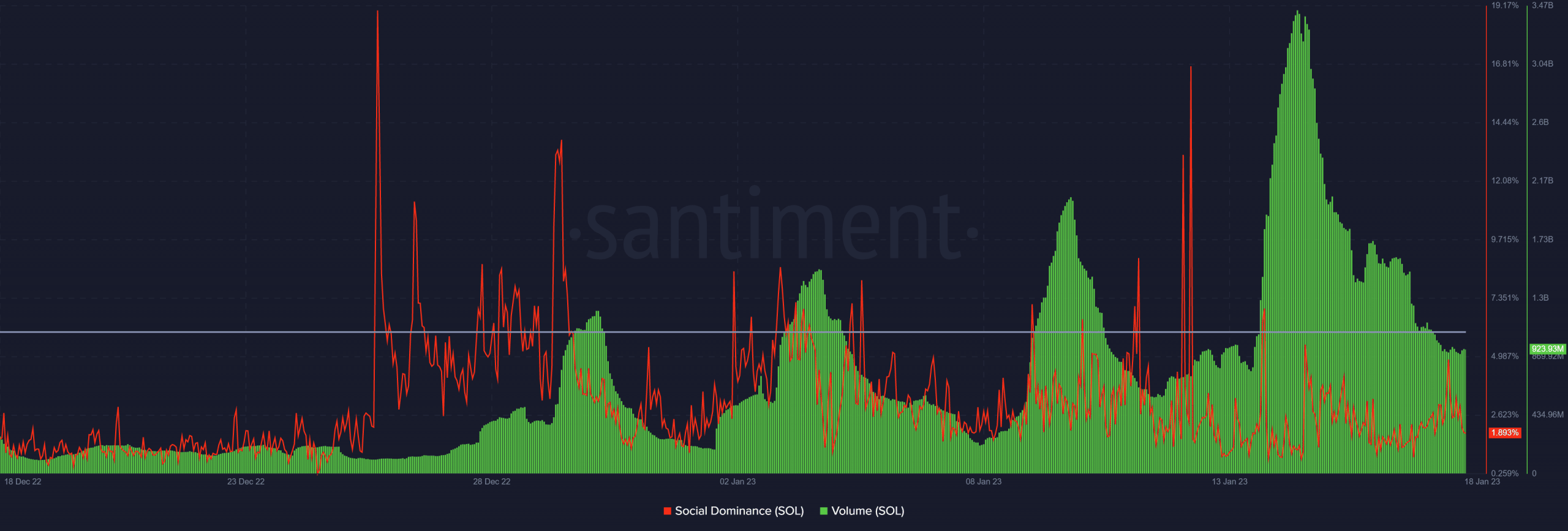

SOL’s social dominance metric revealed that its strongest four-week surge occurred in direction of the top of December. There have been different quite a few social dominance spikes that will point out renewed curiosity. Unsurprisingly, SOL’s buying and selling quantity has been rising for the final 4 weeks.

Supply: Santiment

SOL’s sturdy quantity did lead to a large value rally earlier than the quantity dropped off considerably in the previous few days. Consequently, the worth additionally skilled some slippage since mid-January. It traded at $22.37 at press time, which represented a ten.33% drop from its present month-to-month excessive.

Supply: TradingView

SOL’s value motion was going by means of a bearish retracement at press time after a strong rally within the first half of January. With the subsequent transfer nonetheless within the realm of uncertainty, Solana was in a more healthy place, particularly with the sturdy developer backing.