NFT

The NFT group was in a debating temper final month. To grant royalties or to not grant royalties? Business licensing rights or artistic commons?

However when it comes right down to the numbers, the bear market continues. Month-to-month NFT market volumes are down once more, in keeping with The Block’s information dashboard.

In the meantime in gaming, an anti-bot firm has claimed web3 gaming is stuffed with them — and a few of the numbers put even Elon Musk’s wildest Twitter-bot estimates to disgrace. If correct, the numbers might be a blow to blockchain gaming, which has loved a surge of funding curiosity this 12 months.

Greater than $100 million value of NFTs have been stolen within the final 12 months

Over $100 million value of NFTs have been stolen between July 2021 and July 2022, together with a complete of 167 Bored Ape Yacht Membership NFTs value over $43.6 million. That is in keeping with a brand new report from blockchain analytics agency Elliptic launched this month. After Bored Apes, probably the most focusing on collections have been Mutant Ape Yacht Membership and Azuki.

The report additionally checked out cash laundering utilizing NFTs and located that, regardless of fears, it’s not that widespread. Over $8 million in illicit funds has been laundered by means of NFT-based platforms since 2017, representing 0.02% of buying and selling exercise originating from recognized sources.

The OpenSea buying and selling ‘down 99%’ debate

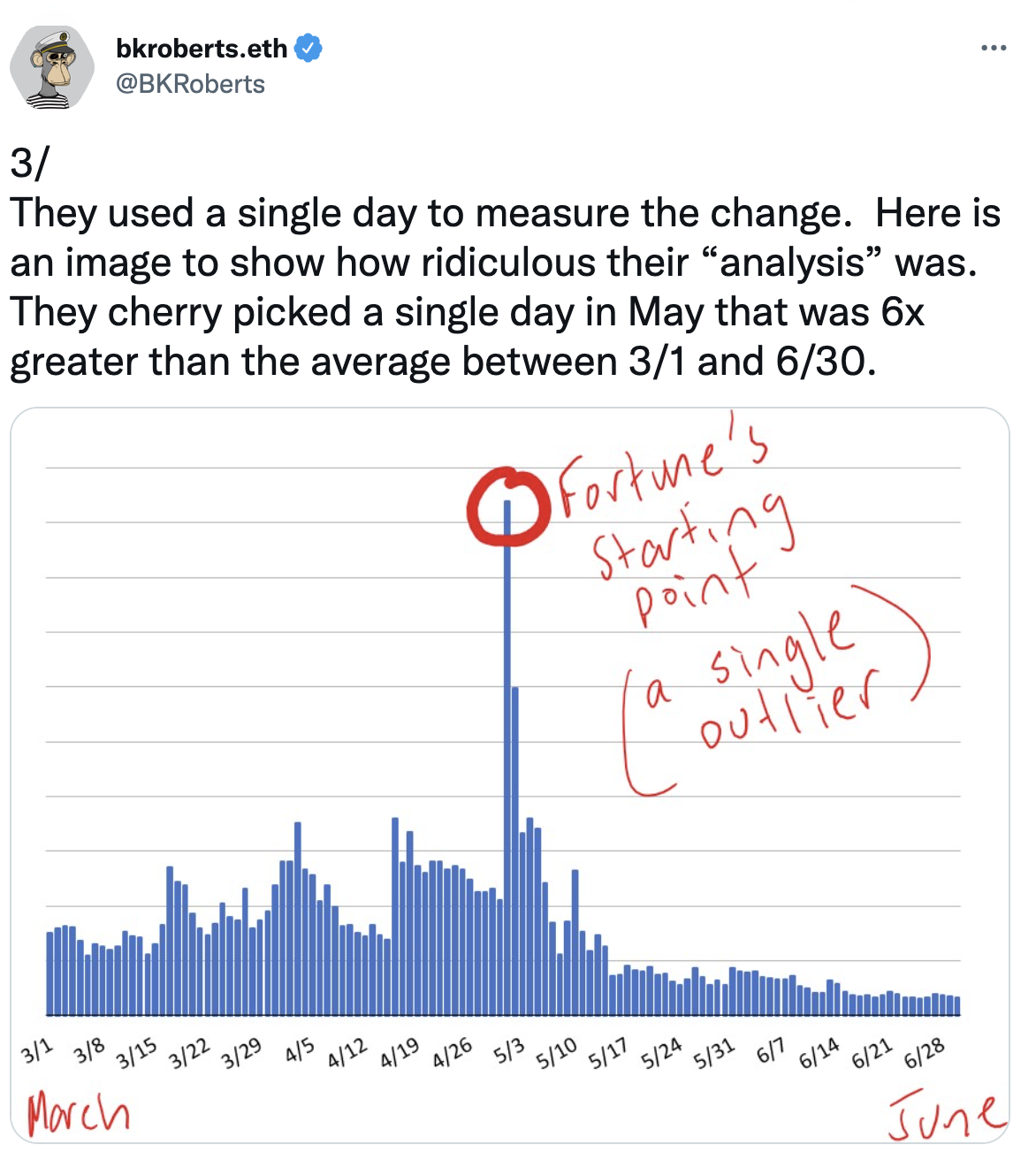

An article on Aug. 29 in Fortune described OpenSea transactions as “down 99%,” noting that the earlier Sunday {the marketplace} had recorded simply $9.34 million in NFT transactions, down from a document $2.7 billion on Could 1.

Nonetheless, OpenSea CFO Brian Roberts hit again on the claims on Twitter, accusing Fortune of getting “cherry picked” a single day in Could that noticed six instances larger than the common between March and June. The spike was probably pushed by the Apr. 30 Otherdeed sale.

The height the article used is probably going attributable to the Otherdeed sale on Apr. 30. However that mentioned, quantity transactions for NFT marketplaces are however down, albeit lower than the seismic drop from Could to June. OpenSea’s month-to-month quantity went from $528.64 million in July to $485.32 million in August.

Throughout the highest ten marketplaces, quantity was down from $675.43 million to 592.34 million.

The rise of no royalty marketplaces?

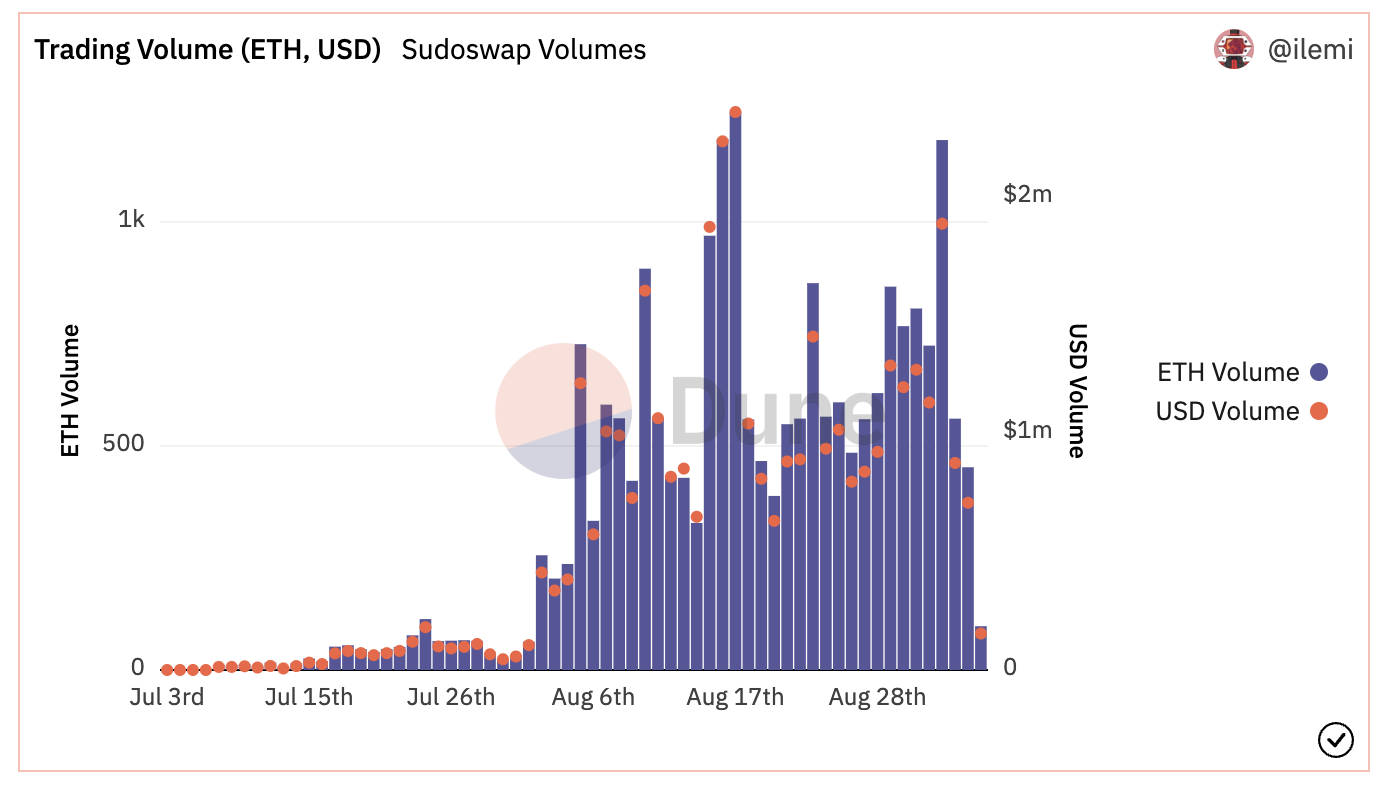

Decentralized NFT market Sudoswap sparked controversy in mid-August with its automated market maker (AMM) that permits folks to purchase and promote routinely with out having to attend for patrons or sellers. The gripe folks have although is it bypasses royalties that go to creators.

However in keeping with this Dune Sudoswap dashboard, since Sudoswap launched its AMM in July, it skilled a surge in quantity.

A number of no-royalty marketplaces have additionally popped up over the earlier months, together with Solanart and Yawww. X2Y2 additionally lately introduced patrons would be capable to select how a lot in royalties they wish to give to initiatives.

The result’s an ongoing debate over the appliance and enforcement of royalties within the NFT area.

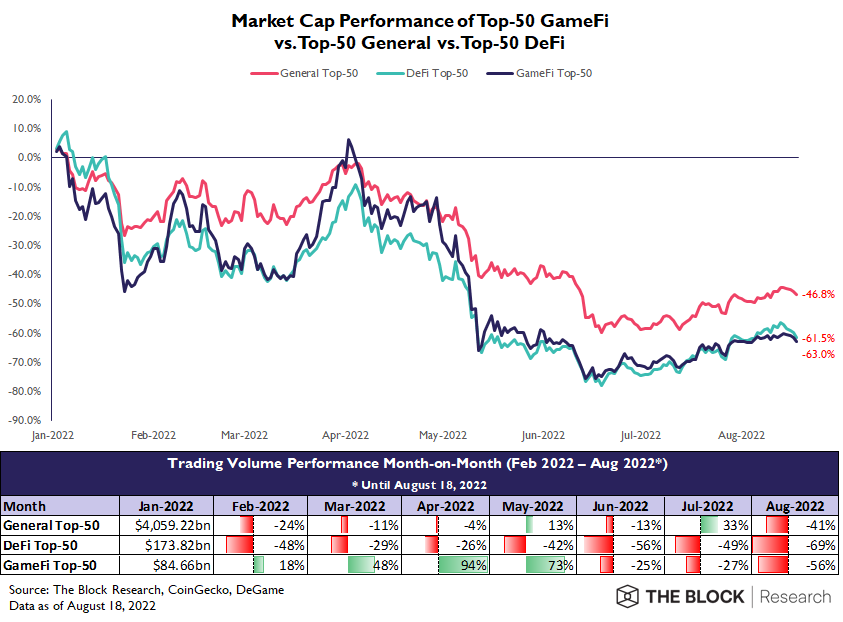

GameFi token market caps have declined

The market capitalization of the highest 50 GameFi tokens dropped by over 60% from January to August 2022, in keeping with The Block Analysis. That’s just like the market cap decline of the highest 50 DeFi tokens.

As of August 2022, it has additionally recorded a complete of 1,575 GameFi initiatives — 40% of those are based mostly on BNB Chain. Simply over 1 / 4 are Ethereum-based and 15% are on Polygon. However even they’re faring significantly better than gaming-specific blockchains. Ones like Immutable X, Gala Video games, WAX, Enjin, and Wemix are solely snagging between 1% and 6% of the market share.

However gamers can solely mess around a 3rd of all GameFi initiatives in the meanwhile. In keeping with The Block Analysis, “that is in step with the expectation of an extended recreation improvement cycle of three to five years since most GameFi initiatives solely obtain funding between 2021 and 2022.”

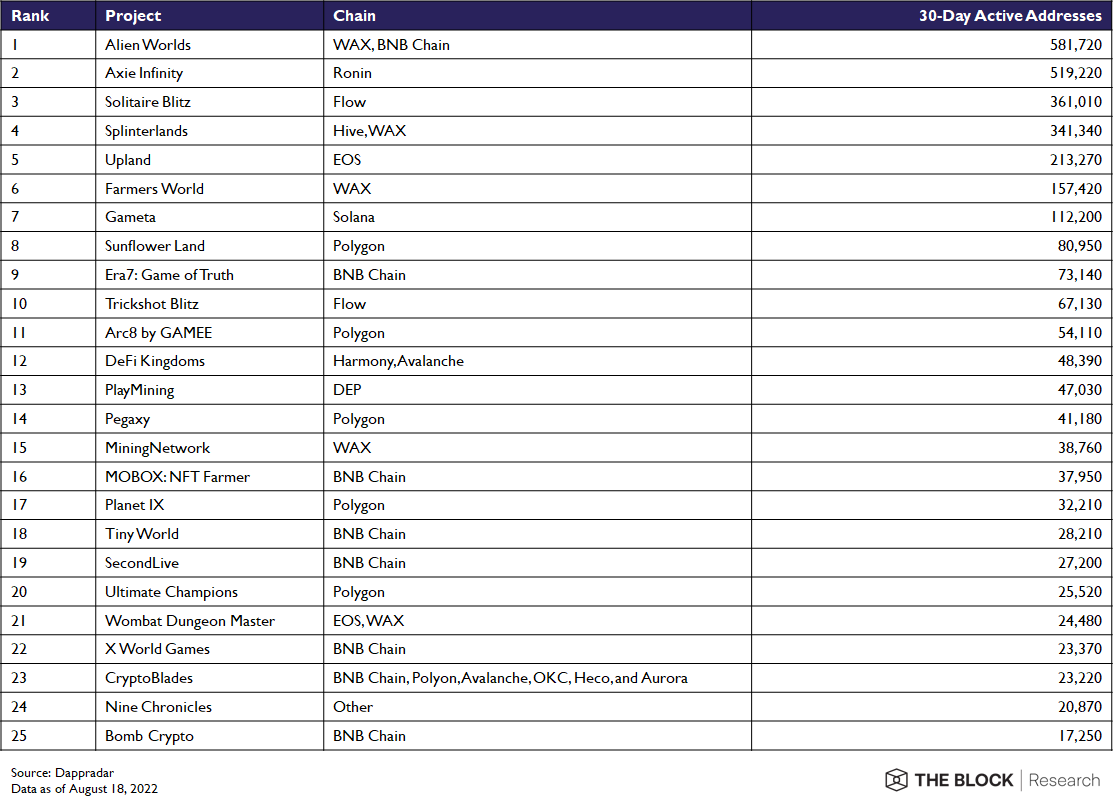

Alien Worlds is probably the most performed recreation

Alien Worlds is at the moment hottest blockchain-based recreation by lively addresses. Axie Infinity, Solitaire Blitz, Splinterlands and Upland spherical out the highest 5.

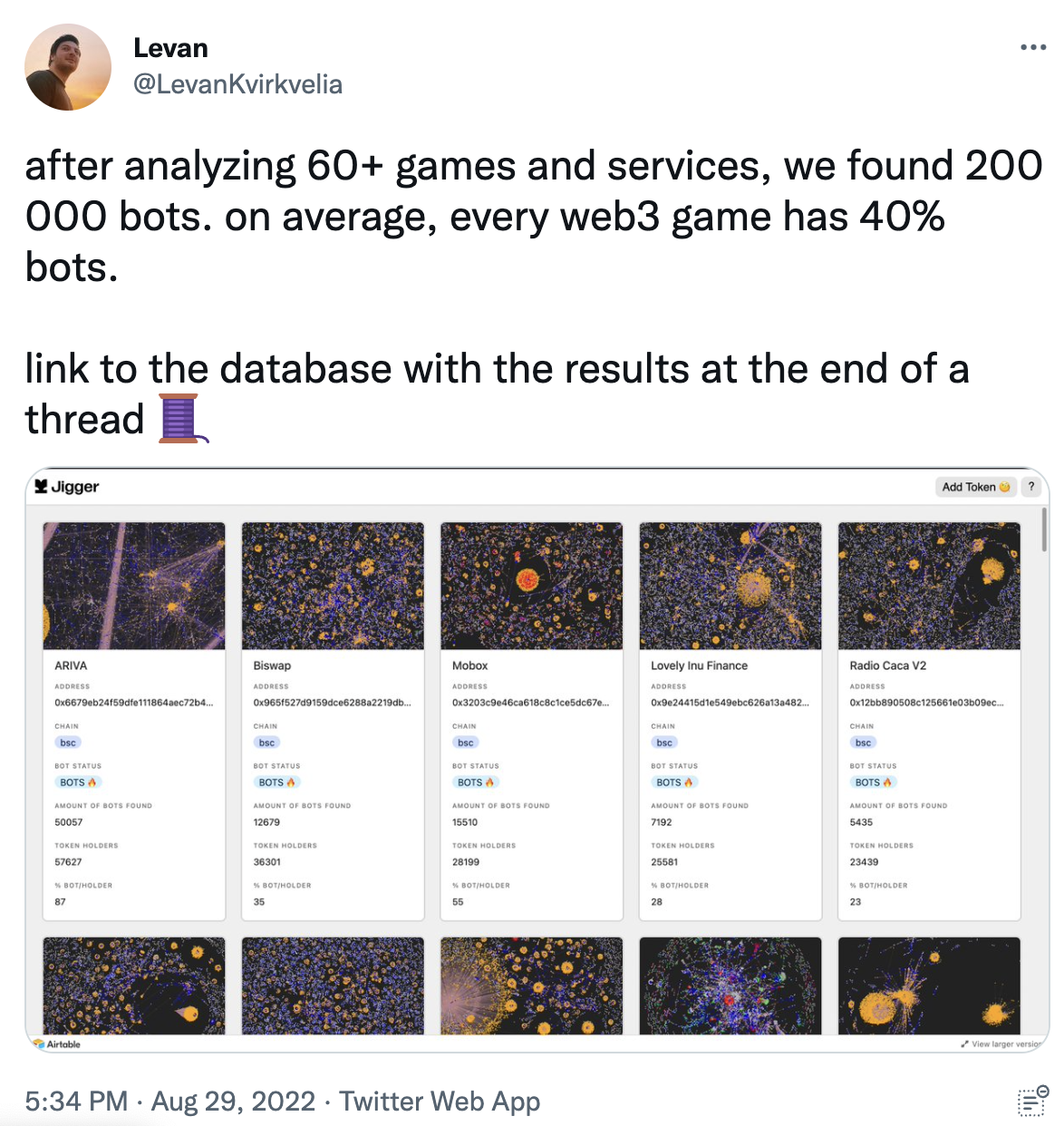

…However are they bots?

Anti-bot safety software program firm Jigger got here out with an fascinating stat final week. It claims that 40% of the “gamers” in web3 video games are bots. The analysis checked out over 60 web3 video games and located proof of round 200,000 bots throughout all of them.

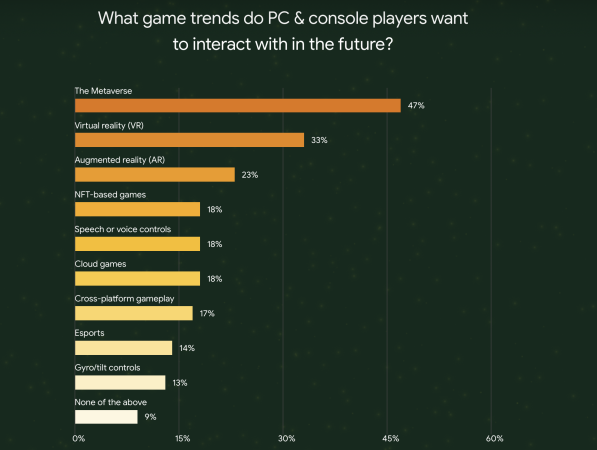

Half of PC and console players interested by metaverse

Google’s 2022 PC & Console Insights Report revealed that 47% of PC and console players are interested by interacting with the metaverse sooner or later. Respondents have been additionally extra interested by VR and AR than NFT-based video games.