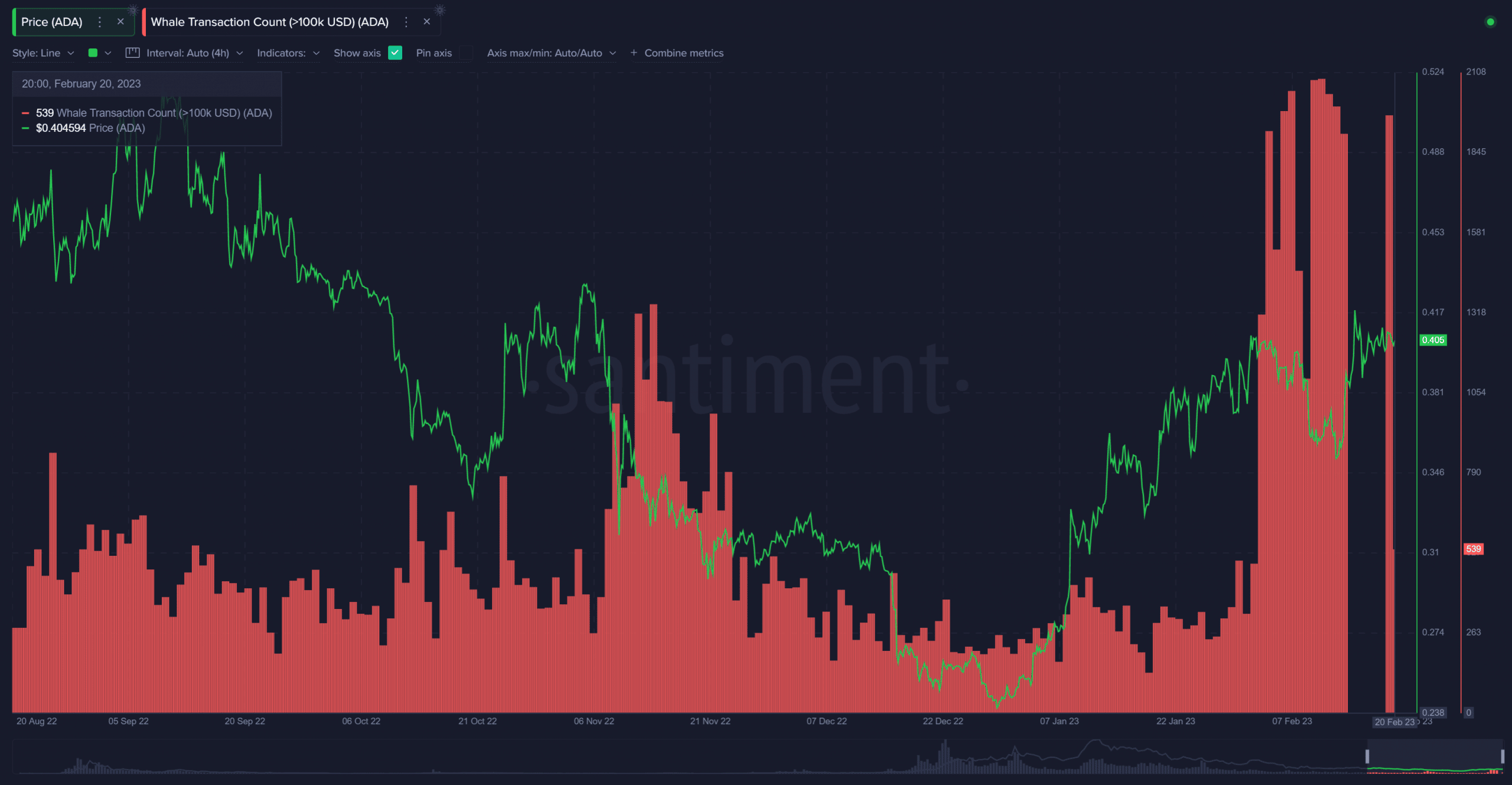

- Whale exercise spiked significantly in the previous few weeks.

- A couple of metrics have been bullish, however market indicators steered a value decline.

Santiment’s report on 21 February revealed that Cardano [ADA] was the recipient of elevated curiosity from whales. This was evident from the whale transaction depend, which skyrocketed in February 2023.

Supply: Santiment

Is your portfolio inexperienced? Take a look at the Cardano Revenue Calculator

Furthermore, Cardano’s builders pushed fairly a number of upgrades for the community, the most recent and most notable one being the Valentine improve, which was launched on 14 February.

Curiously, on 21 February, Enter Output International (IOG) posted a thread on Twitter that was geared toward serving to newcomers higher perceive the Cardano community by simplifying a number of jargons and technical phrases.

We get it, #blockchain-speak could be fairly the impenetrable code while you’re simply beginning out

That’s why we’ve put collectively a choice of key phrases from our glossary, so when you’re a newcomer – or when you simply have to brush up on vocab – you may navigate #Web3 like a professional@Cardano

— Enter Output (@InputOutputHK) February 21, 2023

Other than these updates, another excuse for the surge could possibly be ADA’s latest value motion, which has been within the traders’ favor. As per CoinMarketCap, ADA was up by over 10% within the final seven days, and on the time of writing, it was buying and selling at $0.397 with a market capitalization of over $13.7 billion.

Nevertheless, the worth pattern appeared to have modified as ADA’s value registered a decline of over 2% within the final 24 hours.

These can deliver hassle

Regardless of the latest decline in ADA’s value, it by some means remained in demand within the derivatives market, as its Binance funding price remained excessive. ADA’s every day energetic addresses additionally registered a rise, which steered extra customers within the community. Nevertheless, ADA’s MVRV Ratio declined, which elevated the possibilities of a continued downtrend.

Furthermore, ADA’s growth exercise went down over the past week, which was yet one more level of concern.

Supply: Santiment

Ought to the traders be apprehensive?

A have a look at the ADA’s every day chart gave extra causes to fret, as a lot of the market indicators revealed that the bears had entered the market. For example, ADA’s Relative Energy Index (RSI) registered a downtick and was heading in direction of the impartial mark, which was a growth within the sellers’ favor.

How a lot are 1,10,100 ADAs price at present?

ADA’s Chaikin Cash Circulation (CMF) additionally adopted the identical route and went down. The MACD steered that the bulls and the bears have been in a battle. Nevertheless, contemplating the opposite indicators, it was extra doubtless for the bears to win.

ADA’s Bollinger Bands identified that the token’s value was in a much less risky zone, decreasing the possibilities of an unprecedented surge. Nonetheless, the Exponential Shifting Common (EMA) Ribbon gave some hope because the 20-day EMA was nonetheless above the 55-day EMA.

Supply: TradingView

![Is whale interest in Cardano [ADA] enough to sustain its bull rally?](https://ambcrypto.com/wp-content/uploads/2023/02/ADA-4-1000x600.jpg)