- Lido skilled extra utility courtesy of ETH whales.

- Lido Finance earned a spot within the record of most used sensible contracts by the highest 500 ETH whales.

Lido Finance’s LDO token simply made it into the record of essentially the most used sensible contracts among the many 500 largest ETH whales. However is that this data sufficient to gas LDO’s continued upside?

Learn LDO’s Value Prediction 2023-2024

Nicely, Ethereum has probably the most common DeFi ecosystems. The truth that Lido Finance made the record within the final 24 hours means a large quantity of capital was going by means of Lido’s ecosystem.

JUST IN: $LDO @lidofinance one of many MOST USED sensible contracts amongst high 500 #ETH whales within the final 24hrs🐳

Peep the highest 100 whales right here: https://t.co/tgYTpOm5ws

(and hodl $BBW to see information for the highest 500!)#LDO #whalestats #babywhale #BBW pic.twitter.com/6PtXsUUcin

— WhaleStats (monitoring crypto whales) (@WhaleStats) December 15, 2022

LDO is down considerably in the previous couple of weeks particularly in comparison with its place at the beginning of November. It managed to ship a big upside thus far this week, by as a lot as 13%.

Whereas this isn’t essentially a big uptick within the grand scheme of issues, it’s a optimistic step for the bulls. That is significantly contemplating the token’s earlier propensity for the draw back.

One of many extra fascinating observations about LDO’s efficiency this week is that it managed to push to the 50% RSI stage. It’s now beginning to expertise vital friction close to its present worth stage.

Supply: TradingView

Will the bulls prevail?

Maybe on-chain metrics might present solutions to those questions. Particularly people who spotlight LDO demand traits.

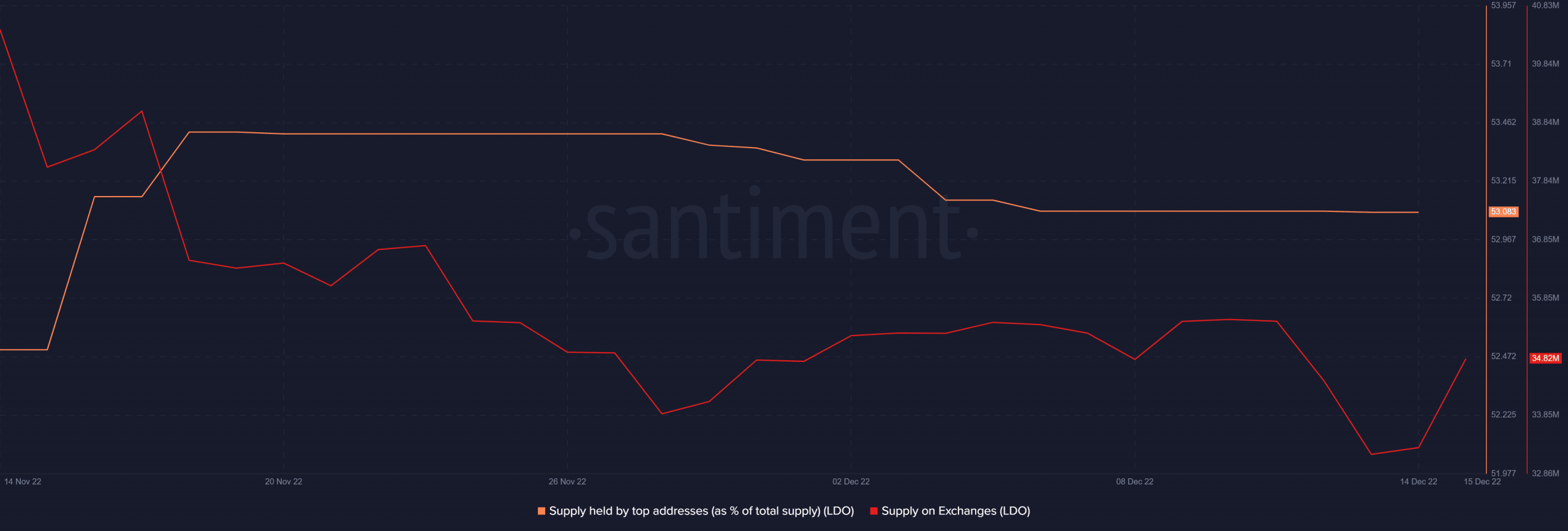

LDO’s provide held by high addresses dropped barely because the begin of the month. This means that the highest whales have been decreasing their LDO balances, a transfer that leads to promote strain.

This was significantly the case within the first week of December. Nevertheless, the identical metric signifies an absence of serious exercise. In different phrases, the highest LDO whales neither contributed to bullish nor bearish momentum this week.

Supply: Santiment

It additionally means traders shouldn’t count on a whole lot of purchase strain within the absence of whale exercise. As well as, LDO’s provide on exchanges has elevated within the final three days, which is an indication of incoming promote strain.

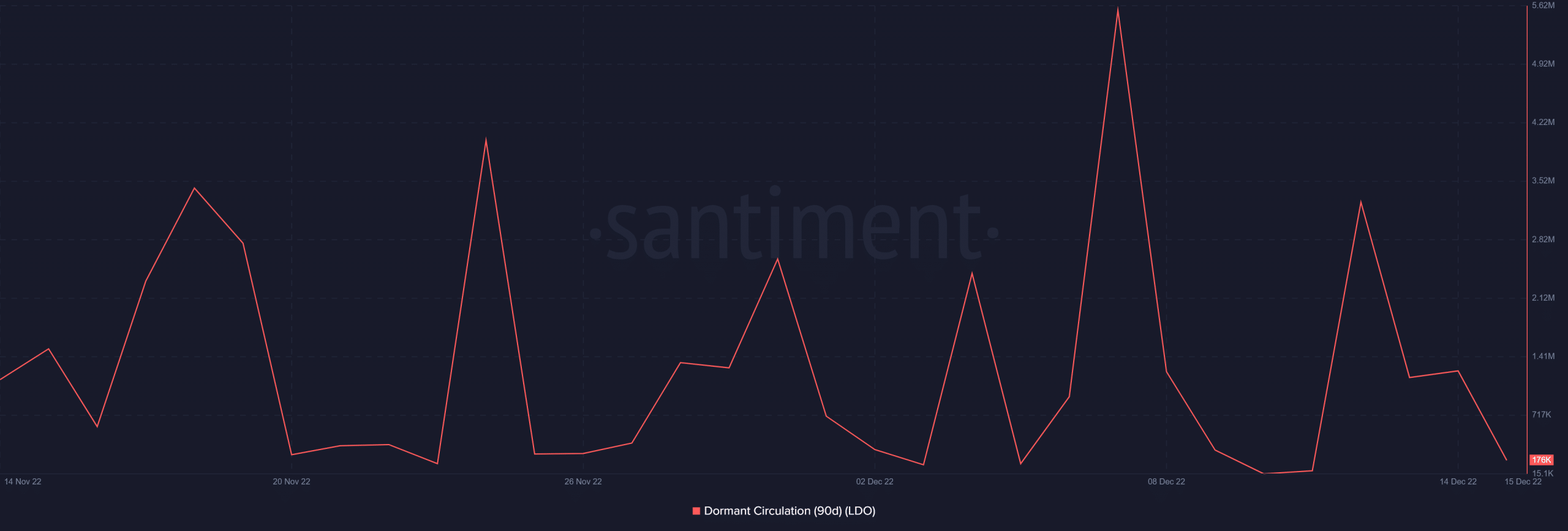

Moreover, LDO’s dormant circulation is down within the final three days. That is affirmation {that a} vital quantity of the token was moved throughout this era.

Supply: Santiment

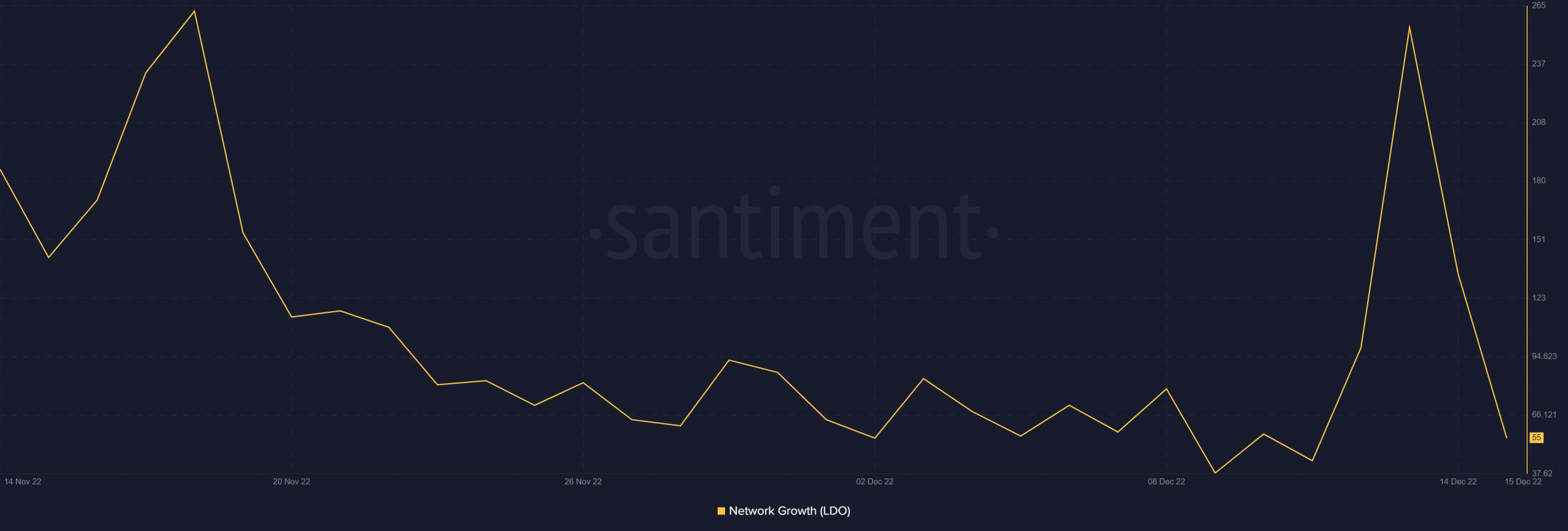

The decrease dormant circulation means there’s not a lot incentive for traders to carry on to the coin. In different phrases, there’s not a lot confidence in LDO’s potential upside, therefore the decline. Notably, the altcoin’s community development has additionally been on a decline for the final three days.

Supply: Santiment

The above LDO metrics counsel that LDO would possibly discover it tougher to proceed rallying. It’s potential that we might even see a little bit of a bearish retracement in direction of the weekend courtesy of those observations.

![Lido Finance [LDO] might find it harder to continue rallying, but here’s the catch](https://ambcrypto.com/wp-content/uploads/2022/12/1671118684937-2d4a8602-a6b6-41f4-837d-2b79b5383717-1000x600.png)