- Lido Finance TVL has remained within the second place regardless of the autumn of the general DeFi protocol

- The worth motion confirmed that purchasing and promoting momentum was in rivalry for relevance

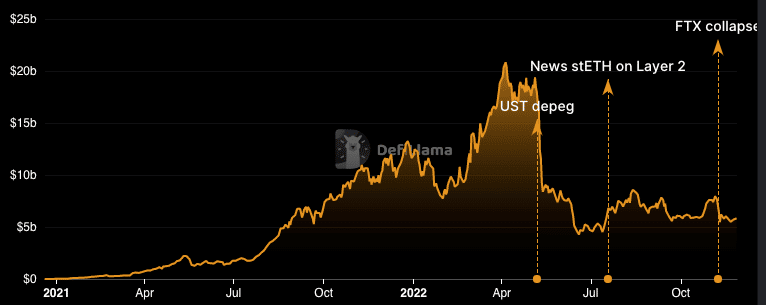

Lido Finance’s [LDO] Whole Worth Locked [TVL] has saved the liquid staking protocol among the many high DeFi ecosystems. This has occurred regardless of the large drop within the wider DeFi market.

At press time, the Lido DeFi TVL was $5.88 billion. In accordance with DeFi Llama, Lido had maintained its second place, solely behind MakerDAO [MKR]. The efficiency of the protocol during the last 30 days had declined by 33%. This implied that deposits into the Lido protocol weren’t spectacular, regardless of the elevated incentives with its Ethereum [ETH] staking.

Supply: DeFi Llama

Learn Lido Finance’s Value Prediction for 2023-2024

Lido Finance: Developments and quantity surge

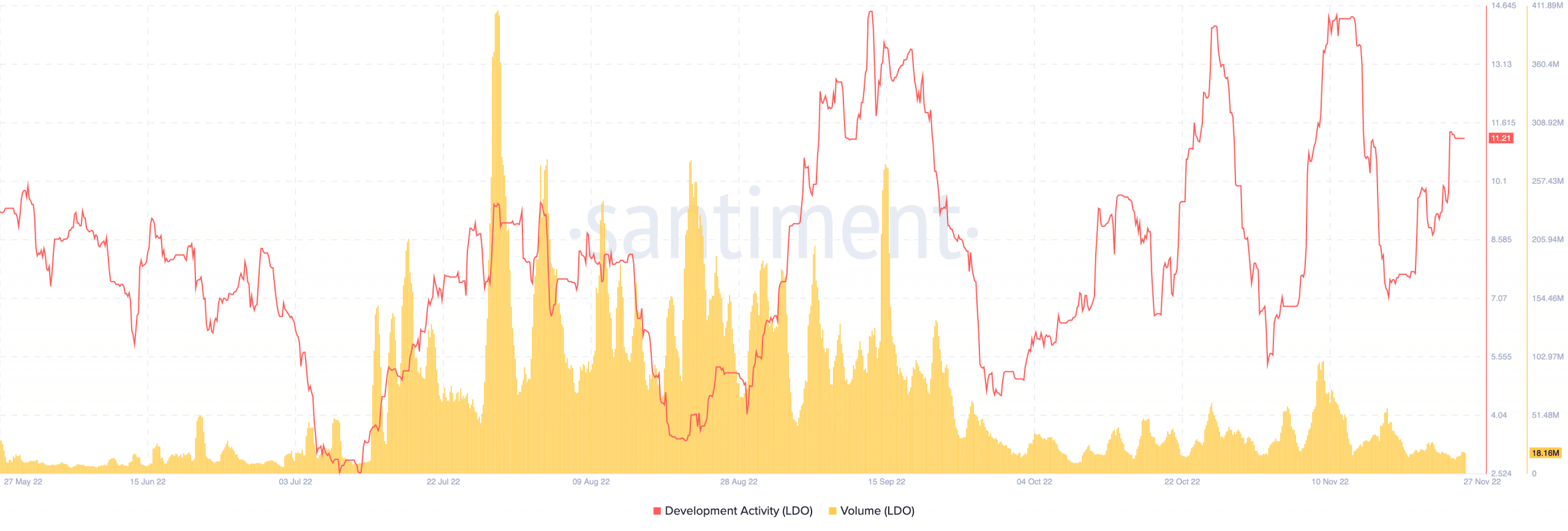

Although there have been decreases, it was not evident in Lido’s growth exercise. Information by Santiment confirmed that the event exercise, which dropped on 23 November, had revived to a worth of 11.21 at press time. This meant that the workforce was regularly sprucing and refining upgrades in its protocol.

One other hike that appeared just a little important was its quantity. As of this writing, the 24-hour quantity was $18.16 million. This represented a 20.83% enhance from yesterday. So, there have been a comparatively good variety of transactions which have handed by the Lido chain currently.

Supply: Santiment

Of worth and what’s coming

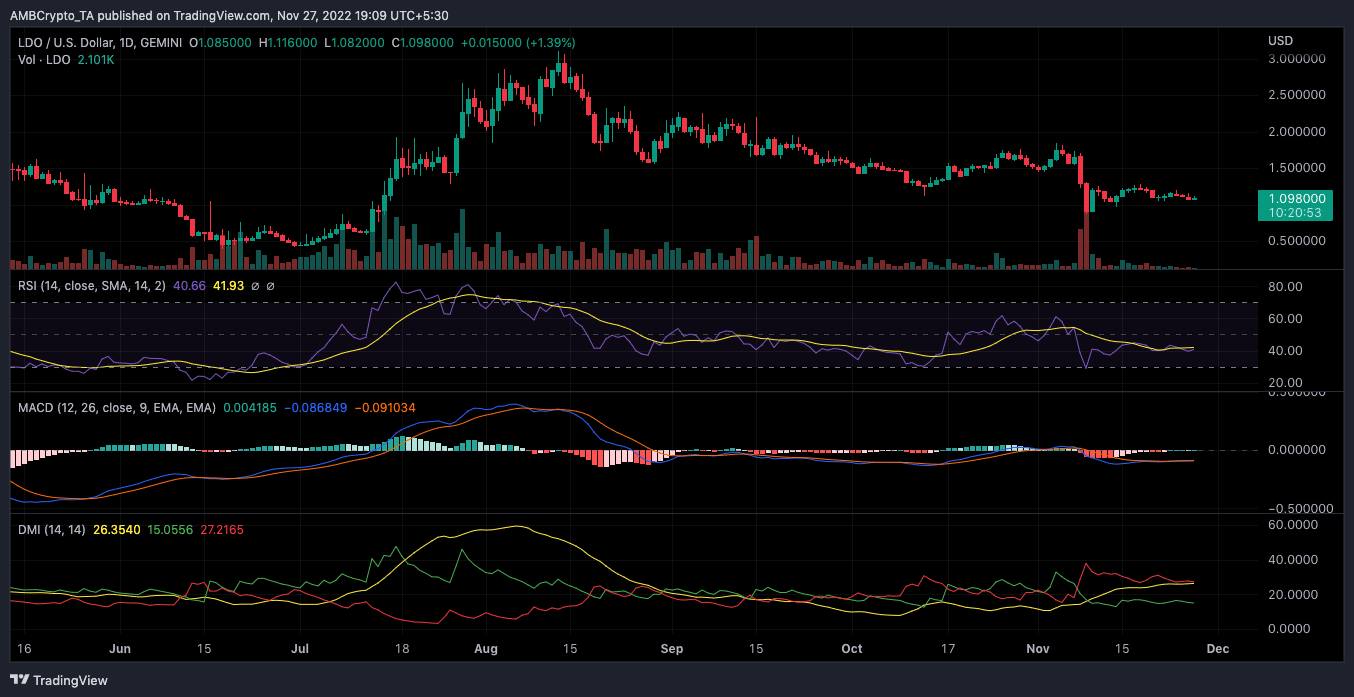

As for the value, LDO was buying and selling at $1.10, in line with CoinMarketCap. Though it was a minimal enhance from the final 24 hours, the four-hour chart confirmed that there may very well be potential for a restoration.

This was as a result of the Relative Energy Index (RSI) confirmed some try for purchasing energy at 40.66. Thus, the bearish expertise may turn out to be bullish, however there was no robust sign to indicate the identical.

Nevertheless, the Transferring Common Convergence Divergence (MACD) indicated a battle for purchasing and promoting power. At press time, the MACD confirmed that the bearish momentum was not all gone.

This was as a result of shopping for power (blue) and the sellers (pink) have been at nearly the identical level. Nonetheless, the MACD appeared to mirror extra of a drawdown than an uptick.

Supply: TradingView

As for its path, it is perhaps difficult for LDO to exit its bearish state. This was due to the place of the Directional Motion Index (DMI). At press time, the optimistic DMI (inexperienced) was 15.05 and the adverse DMI (pink) was 27.21. Since this was not an in depth name, LDO would possibly lose maintain of the $1.10 area

Moreover, the stance of the Common Directional Index (ADX) confirmed an upward directional power. With the ADX (yellow) at 26.35, there was extra assist for LDO to succumb to the pink management.