- Chainlink was a part of the highest ten tokens purchased by Ethereum whales

- Nonetheless, on-chain information went in opposition to accumulation metrics

Chainlink [LINK] turned one of many prime 10 bought tokens by the highest 1000 Ethereum [ETH] whales, as per a ten December tweet by WhaleStats.

In keeping with the whale monitoring platform, Chiliz [CHZ] additionally broke into the group within the final 24 hours. However LINK’s introduction was particular. This was as a result of it entered the listing regardless of recording a subpar efficiency over the week.

JUST IN: $LINK @chainlink now on prime 10 bought tokens amongst 1000 largest #ETH whales within the final 24hrs 🐳

We have additionally bought $BAT, $OMG & $CHZ on the listing 👀

Whale leaderboard: https://t.co/jFn1zIwOBt#LINK #whalestats #babywhale #BBW pic.twitter.com/HYX2DFTJzI

— WhaleStats (monitoring crypto whales) (@WhaleStats) December 10, 2022

Learn Chainlink’s [LINK] Value Prediction 2023-2024

Fall in your knees

CoinMarketCap‘s information confirmed that LINK traded at $6.92 at press time. This worth represented a 5.84% lower within the final seven days, additionally bringing LINK to its lowest worth prior to now three weeks.

Due to the autumn, LINK fell per market capitalization—after it edged out Dogecoin [DOGE] within the weekly efficiency of the highest 20 cryptocurrencies.

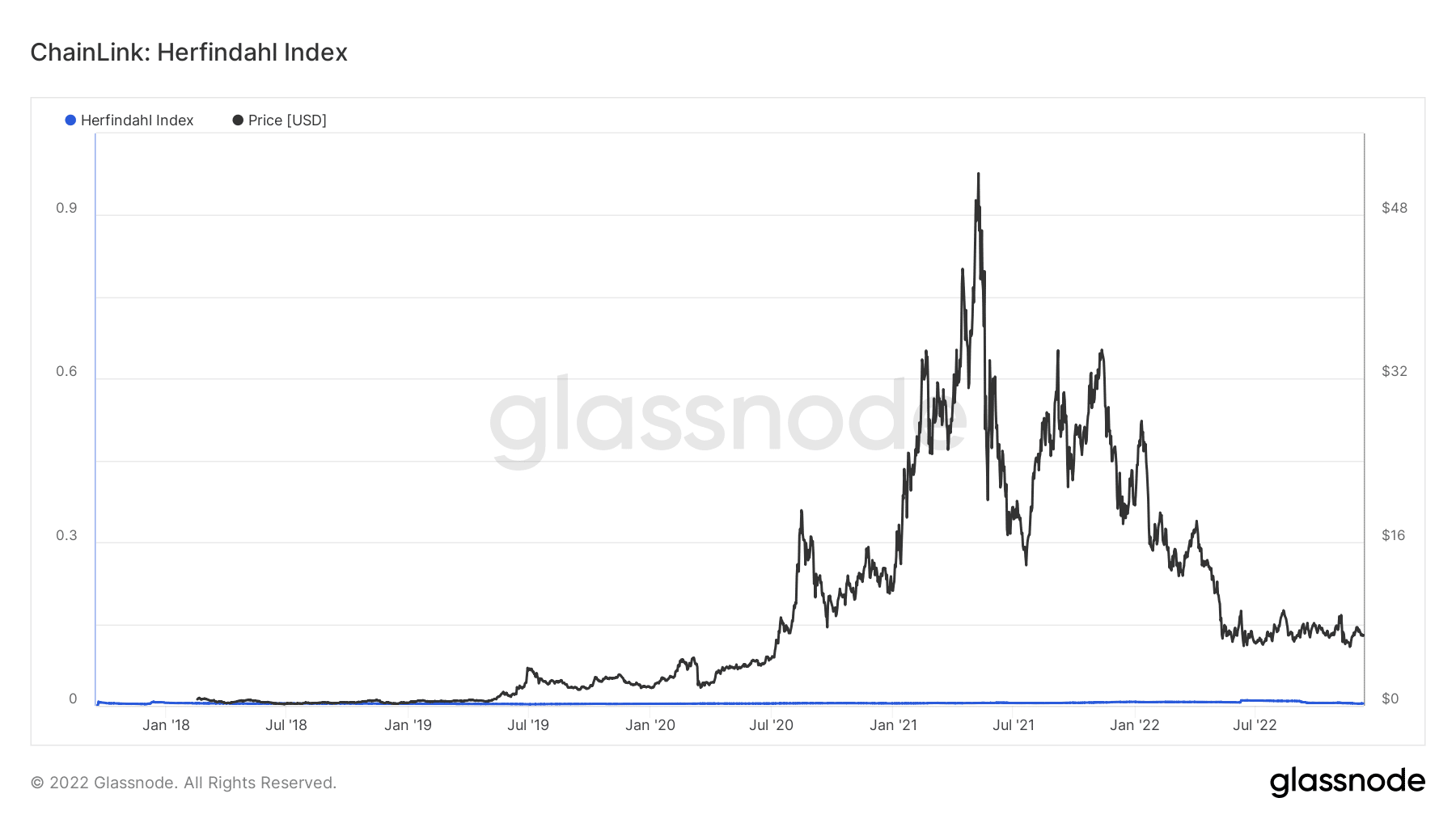

Nonetheless, there have been some notable occurrences on the on-chain situation of Chainlink, a few of which contributed to the current drawdown. In keeping with Glassnode, LINK’s Herfindahl Index rose to 0.00418 in the course of the rally, however declined to 0,00393 on the time of writing.

Supply: Glassnode

The Herfindahl Index acts as a measure for weighted tackle balances inside a community. It additionally shows provide focus. Since LINK’s Herfindahl Index mirrored a low worth, it implied comparatively evenly distributed addresses, whereas provide was sparsely concentrated.

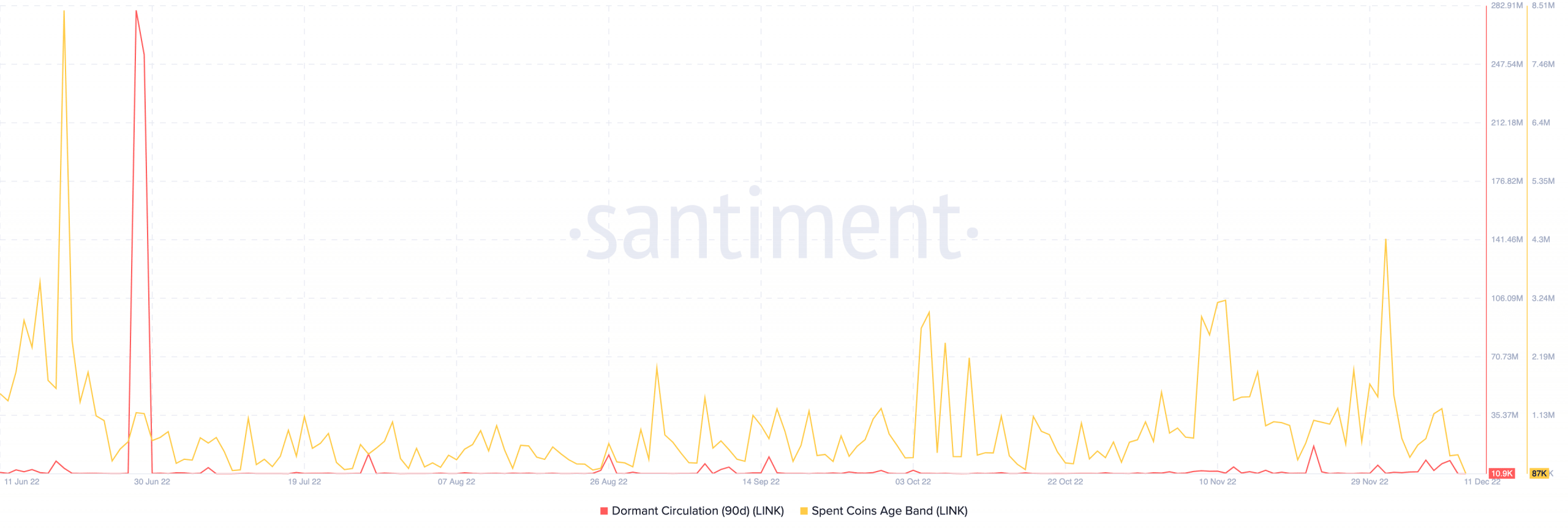

Additionally highlighted was the standing of the dormant circulation. On-chain platform Santiment showed that LINK’s 90-day dormant circulation was 10,900. Earlier than the present worth, it improved to thousands and thousands. So, most Chainlink tokens held in the course of the interval resisted involvement in transacting or spending.

The Spent Cash Age Band shared the same sentiment with the dormant circulation. At press time, LINK’s Spent Cash Age Band decreased to 87,000. This metric confirmed the variety of tokens obtainable relative to these spent inside a given interval.

Because it represented a truncated worth, it defined that LINK traders spent extra tokens inside a more moderen timeframe than they’ve held. Thus, this would possibly sign that the weekly worth stoop may very well be linked to promoting stress.

Supply: Santiment

Chainlink: Ready on indicators and wonders

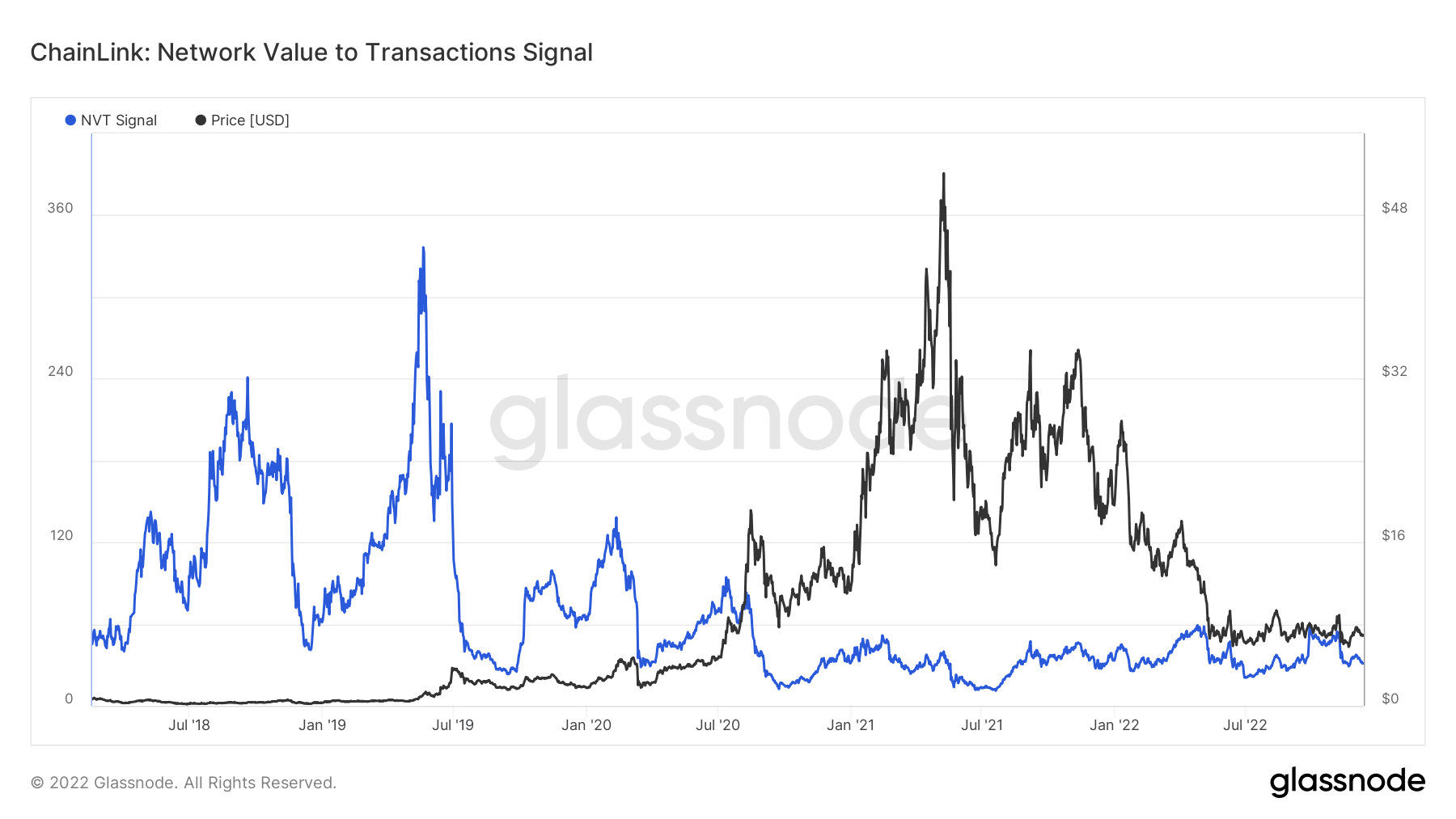

Transferring forward, LINK could be plagued with minimal market spikes. This was resulting from indications revealed by the Community Worth to Transactions (NVT) sign. On the time of writing, Chainlink’s NVT sign was right down to 35.30.

At such a place, LINK exhibited traits of its worth outpacing utility. Therefore, it may not be the best time to start re-accumulation.

Supply: Glassnode