Forward of The Merge in September, a number of on-chain datasets point out a risky finish to proof-of-work on Ethereum.

Will Ethereum rally into Merge Day, or will there be a widespread “promote the information” occasion?

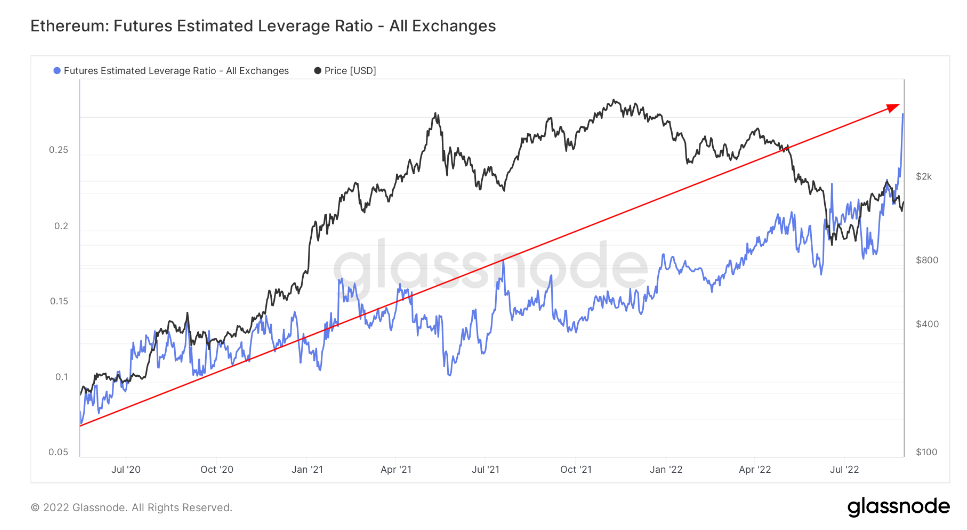

Estimated Leverage Ratios

The quantity of leverage throughout the Ethereum ecosystem has hit all-time highs going into The Merge. The impression might be assessed by reviewing the Estimated Leverage Ratio under. An Estimated Leverage Ratio (ELR) is outlined by the open curiosity ratio in futures contracts in opposition to the stability of the corresponding alternate.

As seen from the chat under, there was a major uptick in ELR in August. The ELR acts as an Indicator that measures the ratio between open contracts awaiting execution and the reserve of currencies on futures buying and selling platforms. The graph reveals the ELR has reached an all-time excessive of 0.28 — indicating the potential for prime volatility ought to there be giant worth swings.

As might be seen from the graph, there’s little correlation between Ethereum and ELR when it comes to worth prediction. New all-time highs in ELR haven’t traditionally marked both tops or bottoms for Ethereum.

Nonetheless, the extra leverage, open curiosity, and shorts taking part out there, the upper the chance of volatility, as liquidations could cause a snowball impact in both path.

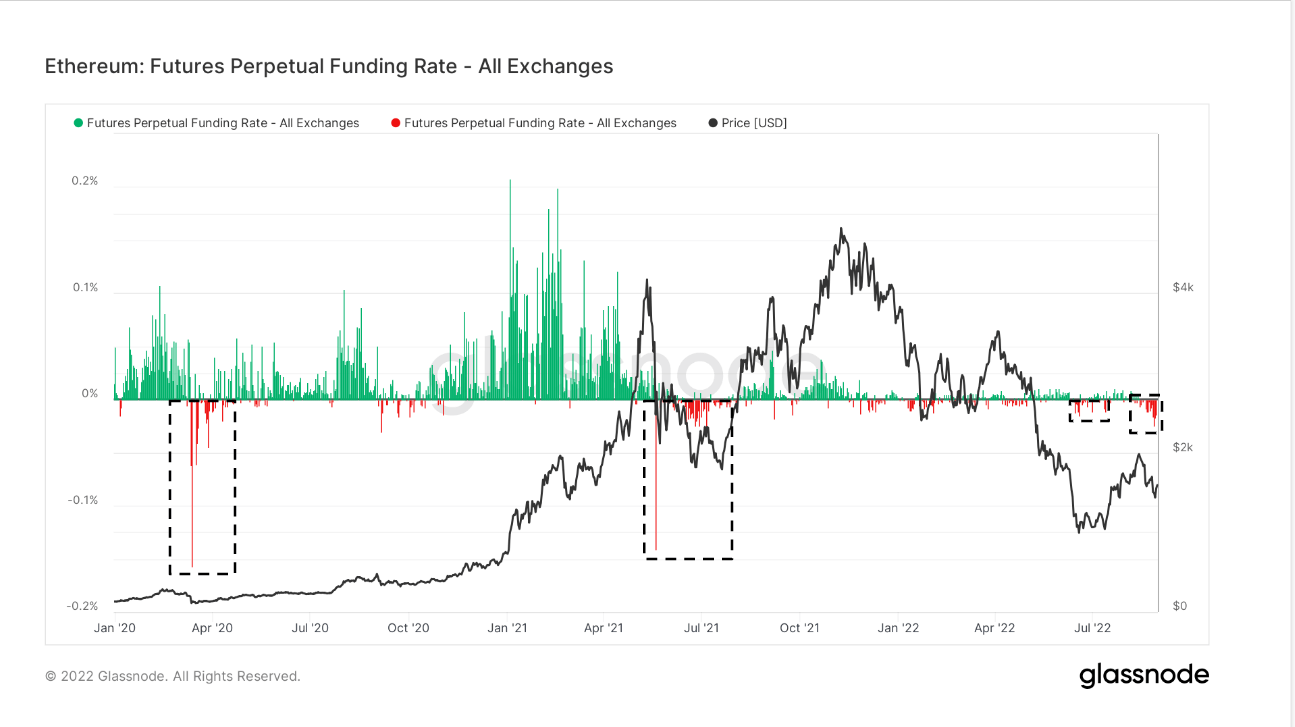

Funding Charges

Funding charges have been extremely adverse and correlate with different important occasions throughout the ecosystem, equivalent to Covid-19, Chinese language miner bans, and the Terra Luna collapse.

The Merge is probably going the catalyst for the adverse funding charges because the begin of August. Anticipation of The Merge is excessive for these seeking to speculate on worth with swing trades across the occasion.

The chart under highlights the typical funding fee share set by exchanges for perpetual futures contracts. When the speed is constructive, lengthy positions periodically pay brief positions. Conversely, when the speed is adverse, brief positions periodically pay lengthy positions.

In latest weeks, there was neutrality in funding as charges repeatedly flipped between constructive and adverse funding, suggesting stability. Nonetheless, adverse funding has been persistent and aggressive within the final week.

The present ranges match the miner sell-off the earlier summer time, which marked the cycle backside, just like Covid. When shorts are daring, this has traditionally marked a cycle backside.

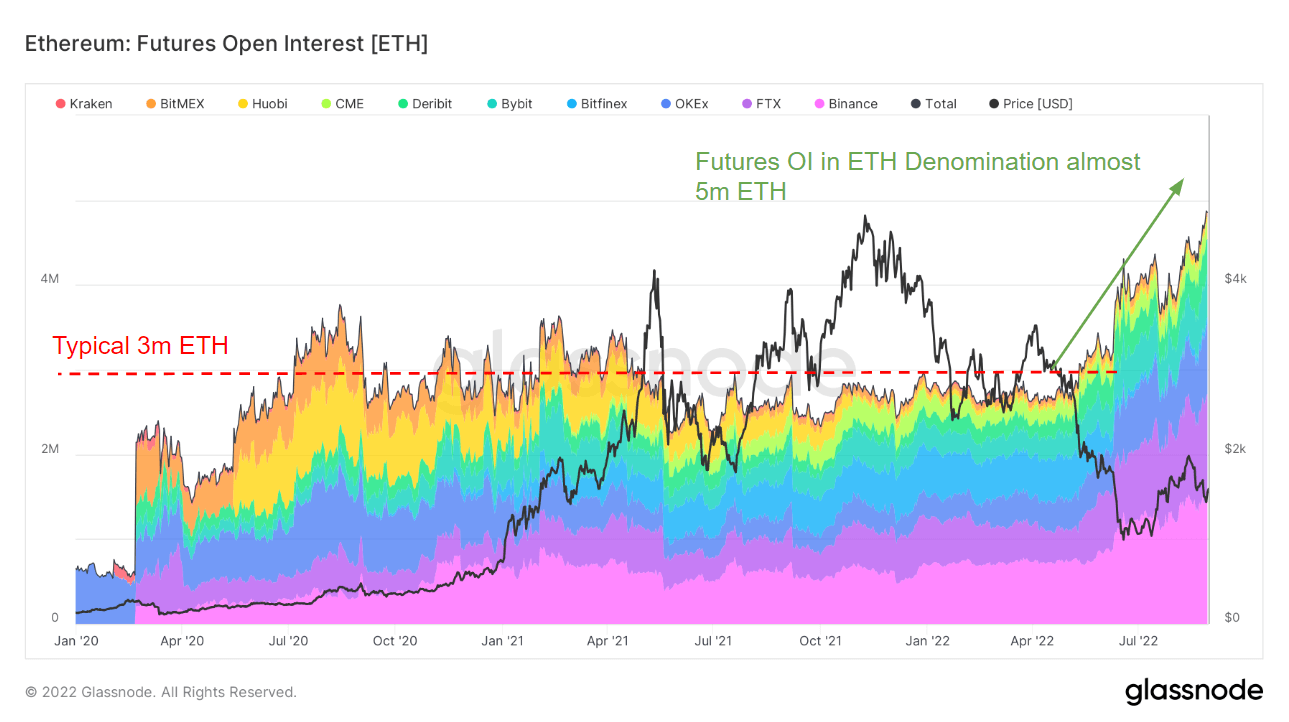

Open Curiosity

Because the begin of Could, Ethereum futures markets have seen a dramatic enhance in open curiosity. Open curiosity lifted off the baseline of round 3 million ETH and reached new heights of 5 million ETH in August. The expansion was led by a handful of exchanges — primarily Binance, Deribit, OKEx, Bybit, FTX, and CME.

The chart under reveals the overall quantity of funds — in native coin ETH — allotted in open futures contracts.

Evaluating open curiosity in an ETH denomination helps isolate durations of development in futures leverage from coin worth adjustments. On a USD foundation, the present open curiosity is $8 billion, which is comparatively low and equal to the early bull market in January 2021.

The stage is ready for one of many largest days in web historical past as Merge Day comes ever nearer. The information means that we’re in for a rollercoaster of a journey, and you may watch each minute of it dwell with CryptoSlate throughout our Ethereum Merge Watch Occasion on September 14.

Comply with CryptoSlate on Twitter or Subscribe on YouTube to search out the precise time and date as soon as it’s confirmed.

We can be joined by MetaMask, PolkaStarter, Xborg, DefiYieldApp, Swissborg, Coin Bureau, Crypto busy, and plenty of, many extra — so don’t miss out on the one place to be on Merge Day.