Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.

- The four-hour market construction was damaged, and a minor pullback may begin.

- The general bias was bullish for Litecoin.

Litecoin [LTC] slumped to $88.16 on 13 February, whereas Bitcoin [BTC] dipped to $21.3k. Since then, each belongings have rebounded greater on the worth charts. This was encouraging for the bulls. Litecoin patrons, specifically, have been vigorous in February 2023.

Learn Litecoin’s [LTC] Value Prediction 2023-24

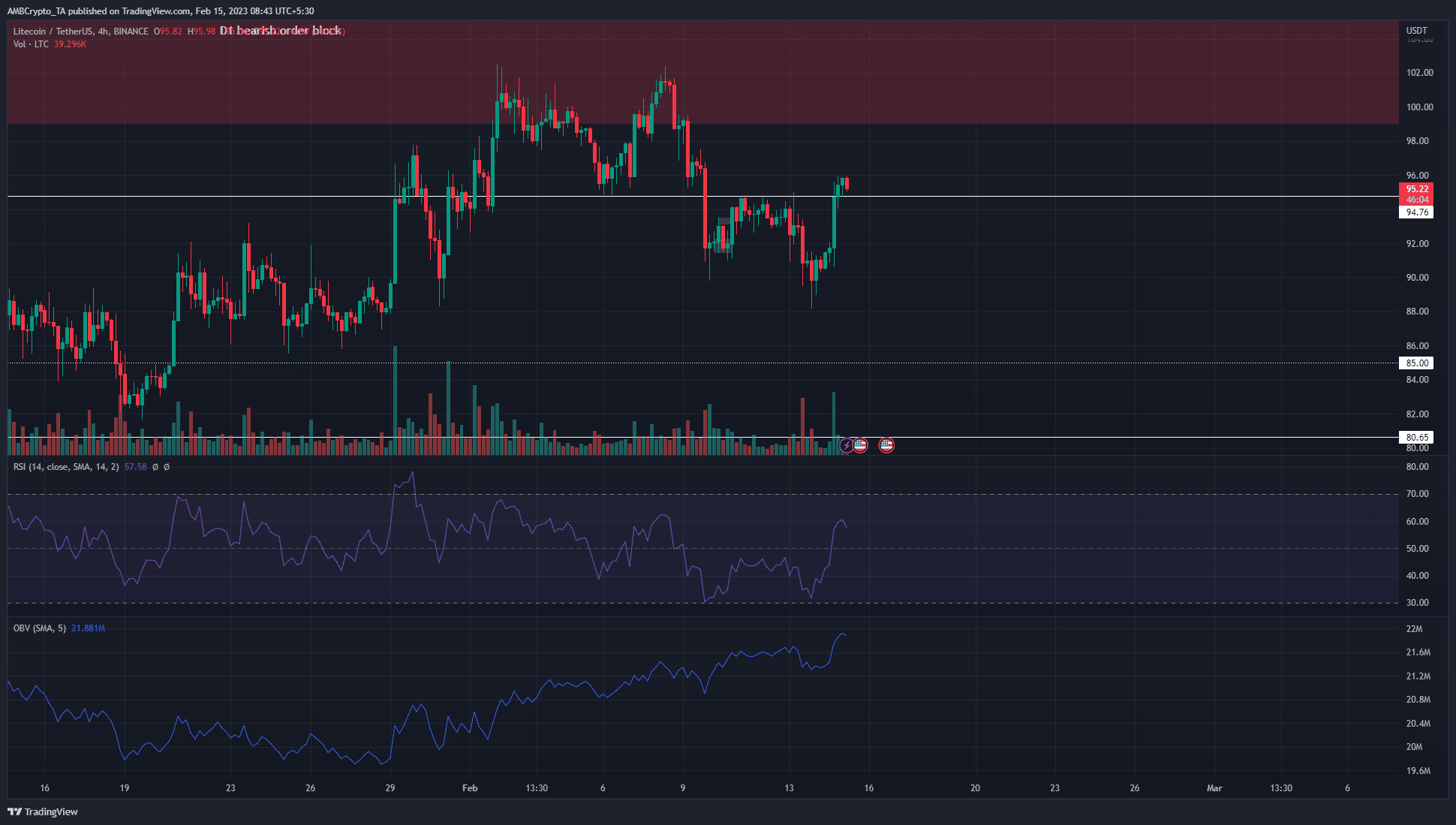

The fast surge from $88 to $96 confirmed bullish energy. Decrease timeframe merchants can look to purchase the coin within the $93-$94.8 area, though a deeper dip to $91.4 was additionally doable.

The rejection at $102 didn’t faze Litecoin bulls

Supply: LTC/USDT on TradingView

The four-hour chart confirmed LTC recovered and pushed again above the $94.7 resistance stage. Throughout the drop of 12 February, this stage had been retested as resistance. When the worth made a decrease low and touched $88.4, the RSI made the next low. This bullish divergence was adopted by a pointy bounce in costs.

This bounce, mixed with the OBV information, confirmed that Litecoin was doubtless able to push above the $100-$106 resistance within the coming days. The OBV has been in a gentle uptrend all through February. Any pullbacks within the value weren’t mirrored as sharply on the OBV. This meant promoting stress was negligible and real demand was persistent behind Litecoin.

To the north, a every day bearish order block lay within the $100-$106 area. It won’t be damaged instantly, and a few consolidation simply above $100 earlier than an eventual breakout was a risk. Since Bitcoin was additionally profitable in its protection of $21.6k, LTC bulls can hope for additional good points. Above $106, $115 was the subsequent timeframe resistance stage to look at.

Practical or not, right here’s LTC’s market cap in BTC’s phrases

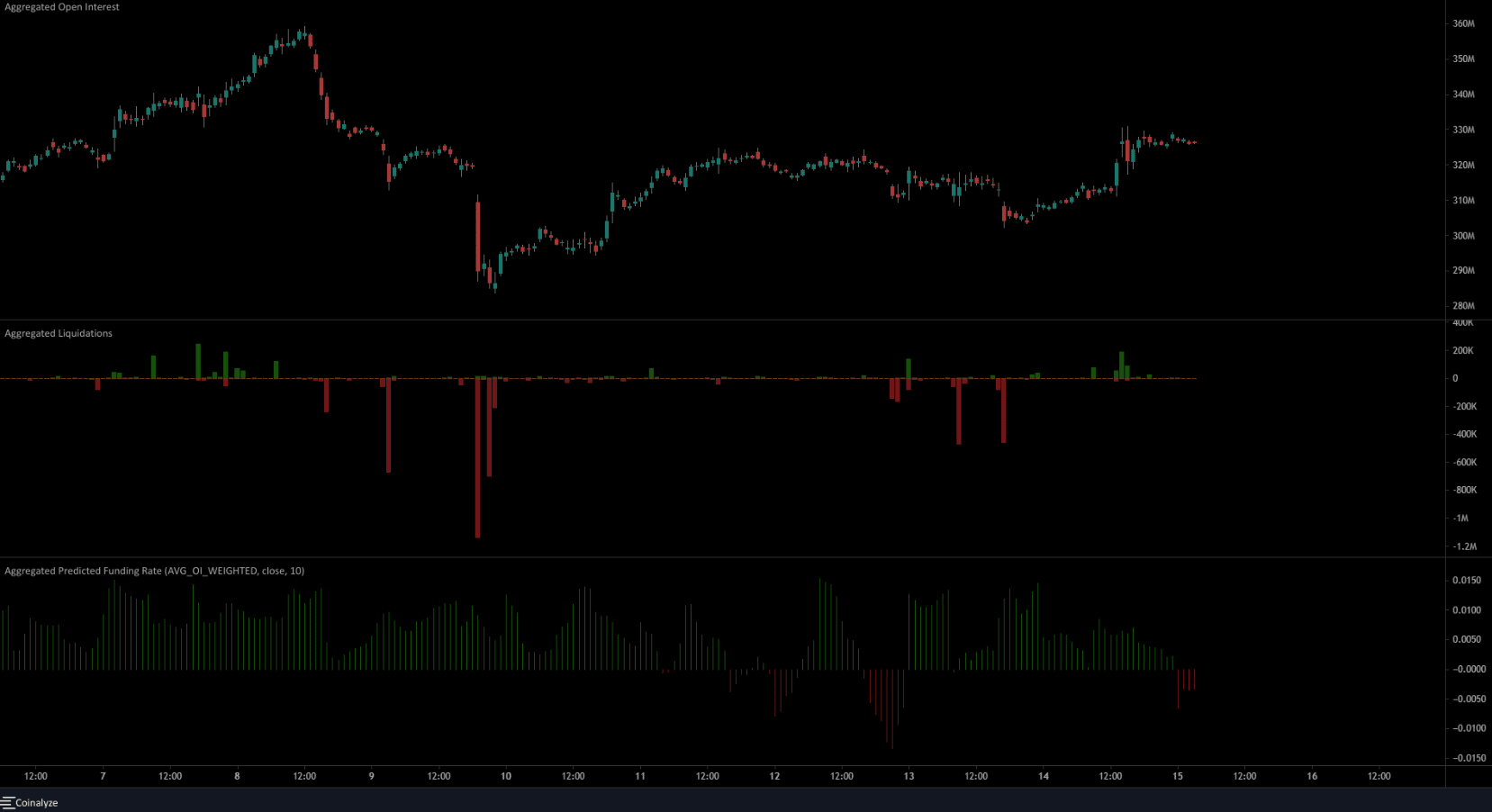

Funding charge slips into damaging territory as soon as extra, however bullish intent was obvious

The expected funding charge slipped under zero a number of hours earlier than press time, simply because it had on 12 February. That day, LTC had confronted rejection at $94.7. Did the metric point out that one other dump could possibly be across the nook? The Open Curiosity confirmed bullish sentiment.

Alongside the costs, the OI has been on the rise, particularly over the previous couple of days. This confirmed sentiment remained bullish, and OI could be anticipated to rise additional as LTC broke above $94.7. The liquidation information confirmed $310k value of quick positions liquidated inside three hours on 14 February, when the worth pushed previous the $92.6 mark.

![Litecoin [LTC] bounces from $90, will there be a breakout past $100 this time?](https://ambcrypto.com/wp-content/uploads/2023/02/PP-1-LTC-cover-1-1000x600.jpg)