- LTC whales have began promoting off their holdings.

- Open curiosity has been on a decline up to now two weeks.

On 23 January, on-chain information supplier Santiment warned traders that Litecoin’s [LTC] worth could drop within the coming days as a consequence of a rise in promoting exercise amongst whales.

In response to the report, the coin distribution amongst this cohort of LTC holders up to now few days was a profit-taking transfer, as demand for the altcoin had surged, thereby creating a synthetic pump that the whales frightened won’t final.

Learn Litecoin’s [LTC] Value Prediction 2023-24

Per information from Santiment, within the final two weeks, the depend of whale addresses that held between 100 and 1,000,000 LTC tokens fell by 0.2%. Whereas, on a year-to-date foundation, LTC’s worth rallied by 29%. At press time, the alt exchanged fingers for $90.92, information from CoinMarketcap confirmed.

Supply: Santiment

Perhaps you need to fear for those who maintain LTC

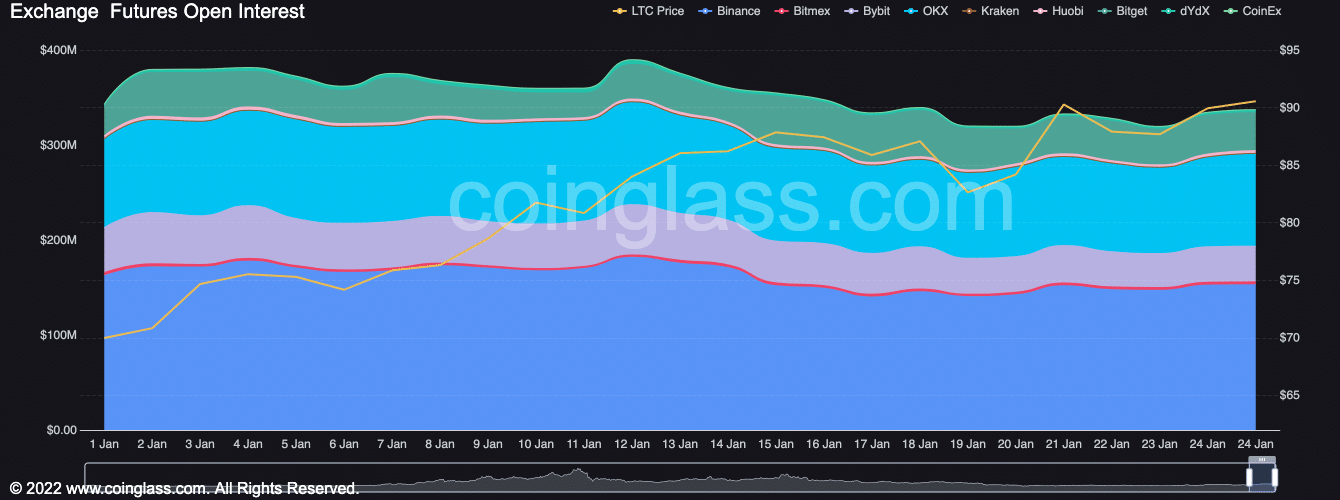

Mirroring the expansion within the normal cryptocurrency market in the previous couple of weeks, LTC’s Open Curiosity rose by 14% between 1 – 12 January.

An rising open curiosity within the crypto market meant that extra merchants have been opening new positions in derivatives akin to futures or choices. It usually indicated an elevated exercise and curiosity available in the market. It additionally urged that extra merchants have been changing into assured available in the market and have been seeking to make the most of potential worth actions.

Nevertheless, as profit-taking started, and plenty of merchants closed off their LTC commerce positions, the alt’s Open Curiosity quickly fell. At $337 million at press time, LTC’s Open Curiosity fell by 13% since 12 January, information from CoinGlass confirmed.

A decline in an asset’s Open Curiosity is usually taken as a bearish sign. It signifies that merchants are closing out their positions, which may sign a insecurity within the present path of the market or a lower in general exercise.

Supply: CoinGlass

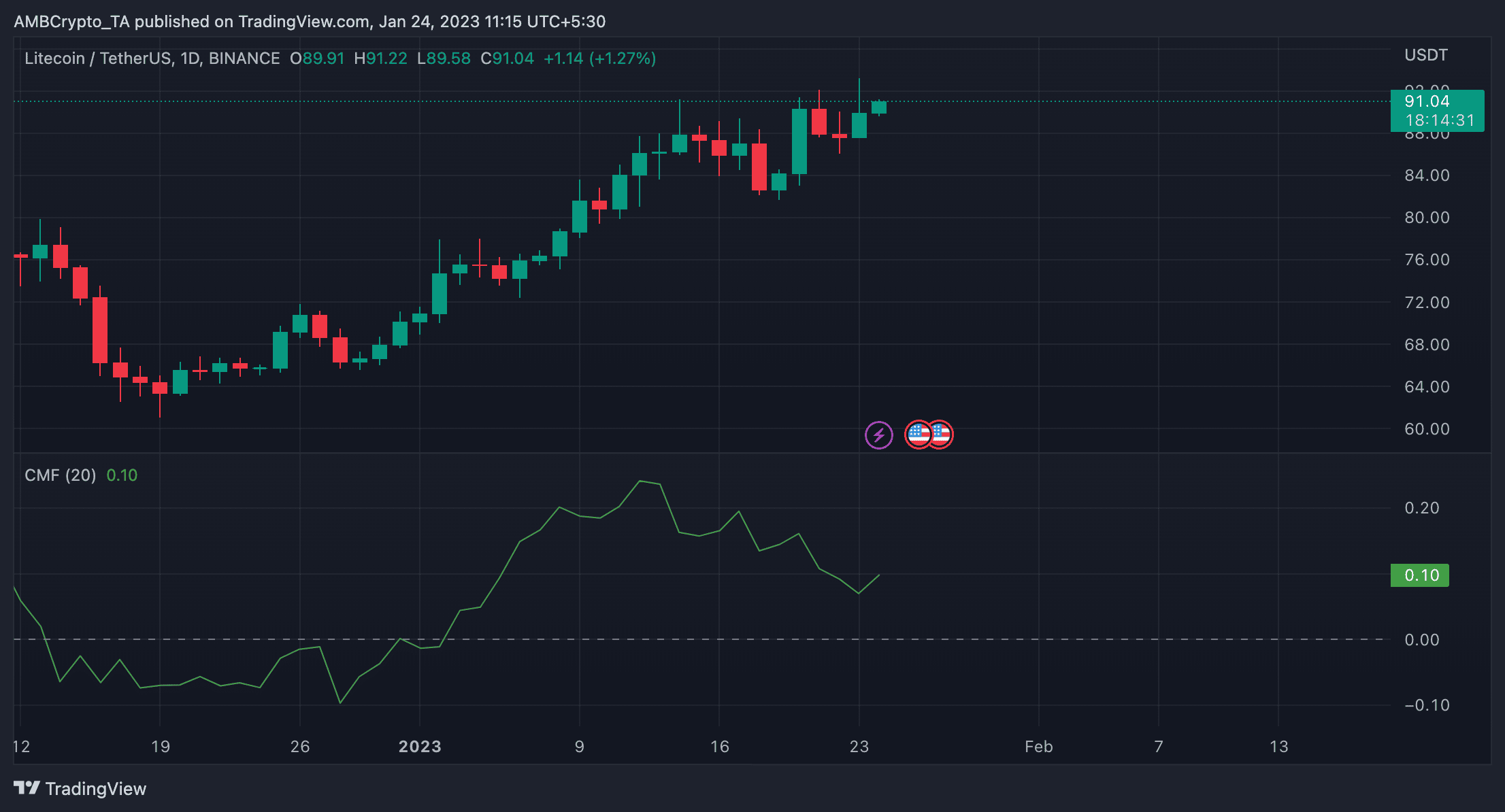

An extra evaluation of LTC’s worth motion on a every day chart revealed the formation of a bearish divergence between the alt’s worth and its Chaikin Cash Movement (CMF). Though nonetheless positioned above the middle line, LTC’s CMF had launched into a downtrend since 13 January, whereas its worth chased new highs.

Life like or not, right here’s LTCs market cap in BTC’s phrases

A risk of Litecoin’s worth reversal?

A lowering CMF worth, mixed with a excessive worth, can point out that the market is overbought and that there could also be potential for a worth correction. This might imply that though Litecoin’s worth was excessive, the shopping for strain behind it’s lowering, which may recommend that the market is changing into extra bearish and that merchants have gotten extra hesitant to purchase at such excessive costs.

This example might be an indication that merchants ought to contemplate taking earnings or decreasing their publicity to the market.

Supply: LTC/USDT on TradingView