- MakerDAO is ready to introduce some adjustments to its Compound V2 D3M.

- MKR has seen a decline in shopping for stress within the final week.

In a brand new proposal, the Open Market Committee of main decentralized finance platform (DeFi) MakerDAO has sought neighborhood approval to extend the utmost debt ceiling on its Compound DAI Direct Deposit Module (Compound V2 D3M) by 300% and to set the Goal Out there Debt on the identical vault to five million DAI.

🌊🌊🌊 A brand new wave of contemporary 15 million DAI is preparing for a direct, automated, and algorithmic deposit into @compoundfinance.

If enacted, the presently energetic Government Vote will elevate the Compound D3M Debt Ceiling from 5 million DAI to twenty million DAI! pic.twitter.com/NUZbuMc5jc

— Maker (@MakerDAO) January 27, 2023

In accordance with its Operational Manual, MakerDAO’s DAI Direct Deposit Module (D3M) is a software that permits the creation and deposit of DAI into different lending protocols on the Ethereum blockchain in alternate for a deposit/collateral token from these protocols.

It permits MakerDAO to distribute newly minted DAI via different lending protocols whereas sustaining a full backing of DAI.

Lifelike or not, right here’s MKR’s market cap in BTC phrases

In December 2022, D3M was deployed on Compound Finance with a DAI provide of 5 million DAO tokens. The utmost debt ceiling was additionally pegged at 5 million DAI.

D3M deployed.

5 million contemporary newly generated DAI have been deposited into @compoundfinance.

→ https://t.co/NOxDL5ugo6 pic.twitter.com/sPnttbj5hO

— Maker (@MakerDAO) December 6, 2022

The utmost debt ceiling represents the higher restrict of the full debt that may be generated as DAI on Compound V2 D3M. That is often specified and glued to make sure the soundness of the platform. With the brand new proposal, MakerDAO is searching for to boost the debt ceiling to twenty million DAI.

Additional, the Goal Out there Debt on Compound V2 D3M may even be set to five million DAI, ought to the brand new proposal undergo.

The Goal Out there Debt or “Hole” in MakerDAO is a measure of the quantity of debt that may be safely generated in its vaults with out compromising its stability.

Wholistically, these parameter adjustments goal to extend the power of the MakerDAO to generate extra debt within the type of DAI whereas sustaining a steady system and making certain that there’s sufficient collateral to again the generated DAI.

By rising the Most Debt Ceiling and setting the Goal Out there Debt to a particular worth, the DeFi protocol will have the ability to generate extra DAI whereas additionally making certain that there’s sufficient collateral to again it.

This might result in a extra sturdy and environment friendly system, permitting extra customers to take part and generate DAI.

Learn MakerDAO’s [MKR] Value Prediction 2023-2024

MKR within the final month

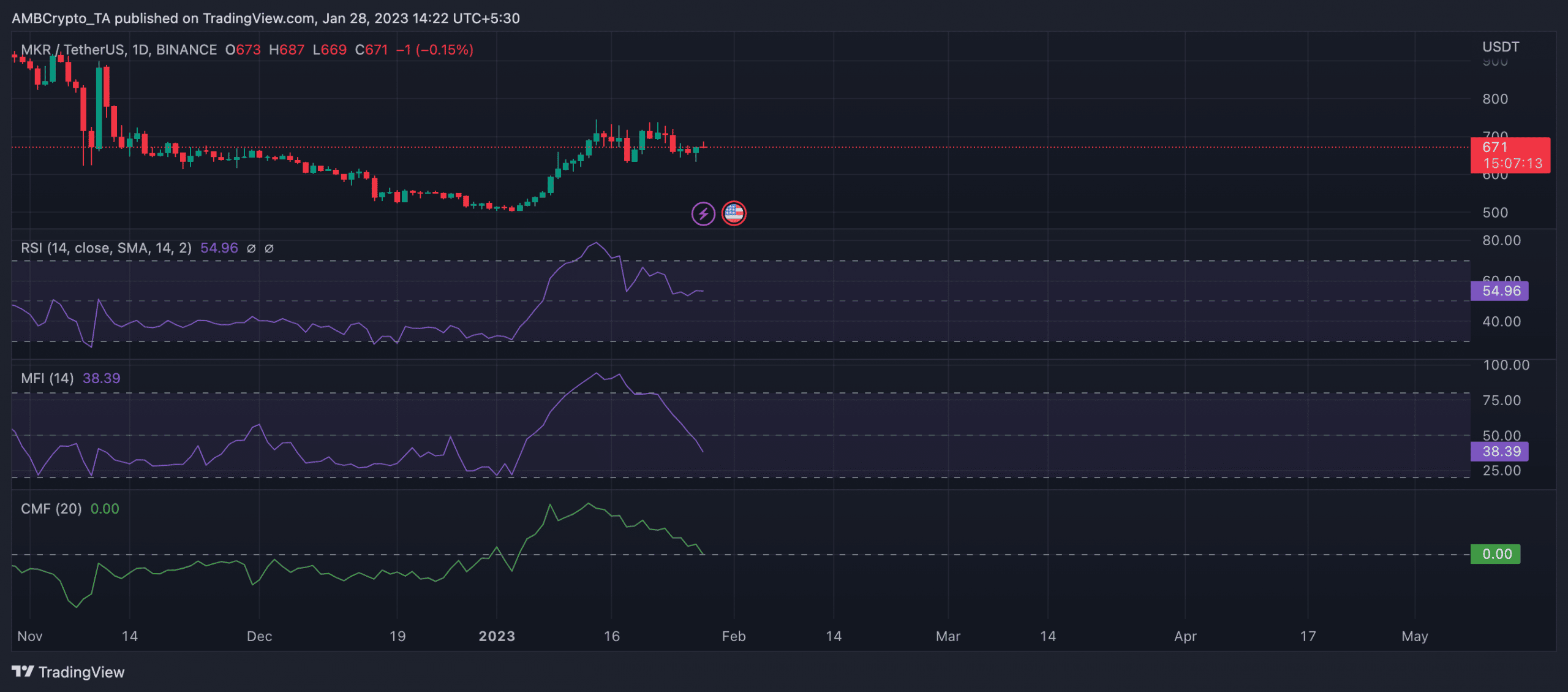

MKR’s value grew considerably within the first three weeks of the month however has launched into a decline within the final week. Per knowledge from CoinMarketCap, the alt’s worth has dropped by 7% within the final week. At press time, MKR exchanged arms at $672.05.

On a day by day chart, key momentum indicators have been noticed in downtrends, suggesting a waning shopping for stress. In actual fact, the token’s Cash Move Index (MFI) breached the 50-neutral area to be pegged at 38.39 at press time.

Additionally, the dynamic line (inexperienced) of the asset’s Chaikin Cash Move (CMF) rested on the middle line at 0. All of those confirmed a major decline in shopping for MKR momentum within the final week.

Supply: MKR/USDT on TradingView