- MATIC makes it into the listing of the highest most bought tokens by ETH whales.

- Its value motion within the final 24 hours reveals that the token continues to be struggling to safe extra upside.

Polygon’s native token MATIC kicked off this week with a bullish pivot on Monday (12 December) and has been steadily recovering since then. A latest WhaleStats evaluation revealed incoming whale demand that will set off extra upside for MATIC.

In accordance with the WhaleStats report, MATIC was among the many prime 10 tokens that discovered favor from the 100 largest ETH whales within the final 24 hours. The remark means ETH whales have been shopping for MATIC, a transfer that will lend extra power to the bulls.

JUST IN: $MATIC @0xPolygon now on prime 10 bought tokens amongst 100 largest #ETH whales within the final 24hrs 🐳

Examine the highest 100 whales right here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see knowledge for the highest 5000!)#MATIC #whalestats #babywhale #BBW pic.twitter.com/41C7tpFjhv

— WhaleStats (monitoring crypto whales) (@WhaleStats) December 14, 2022

ETH whale participation in MATIC’s prevailing bullish demand might strengthen its rally. Sufficient bullish momentum might assist it soar above the 50-day shifting common.

The token has been struggling to push above this indicator for the reason that begin of December. MATIC traded at $0.921 at press time, which was nonetheless beneath the 50-day MA.

Supply: TradingView

MATIC’s value motion within the final 24 hours revealed that it was nonetheless struggling to safe extra upside. However can this modification because the weekend approaches? Maybe a few of Polygon’s metrics might present helpful insights into what to anticipate.

Is brief-term profit-taking holding MATIC again?

MATIC dropped barely within the final 24 hours regardless of noticed ETH whale exercise. One of many potential explanations for this consequence is that there was vital profit-taking by some market members.

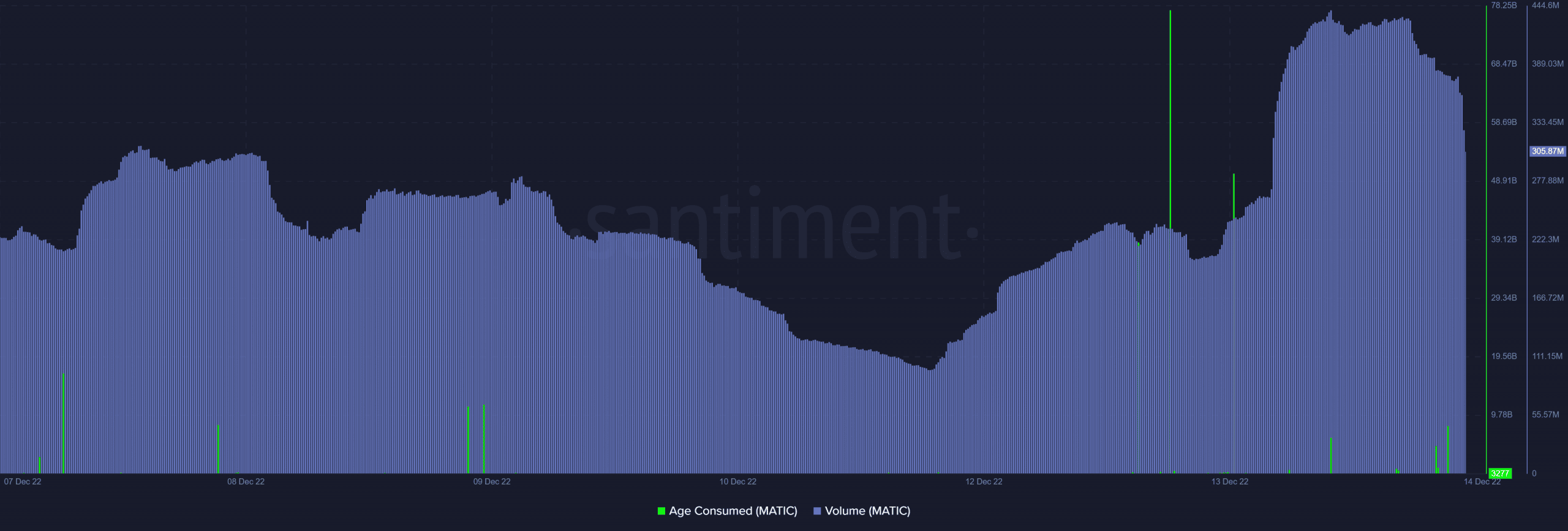

Such an consequence might have canceled out the shopping for strain. Moreover, MATIC’s age consumed metric registered elevated exercise within the final two days.

Supply: Santiment

The age-consumed metric would possibly point out that some massive whales are making the most of the resurgence of bullish demand to safe exit liquidity.

Additionally value noting is that MATIC’s quantity simply achieved a brand new 7-day excessive within the final 24 hours. This confirms that buying and selling exercise has definitely elevated over the past day.

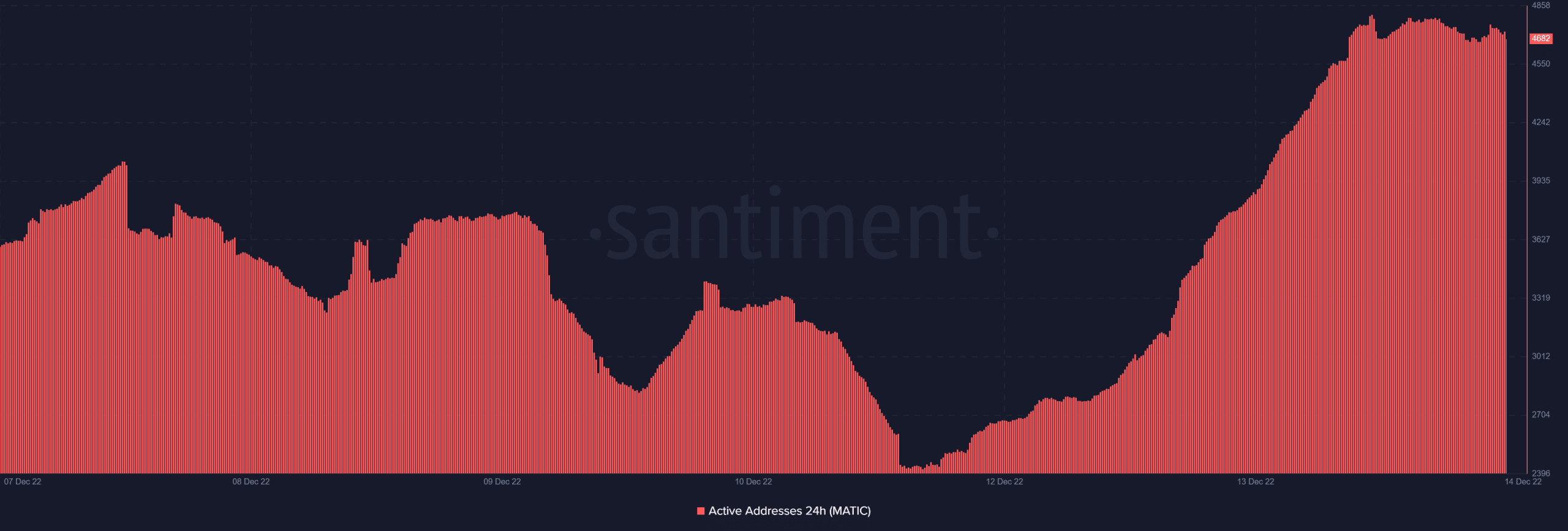

As anticipated, day by day lively addresses have additionally elevated particularly within the final 4 days, which steered that there was vital retail exercise.

Supply: Santiment

This surge in day by day lively addresses continues to be favorable to MATIC from a community exercise standpoint. The token will seemingly have extra value volatility now that there’s extra shopping for and promoting happening.

However this doesn’t supply a lot readability by way of course. Maybe provide distribution can present extra readability.

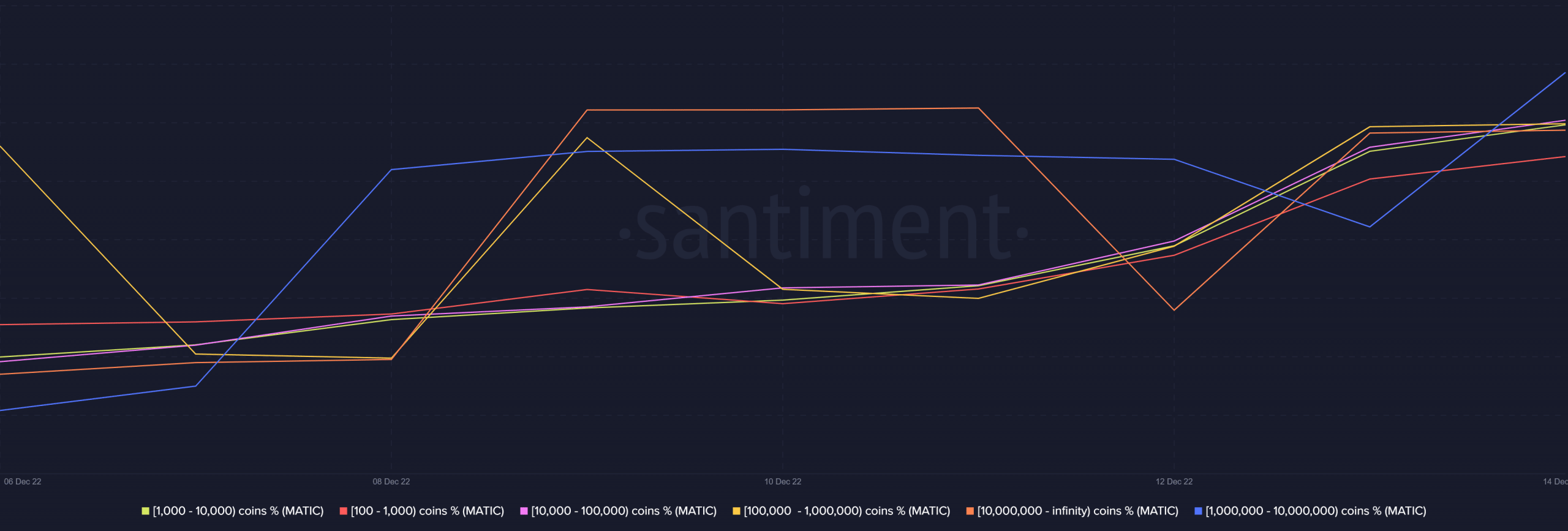

In accordance with latest observations, the highest addresses are at present growing their balances. This implies there’s a increased chance that MATIC will ship a major upside.

Supply: Santiment