Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- The bulls appear to have fronted a restoration on the charts

- CVD (Cumulative Quantity Delta) fell and will have an effect on bulls’ efforts

Whereas the bears have managed MATIC’s market since mid-February, bulls solely gained appreciable leverage on 10 March. On the time, whereas the worth motion rebounded from $0.943, it has since confronted stiff resistance ranges.

Learn Polygon [MATIC] Value Prediction 2023-24

Moreover, Bitcoin [BTC] confronted rejection across the $26K zone and dropped beneath $25K, additional undermining the remainder of the altcoin’s market restoration within the short-term. Nevertheless, a retest of BTC’s newest highs may lead the altcoin market right into a renewed restoration course of.

MATIC’s restoration at stake – Can bulls push ahead?

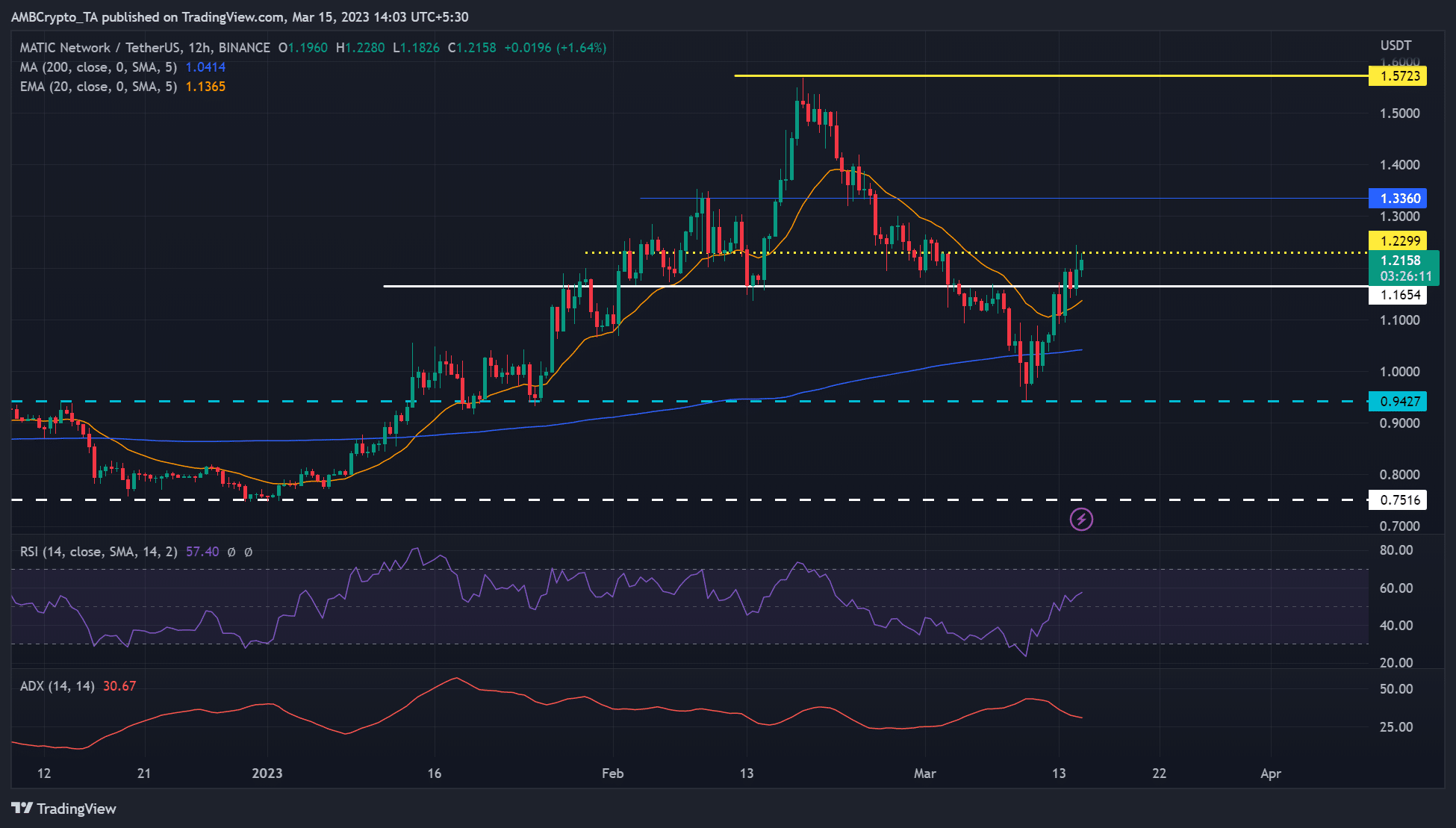

Supply: MATIC/USDT on TradingView

MATIC’s drop since mid-February was efficiently stopped by the $.9427 help. The help was additionally essential in January. Bulls cleared the hurdle at 200-period MA (Transferring Common), the 20 EMA (Exponential Transferring Common), and the $1.1654-resistance degree. At press time, MATIC was struggling to bypass the impediment at $1.23, partly because of BTC’s worth fluctuations.

Bulls might try and clear the $1.23 hurdle if BTC surges above $25K. A detailed above the hurdle might push the worth in the direction of the overhead resistance of $1.5723, particularly if the impediment at $1.34 is cleared too.

Quite the opposite, BTC fluctuations might set MATIC right into a consolidation vary of $1.17 – $1.23 if 20 EMA stays regular. Nevertheless, MATIC might sink to the brand new low of $0.943 if bears clear the impediment at 200 MA ($1.0414).

The Relative Energy Index (RSI) retreated from the oversold territory – Proof of elevated shopping for strain over the previous few days. Nevertheless, the Common Directional Index (ADX) slope hadn’t moved north, indicating a weak uptrend route which ought to warning bulls.

Funding fee was constructive, however CVD fell

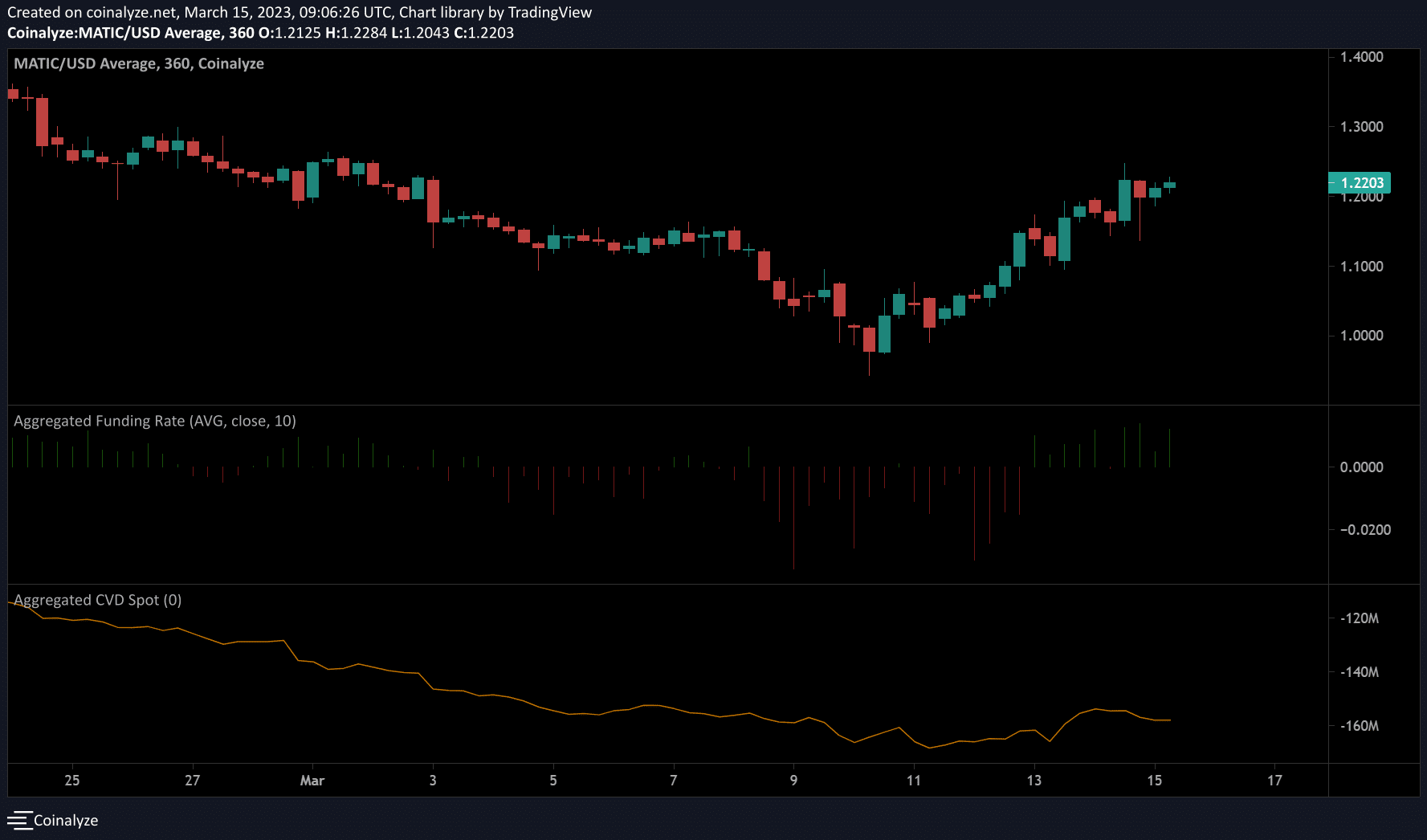

Supply: Coinalyze

In accordance with the crypto-derivatives knowledge platform Coinalyze, MATIC’s funding charges have been constructive since March 13. It underlined elevated demand for MATIC within the derivatives market, which helped bypass the $1.1654-hurdle.

Is your portfolio inexperienced? Take a look at MATIC Revenue Calculator

Nevertheless, the CVD (cumulative quantity delta) fell with a destructive slope, indicating sellers had been gaining leverage available in the market. If the CVD was flat, it could imply neither patrons nor sellers had absolute leverage. Quite the opposite, a constructive slope and progress would counsel patrons’ higher market affect. The destructive slope, subsequently, might complicate the restoration.