CryptoSlate evaluation of Bitcoin (BTC) metrics reveals that the market backside might have been reached as traders proceed accumulating BTC and pushing illiquid provide as much as 80%.

Analysts reviewed metrics, together with the MVRV-Z and Realized Worth metrics, to find each point out bullish sentiments.

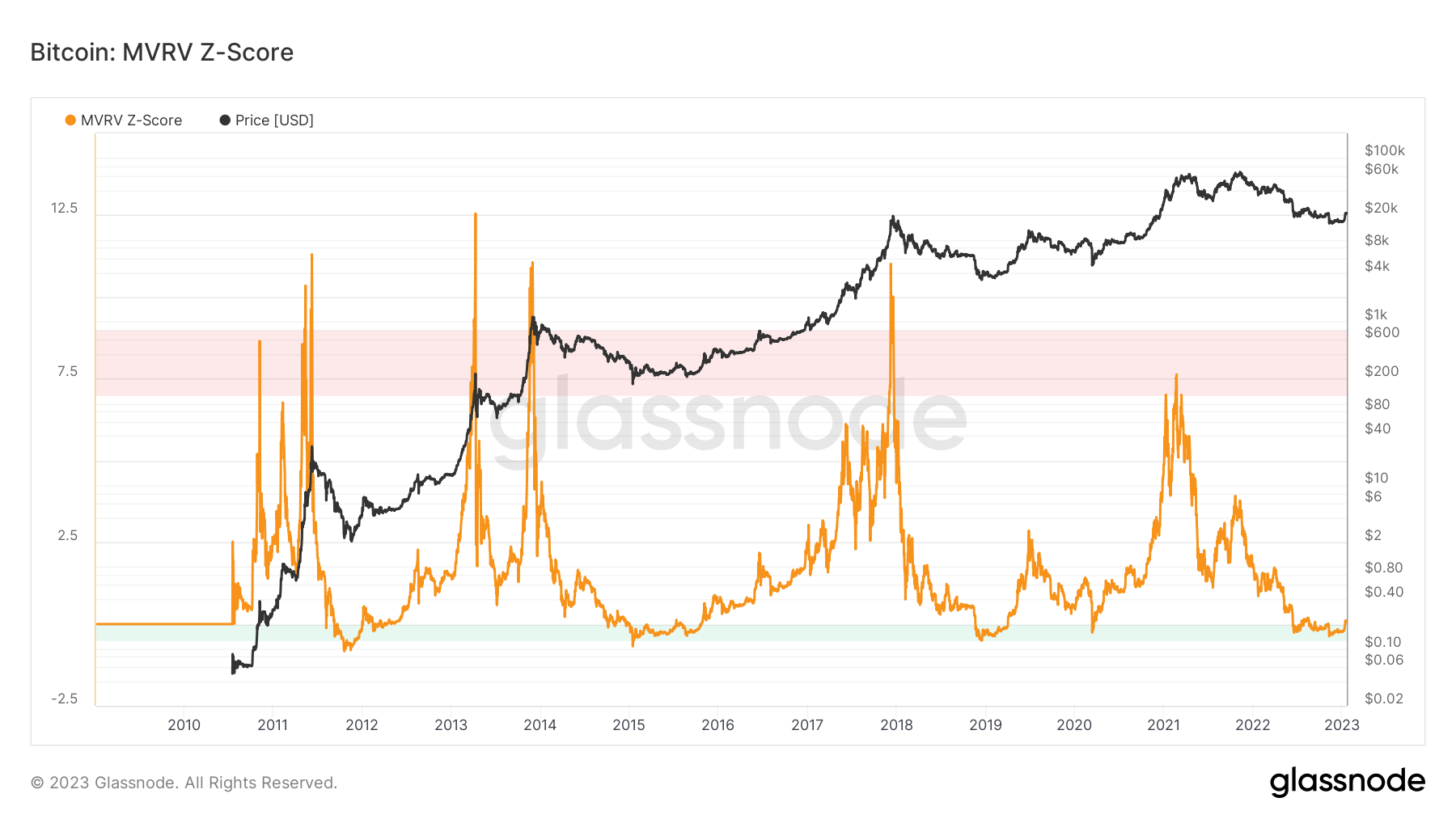

MVRV-Z metric

The MVRV-Z rating is used to evaluate whether or not BTC is over or under-valued. When the market worth is considerably greater than BTC’s “honest worth,” the metric stays within the purple zone. Then again, if the worth is decrease than BTC’s realized worth, the metric lingers round within the inexperienced space. The chart beneath represents the MVRV-Z metric with the orange line.

The metric entered the inexperienced zone in mid-2022, proper after the LUNA collapse, and has been transferring inside the inexperienced space since then. It solely broke by very just lately, which could sign that the market backside has been reached.

Traditionally, Bitcoin’s worth has considerably decreased each time the MVRV-Z metric reached the purple zone. In accordance with the chart, this correlation has been seen six instances since 2010. Due to this fact, it’s doable to conclude that the MVRV-Z metric signifies a market high whether it is within the purple zone.

Equally, historic proof additionally exhibits that Bitcoin’s worth will increase after the metric reaches the inexperienced zone, indicating a market backside. The worth actions recorded in early 2012, 2015, 2019, and 2020 correspond to market bottoms.

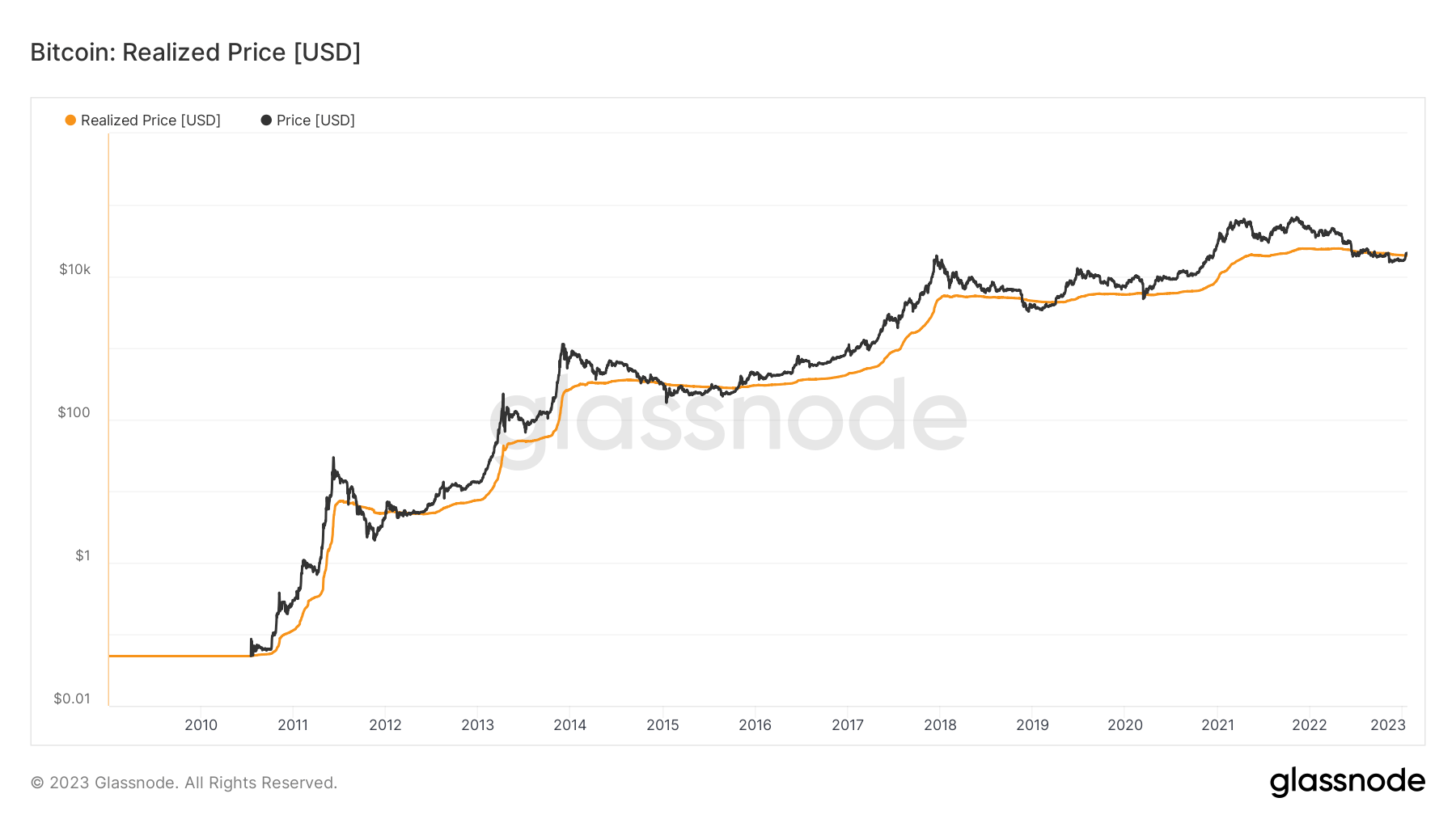

BTC realized worth

The realized worth is calculated by dividing the realized cap by the present provide. The metric signifies a bear market when the precise worth falls beneath the realized worth. Conversely, if the actual worth will increase above the realized worth, it signifies a bull market.

The chart above represents the connection between BTC’s realized worth and precise worth since 2010. The true BTC worth has been beneath the realized worth since mid-2022. Nevertheless, this steadiness modified very just lately because the precise worth surpassed the realized worth, which signifies a bull market sentiment.

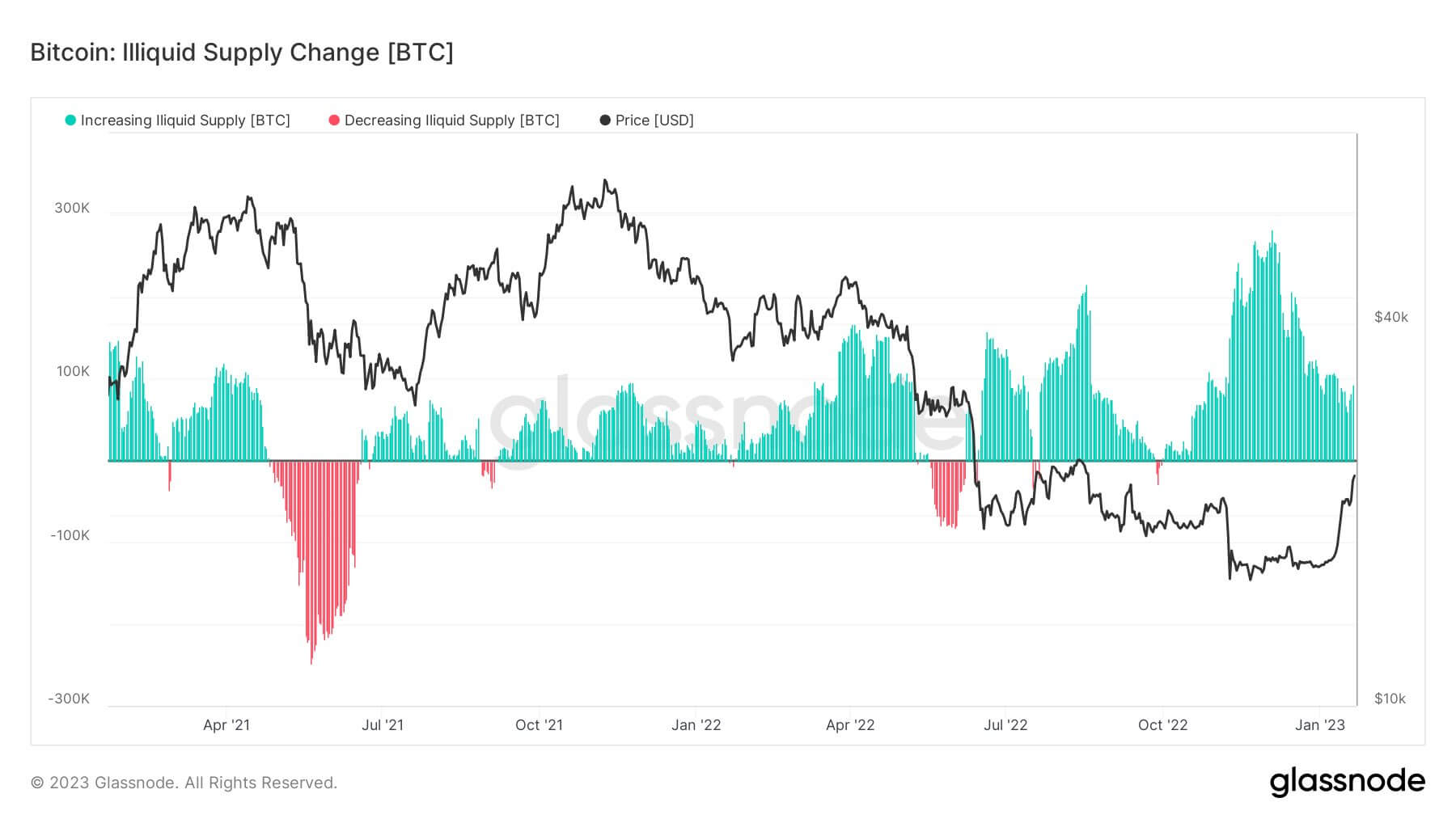

80% of BTC is illiquid

Buyers have been accumulating BTC over the previous few months. Nevertheless, cCyptoSlate evaluation from Dec. 13, 2022, revealed that the quantity of BTC that sat on exchanges had hit its all-time low since 2018.

The withdrawals have additionally been in massive chunks, and on the finish of November, over $2 billion value of BTC was withdrawn from Coinbase. On Dec. 23, Binance misplaced 90,000 BTC from its reserves in every week. One other $120 million value of Bitcoin was withdrawn from completely different exchanges throughout the first ten days of 2023.

The present metrics have been signaling a BTC backside since Jan. 19. On Jan. 21, BTC broke by the $23,000 degree, recording a 50% enhance since its bear-market low of $15,400. Nevertheless, the upwards worth actions didn’t cease the BTC withdrawals. A0,000 BTC was withdrawn from exchanges on Jan. 20, with the bulk being pulled out from Binance.

Information additionally signifies that a considerable amount of withdrawn BTC is being despatched to chilly storage. For instance, 450,000 BTC held on sizzling wallets or exchanges had been moved to chilly storage in 2022.

One other 110,000 BTC has been despatched to chilly storage thus far in 2023. With this, the quantity of illiquid BTC held in chilly wallets reached an all-time excessive of 15.1 million cash. This quantity accounts for 80% of the whole circulating provide of BTC.

The chart above represents the illiquid BTC provide with the inexperienced zones whereas displaying the liquid provide with the purple. The BTC accumulations have considerably elevated the illiquid provide since July 2022, apart from temporary intervals throughout July and October.