- Michael Saylor confirmed as we speak that Microstrategy bought a further 301 Bitcoins at a mean worth of $19,851 per Bitcoin.

- In response to Saylor, Microstrategy now holds $130,000 Bitcoins acquired at a mean of $30,639 per Bitcoin.

MicroStrategy’s former CEO Micheal Saylor revealed as we speak through his official Twitter account that MicroStrategy bought one other $6 Million Bitcoin taking your entire firm’s BTC holdings to $3.98 billion at a mean worth of $30,639 per Bitcoin. Saylor not too long ago stepped down as MicroStrategy CEO, taking the function of govt chairman. His reasoning behind his resolution is that he’ll be capable to present oversight of the corporate’s bitcoin acquisition technique.

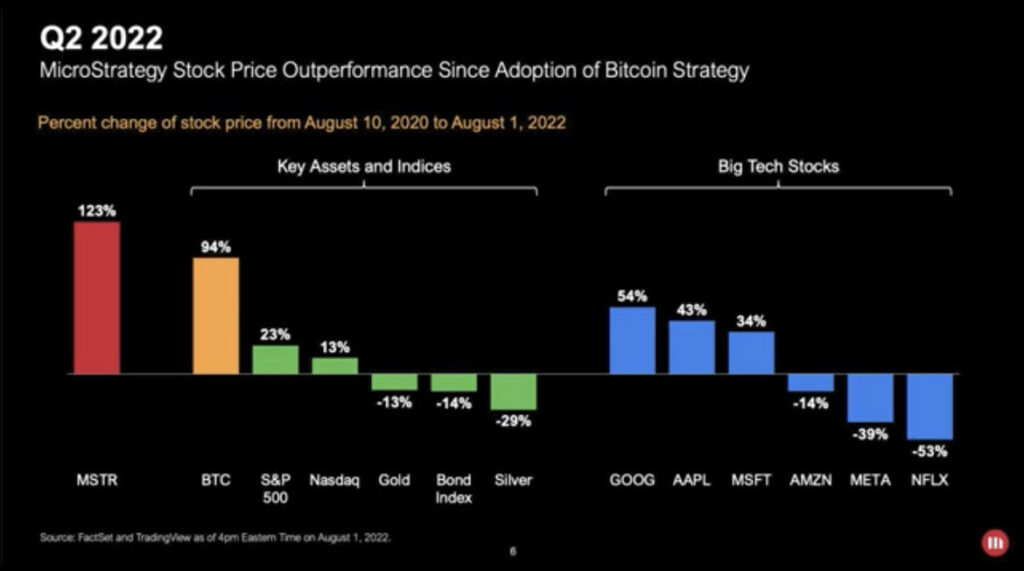

Michael Saylor beforehand said that since MicroStrategy adopted the Bitcoin Normal, the corporate closely outperformed the S&P 500, Nasdaq, Gold, Bond Index, and any Huge Tech Shares.

Might This Lastly Be The Bitcoin Backside?

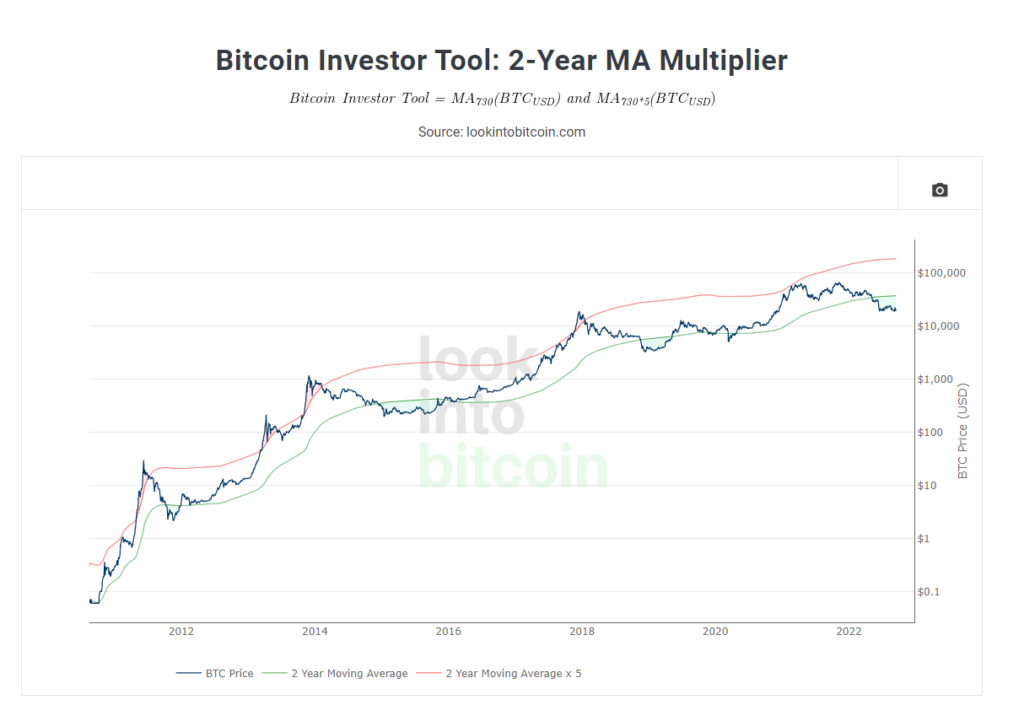

As beforehand said, many long-term holder charts are instigating the Bitcoin backside could be in such because the Bitcoin Investor Device: 2-Yr MA Multiplier.

The chart exhibits intervals when shopping for and promoting Bitcoin would have produced outsized returns.

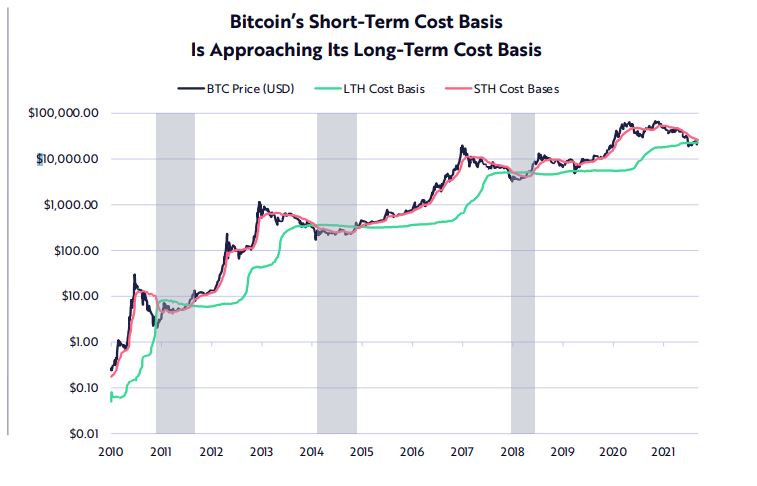

Ark Make investments’s Bitcoin Month-to-month Report additionally exhibits that lengthy and short-term price bases seem to cross, which might traditionally recommend a cyclical backside.

In response to the report, the provision held by long-term holders is on tempo to achieve all-time highs, suggesting that the chance of promoting and spending sooner or later diminishes dramatically.

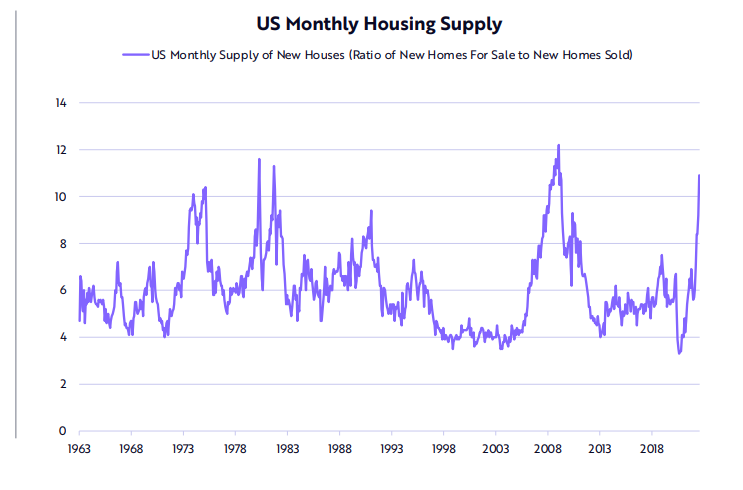

Nevertheless, on a macroeconomic scale, indicators of recession are surfacing because the FED tries to curb inflation. The CPI index has reached highs not seen because the Eighties, and residential inventories have spiked dramatically relative to Dwelling Gross sales, indicating we could possibly be in a recession.