Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- XMR dropped to its January lows.

- Its decline chalked a bullish descending wedge.

Monero’s [XMR] hiked 27% in January, reaching a excessive of $188, up from $147. Nonetheless, the privacy-focused cryptocurrency has corrected all of the features throughout its decline in February.

Its decline chalked a bullish descending wedge, which might provide a lifeline to bulls. However the prevailing macroeconomic headwinds might complicate issues.

Learn Monero’s [XMR] Worth Prediction 2023-24

XMR fashioned a bullish descending wedge sample

Supply: XMR/USDT on TradingView

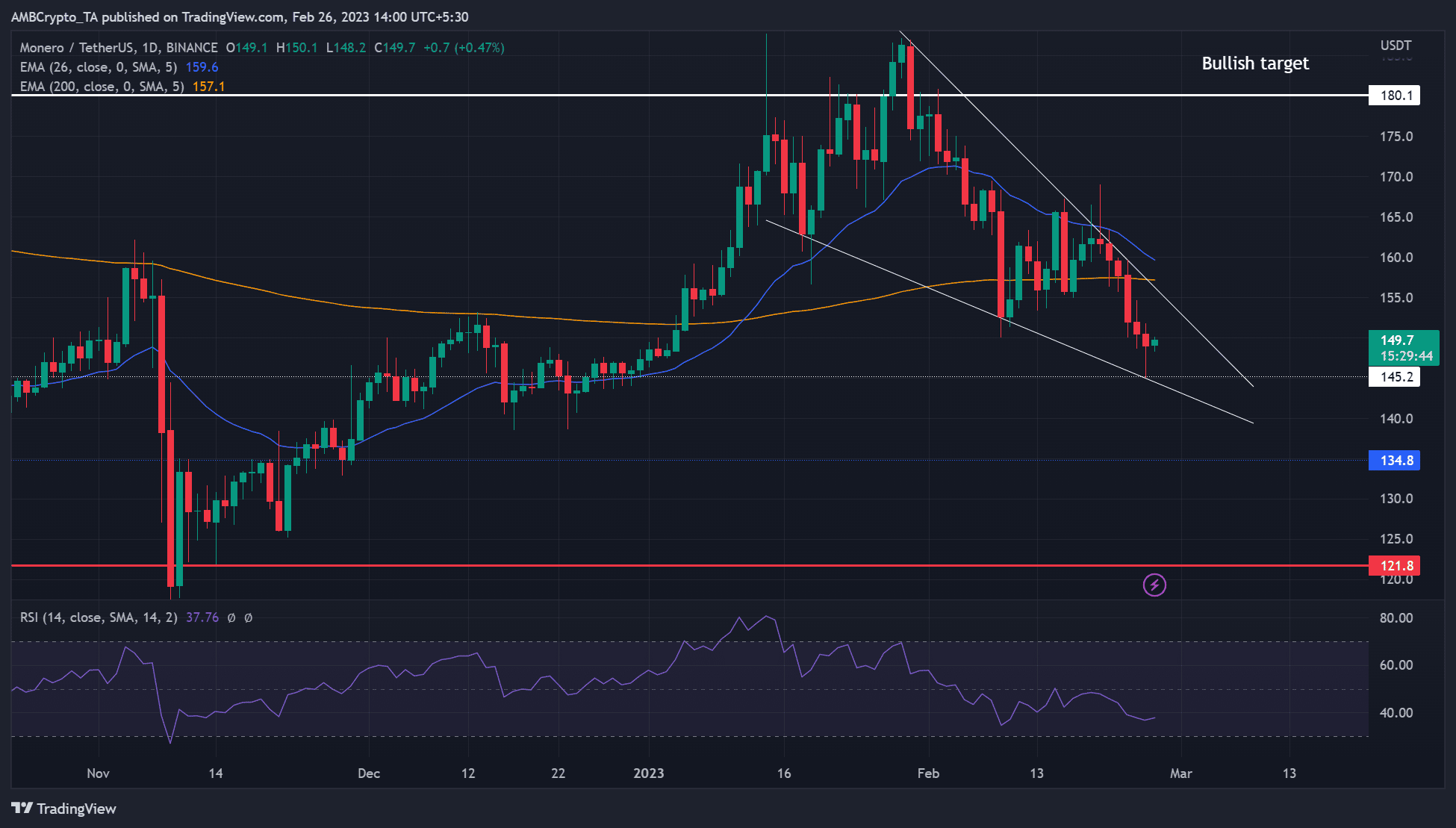

At press time, XMR had dropped under $150 and fashioned a bullish descending wedge sample. The asset recovered strongly after the FTX saga, leaping from under $120 to a excessive of $187. Nonetheless, the prolonged correction in February threatened to wipe out even features made in December.

Nonetheless, the chalked descending wedge sample is a bullish formation that would give bulls hope. Lengthy-term bulls might make strikes if XMR instantly breaks above the sample or waits for a possible pullback to retest the damaged resistance. They’ll purpose on the bullish goal of $180 – a 14% potential hike.

Then again, short-sellers can look to guide income at $134 or $122 if a bearish breakout happens.

They need to anticipate a day by day session shut under $145 (decrease boundary) and retest to verify an additional downtrend. The RSI was under 50, thus, bears had extra affect out there on the time of writing.

How a lot is 1,10,100 XMRs price immediately?

XMR’s hash charge fell, however open rates of interest gained momentum

Supply: Messari

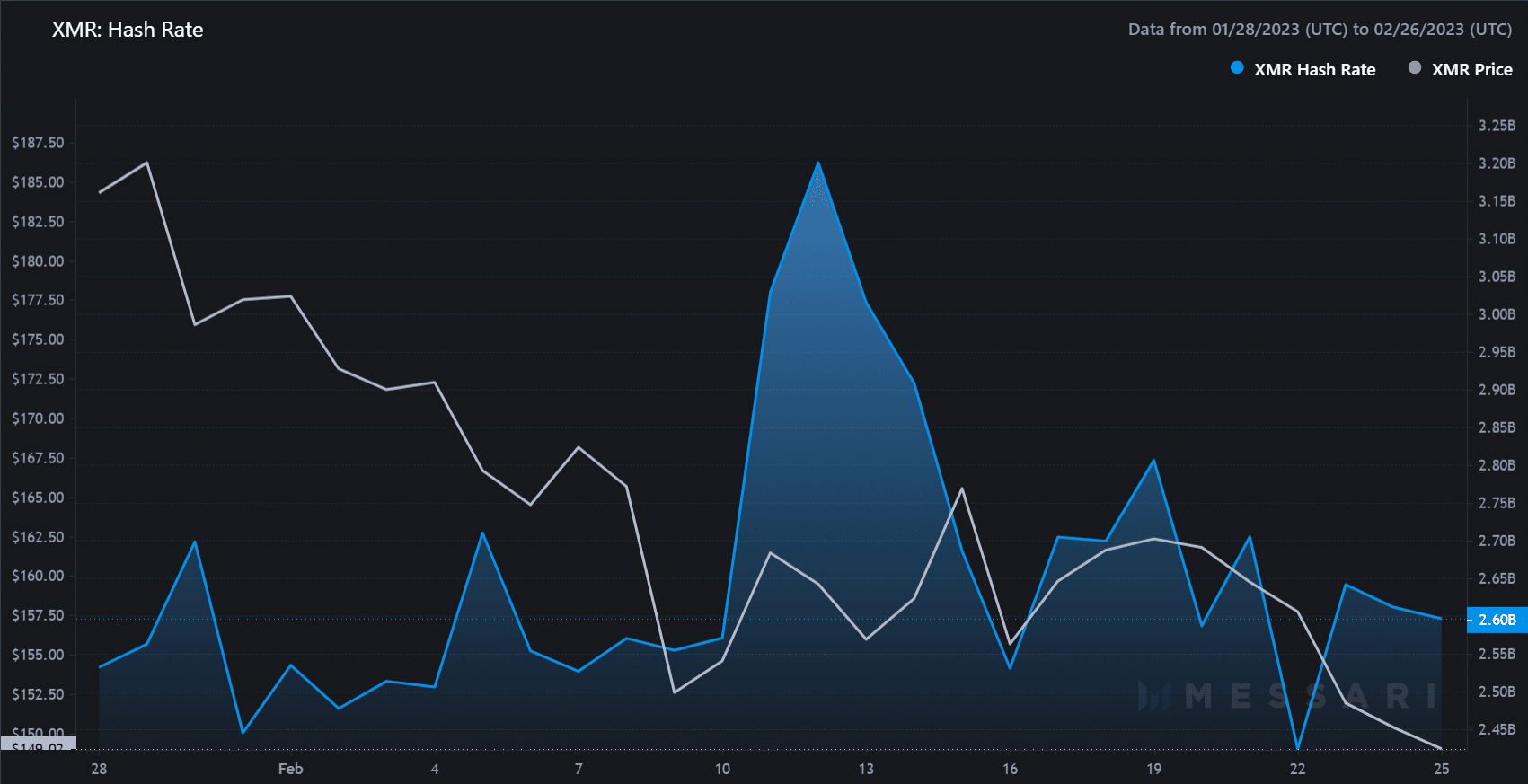

XMR’s hashrate has declined considerably since mid-February. It has made low highs since mid-February, exhibiting that much less computational energy and assets have been wanted to safe the community.

The drop in allotted assets to safeguard the community results in depreciation as a result of miners are compensated in XMR. Due to this fact a powerful bullish breakout may very well be far-fetched if the hash charge continues to drop.

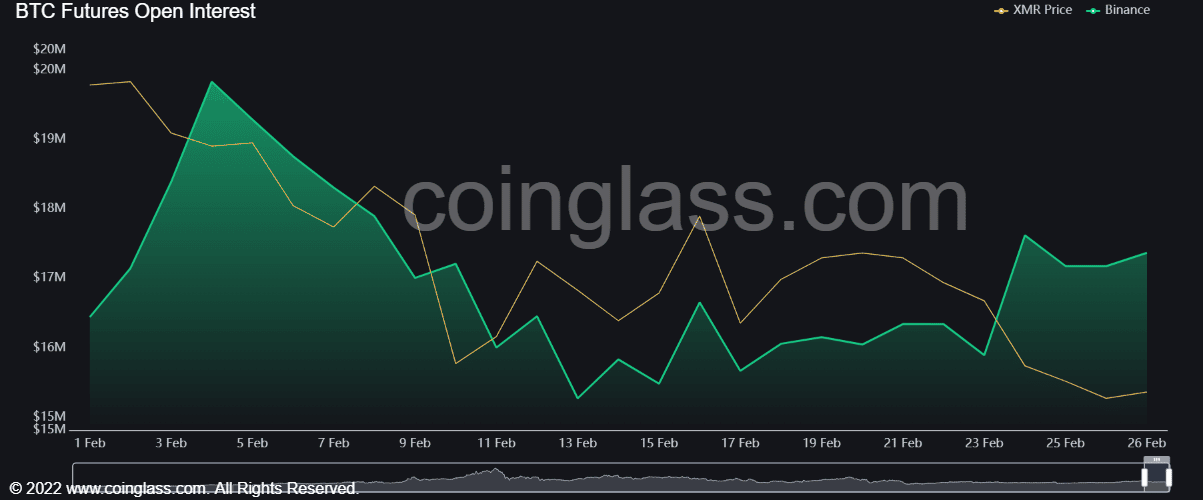

Nonetheless, XMR’s open curiosity (OI) charges confirmed slight enchancment. Based on Coinglass, OI has made excessive lows since mid-February, which exhibits a rising demand for XMR within the futures market. If the momentum picks tempo, the bulls might inflict a bullish breakout.

Supply: Coinglass