- Monero enjoys wholesome social quantity which can assist in attracting again buyers.

- XMR conforms to the market circumstances this week regardless of earlier resilience.

Monero achieved some degree of success in overcoming promote strain in direction of the tip of February and briefly within the first week of March. Nonetheless, the bears have lastly caught up with it this week triggering vital worth slippage.

What number of are 1,10,100 XMRs price immediately?

Monero’s worth fell by roughly 14% courtesy of the prevailing bearish market circumstances this week.

It danced across the 200-day transferring common previous to that, earlier than finally yielding to the bears. It hovered across the $132 assist line on the time of writing, whereas nearly dipping into oversold territory on the RSI.

Supply: TradingView

Monero remains to be having fun with some wholesome visibility

That mentioned, nevertheless, Monero nonetheless managed to safe a win within the social rating regardless of the losses suffered in its worth motion.

LunarCrush’s newest rating picked Monero because the coin of the day by way of social rating. This was an indication that it was receiving lots of social consideration which is an effective factor particularly now that it’s at a reduction.

In the present day’s Coin of the Day in accordance with the social rating by @LunarCrush is $XMR (@monero)⚡️

High influencers are @halomancer1 @100xShaman @CrypttoManiac_ @fluffypony✨🚀 pic.twitter.com/rRySSFIuiE

— BlockTalks (@HiBlockTalks) March 9, 2023

The favorable social rating means that Monero could be ready to sum up sturdy volumes for a large comeback if want be.

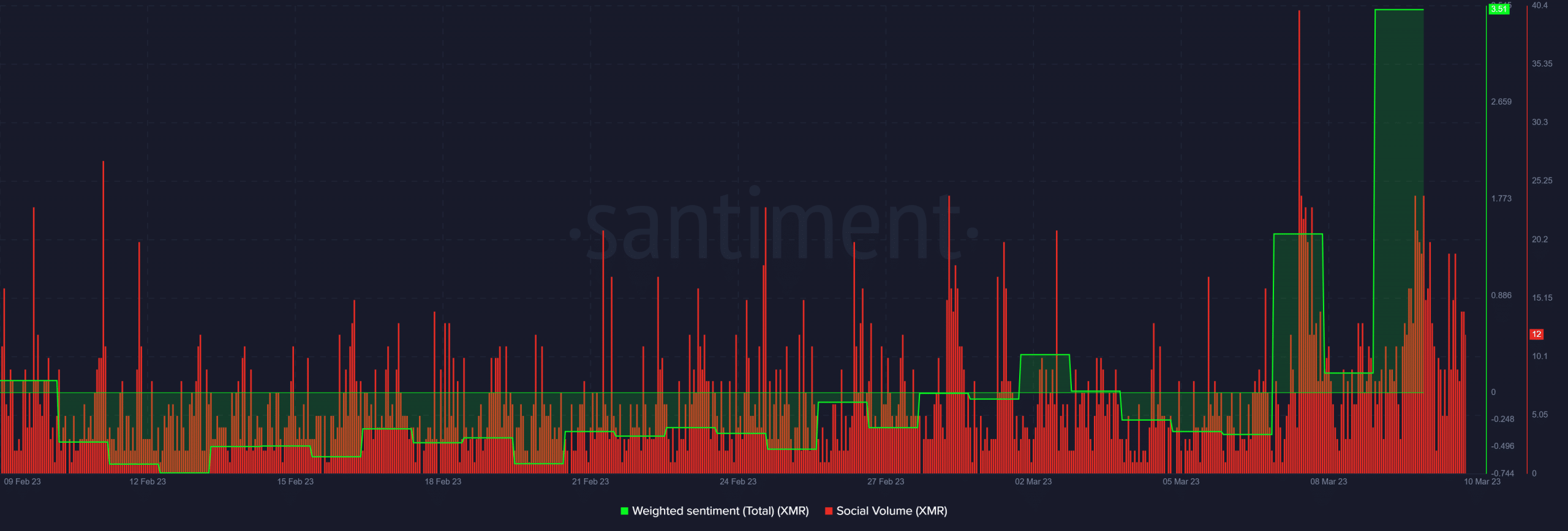

The rating displays the surge noticed in social quantity this week, resulting in a brand new month-to-month peak on Tuesday. It additionally registered one other sizable surge within the final 24 hours, at press time.

Supply: Santiment

A surge in Monero’s weighted sentiment accompanied the sturdy social quantity exercise. Its weighted sentiment highlighted an inverse correlation with the value motion. However the dynamics of XMR holders supplied a extra attention-grabbing outlook.

Practical or not, right here’s XMR market cap in BTC’s phrases

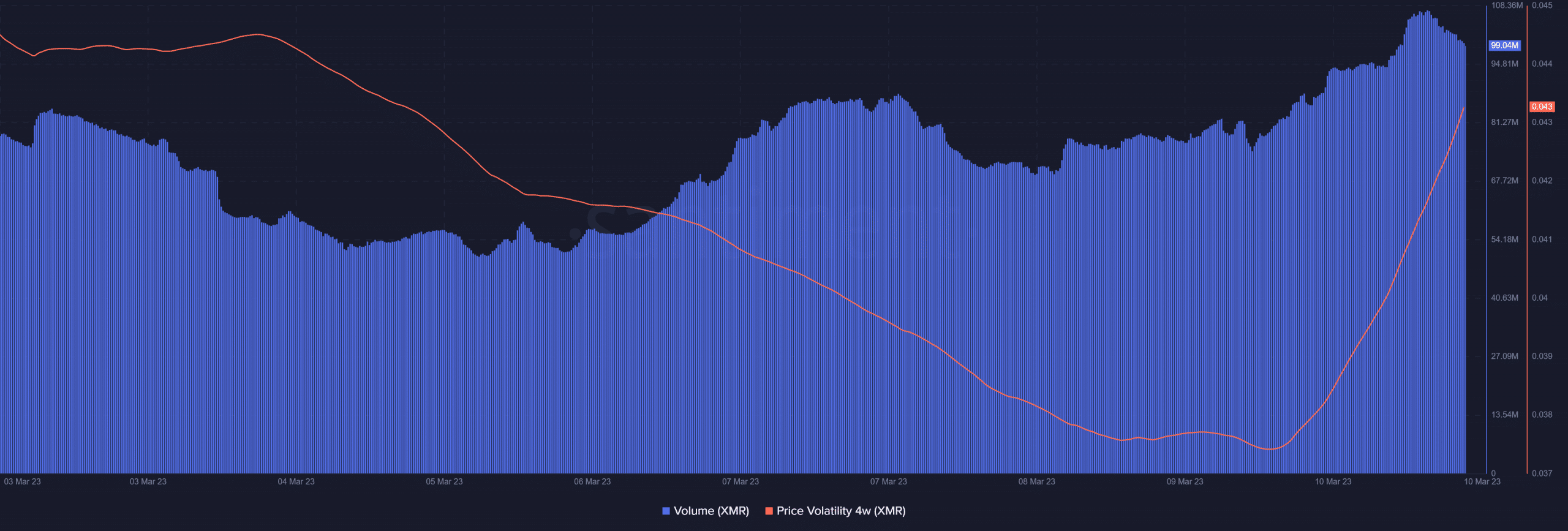

Monero’s on-chain quantity achieved a brand new month-to-month excessive within the final 24 hours at press time. On the identical time that its worth registered its largest single-day transfer within the final two weeks.

Supply: Santiment

XMR quantity has since demonstrated indicators of slowing down, after its peak on Friday.

A possible signal of bearish exhaustion. Apparently, the value volatility metric pivoted on the identical day after beforehand slowing down.

Nonetheless, it stays unclear whether or not this volatility could symbolize a powerful wave of accumulation particularly now that the value is buying and selling at a reduction.

Conclusion

There are a number of indicators thus far that spotlight the probabilities of a pivot, such because the assist retest and interplay with oversold circumstances.

Nonetheless, this doesn’t essentially assure that Monero bears are performed. We should still witness extra draw back if the FUD prevails however the intensive pullback additionally means a bullish pivot could be simply across the nook.