A brand new research by monetary large Financial institution of America reveals that younger buyers are dropping confidence in conventional investments.

The report, which was performed by market analysis agency Escalent on behalf of Financial institution of America, polled 1,052 high-net-worth respondents throughout the US.

The respondents had been over the age of 21 and had a minimum of $3 million in investable property, excluding major residence.

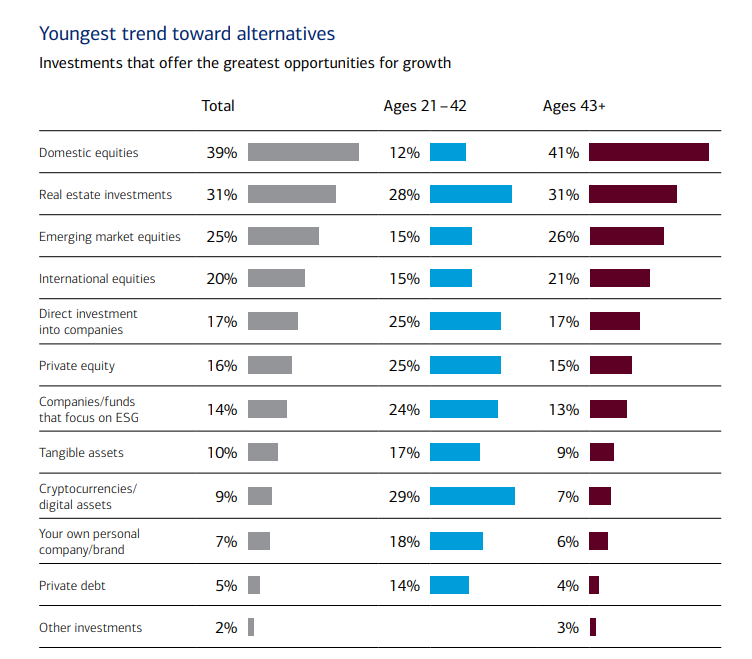

In response to the research, respondents between 21 and 42 years previous have allotted solely 1 / 4 of their property to shares. The research additionally exhibits that 75% of respondents from the identical age group say that “it’s not potential to realize above-average returns” on conventional funding automobiles.

With majority of younger buyers dropping confidence in conventional property like shares and bonds, the report reveals that their high asset of selection is crypto.

The Financial institution of America research exhibits that 29% of youthful buyers declare that crypto “presents a number one alternative to create wealth.” The identical group of buyers are additionally fascinated by different different investments akin to personal fairness, debt and ESG-related ventures.

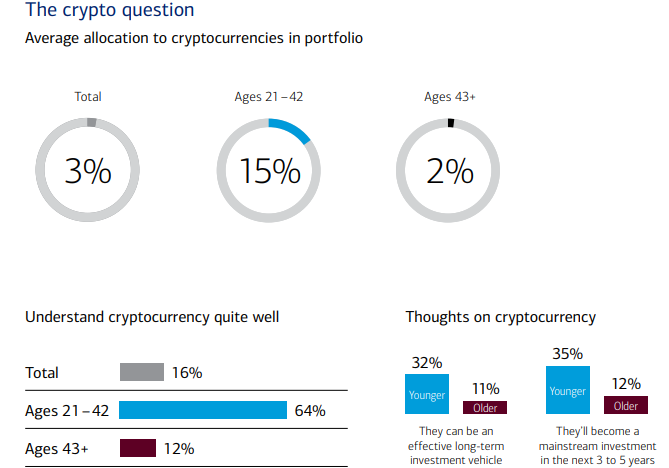

In response to the research, younger buyers between 21 and 42 years previous say that 15% of their portfolio is made up of crypto with 32% of them believing that digital property may be an efficient long-term funding automobile. Of the identical investor cohort, 64% declare they perceive crypto fairly effectively and 35% say they consider digital property will turn into a mainstream funding inside half a decade.

As well as, the report says that 60% of younger buyers have direct publicity to crypto property, whereas almost half have invested in shares of firms within the digital asset house. Younger buyers are additionally exploring the world of non-fungible tokens (NFT) with 59% of them saying that they presently personal NFTs or have an interest within the new sort of digital asset.

You possibly can learn the total report here.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in online marketing.

Featured Picture: Shutterstock/Den Rise/Sensvector