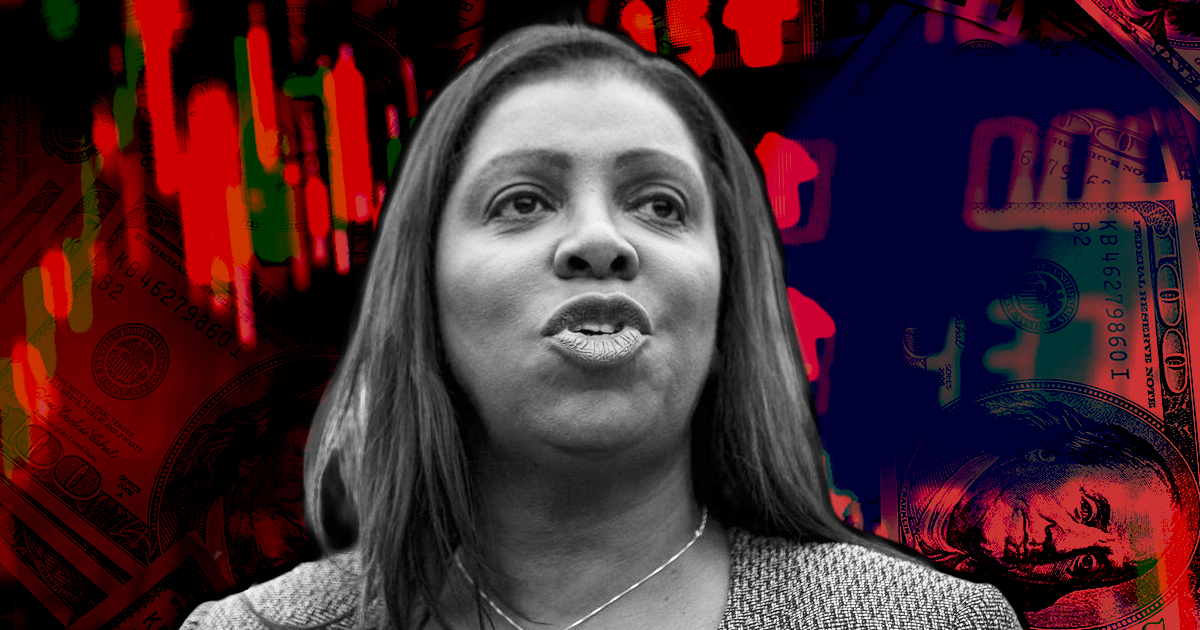

New York’s Legal professional Basic Letitia James has urged victims of the current crypto market crash to contact her workplace.

The investor alert requested those that consider they’ve been deceived or locked out of their accounts by varied crypto initiatives impacted by the current market crash to contact the NYAG Investor Safety Bureau.

James additionally urged staff within the crypto business who may need witnessed fraud or misconduct to file a whistleblower report together with her workplace. The person may file the whistleblower report anonymously.

James mentioned:

“The current turbulence and important losses within the cryptocurrency market are regarding. Traders had been promised giant returns on cryptocurrencies however as a substitute misplaced their hard-earned cash.”

The press launch talked about the collapse of the Terra/LUNA ecosystem and “account freezes on cryptocurrency staking or incomes applications, equivalent to Anchor, Celsius, Voyager, and Stablegains,” have considerably affected New Yorkers.

In the meantime, those that know somebody that the collapse has impacted can nonetheless contact the lawyer common’s workplace.

New York has had a number of makes an attempt at regulating the crypto business. In October 2021, the lawyer common workplace ordered all unregistered crypto lending platforms to stop operations.

The lawyer common issued a taxpayer discover this yr directing digital belongings traders to declare and pay tax on their belongings. The workplace reached a settlement of near $1 million with BlockFi for providing unregistered securities in June.

US states concentrating on Celsius, others

Whereas New York is simply declaring its curiosity in investigating crypto lenders like Celsius and others, a number of US states like Vermont, Alabama, and Texas have opened investigations into how these corporations operated.

Vermont’s Division of Monetary Regulation (DFR) declared that Celsius mismanaged its customers’ funds and that it was deeply bancrupt.

Regulators in Alabama and Texas had been additionally investigating whether or not the corporations’ choices certified as securities and whether or not they met disclosure necessities.